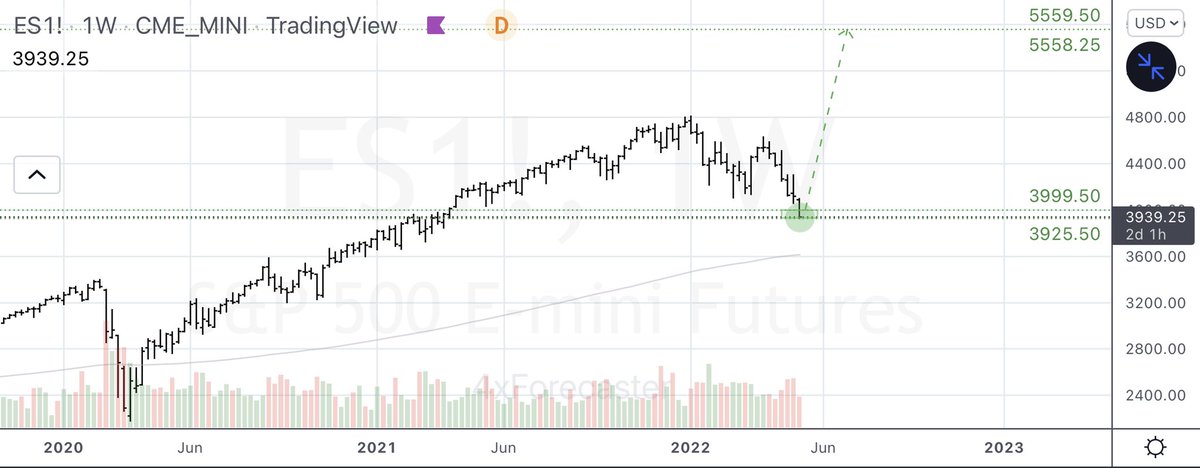

$ES (S&P-500 e-Mini Futures):

- ST: Model eyes high-probability reversal at 3999.50/3925.50 range

- MT: Bullish pending reversal sequence validation; if true, Model eyes narrow 5558.25/5559.50 target range

- LT: Bearish

#SP500

- ST: Model eyes high-probability reversal at 3999.50/3925.50 range

- MT: Bullish pending reversal sequence validation; if true, Model eyes narrow 5558.25/5559.50 target range

- LT: Bearish

#SP500

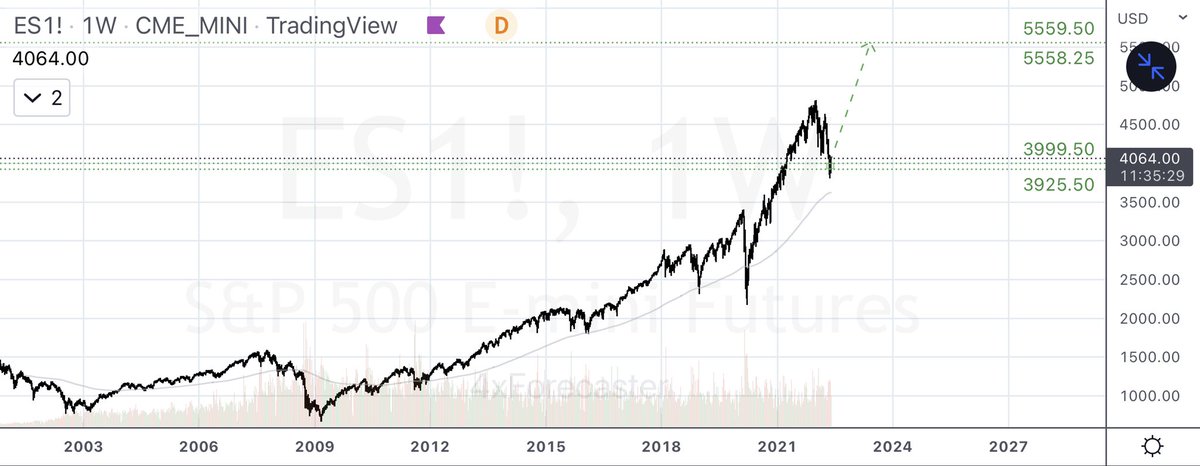

$ES (S&P 500 e-Mini Futs):

- ST: Fell, hit 3999.50/3925.50 target range as forecast; RSI in reversal range; Model is bullish, nears reversal

- MT: Bullish; unchanged target at 5558.25/5559.50

- LT: Bearish

- ST: Fell, hit 3999.50/3925.50 target range as forecast; RSI in reversal range; Model is bullish, nears reversal

- MT: Bullish; unchanged target at 5558.25/5559.50

- LT: Bearish

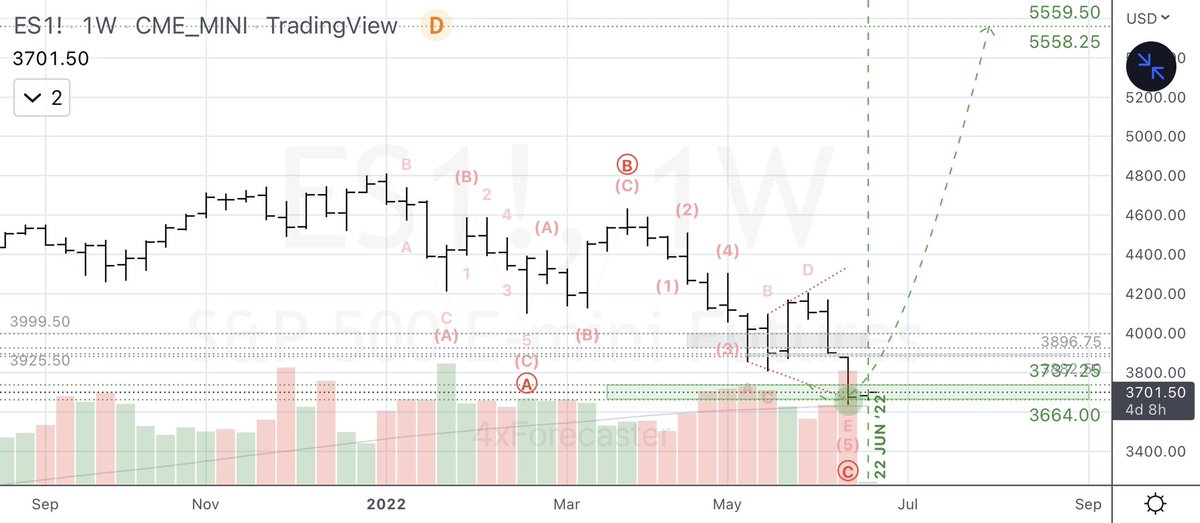

$ES (S&P-500 e-Mini Futures):

- ST: high-probability reversal at 3896.75/3882.50 target range; 3882.50 favored; invalidated if breaks below wave-C⃝ = 3807.50

#SP500 $SPY #ES1

- ST: high-probability reversal at 3896.75/3882.50 target range; 3882.50 favored; invalidated if breaks below wave-C⃝ = 3807.50

#SP500 $SPY #ES1

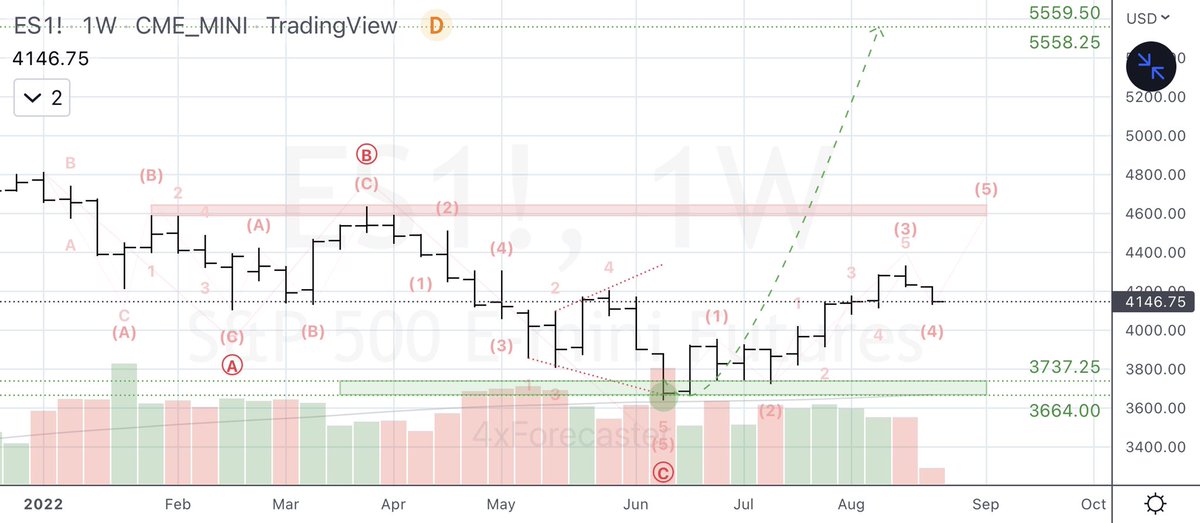

$ES (S&P-500 e-Mini Futures):

Note: wide swings, esp. those shaping into geometries are hard to pin. Their core symmetry = future R/S level:

- ST: significant swings completing into terminal geometry (A-B-C-D-E) at wave-C⃝ = 3737.25/3664.50

- MT: bullish

#SP500 #ES1 #SPX #SPY

Note: wide swings, esp. those shaping into geometries are hard to pin. Their core symmetry = future R/S level:

- ST: significant swings completing into terminal geometry (A-B-C-D-E) at wave-C⃝ = 3737.25/3664.50

- MT: bullish

#SP500 #ES1 #SPX #SPY

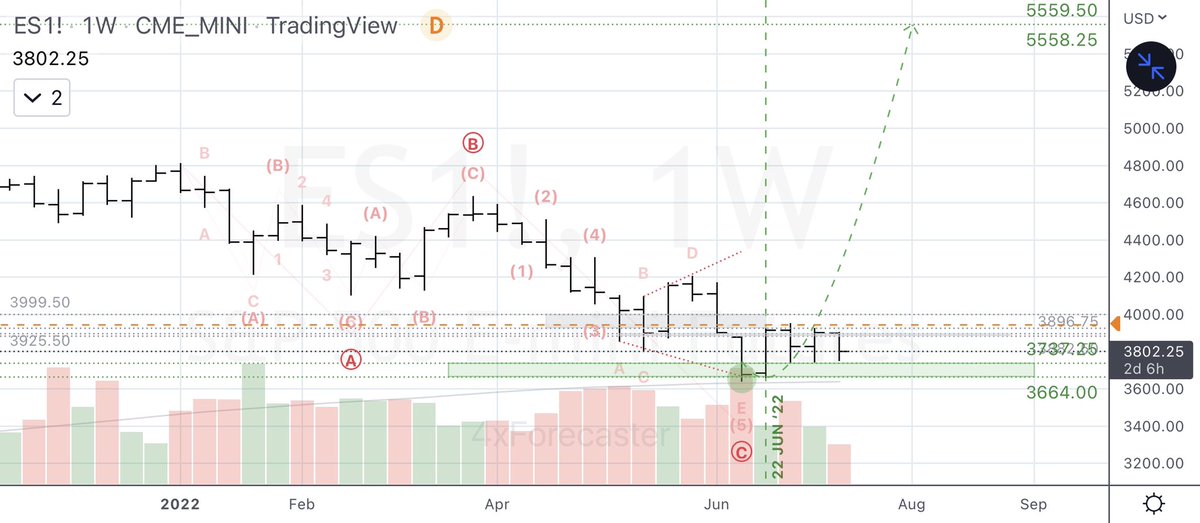

$ES (S&P-500 e-Mini Futures):

Target HIT (in its entirety)

- No change in MT forecast (see thread; charts for context)

#SP500 #ES1 #SPX #SPY

Target HIT (in its entirety)

- No change in MT forecast (see thread; charts for context)

#SP500 #ES1 #SPX #SPY

$ES (S&P-500 e-Mini Futures):

Still moving as forecast (see thread above)

- ST: bullish; 22 JUN timing carved support at 3735.00 low (daily chart)

- MT: bullish; still eyeing 5558.25/5559.50 bearish reversal target

- ST: bearish

#SP500 #ES1 #SPX #SPY

Still moving as forecast (see thread above)

- ST: bullish; 22 JUN timing carved support at 3735.00 low (daily chart)

- MT: bullish; still eyeing 5558.25/5559.50 bearish reversal target

- ST: bearish

#SP500 #ES1 #SPX #SPY

$ES (S&P-500 e-Mini Futures):

- ST: bullish; still moving as forecast (see thread)

- MT: bullish; interim resistance circa 4600.00; still eyeing 5558.25/5559.50 bearish reversal target

- ST: bearish

#SP500 #ES1 #SPX #SPY

- ST: bullish; still moving as forecast (see thread)

- MT: bullish; interim resistance circa 4600.00; still eyeing 5558.25/5559.50 bearish reversal target

- ST: bearish

#SP500 #ES1 #SPX #SPY

$ES (S&P-500 e-Mini Futures):

- ST: wave-(4) correction likely over; for overall bullish impulse to remain valid, it must remain > 3950.00

- MT: bullish; interim resistance circa 4600.00; still eyeing 5558.25/5559.50 bearish reversal target

- LT: bearish

#SP500 #ES1 #SPX #SPY

- ST: wave-(4) correction likely over; for overall bullish impulse to remain valid, it must remain > 3950.00

- MT: bullish; interim resistance circa 4600.00; still eyeing 5558.25/5559.50 bearish reversal target

- LT: bearish

#SP500 #ES1 #SPX #SPY

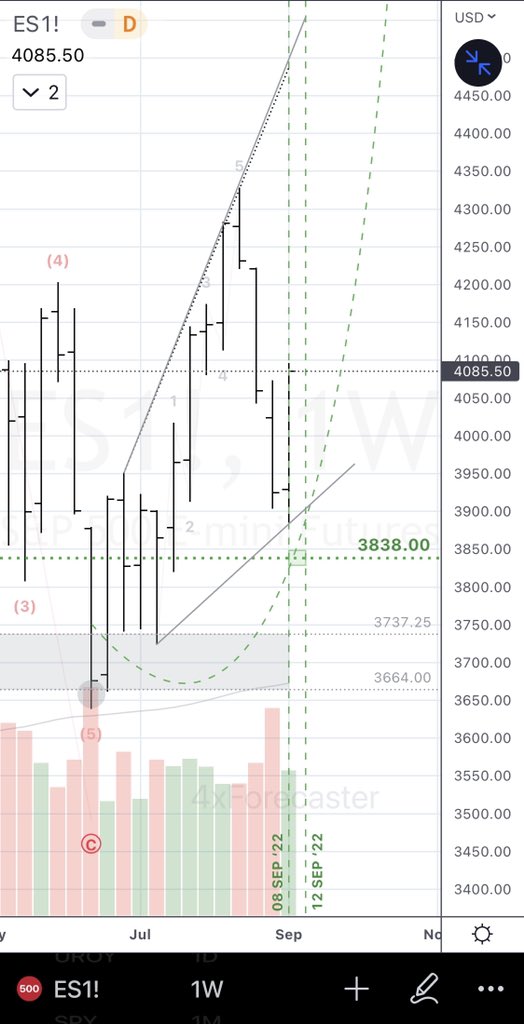

$ES (S&P-500 e-Mini Futures):

- ST: prior impulse invalidated; for current EW pattern (expanding leading diagonal: 5-3-5-3-5) to survive, wave-(4) must end at/near 3838.00 (circa 08-12 SEP per tentative timing)

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY

- ST: prior impulse invalidated; for current EW pattern (expanding leading diagonal: 5-3-5-3-5) to survive, wave-(4) must end at/near 3838.00 (circa 08-12 SEP per tentative timing)

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY

$ES (S&P-500 e-Mini Futures):

- ST: rallying at tentative time-target window of 08 SEP/12 SEP as forecast

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY

- ST: rallying at tentative time-target window of 08 SEP/12 SEP as forecast

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY

$ES (S&P-500 e-Mini Futures):

* * * NEW Targets * * *

- ST: rallying at tentative time-target 08-12 SEP as forecast; watching these R/S targets

4491.25-R (21 SEP ‘22?)

3838.0-S

5489.50-R

4942.50-S

5835.25 (NEW price-target)

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY

* * * NEW Targets * * *

- ST: rallying at tentative time-target 08-12 SEP as forecast; watching these R/S targets

4491.25-R (21 SEP ‘22?)

3838.0-S

5489.50-R

4942.50-S

5835.25 (NEW price-target)

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY

$ES (S&P-500 e-Mini Futs):

- ST: falling towards 3838.00 target as forecast; time-target saw rallies on weaker volume; now eyeing strength circa 21 SEP ‘22 as possible confluence of price-target and time-target levels.

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY $ES_F

- ST: falling towards 3838.00 target as forecast; time-target saw rallies on weaker volume; now eyeing strength circa 21 SEP ‘22 as possible confluence of price-target and time-target levels.

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY $ES_F

Re: $ES

RT from @CyclesFan … similar time-target (see thread), 21 SEP ‘22

RT from @CyclesFan … similar time-target (see thread), 21 SEP ‘22

https://twitter.com/CyclesFan/status/1572318448004337670

$ES (S&P-500 e-Mini Futs):

- ST: RISK of lower low from current vicinity, eyeing interim and imminent bearish reversal at the 4027.50/4134.00 target range; eyeing bullish reversal target at 3402.25

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY $ES_F

- ST: RISK of lower low from current vicinity, eyeing interim and imminent bearish reversal at the 4027.50/4134.00 target range; eyeing bullish reversal target at 3402.25

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY $ES_F

$ES:

PERSPECTIVE

- RT from @ChandlerTrading:

PERSPECTIVE

- RT from @ChandlerTrading:

https://twitter.com/ChandlerTrading/status/1598785600643076114

$ES (S&P-500 e-Mini Futs):

- ST: still reversing as forecast from its bearish reversal target range at 4027.50/4134.00 target range; watching for interim support at 3842.00/3833.75; unchanged RISK of decline to 3402.25

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY $ES_F

- ST: still reversing as forecast from its bearish reversal target range at 4027.50/4134.00 target range; watching for interim support at 3842.00/3833.75; unchanged RISK of decline to 3402.25

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY $ES_F

$ES (S&P-500 e-Mini Futs):

Tech-Note:

1. A rally from forecast target range at 3842.00/3833.75 would meet significant resistance at prior bearish reversal range, strongest at 4027.50

2. Invalidation of current lower-low thesis would require breach > this week’s high

3. …

Tech-Note:

1. A rally from forecast target range at 3842.00/3833.75 would meet significant resistance at prior bearish reversal range, strongest at 4027.50

2. Invalidation of current lower-low thesis would require breach > this week’s high

3. …

$ES (S&P-500 e-Mini Futs):

(…)

3. Decline from 4027.50 would establish a slightly lower target, effectively defining a bullish reversal target range at 3402.25/3388.50

D.

(…)

3. Decline from 4027.50 would establish a slightly lower target, effectively defining a bullish reversal target range at 3402.25/3388.50

D.

Re: $ES and The Santa Clause Rally effects

Attaching my review of SCR, it’s historical timing and performance, and how it may apply to the current $ES pricing:

Attaching my review of SCR, it’s historical timing and performance, and how it may apply to the current $ES pricing:

https://twitter.com/4xForecaster/status/1603786441519431680

$ES (S&P-500 e-Mini Futs):

Tech-Note:

For a rally to occur right away (i.e.: a Santa Claus Rally, plus setting aside historical facts that it could occur until a week from now and it would require beating the 7.3% record gain), a 4134.00 ceiling …

#SP500 #ES1 #SPX #SPY $ES_F

Tech-Note:

For a rally to occur right away (i.e.: a Santa Claus Rally, plus setting aside historical facts that it could occur until a week from now and it would require beating the 7.3% record gain), a 4134.00 ceiling …

#SP500 #ES1 #SPX #SPY $ES_F

$ES

Tech-Note:

… constitute the type of resistance that may best be overcome by the force compression assimilated in inter-collapsing, strength-gathering geometries, such as Ending Diagonal.

Just a thought.

D.

Tech-Note:

… constitute the type of resistance that may best be overcome by the force compression assimilated in inter-collapsing, strength-gathering geometries, such as Ending Diagonal.

Just a thought.

D.

$ES:

PERSPECTIVE:

Here is a good follow, giving winning trades; here offering a similar perspective on a lingering bear strength in $SPY:

- RT from @Mr_Derivatives:

PERSPECTIVE:

Here is a good follow, giving winning trades; here offering a similar perspective on a lingering bear strength in $SPY:

- RT from @Mr_Derivatives:

https://twitter.com/Mr_Derivatives/status/1604139341139177472

$ES (S&P-500 e-Mini Futs):

- ST: price reacted to bullish target range at 3842.00/3833.75 as forecast; watching for high-prob RISK of reversal from 4030.00 towards 3402.25/3388.50 bullish reversal target range as shown

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY $ES_F

- ST: price reacted to bullish target range at 3842.00/3833.75 as forecast; watching for high-prob RISK of reversal from 4030.00 towards 3402.25/3388.50 bullish reversal target range as shown

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY $ES_F

$ES:

Seeing 👁️ to 👁️ here, using different methods.

Perspective

- RT from @ChandlerTrading (also one I recommend following if interested in TA education):

Seeing 👁️ to 👁️ here, using different methods.

Perspective

- RT from @ChandlerTrading (also one I recommend following if interested in TA education):

https://twitter.com/ChandlerTrading/status/1605670361781133319

$ES (S&P-500 e-Mini Futs):

- ST: price remains above 3842.00/3833.75, still eyeing for high-prob RISK of reversal from 4030.00 to 3402.25/3388.50; watching for reversal circa 10 JAN ‘23

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY $ES_F

- ST: price remains above 3842.00/3833.75, still eyeing for high-prob RISK of reversal from 4030.00 to 3402.25/3388.50; watching for reversal circa 10 JAN ‘23

- MT: bullish

- LT: bearish

#SP500 #ES1 #SPX #SPY $ES_F

$ES:

- ST: still bearish with little more than sideways action over the week. Window for a SCR closed, adding credence for a bearish continuation thesis. Watching for this setup favoring further decline to 3402.25/3388.50. Last two charts are tentative, yet favored counts.

$SPX

- ST: still bearish with little more than sideways action over the week. Window for a SCR closed, adding credence for a bearish continuation thesis. Watching for this setup favoring further decline to 3402.25/3388.50. Last two charts are tentative, yet favored counts.

$SPX

$ES:

- ST: unchanged bearish bias per model; technically, continuation geometries support bearish outlook as well; watching for 3788.50 to trigger a still favored decline to 3402.25/3388.50.

Invalidated IFF #ES > point-A of triangle.

$SPX

- ST: unchanged bearish bias per model; technically, continuation geometries support bearish outlook as well; watching for 3788.50 to trigger a still favored decline to 3402.25/3388.50.

Invalidated IFF #ES > point-A of triangle.

$SPX

$ES:

- ST: still bearish, despite interim consolidation; recent move appears impulsive (1-2-3-4-5) to the downside, suggesting possible beginning of wave-C⃝.

In any case and any interim configuration, predictive model remains bound towards target range below.

$SPX

- ST: still bearish, despite interim consolidation; recent move appears impulsive (1-2-3-4-5) to the downside, suggesting possible beginning of wave-C⃝.

In any case and any interim configuration, predictive model remains bound towards target range below.

$SPX

$ES:

Similar views, different methodology.

Perspective

- RT from @ChandlerTrading

$SPX

Similar views, different methodology.

Perspective

- RT from @ChandlerTrading

$SPX

https://twitter.com/ChandlerTrading/status/1616213659839078400

$ES:

- ST: still bearish; current level is highest reversal from interim bullish reversal at 3842.00/3833.75 (see thread), before reaching invalidation > 4180.00

- MT: bullish, still eyeing reversal at 3402.25/3388.50; highest reversibility at 3191.25

#ES $SPX #SP500

- ST: still bearish; current level is highest reversal from interim bullish reversal at 3842.00/3833.75 (see thread), before reaching invalidation > 4180.00

- MT: bullish, still eyeing reversal at 3402.25/3388.50; highest reversibility at 3191.25

#ES $SPX #SP500

$ES

Tech-Note:

- ST: Model remains bearish. Unrelated to the predictive model, note the development of a NEGATIVE DIVERGENCE in RSI (i.e.: RSI makes a higher high relative to price peaks, whereas price makes a lower-high.

(see attached DAILY chart)

(…)

#ES $SPX #SP500

Tech-Note:

- ST: Model remains bearish. Unrelated to the predictive model, note the development of a NEGATIVE DIVERGENCE in RSI (i.e.: RSI makes a higher high relative to price peaks, whereas price makes a lower-high.

(see attached DAILY chart)

(…)

#ES $SPX #SP500

(…) As a point of illustration - and perhaps of education to those who aimlessly look for bearish divergences - here is the same chart but WEEKLY frames, wherein a same (-) Div. occurred recently, and appears to prepare once more.

(…)

(…)

(…) it would take price breaking above and closing above (BACA) its recent high at 4180.00 to erase the (-) Div in the DAILY chart.

I recently tried to explain this concept to a trader convinced that fundamental hype would support price (see attached), when it ended up falling.

I recently tried to explain this concept to a trader convinced that fundamental hype would support price (see attached), when it ended up falling.

https://twitter.com/4xforecaster/status/1615048316085227522

Overall, know your divergences. Most rookies will use RSI in ways instructed by conventional institutions.

Notions such as over/under-bought or bearish/bullish divergences are NOT helping anyone. If anything, they do NOT signal anything of imminent relevance.

Trust, but verify!

Notions such as over/under-bought or bearish/bullish divergences are NOT helping anyone. If anything, they do NOT signal anything of imminent relevance.

Trust, but verify!

Tech-Note Addendum:

Re: (-)Div.:

Here is another illustration from $DNN, where a (-) Div would still work (i.e.: RSI highs vs lower price spikes), even in the even that a price carves a perfect double-top (here at 1.52).

Until price carved a higher-high at 1.53, (-)Div stands.

Re: (-)Div.:

Here is another illustration from $DNN, where a (-) Div would still work (i.e.: RSI highs vs lower price spikes), even in the even that a price carves a perfect double-top (here at 1.52).

Until price carved a higher-high at 1.53, (-)Div stands.

(…) Remember, you’re only dealing with probabilities (and don’t think numbers, just LOW/MOD/HIGH probability of an event occurring.

Bullish/bearish divergences- for reasons I have illustrated in the linked thread above - are LOW probability of an imminent directional event.

…

Bullish/bearish divergences- for reasons I have illustrated in the linked thread above - are LOW probability of an imminent directional event.

…

(…) In contrast, POSITIVE or NEGATIVE Divergences are rarer events with greater specificity (i.e.: “they do what they say they’ll do”), while being rare events (i.e. low sensitivity), whereas bearish/bullish divergences are very sensitive (“ring a lot”), but have a very low (…)

(…) specificity (i.e.: “they talk a lot about doing it, but don’t or not as immediately”).

Review the linked thread for illustrations, and rehearse these in your own (Google them under my alias too; been talking about these for a long while).

Cheers,

David

Review the linked thread for illustrations, and rehearse these in your own (Google them under my alias too; been talking about these for a long while).

Cheers,

David

• • •

Missing some Tweet in this thread? You can try to

force a refresh