🧵 Mega Thread, for the Mega IPO of #LIC 💰

Let us dive 👇

Please Like, Share, Retweet if you find it useful 😄

Let us dive 👇

Please Like, Share, Retweet if you find it useful 😄

IPO details:

IPO Opens: 4th May,2022

IPO Closes: 9th May,2022

Face Value: ₹10 per equity share

Price Band: ₹902 to ₹949 per share

Min lot: 15 shares

Issue Size: ₹21,008.48 crs

OFS: 221,374,920 Shares

(1/n)

IPO Opens: 4th May,2022

IPO Closes: 9th May,2022

Face Value: ₹10 per equity share

Price Band: ₹902 to ₹949 per share

Min lot: 15 shares

Issue Size: ₹21,008.48 crs

OFS: 221,374,920 Shares

(1/n)

The IPO will be purely OFS where Government of India will be offloading 3.5% stake in LIC

Employee reservation- Up to 1,581,249 Equity Shares

Policy Holder reservation- Up to 22,137,492 Equity Shares

Post that

QIB - 50%

Retail - 35%

NII - 15%

(2/n)

Employee reservation- Up to 1,581,249 Equity Shares

Policy Holder reservation- Up to 22,137,492 Equity Shares

Post that

QIB - 50%

Retail - 35%

NII - 15%

(2/n)

How can discount be ignored when it comes to sale! 🛒

-Policy Holders shall be eligible for ₹60 per share discount

- Employees and Retail shall be eligible for for ₹45 per share discount

- There will be no discount for HNI segment

(3/n)

-Policy Holders shall be eligible for ₹60 per share discount

- Employees and Retail shall be eligible for for ₹45 per share discount

- There will be no discount for HNI segment

(3/n)

At the Issue price of ₹949(upper band), LIC is valued at 6 lakh crore!

Now, if it lists at such valuations, LIC will be amongst top 5 listed companies based on market cap.

Currently, #Reliance, #TCS, #HDFCbank, #Infosys are top 4 companies based on market cap

(4/n)

Now, if it lists at such valuations, LIC will be amongst top 5 listed companies based on market cap.

Currently, #Reliance, #TCS, #HDFCbank, #Infosys are top 4 companies based on market cap

(4/n)

LIC IPO will be the biggest ipo in history of Indian stock market. Aramco moment for India!

Currently #Paytm holds the record for the biggest IPO of ₹18,300 crs followed by Coal India whose IPO size was ₹15,475.

(5/n)

Currently #Paytm holds the record for the biggest IPO of ₹18,300 crs followed by Coal India whose IPO size was ₹15,475.

(5/n)

The financial behemoth is amongst the most awaited IPO which now becomes a reality after so many odds.

The IPO was actually expected in FY21-22 but it took several months to value this company! Imagine!

(6/n)

The IPO was actually expected in FY21-22 but it took several months to value this company! Imagine!

(6/n)

There were lot of considerations on valuation part

As per the market buzz at respective times, earlier, LIC IPO was rumored at valuations of ₹16 lakh crores, ₹13 lakh crores, ₹10 lakh crores and now finally it comes at ₹6 lakh crores!

(7/n)

As per the market buzz at respective times, earlier, LIC IPO was rumored at valuations of ₹16 lakh crores, ₹13 lakh crores, ₹10 lakh crores and now finally it comes at ₹6 lakh crores!

(7/n)

To sail a PSU IPO which will be the largest IPO is a challenging task for the government so necessary considerations were needed keeping the market condition in focus and deciding the valuation which can lure the investors as failure of LIC IPO would be a big set back!

(8/n)

(8/n)

The embedded value of LIC is around 5.4 lakh crores. Thus, LIC is valued at 1.1x times to its embedded value which looks cheaper comparatively as its listed private sector peers are trading around 3x embedded value (9/n)

What is Embedded Value? 🤔

Embedded value is calculated by adding present value of future profits of a firm to the NAV (Net Asset Value) of firms capital and surplus.

(10/n)

Embedded value is calculated by adding present value of future profits of a firm to the NAV (Net Asset Value) of firms capital and surplus.

(10/n)

Why Embedded value?

Not all sectors gets valued on same criteria. Just like p/e ratio is not that significant while valuing any bank. In Insurance companies, Embedded value is given more importance.

(11/n)

Not all sectors gets valued on same criteria. Just like p/e ratio is not that significant while valuing any bank. In Insurance companies, Embedded value is given more importance.

(11/n)

LIC is priced at 200x its earning! Is it costly?

Price to earning ratio is not given more emphasis while valuing insurance company and Embedded value is considered. There are other factors too to consider valuations

(12/n)

Price to earning ratio is not given more emphasis while valuing insurance company and Embedded value is considered. There are other factors too to consider valuations

(12/n)

However, the share of LIC is way more than its industry peers.

Market share:

The Market share of LIC in term of Gross Written Premium is 64.1% while the next largest competitor's market share is only 8%!

(13/n)

Market share:

The Market share of LIC in term of Gross Written Premium is 64.1% while the next largest competitor's market share is only 8%!

(13/n)

As on December,2021 the AUM of LIC was ₹40.1 trillion on standalone basis which was more than 3.2 times the total AUM of all private life insurers in India!

Also, LIC investment in listed Equity represented around 4% of total market cap of nse!

(14/n)

Also, LIC investment in listed Equity represented around 4% of total market cap of nse!

(14/n)

Another interesting fact:

LIC was formed by merging and nationalizing 245 private life insurance companies in India on September 1, 1956, with an initial capital of ₹50.00 million

LIC was recognised as the third strongest and 10th most valuable global insurance brand

(15/n)

LIC was formed by merging and nationalizing 245 private life insurance companies in India on September 1, 1956, with an initial capital of ₹50.00 million

LIC was recognised as the third strongest and 10th most valuable global insurance brand

(15/n)

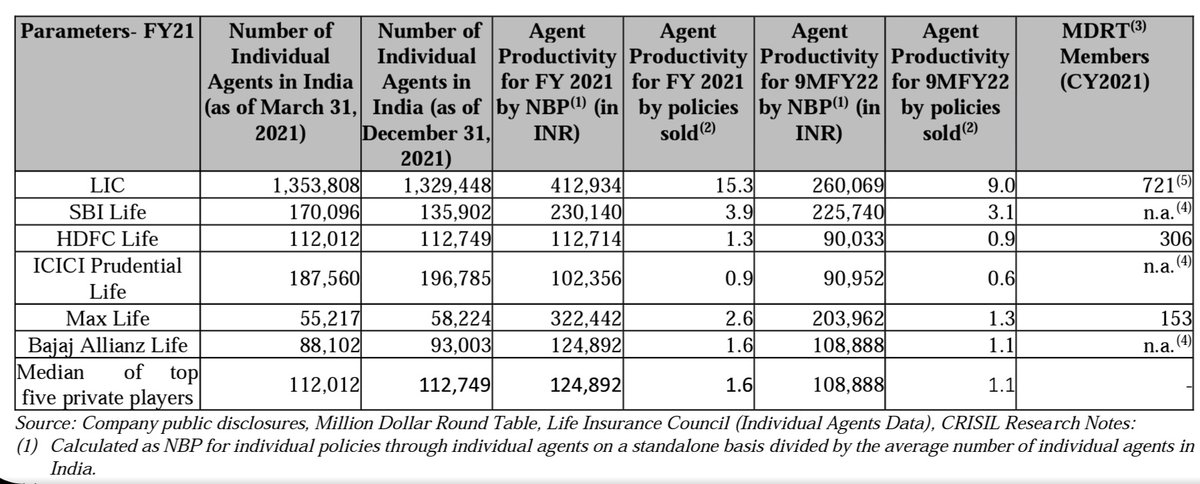

LIC’s agent network is wider than entire private life insurance player’s agent network in India. As of March 31, 2021, LIC had 1.35 million individuals in its agent network compared to 1.10 million individuals for the entire private life insurance industry.

(17/n)

(17/n)

VNB Margins:

VNB margin is calculated by dividing the value of new business by 1 year's annualised premium and it indicates the profit margins of a company.

LIC's VNB Margin remained at 9.9% for FY21. HDFC life and ICICI pru's VNB Margin was 26.1% and 25.1% respectively

(18/n)

VNB margin is calculated by dividing the value of new business by 1 year's annualised premium and it indicates the profit margins of a company.

LIC's VNB Margin remained at 9.9% for FY21. HDFC life and ICICI pru's VNB Margin was 26.1% and 25.1% respectively

(18/n)

Verdict -

Valuations seems to be definately exciting. Looks Government has kept enough for investors on the table.

However, there are some concerns on reducing market share. Private players are more ahead on digitalisation front. (20/n)

Valuations seems to be definately exciting. Looks Government has kept enough for investors on the table.

However, there are some concerns on reducing market share. Private players are more ahead on digitalisation front. (20/n)

However, based on the market share, valuations, huge distribution network & trustworthy image which LIC has built over years, I think the IPO should sail out smoothly. (21/n)

Disclaimer- Views are totally personal and not a reco to buy/subscribe/sell.

#stockmarket #LICIPO #markets #stockmarkets #StockMarketindia #stockstowatch #nifty

#stockmarket #LICIPO #markets #stockmarkets #StockMarketindia #stockstowatch #nifty

• • •

Missing some Tweet in this thread? You can try to

force a refresh