Elon Musk has launched a $43bn hostile takeover of #Twitter by offering $54.20 per share in cash.

This is hostile takeover strategy is known as a tender offer (an offer to purchase stock shares from a target Company's shareholders at a premium higher than the market price)

This is hostile takeover strategy is known as a tender offer (an offer to purchase stock shares from a target Company's shareholders at a premium higher than the market price)

A hostile takeover in mergers and acquisitions (M&A), is the acquisition of a target company by another company/person (the acquirer) by directly approaching the target company’s shareholders, either by making a tender offer or through a proxy vote without the Board's approval.

Hostile takeovers may happen if a company or individual (in this case Mr. Musk) believes that a target is undervalued or when activist shareholders want changes in a company.

Elon has been categorical about the changes he wants to implement at Twitter.

Elon has been categorical about the changes he wants to implement at Twitter.

In some cases, intending acquirers use "bear hugs", an offer made by to buy shares of another comoany for a much higher per-share price than the market price. Typically deployed when there is doubt that the target company's management or shareholders are willing to sell.

There are defensive tactics to hostile takeovers. Some have the fanciest names in corporate law e.g poison pills, crown jewels defence, golden parachute, pac-man defence, etc.

All these strategies have varying practical effects.

I explain my favourite- the poison pill.

All these strategies have varying practical effects.

I explain my favourite- the poison pill.

Some types of poison pills

•Flip-in (Board allows shareholders except the acquirer to purchase additional shares at a discount)

•Flip-over (target's stockholders purchase shares of acquirer at a deeply discounted price if hostile attempt is successful)

Both dilute the equity

•Flip-in (Board allows shareholders except the acquirer to purchase additional shares at a discount)

•Flip-over (target's stockholders purchase shares of acquirer at a deeply discounted price if hostile attempt is successful)

Both dilute the equity

Hostile takeovers can be very litigious and thus a proper strategy detailing the bid arsenal and disarming tactics is required.

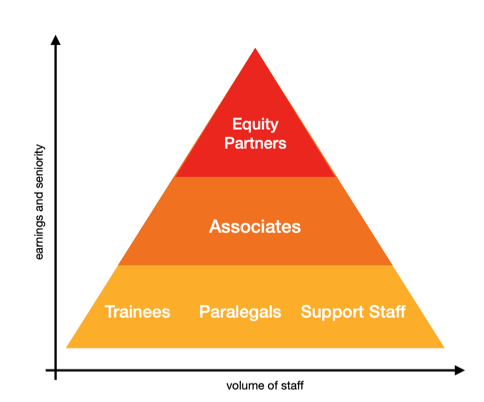

It is also lucrative business for lawyers.

We look forward to handling such complex and market-defining matters @OrtusAdvocates soon.

It is also lucrative business for lawyers.

We look forward to handling such complex and market-defining matters @OrtusAdvocates soon.

For those interested in developing their knowledge on the subject, there are some free online resources you may consider.

Good luck as you follow some of the most interesting developments of our time.

#CorporateFinance #CorporateGovernance #CorporateLaw

Good luck as you follow some of the most interesting developments of our time.

#CorporateFinance #CorporateGovernance #CorporateLaw

• • •

Missing some Tweet in this thread? You can try to

force a refresh