How to get URL link on X (Twitter) App

2/

2/

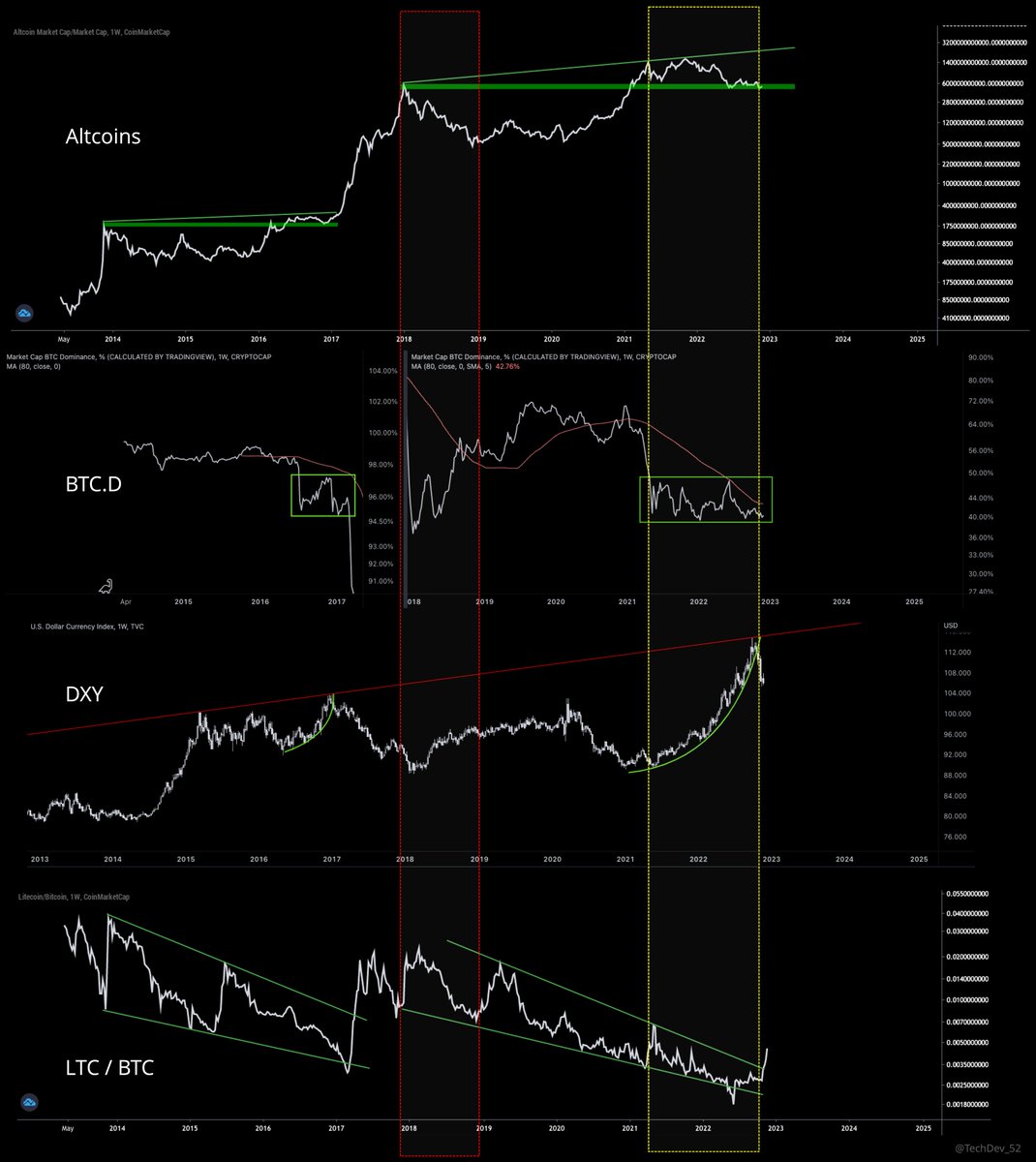

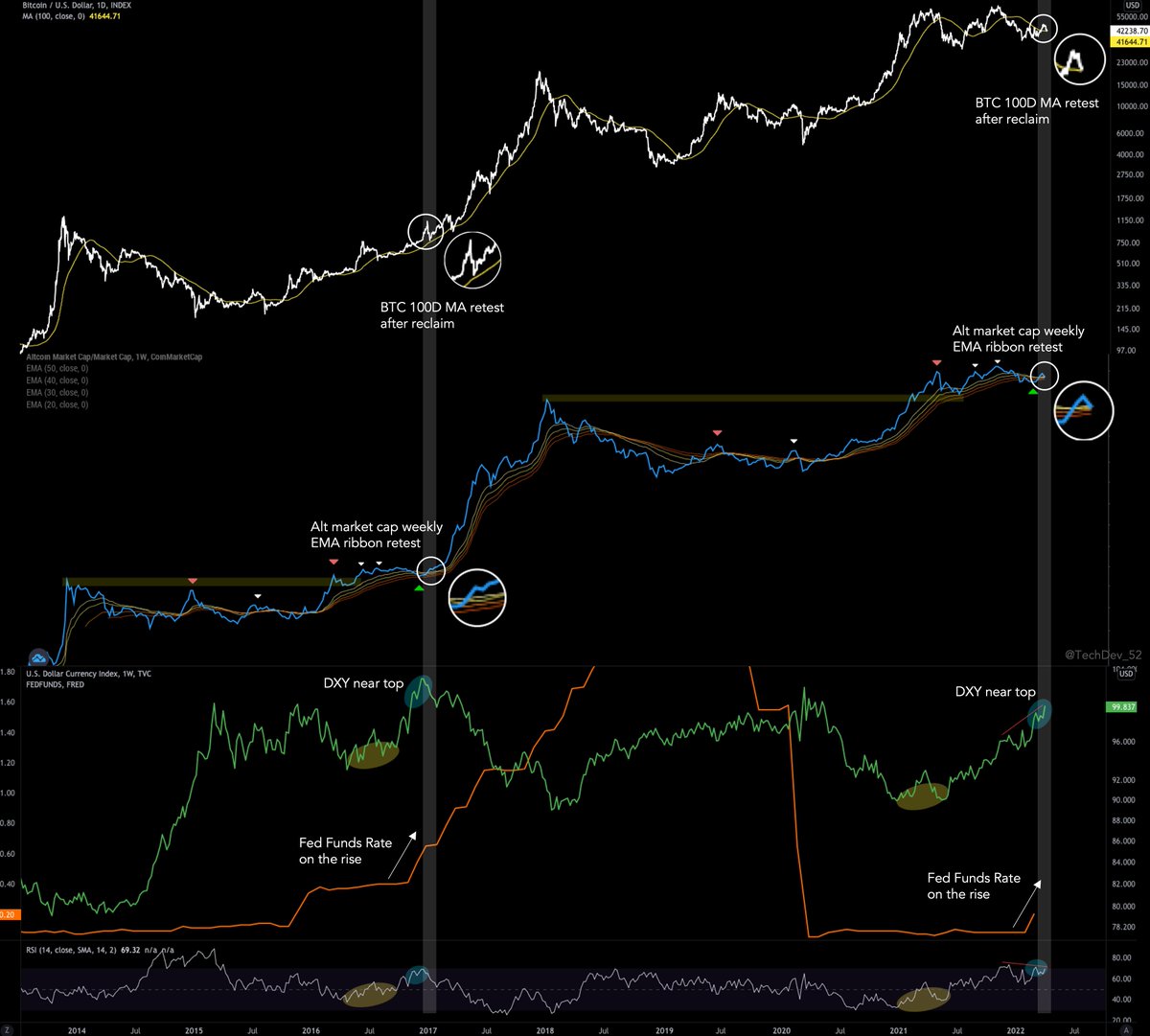

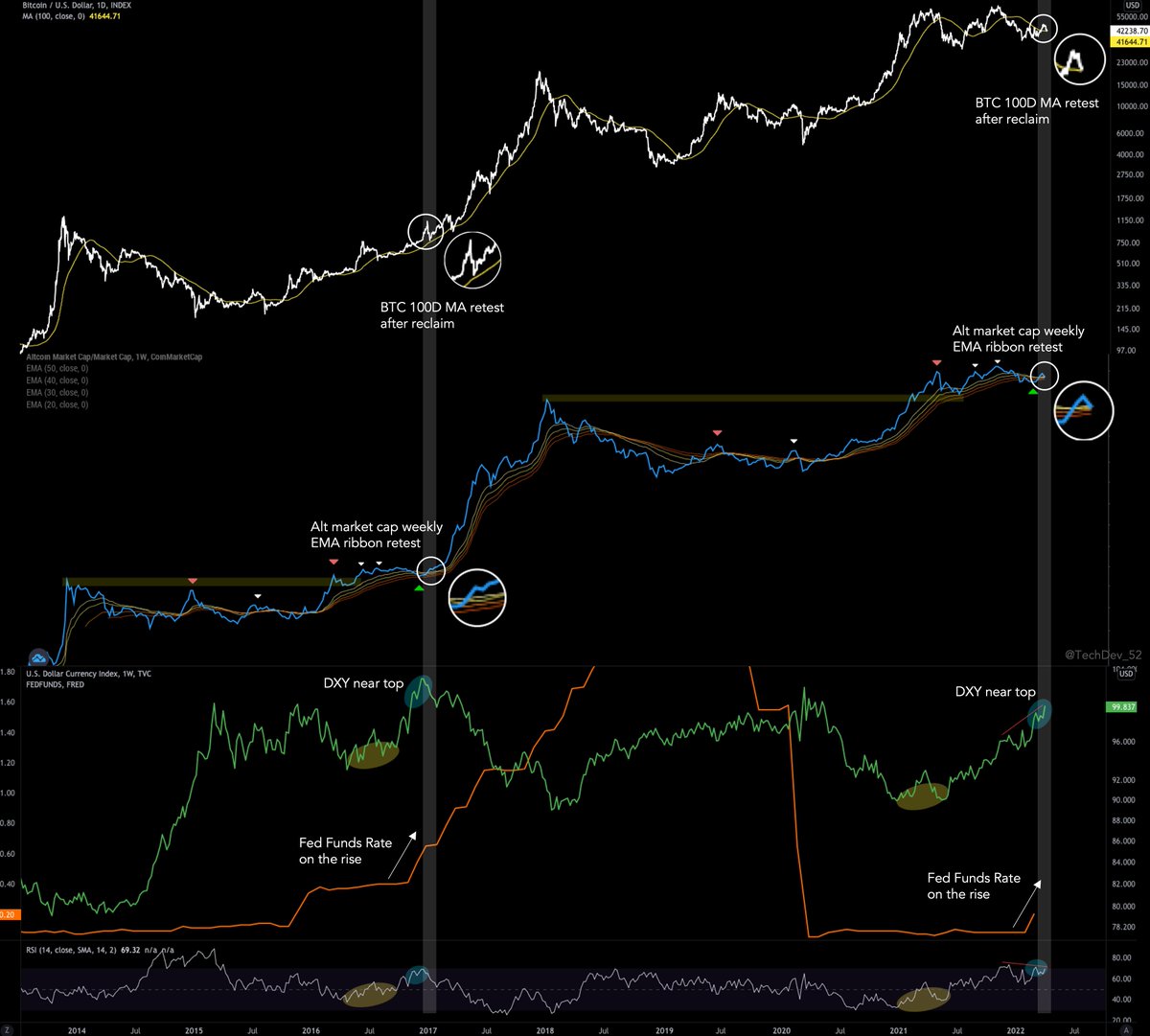

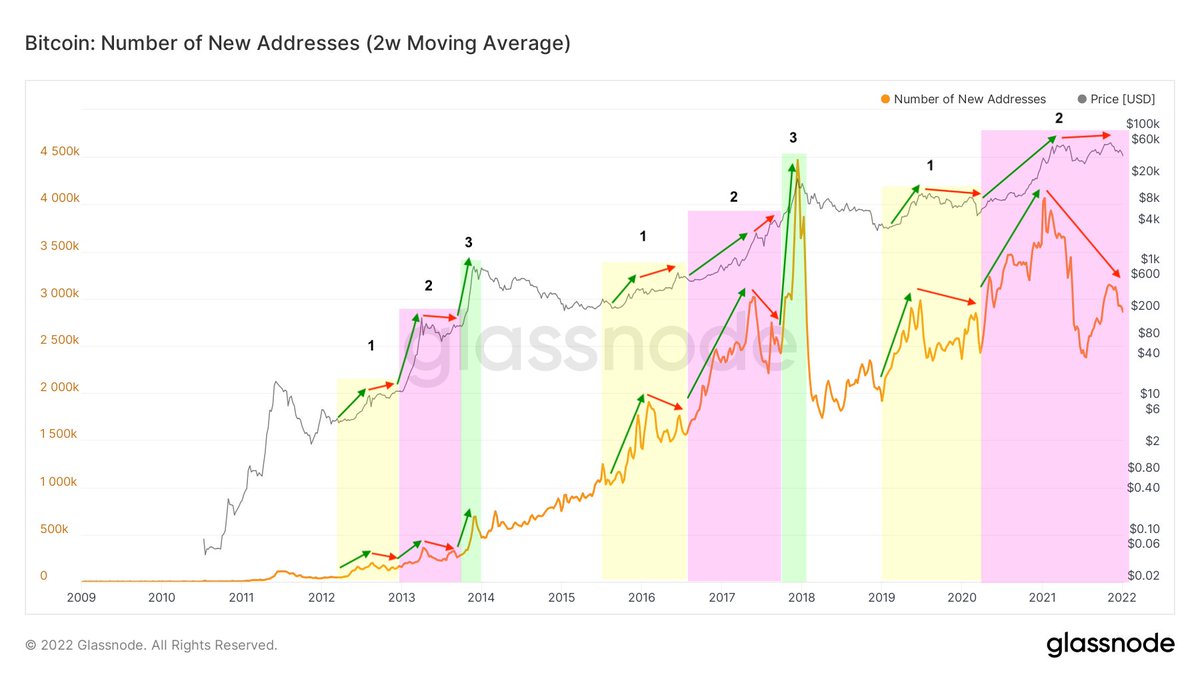

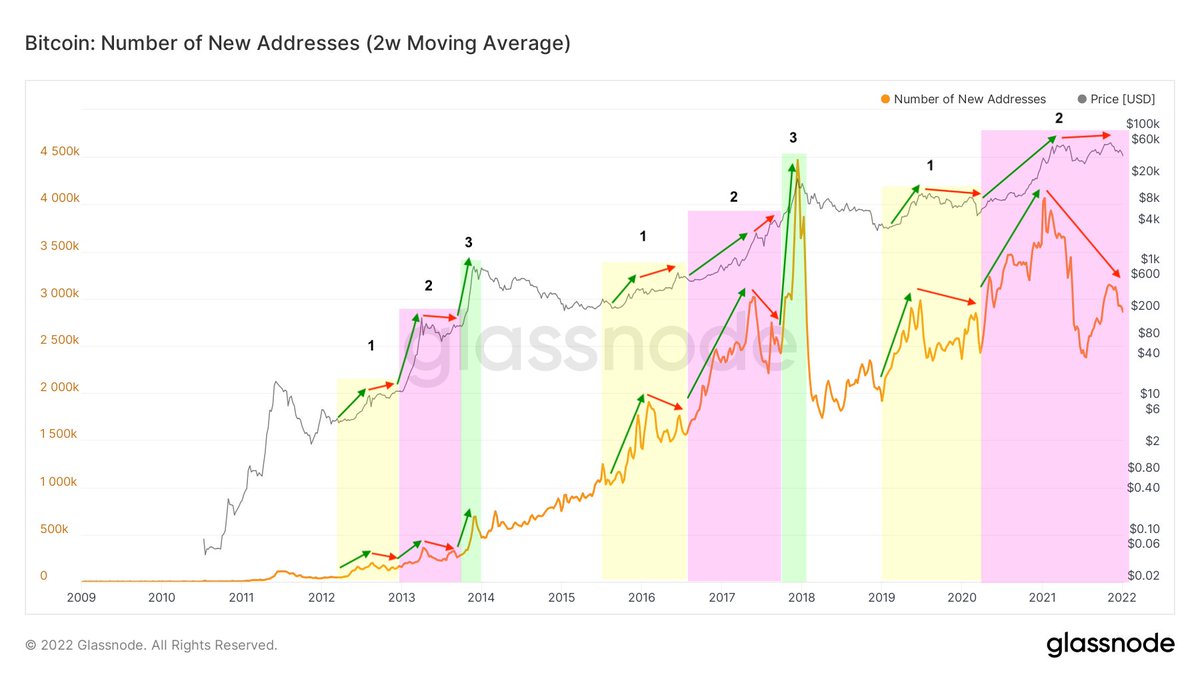

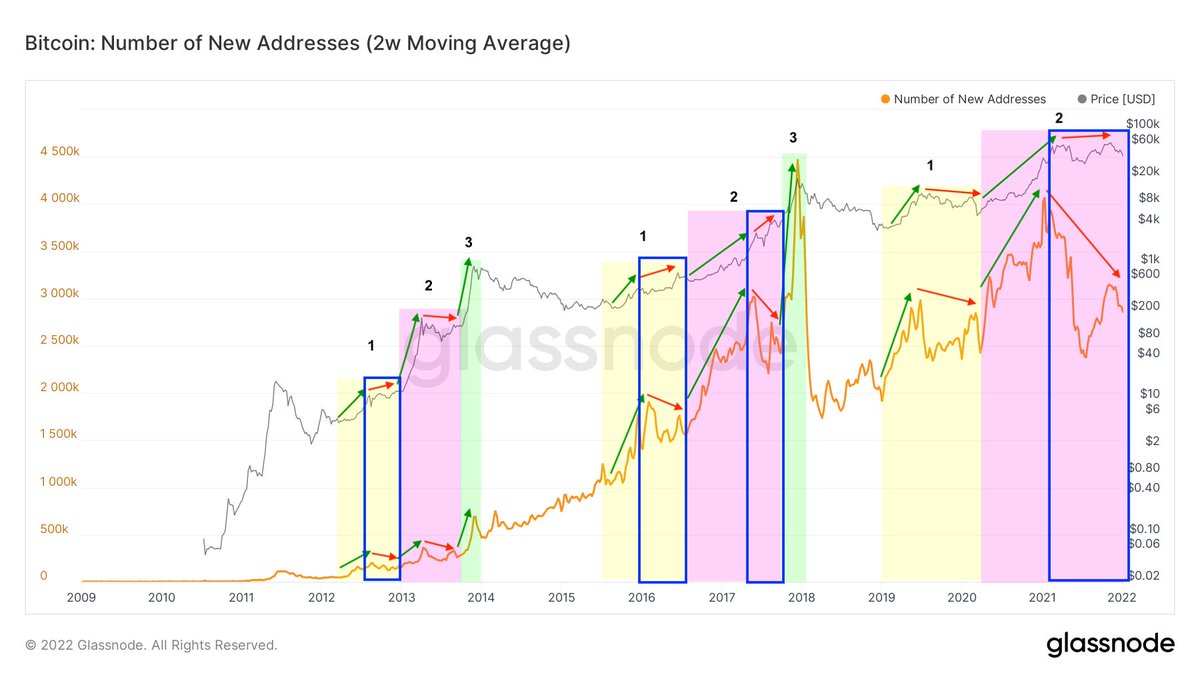

A problem with arbitrarily dividing the market into discrete "cycles", based on arbitrary definitions of "bear markets", is it may leave you blind to the rest of it.

A problem with arbitrarily dividing the market into discrete "cycles", based on arbitrary definitions of "bear markets", is it may leave you blind to the rest of it.

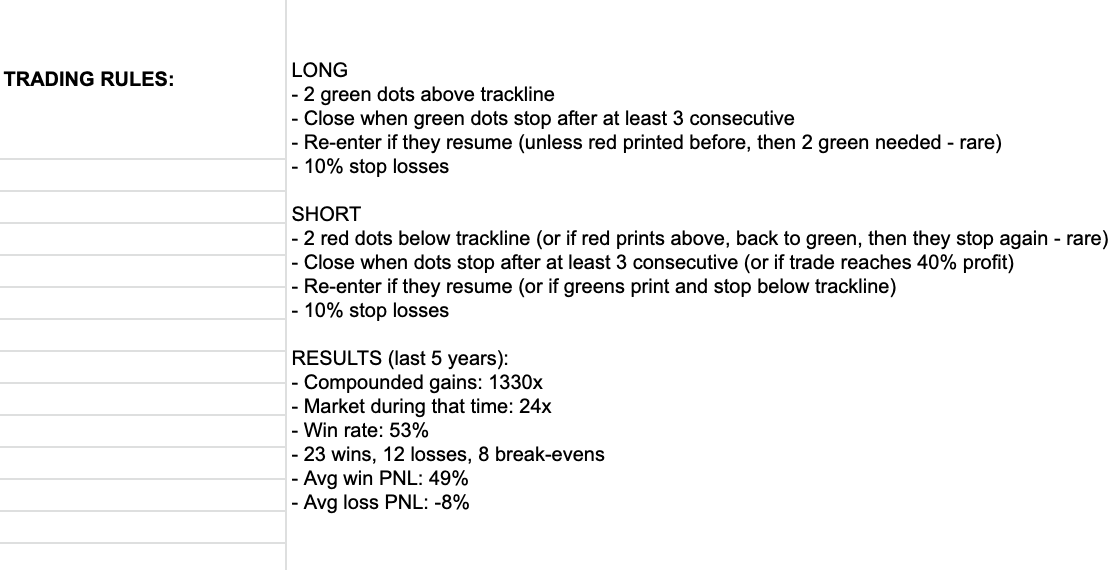

Dots and Trackline available exclusively in yearly Alpha Bundle.

Dots and Trackline available exclusively in yearly Alpha Bundle.

.@ZeroHedge_ has spent an enormous amount of time building an impressive indicator set.

.@ZeroHedge_ has spent an enormous amount of time building an impressive indicator set.

For those wondering:

For those wondering:

2/

2/https://twitter.com/TechDev_52/status/1512830137154347008?s=20&t=8C7LDLZ0NEjEjW4UdW7-iw

Primary -

Primary -

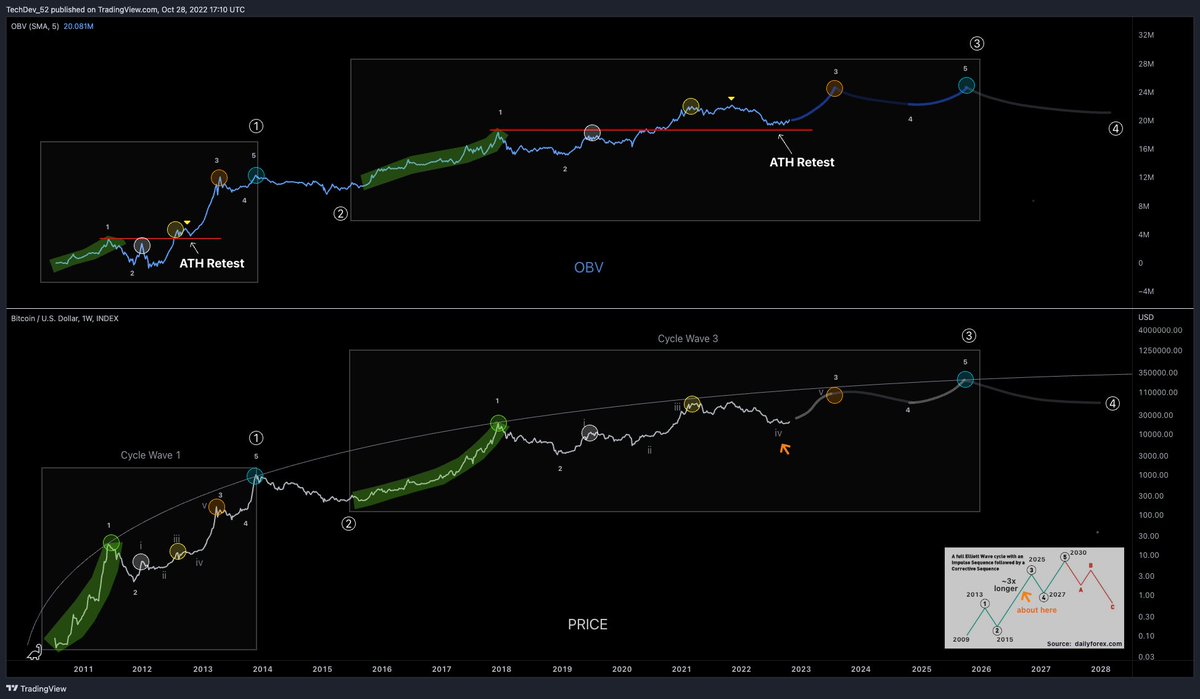

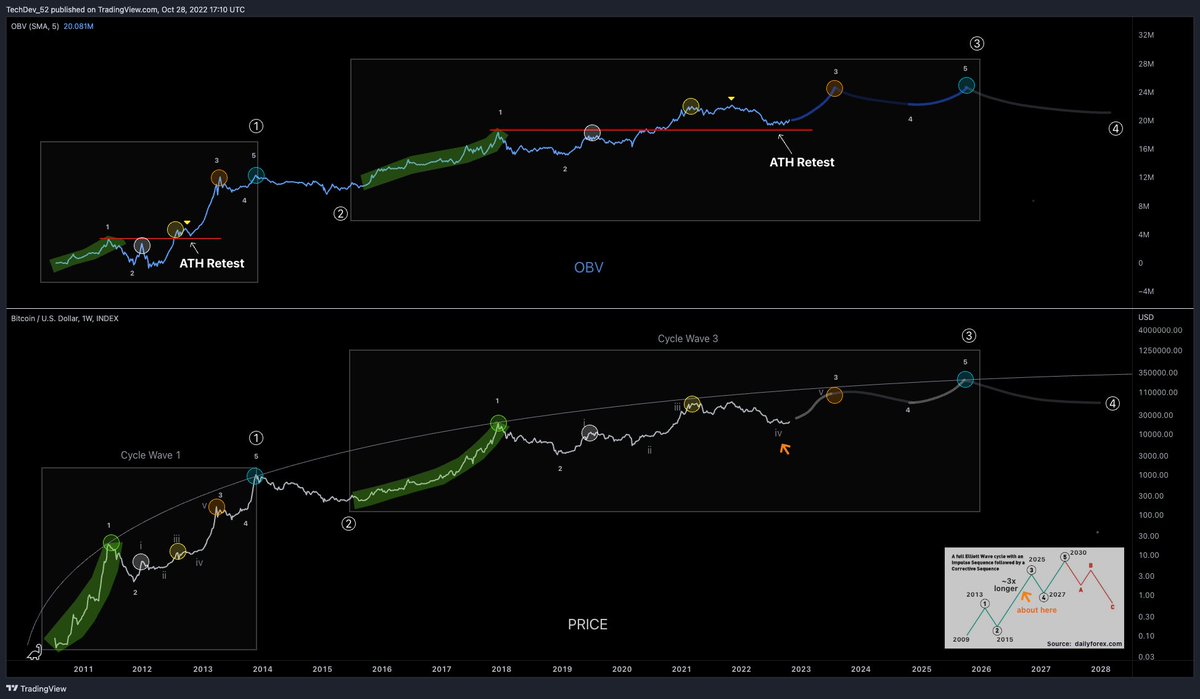

First off, h/t to @888Velvet who has had a similar read for quite some time.

First off, h/t to @888Velvet who has had a similar read for quite some time.https://twitter.com/888Velvet/status/1259588663933046791?s=20&t=i6H2jcdY-dBN4dpXzVUffQ

2/

2/

2/

2/

https://twitter.com/techdev_52/status/14647410209738137622/

We can also see that both 2013 and 2017 looked to interact with their linear 4.236 before moving higher.

We can also see that both 2013 and 2017 looked to interact with their linear 4.236 before moving higher.

So it’s clear, by “I’m out” at those indicator levels, I mean that:

So it’s clear, by “I’m out” at those indicator levels, I mean that: