Can the European Union ban Russian gas imports?

Answer: Faster than you might expect, but it comes down to great leadership & setting the right priorities!

We continue - Part II with a total of 25 Tweets

1/n 🧵

#UkraineRussiaWar #EuropeanUnion

Answer: Faster than you might expect, but it comes down to great leadership & setting the right priorities!

We continue - Part II with a total of 25 Tweets

1/n 🧵

#UkraineRussiaWar #EuropeanUnion

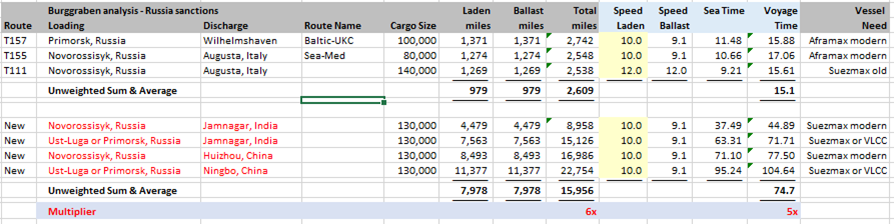

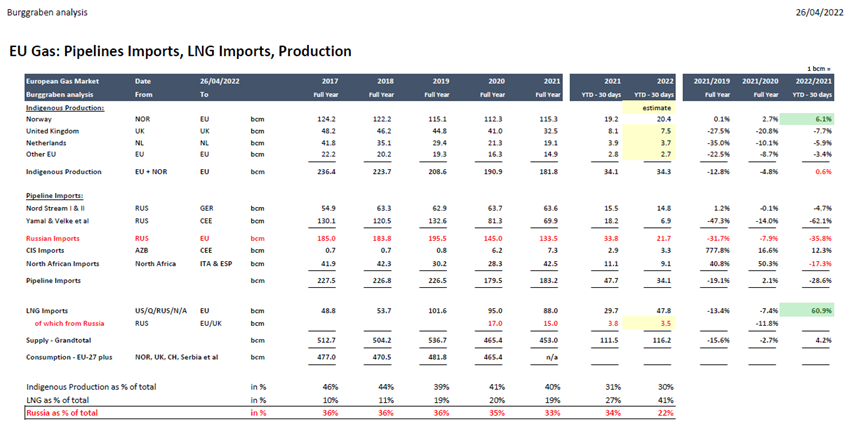

In part I we explained that Europe must replace 150bcm of Russian gas imports to help support the end of the Russian genocide in Ukraine.

It will also be the recipe to reduce the current risk-premium in gas prices & avoid long-lasting food shortages or a refugee crisis.

2/n

It will also be the recipe to reduce the current risk-premium in gas prices & avoid long-lasting food shortages or a refugee crisis.

2/n

We explained that...

- (1) higher LNG imports from optimised infra & capacity utilisation can deliver up to 90bcm or 62% of 150bcm if free market prices can continue to "pull" LNG into Europe;

- (2) one-off storage potential of up to 25bcm (one winter) to buy some time...

3/n

- (1) higher LNG imports from optimised infra & capacity utilisation can deliver up to 90bcm or 62% of 150bcm if free market prices can continue to "pull" LNG into Europe;

- (2) one-off storage potential of up to 25bcm (one winter) to buy some time...

3/n

- (3a) ...to fix some policy shortcomings & get new fields up & running;

- (3b) while having identified Groningen has an immediate "swing producers", capabable to deliver 20bcm (13%) within weeks and subject to local & Dutch government "consent";

4/n

- (3b) while having identified Groningen has an immediate "swing producers", capabable to deliver 20bcm (13%) within weeks and subject to local & Dutch government "consent";

4/n

https://twitter.com/BurggrabenH/status/1519135117779902465?s=20&t=pt9Vl7IVIA2Zbo7HosT46g

For good order sake, let us now illustrate Europe's indigenous production potential by picking 3 projects in 3 different European countries that should be capabale to add 10-12bcm soon:

a) North Eigg (tie-back): 2025

b) Tyra: 2023

c) Neptun Deep: 2025/26

5/n

a) North Eigg (tie-back): 2025

b) Tyra: 2023

c) Neptun Deep: 2025/26

5/n

(a) @SericaEnergyUK will spud the the promising exploration well of the so called North & South Eigg license. If successful in October, a straightforward tie-back into existing infrastructure may deliver 2-3bcm per annum by 2024 for 10-15 years (60mboe resource).

6/n

6/n

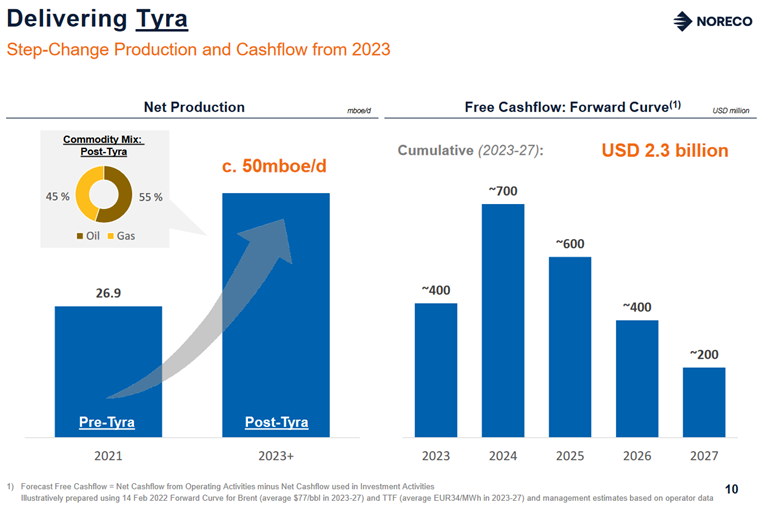

(b) TotalEnergies (& Noreco) will deliver Tyra in Denmark next year, a project with some "Covid-related" delay but 200mboe 2P reserves. It should produce >1.5bcm for more than 10 years.

The North Sea has at least dozen more such ready-made (although less advanced) projects.

7/n

The North Sea has at least dozen more such ready-made (although less advanced) projects.

7/n

(c) There is a bigger fish to fry: @omv must approve Neptun Deep in the Black Sea - capable to deliver 8bcm pa for 20y to replace 5.5% of RUS imports.

The questions: why is the Romanian project - around for 10y - still not approved?

8/n @vonderleyen

The questions: why is the Romanian project - around for 10y - still not approved?

8/n @vonderleyen

https://twitter.com/BurggrabenH/status/1516028180196438016?s=20&t=FnlGZv_AGCpfsRf841vf2Q

OMV is majority owned by the Gov.

Austria is also the one EU member with significant RUS import dependence. Worse, as Eastern Europe's gas hub it comes out of this winter with the lowest EU storage-fill-percentage reading (17% now).

Maybe that will speed up Neptun Deep?

9/n

Austria is also the one EU member with significant RUS import dependence. Worse, as Eastern Europe's gas hub it comes out of this winter with the lowest EU storage-fill-percentage reading (17% now).

Maybe that will speed up Neptun Deep?

9/n

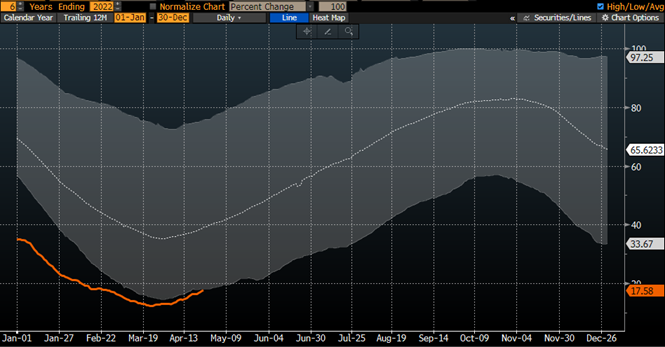

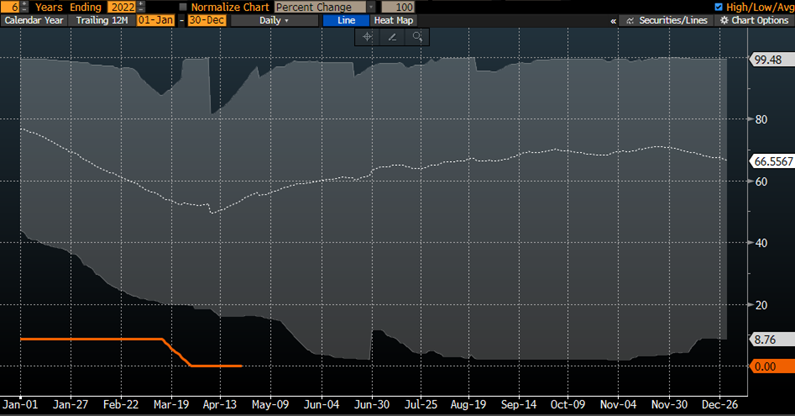

Why is Austrian storage so low?

Answer: Because its local business community had close ties with Gazprom, not just for imports but storage too.

The issue: Gazprom did not re-fill its Haidach storage (below), visibly so since May 2021. It left it go "dry" since!

10/n

Answer: Because its local business community had close ties with Gazprom, not just for imports but storage too.

The issue: Gazprom did not re-fill its Haidach storage (below), visibly so since May 2021. It left it go "dry" since!

10/n

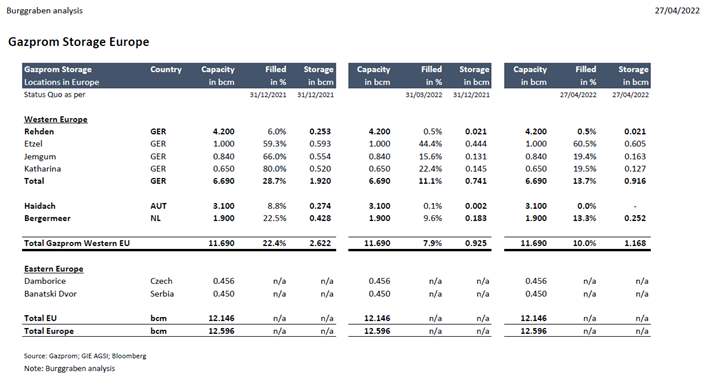

Which brings us to some EU policy shortcomings.

For that, let us first understand the remaining 7 EU Gazprom storage facilities. Is there evidence that Gazprom is about to replenished 12bcm of much needed EU storage?

Answer: Not really!

11/n

For that, let us first understand the remaining 7 EU Gazprom storage facilities. Is there evidence that Gazprom is about to replenished 12bcm of much needed EU storage?

Answer: Not really!

11/n

Instead, the Kremlin now requests payments in Rubel which may violate EU sanction rules.

We discussed it below but in essence it the Kremlin's way to support the Rubel (set FX rate) while putting EU utilities at risk of sanction violation.

12/n

We discussed it below but in essence it the Kremlin's way to support the Rubel (set FX rate) while putting EU utilities at risk of sanction violation.

12/n

https://twitter.com/BurggrabenH/status/1509658326518403077?s=20&t=pt9Vl7IVIA2Zbo7HosT46g

Which is why past policy shortcomings mustn't be repeated. Take the NOR-POL link to reduce POL from RUS imports. Its permit for the undersea pipe was rejected by Danish authorities last year due to "environmental concerns", just to be resumed now.

13/n

13/n

https://twitter.com/BurggrabenH/status/1518343103307993088?s=20&t=8eEYcl0R438jsp5KkHsltw

The issue: this was a rather painful policy mistake b/c VVP & cronies maybe brutal murderers but they are not stupid. And so they decided for yesterday to stop gas delivers to Poland as a first example & as of next week.

17/n

bbc.com/news/business-…

17/n

bbc.com/news/business-…

At least the Polish government had the wisdom to bring an LNG regasification terminal with the entry point "Kamminke" online. That terminal is now advertises to be "in expansion" according to the latest EU Commission paper on LNG from Feb 2022.

18/n #LNG

18/n #LNG

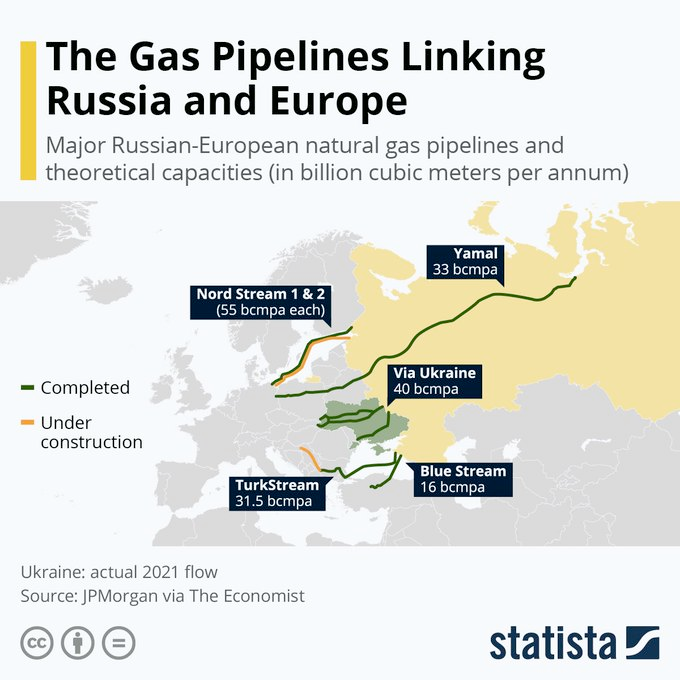

Which brings us to Germany which consumes 20% of (90-100bcm) of a total of 500bcm in the EU but it does have a single regasification terminal.

Instead it mainly relies on pipeline imports from Russia (Yamal & Nord Stream I&II) to keep the 4th largest economy going.

19/n

Instead it mainly relies on pipeline imports from Russia (Yamal & Nord Stream I&II) to keep the 4th largest economy going.

19/n

Yes - democracies have corrective mechanisms - unlike autocracies..!

Minister Habeck made it clear that the dependence on Russian imports must be reduced quickly "as the latest Russia's war of aggression against Ukraine makes this mandatory".

20/n

handelsblatt.com/unternehmen/en…

Minister Habeck made it clear that the dependence on Russian imports must be reduced quickly "as the latest Russia's war of aggression against Ukraine makes this mandatory".

20/n

handelsblatt.com/unternehmen/en…

It's just that only in January 2022, the project failed because "it would drive up Germany's CO2 emissions while the terminal's operation was considered an IMMENSE safety risk if operated improperly". Google translate for yourself.

21/n

energiezukunft.eu/wirtschaft/gep…

21/n

energiezukunft.eu/wirtschaft/gep…

Here is a recent interview with its previous project manager Marcel Tijhuis & his view on the risk of the Germany's energy policy.

Note that this was 4 months ago when Vopak was still its sponsor. It left since.

22/n @RoyalVopak

Note that this was 4 months ago when Vopak was still its sponsor. It left since.

22/n @RoyalVopak

The terminal in Brunsbüttel wasn't the only LNG project in Germany that hit obstacles. Uniper decided earlier in 2021 to ditch a terminal project in Wilhelmshaven in favor of turning the site into a green hydrogen hub. Has the EU Commission noticed?

23/n

bloomberg.com/news/articles/…

23/n

bloomberg.com/news/articles/…

What's next for German LNG?

It seems Minister Habeck is serious & now launches up to 4 terminals for >12bcm by 2024, some of which in the from of floating terminals. Permits? Exemption. The new sponsor? German tax payers. Cost? €12bn.

24/n

ndr.de/nachrichten/sc…

It seems Minister Habeck is serious & now launches up to 4 terminals for >12bcm by 2024, some of which in the from of floating terminals. Permits? Exemption. The new sponsor? German tax payers. Cost? €12bn.

24/n

ndr.de/nachrichten/sc…

Maybe the Minister can also decide to keep the remaining 3GWh of nuclear online. Or how about bringing 3GWh of nuclear back that Germany took offline in Dec 2021 - for a total of 5bcm of gas savings?

25/n End of Part II

25/n End of Part II

https://twitter.com/BurggrabenH/status/1505858479621296128?s=20&t=pt9Vl7IVIA2Zbo7HosT46g

• • •

Missing some Tweet in this thread? You can try to

force a refresh