Algorithmic #stablecoins have become the most discussed topic in CT since the collapse of $LUNA and $UST.

1/ But what preceded these events and is there a future for also stables? The thread will be very long 🧵

1/ But what preceded these events and is there a future for also stables? The thread will be very long 🧵

2/ *Intro starts here*

Algorithmic stablecoins probably started with two articles from as far back as 2014:

◽️ Hayek's Money: A Solution for Cryptocurrency Price Stability" by @Ferdinando1970

◽️Cryptocurrency Stabilization Note: Seigniorage Stocks by @codedlogic

Algorithmic stablecoins probably started with two articles from as far back as 2014:

◽️ Hayek's Money: A Solution for Cryptocurrency Price Stability" by @Ferdinando1970

◽️Cryptocurrency Stabilization Note: Seigniorage Stocks by @codedlogic

3/ @Ferdinando1970 proposed a cryptocurrency with an elastic supply that would be recalculated on the balances of all users in accordance with demand.

4/ All stablecoins with elastic supply are desperation for users, because. the value of user assets can still change not through the price, but through the number of tokens on the balances, let's make an ELI5 example:

5/ @codedlogic circulated the same message, but with an important addition: using 2 types of tokens, one as an elastic stablecoin and the second as a Seigniorage Share, which will get all the benefits from increased demand, but also retain all the risks when demand decreases.

6/ This system includes 2 or 3 tokens:

◽️Algorithmic stablecoin itself

◽️Share Token

◽️Bond Token

In short, in this case, all the gains and losses from the increase and decrease in supply pass to the holders of stocks and bonds, so stablecoin users can keep a truly stable asset.

◽️Algorithmic stablecoin itself

◽️Share Token

◽️Bond Token

In short, in this case, all the gains and losses from the increase and decrease in supply pass to the holders of stocks and bonds, so stablecoin users can keep a truly stable asset.

7/ Does it work?

Unfortunately no. All algorithmic stables have failed to become mainstream and stable. @BasisCash is now worth $0.005, the @emptysetdollar is $0.003, @bdollar_fi is $0.01, etc.

Note that we are not considering $FRAX here as it is a partially backed #stablecoin.

Unfortunately no. All algorithmic stables have failed to become mainstream and stable. @BasisCash is now worth $0.005, the @emptysetdollar is $0.003, @bdollar_fi is $0.01, etc.

Note that we are not considering $FRAX here as it is a partially backed #stablecoin.

8/ The main problem is that all algorithmic stablecoins are pegged because of the people who believe in them. If no one is willing to buy it when supply exceeds demand and the price drops below 1, then the token is failing.

9/ Any stablecoin aspires to become the unit of account of the #DeFi sphere so that it can be traded with many other pairs through different chains, but none of the also stables have been able to do this, except for one...

*the intro finishes here and we move to the plot*

*the intro finishes here and we move to the plot*

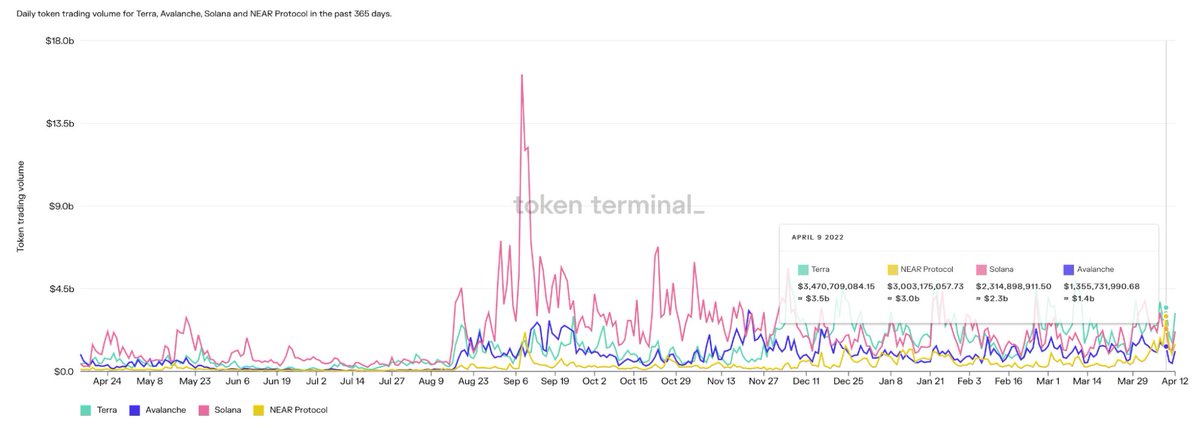

10/ At the top of $UST, its M.Cap reached $18.7 billion and it was traded on many different networks such as @terra_money, @BNBCHAIN, @ethereum, and more. Many AMM protocols have paired with #UST so it has been very successful.

11/ But @anchor_protocol had a big bubble growing under the hood. Many USTs have been issued and moved to Anchor staking because it offers a much higher APY rate than other possible options for farmers.

12/ As a result, out of $18.77 billion $UST, $14 billion, or 74%, came from @anchor_protocol. And all this money was just hired capital that profits from high returns, it was ready to leave Anchor once yields decrease.

13/ Also, the protocol could not maintain such high profitability only at the expense of revenue, therefore, it spent its own reserves on payments.

The chart below shows $UST holdings at @anchor_protocol.

The chart below shows $UST holdings at @anchor_protocol.

14/ It was stable until the end of 2022 (meaning the protocol was generating enough revenue to pay creditors), but after a spike in deposits, @anchor_protocol started burning huge amounts of money.

15/ In mid-February 2022, it was almost completed, but the Terra Foundation financed it for another 500 million euros.

16/ So, the team decided to reduce the yield on @anchor_protocol and bring the rate to the market average, but made this process slow, -1.5% per month, because a sharp decline could scare off investors. And the exit of investors from Anchor would lead to the following results:

17/ If this process were slow, then the system would probably survive the outflow. Especially with more diverse collateral like $BTC, $AVAX, and other coins that #LFG started buying. Of course, $LUNA's price would have suffered a lot, but not as much as it did.

18/ But the planned (or not?) attack on the ecosystem ruined all these plans, and the panic sell of $UST and $LUNA put an end to some future plans.

Here we see the vulnerability of the system.

Here we see the vulnerability of the system.

19/ With a reduction in the supply of $UST, $LUNA holders became lenders and suffered losses from the reduction in $UST. So holders just started selling $LUNA to less informed members, who started doing the same after a while => the value of LUNA as collateral for UST decreased.

20/ And now we come to the next, very important chart designed by @spin_fi researchers.

The most important part here is the $LUNA M.Cap/UST Supply ratio or Risk ratio. The higher this coefficient, the higher the protection of the UST on the capitalization of LUNA.

The most important part here is the $LUNA M.Cap/UST Supply ratio or Risk ratio. The higher this coefficient, the higher the protection of the UST on the capitalization of LUNA.

21/ As we can see, this ratio dropped significantly earlier, in July 2021. And some were afraid of its unpeg, but then $UST survived and the coefficient returned to safe numbers. But in 2022, the ratio fell again, and this time no one saved it.

22/ Generally, if $UST supply is reduced, this should increase $LUNA supply, and the market should lower the price of #LUNA by the same percentage. For example, the supply of LUNA increased by 5% and the market reduced the price of LUNA by 5%.

23/ But in practice, LUNA holders just sell their tokens, and this pushes prices down more, and the flywheel starts to spin.

UST holders, seeing LUNA fall, start selling UST.

LUNA holders, who understand that this will lead to the transfer of UST to LUNA, start selling LUNA.

UST holders, seeing LUNA fall, start selling UST.

LUNA holders, who understand that this will lead to the transfer of UST to LUNA, start selling LUNA.

24/ If #LUNA M.Cap were much larger than #UST's offer, then the stablecoin would have less impact on LUNA's capitalization, but in the case of @terra_money, UST was worth more than 50% of LUNA's capitalization...

25/ So, does it mean that an algorithmic stablecoin cannot exist?

This question will be the main topic of the second part of a series of threads dedicated to algorithmic stablecoins (soon) 🔥

This question will be the main topic of the second part of a series of threads dedicated to algorithmic stablecoins (soon) 🔥

• • •

Missing some Tweet in this thread? You can try to

force a refresh