How do #Options work? How to include options into your strategy? Why do we need options products in #DeFi?

We cover all of the basics you need in our latest visual guide, decentralized options.

(1/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

We cover all of the basics you need in our latest visual guide, decentralized options.

(1/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

An option is a #contract giving the investor the right, but not the obligation, to buy or sell an underlying asset at a specific price on a certain time period. Investors must pay a premium to get the contract.

(2/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

(2/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

The option writer is the seller of an option who opens a position to collect a premium payment from the buyer of the options contract.

(3/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

(3/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

Call options are right to buy an asset at the strike price and specific time period. If buyers think that the price will go up, they buy call options. Conversely, put options are right to sell an asset.

(4/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

(4/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

Buyers can be profitable if the current price in the money (ITM), for call options will be above the strike price and put is below the strike price. Out of the Money (OTM) means the contract is worthless.

(5/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

(5/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

In this example, we can see how call options made a significant profit for Jack in ITM conditions.

(6/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

(6/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

However, ITM also doesn't mean all profit as the cost of premium and transaction fee should be considered. In this example, Lana is in ITM but she is not reaching breakeven and suffered a loss.

(7/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

(7/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

In OTM conditions, the loss is expected as the contract is deemed worthless but the maximum loss will be the amount of premium paid if it is not exercised.

(8/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

(8/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

Another reason to buy the put options is to hedge against volatility and act as an insurance for underlying assets.

(9/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

(9/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

There are also covered and naked options, however in cryptocurrency options contracts come in the form of covered options as they are collateralized by crypto assets.

(10/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

(10/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

There is also a difference in settlement style, the European style exercises the contract ONLY at the end of expiration date meanwhile the American style could exercise it anytime during the contract period.

(11/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

(11/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #Derivatives

Options contract will make your strategy more diverse, as it has the potential to reap large benefits at a fraction of the price. Some also strategically deploy the options to hedge their assets in volatile markets.

(12/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #FTM

(12/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #FTM

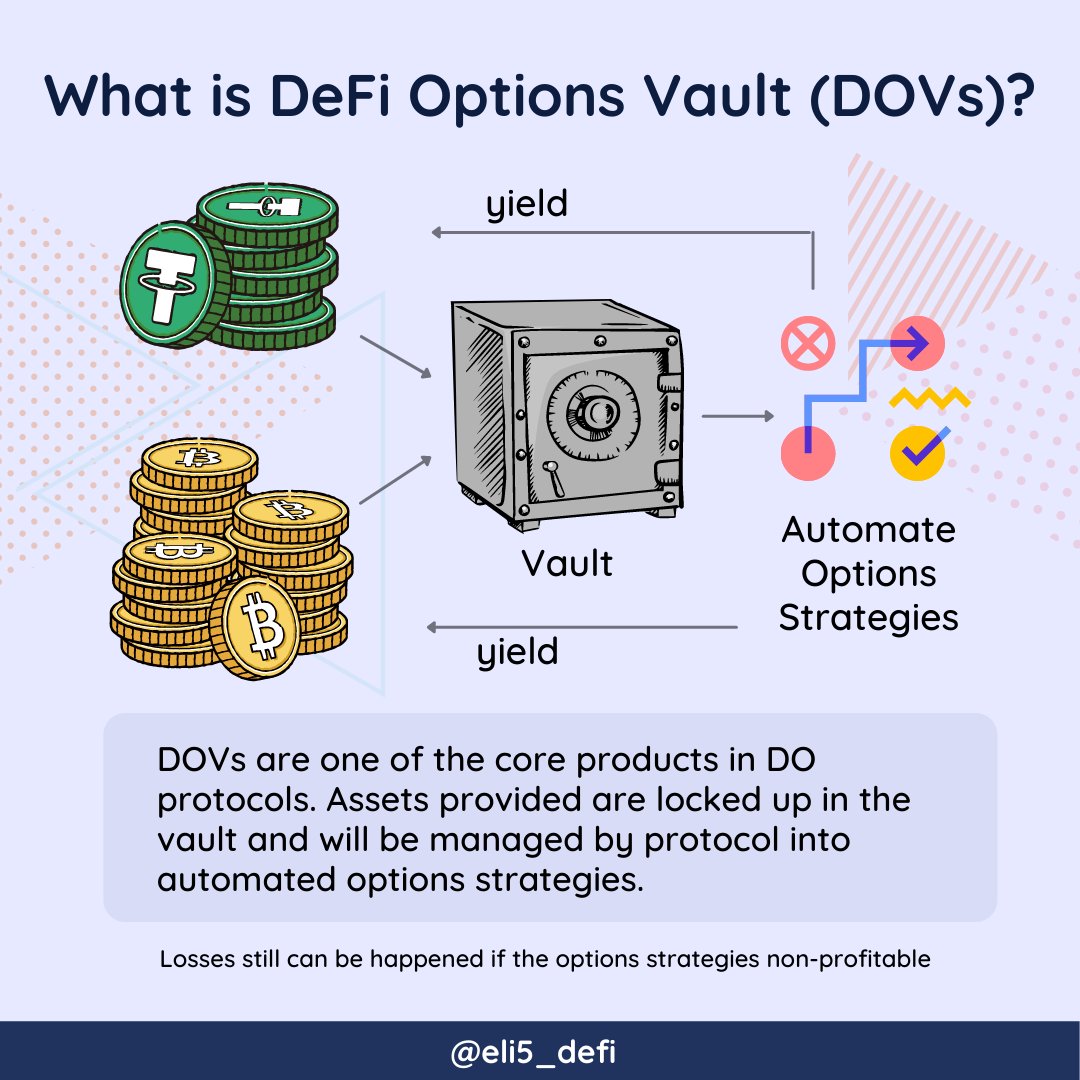

Decentralized Options (DO) enable options trading strategies in a non-custodial manner by utilizing smart contracts in the blockchain.

(13/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #FTM #Arbitrum #Solana #OptionsTrading #Optimism

(13/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #FTM #Arbitrum #Solana #OptionsTrading #Optimism

DOVs are one of the core products in DO protocols. Assets provided are locked up in the vault and will be managed by protocol into automated options strategies.

(14/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #FTM #Arbitrum #Solana #OptionsTrading #Optimism

(14/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #FTM #Arbitrum #Solana #OptionsTrading #Optimism

DOVs rely on the trading volatility and the yield generated is organic and sustainable. It is a breakthrough for DeFi as it not dependent on the distributions/ token inflations.

(15/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #FTM #Arbitrum #Solana #OptionsTrading

(15/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #FTM #Arbitrum #Solana #OptionsTrading

Options trading is also facilitated in several DOs. All processes will go through a smart contract from the creation contract until settlement.

(16/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #FTM #Arbitrum #Solana #OptionsTrading

(16/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #FTM #Arbitrum #Solana #OptionsTrading

Understanding how options work will enrich your strategy. By practising careful risk management you can have significant profit with limited risk.

(17/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #FTM #Arbitrum #Solana #OptionsTrading

(17/17)

#Cryptocurrency #Bitcoin #Ethereum #AVAX #BNB #FTM #Arbitrum #Solana #OptionsTrading

Below is the list of Options Protocol in DeFi:

@opyn_

@HegicOptions

@ribbonfinance

@Buffer_Finance

@dopex_io

@DAOJonesOptions

@FODLfi

@PolynomialFi

@Katana_HQ

@Opium_Network

@PremiaFinance

@lyrafinance

@StakeDAOHQ

@AuctusOptions

Full list:

defillama.com/protocols/Opti…

@opyn_

@HegicOptions

@ribbonfinance

@Buffer_Finance

@dopex_io

@DAOJonesOptions

@FODLfi

@PolynomialFi

@Katana_HQ

@Opium_Network

@PremiaFinance

@lyrafinance

@StakeDAOHQ

@AuctusOptions

Full list:

defillama.com/protocols/Opti…

This visual guide had many references from the account below:

@tztokchad

@snarkyzk

@0xBarry

@Tetranode

@antonttc

@0xmjs

@phtevenstrong

@The_ReadingApe

@PlutusDAO_io

@tz_binance

@0xAlexEuler

@thedefiedge

@JiraiyaReal

@tztokchad

@snarkyzk

@0xBarry

@Tetranode

@antonttc

@0xmjs

@phtevenstrong

@The_ReadingApe

@PlutusDAO_io

@tz_binance

@0xAlexEuler

@thedefiedge

@JiraiyaReal

• • •

Missing some Tweet in this thread? You can try to

force a refresh