Who Will Buy Your Tokens?

Most people buy tokens to sell them later at a higher price.

Who, When and Why will buy it from you at a higher price?

We need a Demand for your tokens.

/THREAD

Most people buy tokens to sell them later at a higher price.

Who, When and Why will buy it from you at a higher price?

We need a Demand for your tokens.

/THREAD

The other side.

Who is on the other side of your trade? We need to understand this in order to predict how the forces of demand for your tokens will change.

This is the main factor that can drive a price.

/1

Who is on the other side of your trade? We need to understand this in order to predict how the forces of demand for your tokens will change.

This is the main factor that can drive a price.

/1

Price.

Demand & Supply => Price

Changes in price are caused by the demand and supply forces.

Demand⬇️ OR Supply⬆️ => Price⬇️

Demand⬆️ OR Supply⬇️ => Price ⬆️

We already covered supply forces in a previous thread.

/2

Demand & Supply => Price

Changes in price are caused by the demand and supply forces.

Demand⬇️ OR Supply⬆️ => Price⬇️

Demand⬆️ OR Supply⬇️ => Price ⬆️

We already covered supply forces in a previous thread.

https://twitter.com/CryptosEngineer/status/1517768650870116352

/2

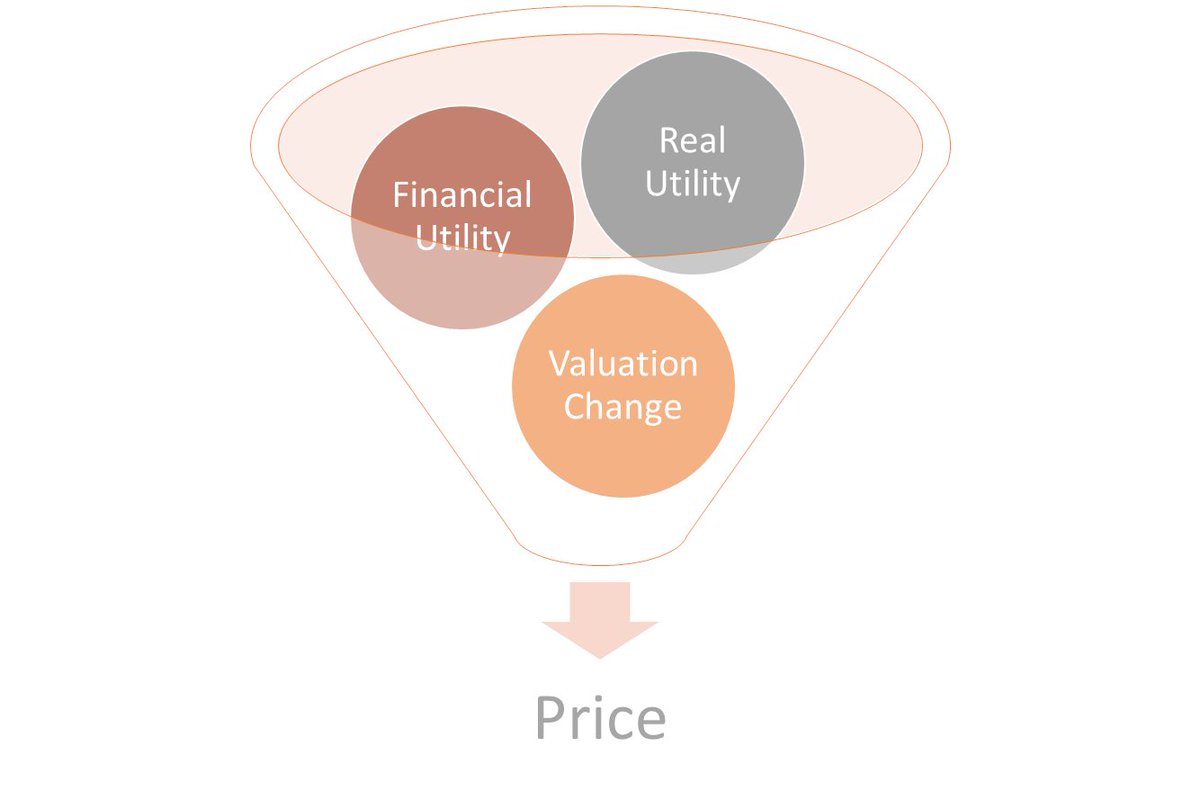

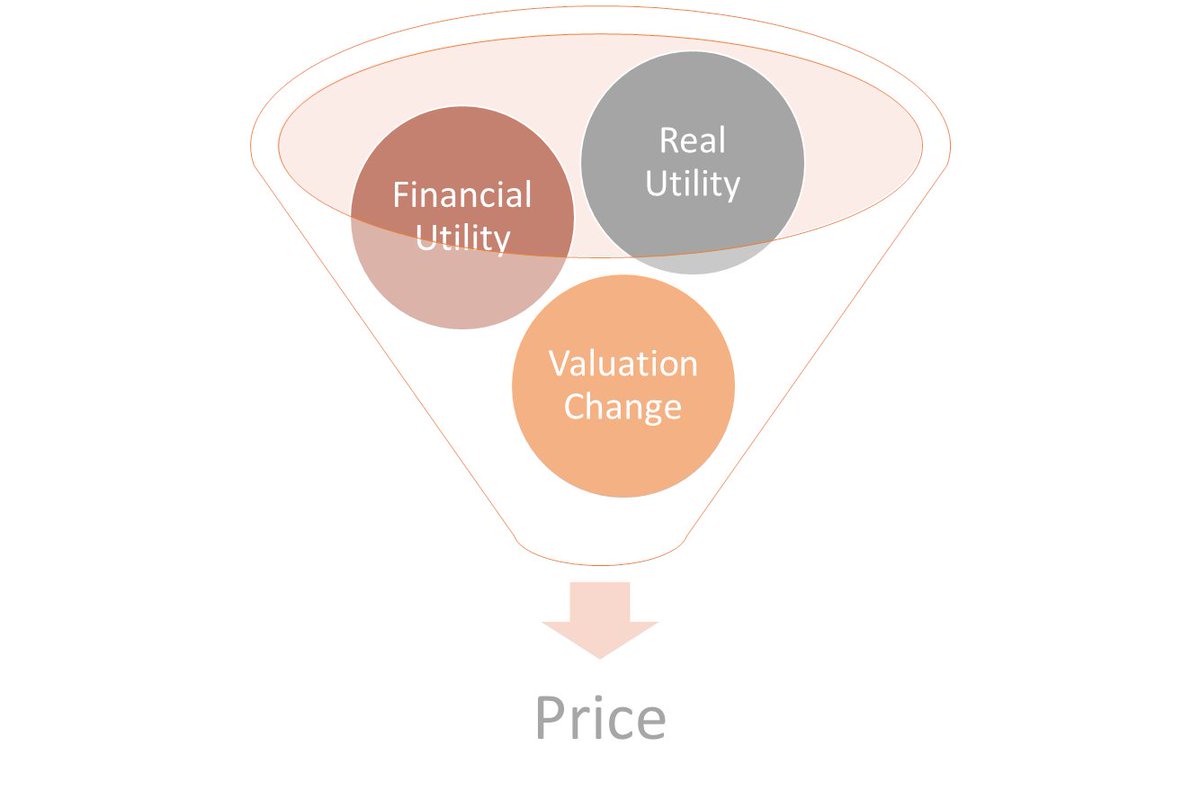

Demand.

We have 3 sources of token demands:

• Real Utility (Value)

• Financial Utility (Earnings on a token in #DeFi)

• Valuation Changes (Speculation)

Let's now check them.

/3

We have 3 sources of token demands:

• Real Utility (Value)

• Financial Utility (Earnings on a token in #DeFi)

• Valuation Changes (Speculation)

Let's now check them.

/3

Real Utility (Value).

What is the Unique Value Proposition provided via token? What benefits do you have from holding this?

The most popular are:

• Utility - you can use it for paying gas fees etc.

• Cash flow - you have part of the protocols revenue

/4

What is the Unique Value Proposition provided via token? What benefits do you have from holding this?

The most popular are:

• Utility - you can use it for paying gas fees etc.

• Cash flow - you have part of the protocols revenue

/4

Cash flow.

Some crypto protocols generate on-chain or off-chain cash flow. Part of the revenue can be also shared with token holders.

I wrote before how to analyze cash flow generated by @beethoven_x - @BalancerLabs fork on #Fantom.

/5

Some crypto protocols generate on-chain or off-chain cash flow. Part of the revenue can be also shared with token holders.

I wrote before how to analyze cash flow generated by @beethoven_x - @BalancerLabs fork on #Fantom.

https://twitter.com/CryptosEngineer/status/1480275940496318466?s=20

/5

Financial Utility.

Tokens are different than stocks. We can also earn on them in different #DeFi protocols. The main parameters to consider are:

• Cash flow (APY)

• Risk (growth and cash flow sustainability)

APY is not the most important:

/6

Tokens are different than stocks. We can also earn on them in different #DeFi protocols. The main parameters to consider are:

• Cash flow (APY)

• Risk (growth and cash flow sustainability)

APY is not the most important:

https://twitter.com/CryptosEngineer/status/1481319609005445126?s=20

/6

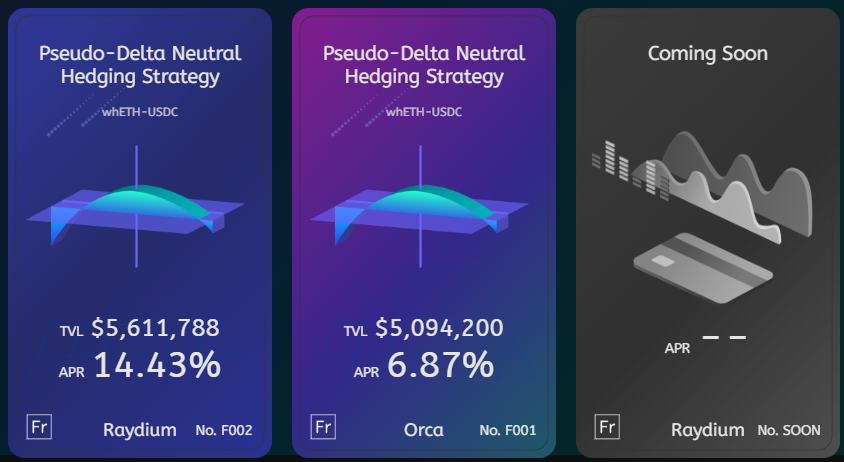

Financial Utility vs Supply.

APY from #DeFi protocols can also mitigate higher supply:

Supply⬆️ & Demand (Financial Utility)⬇️ => Price⬇️

Supply⬆️ & Demand (Financial Utility)⬆️ => Price❔

Supply⬆️ & Demand (Financial Utility)⬆️⬆️ => Price⬆️

/7

APY from #DeFi protocols can also mitigate higher supply:

Supply⬆️ & Demand (Financial Utility)⬇️ => Price⬇️

Supply⬆️ & Demand (Financial Utility)⬆️ => Price❔

Supply⬆️ & Demand (Financial Utility)⬆️⬆️ => Price⬆️

/7

Valuation Changes.

The Crypto market is not effective now. Price is also affected by:

• Momentum (price action)

• Investor mood, narrative

• Other pricing factors (accessibility etc.)

I also shared before example for Smart Contract Platforms:

/8

The Crypto market is not effective now. Price is also affected by:

• Momentum (price action)

• Investor mood, narrative

• Other pricing factors (accessibility etc.)

I also shared before example for Smart Contract Platforms:

https://twitter.com/CryptosEngineer/status/1486697280690442242?s=20

/8

Future demand.

If you are buying a token, you should have Investment Thesis which tells you Who, When and Why will buy your token.

Which of these 3 forces will increase the price?

• Real Utility❔

• Financial Utility❔

• Valuation Changes❔

/9

If you are buying a token, you should have Investment Thesis which tells you Who, When and Why will buy your token.

Which of these 3 forces will increase the price?

• Real Utility❔

• Financial Utility❔

• Valuation Changes❔

/9

Valuation.

Good project valuation is a story and numbers. You can have different scenarios for analyzing these 3 types of demands.

Whenever possible use numbers to back your story. Don't believe in other people's stories. Verify. You are responsible for your outcomes.

/10

Good project valuation is a story and numbers. You can have different scenarios for analyzing these 3 types of demands.

Whenever possible use numbers to back your story. Don't believe in other people's stories. Verify. You are responsible for your outcomes.

/10

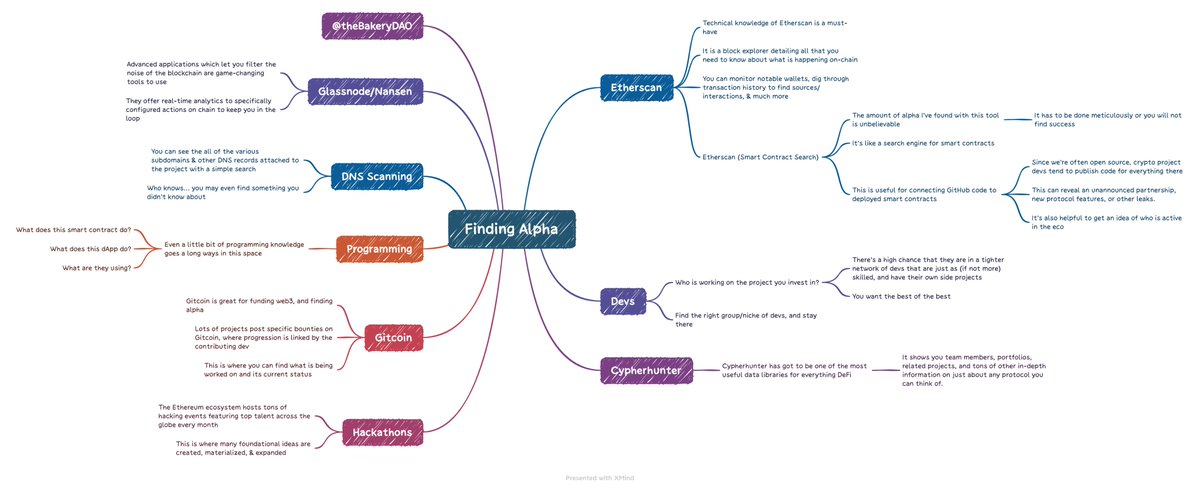

Numbers.

Is hard to find numbers for your analysis in crypto. These tools can be helpful to quantify your Investment Thesis:

@tokenterminal

@DefiLlama

@blocknomy

@MessariCrypto

@DuneAnalytics

@glassnode

@cryptoquant_com

/11

Is hard to find numbers for your analysis in crypto. These tools can be helpful to quantify your Investment Thesis:

@tokenterminal

@DefiLlama

@blocknomy

@MessariCrypto

@DuneAnalytics

@glassnode

@cryptoquant_com

/11

What next?

You can follow these accounts to get more Fundamental Analysis:

@Route2FI

@thedefiedge

@phtevenstrong

@mikocryptonft

@lemiscate

@MiddleChildPabk

@RDM_41

@JackNiewold

@milesdeutscher

@TaschaLabs

@CroissantEth

@PastryEth

/12

You can follow these accounts to get more Fundamental Analysis:

@Route2FI

@thedefiedge

@phtevenstrong

@mikocryptonft

@lemiscate

@MiddleChildPabk

@RDM_41

@JackNiewold

@milesdeutscher

@TaschaLabs

@CroissantEth

@PastryEth

/12

If you enjoyed this and want to learn more about investing, cryptocurrency & finance:

✔️ Follow me @CryptosEngineer for more threads like this.

✔️ Check out some of my other threads:

/13

✔️ Follow me @CryptosEngineer for more threads like this.

✔️ Check out some of my other threads:

https://twitter.com/CryptosEngineer/status/1516477478474289162

/13

• • •

Missing some Tweet in this thread? You can try to

force a refresh