#Elliott leading with an #ESG focus makes sense - no one can be seen to pull back on these initiatives... you know like $SU itself did when it delayed the Coker to CoGen project.

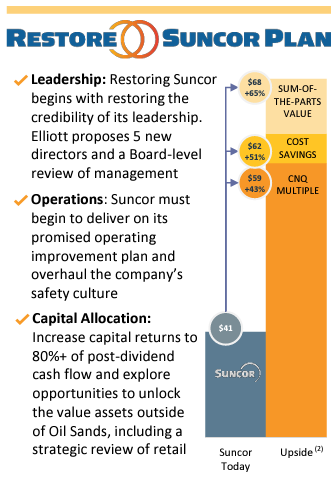

Pretty solid 3 step plan -

1. Management, begets

2. Ops, begets

3. better cap returns.

(4). Profit/ $SU #Elliott

1. Management, begets

2. Ops, begets

3. better cap returns.

(4). Profit/ $SU #Elliott

I remember where I was watching this get rolled out $MPC $SU #Elliott

#Elliott dropping some TRIF bombs in here $SU

Obviously $CNQ is sub optimal here - but what really stands out is $IMO - if I meet some employee in a bar and we start talking about @ImperialOil they invariably start talking about how proud of the safety culture they are - it is really impressive.

One small quibble with #Elliott here, it is kind of odd to be comparing to total $CNQ output and not just their oil sands ops...

Yes $SU's numbers include offshore too but these are very different beasts.

Does show that $CNQ is a master of any domain it enters.

Yes $SU's numbers include offshore too but these are very different beasts.

Does show that $CNQ is a master of any domain it enters.

I am all for owning $SU, but the decision to shut a train down at Fort Hills is... you know the reason for the drop off - that is come important context - it wasn't like they for that much worse at mining.

But ya, not great.

#Elliott

But ya, not great.

#Elliott

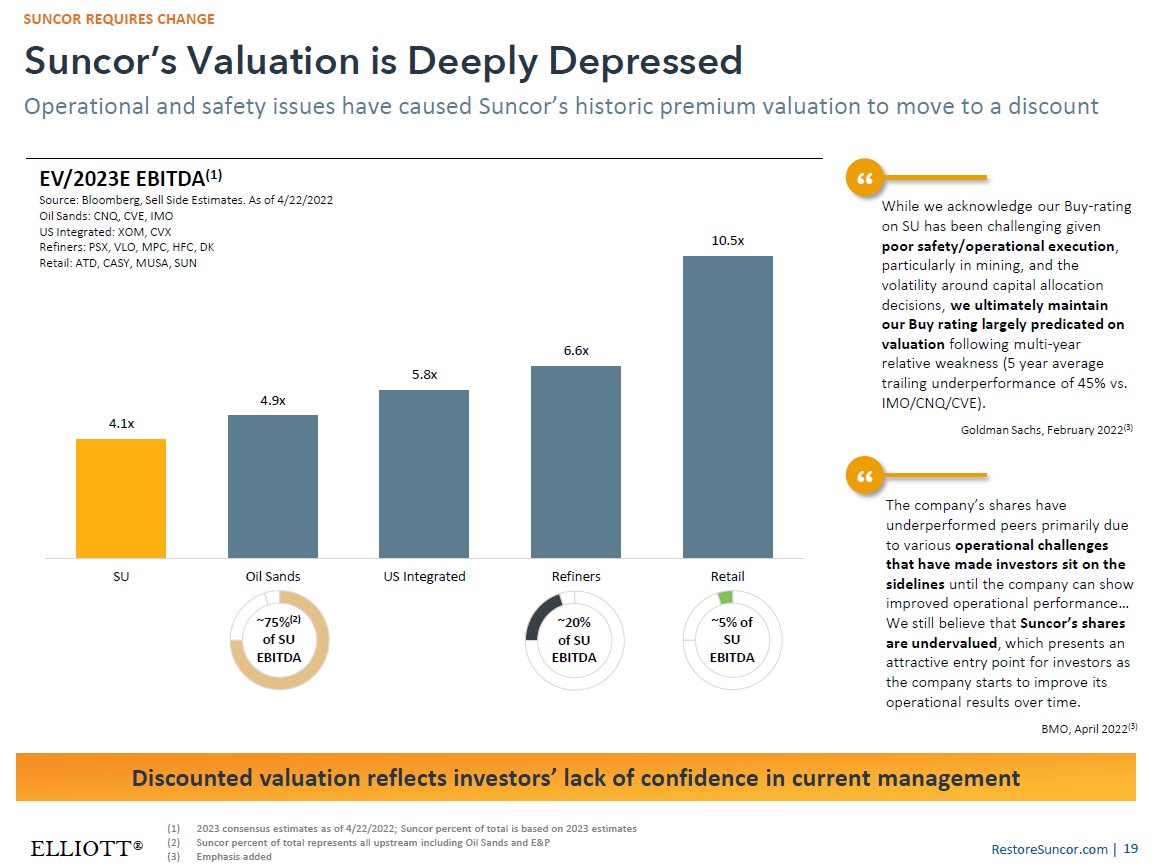

#Elliott even firing shots at $SU's beloved refining group.

There is always room to make @johnwhi60696884 happier.

There is always room to make @johnwhi60696884 happier.

I know you don't want to make the bear case for a company in your turn-a-round deck #Elliott but there is no reason $SU's OS ops should get an $CNQ multiple - the RLI issue is still hanging there like a sword of damocles.

• • •

Missing some Tweet in this thread? You can try to

force a refresh