I believe the market has been correcting for nearly a year.

And that at least one more primary-degree impulse is to come before a cycle-degree correction.

I have several reasons for this thesis and shared each.

Here's a 🧵for those who can't follow past the last tweet.

1/

And that at least one more primary-degree impulse is to come before a cycle-degree correction.

I have several reasons for this thesis and shared each.

Here's a 🧵for those who can't follow past the last tweet.

1/

2/

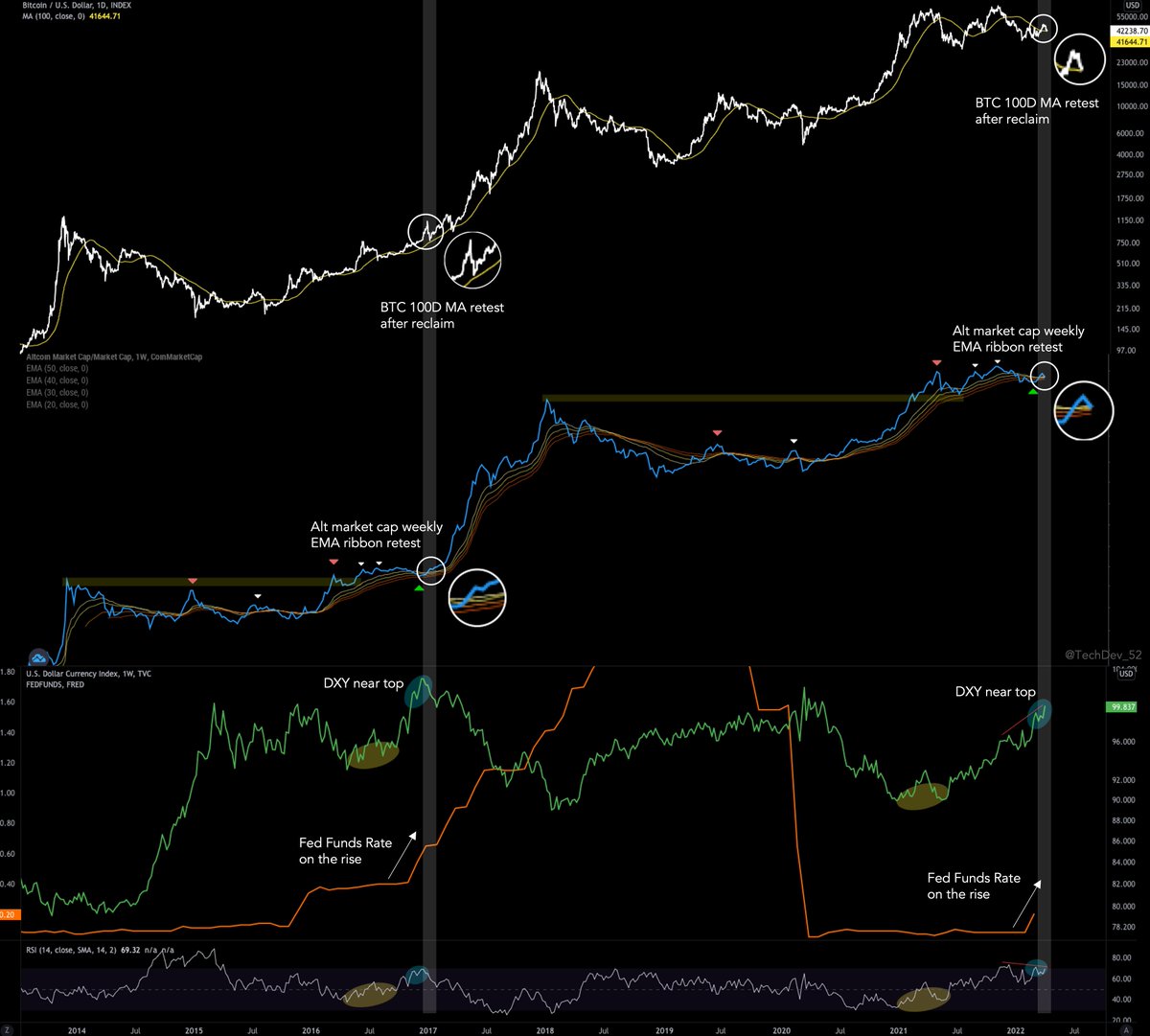

#BTC 100D MA retest + #altcoin structure parallel + $DXY top, all at the start of a Fed Funds Rate hike cycle

#BTC 100D MA retest + #altcoin structure parallel + $DXY top, all at the start of a Fed Funds Rate hike cycle

https://twitter.com/TechDev_52/status/1512830137154347008?s=20&t=8C7LDLZ0NEjEjW4UdW7-iw

3/

Recent #BTC 3W bullish Vortex cross

Recent #BTC 3W bullish Vortex cross

https://twitter.com/TechDev_52/status/1508233291358429194?s=20&t=8FfDzcCzbPDlbwjBpnutMg

4/

3W Vortex cross + Dormancy Flow bottom confluence

3W Vortex cross + Dormancy Flow bottom confluence

https://twitter.com/TechDev_52/status/1512615760522272768?s=20&t=MRyuTu1tYNnuGDBatzXrNg

5/

Large entity accumulation/distribution behavior

Large entity accumulation/distribution behavior

https://twitter.com/TechDev_52/status/1510385018782334982?s=20&t=DIL4OH2EesmL3G209QcPIA

6/

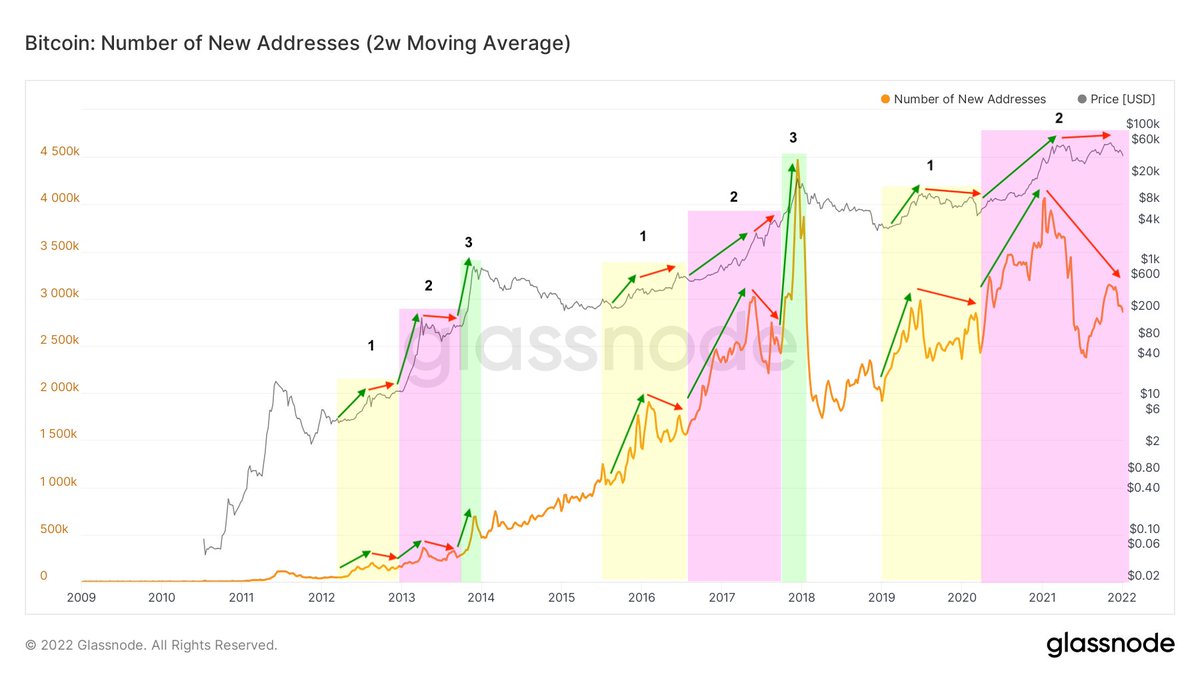

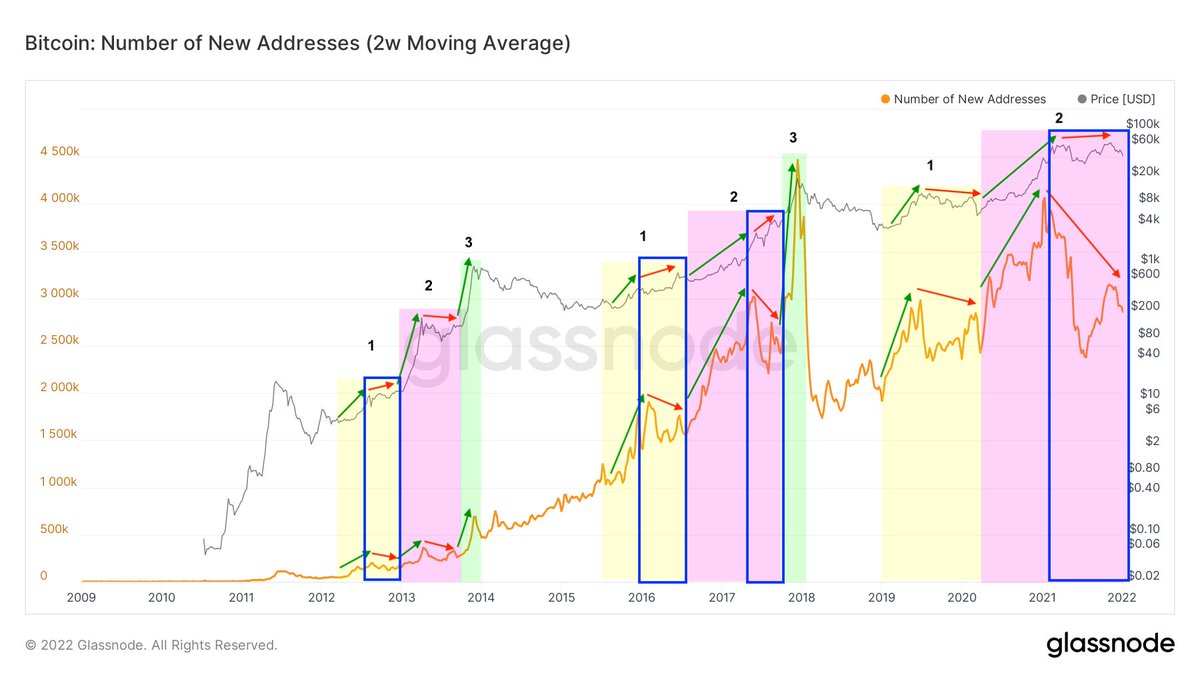

Parallel relative sub-wave structure between cycle degree wave 3 and 1, with wave 3 exhibiting a consistent ~3X time expansion

Parallel relative sub-wave structure between cycle degree wave 3 and 1, with wave 3 exhibiting a consistent ~3X time expansion

https://twitter.com/TechDev_52/status/1511116217364402188?s=20&t=ZavD7Sv34aLP-plIJ1fLWw

7/

Wave symmetry + declining volume + 4 std dev 50W EMA wave extension + corrective RSI + Dormancy Flow decline + SSRO decline

Wave symmetry + declining volume + 4 std dev 50W EMA wave extension + corrective RSI + Dormancy Flow decline + SSRO decline

https://twitter.com/TechDev_52/status/1492199192978239498?s=20&t=uQT-Mask6wTHGwJ8OYvXmg

8/

And yes, a historic example of similar multi-year macro wave structure in a speculative asset with consistent interaction with a key MA, the next projected move of which is confluent with the upcoming impulse suggested by points 1-7.

And yes, a historic example of similar multi-year macro wave structure in a speculative asset with consistent interaction with a key MA, the next projected move of which is confluent with the upcoming impulse suggested by points 1-7.

https://twitter.com/TechDev_52/status/1514356397051367424?s=20&t=uQT-Mask6wTHGwJ8OYvXmg

My respect and appreciation for those that show it to others, regardless of bias.

end/

end/

• • •

Missing some Tweet in this thread? You can try to

force a refresh