Financial speculators are pushing millions of people into hunger, flooding into commodity markets & exacerbating rising food prices. @LHReports reveals the scale of #HungerProfiteers & the lobbying that sabotaged efforts to stop investors gambling with food 🧵

In collaboration with reporters from @DerSpiegel @TheWire_ & @TheContinent_ @FTM_nl, @LHreports tracked a steep increase of money flows into listed commodity funds investing in wheat, the key ingredient for bread and pasta & whose supply is affected by war in #Ukraine

Commodity funds & markets are opaque but what we found should concern anyone worried about the current food crisis. We’ve documented a huge influx of investor cash into specialist agricultural funds, much of it coming from speculators: #HungerProfiteers

$4.5bn flowed into commodity-linked “exchange traded funds” in the 1st week of March. Normally that takes a month. And as wheat futures prices hit their record high on Mar 7, specialist US wheat fund Teucrium had to issue new shares because of soaring investor demand

By Apr 11, the top two US agri funds, Invesco’s agriculture fund and Teucrium’s wheat fund, had attracted net investment of $1.2bn vs. $197mn for the whole of 2021. By mid April they owned contracts for wheat futures equivalent to nearly half the UK's annual flour use.

Data from @CFTC, the US Commodity Futures Trading Commission, showed financiers dealing in investors' cash owned record levels of hard red spring, "the aristocrat" of US wheat whose high gluten content makes it ideal for bread. It makes up a quarter of US exports

A similar story in Europe, where ownership of Paris milling wheat futures by #HungerProfiteers hit record levels in March. Paris milling wheat is the benchmark for European milling wheat, and it's also sold to vulnerable import-dependent countries like Egypt

Our investigation looked for signs of “excessive speculation”. Traditional speculators, investing on the basis of market fundamentals of supply and demand, help farmers & buyers to hedge their risks by acting as buyers and sellers for their hedges

But ‘excessive speculation’ & speculative activity by powerful institutional investors who are unconcerned with agri market fundamentals can drive prices away from supply & demand. These players are “betting on hunger and exacerbating it” @DeSchutterO of @IPESFood told us

A new report by @IPESFood released today identified “opaque, dysfunctional and speculation-prone grain markets” as a key weakness in our food systems. ipes-food.org/pages/foodpric…

This chart illustrates the dysfunction. Cereal production levels have been fairly steady - and even increased slightly - over the past 15 years but food prices have been volatile. These fluctuations are not the result of real shortages but they do cause real hardship

The @IPESFood report shows price of bread has nearly doubled in Sudan & rose 70% in Lebanon. Cost of imported wheat increased by 33% in Kenya. This is devastating for poor households who spend a large chunk of their income on food & now have to cut what and/or how much they eat.

Worst of all, we’ve been here before: In 2007-08 crisis, international prices of maize rose by 70%, rice 180%, & wheat 120%. At least 40mn people were pushed into hunger. Lots of experts said “excessive speculation” and #HungerProfiteers played a role.

Widespread concerns pushed US & European govts to rein in the financial markets. Michael Masters, financier and founder of @BetterMarkets blamed an explosion of investment from pension funds in "commodity index funds" & cited @goldmansachs:

Masters added that this means “everyone out there is effectively paying a kind of tax to facilitate the activities of speculators”, including the poorest. “If you're living on $1 a day and the price of food doubles, it's hard, it can be deadly.” #HungerProfiteers

Like many others who wanted to regulate ‘excessive speculation’, @Bettermarkets advocated for position limits (limits on the no. of contracts a single firm could hold) - but also limits on whole classes of traders - like commodity index funds.

bettermarkets.org/wp-content/upl…

bettermarkets.org/wp-content/upl…

Democratically elected reps in the EU and US government passed laws in response, directing their regulators @EMSA and @CFTC to introduce rules to curb excessive speculation through the Dodd Frank Act and MiFID II.

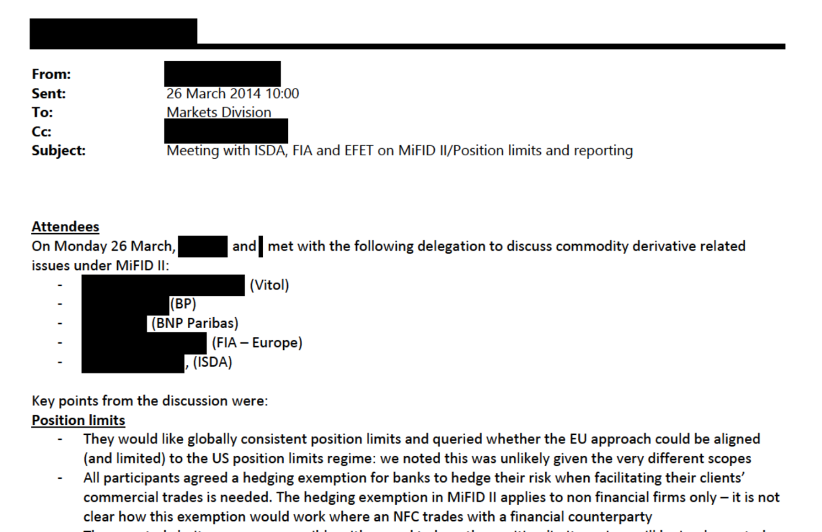

But industry groups such as @ISDA lobbied against new rules and even sued @CFTC to stop them in the US. Documents obtained by @LHreports also show @ISDA & its members @GoldmanSachs, @BNPParibas & @Citi lobbied European regulator @ESMA to weaken EU position limits.

Instead of learning from the 2007-08 crisis, the reverse happened. In 2020, new rules in Europe and the US raised - or lifted - position limits, and introduced new loopholes, benefiting the exchanges, index funds, index providers, financial intermediaries & money managers

Dennis Keller, CEO of @BetterMarkets, told us US @CFTC rule was a “fraud on the public” which “had all the appearance of putting in place an effective position limit regime that would reduce speculation and eliminate excess speculation when in fact, it did just the opposite.”

“Without stricter regulations, the commodity futures markets will just become more and more of a casino that allows speculators to earn massive profits from hunger and farmer livelihoods.” said food security expert @JennClapp. #HungerProfiteers

This investigation on Hunger Profiteers was led by the Food Systems Newsroom @LHreports. Contributors: @LudoHekman, @MargotGibbs, @thinink, @kabira_tweeting, @LiseWitteman, @bearamalhosilva, @LionelFaull, Nils Klawitter, @SiphoKings. #HungerProfiteers

In @derspiegel - "Financial data shows that investors are using the war-related food crisis to speculate. They are driving up prices and exacerbating hardship in poorer countries." spiegel.de/wirtschaft/nah…

• • •

Missing some Tweet in this thread? You can try to

force a refresh