#BTC is down -40% since the Death Cross occurred in early Jan '22

History suggests that whenever a Death Cross occurs, #Bitcoin experiences deeper downside

Now that one has occurred, what could we potentially expect?

Here's a thread with my analysis about the $BTC Death Cross:

History suggests that whenever a Death Cross occurs, #Bitcoin experiences deeper downside

Now that one has occurred, what could we potentially expect?

Here's a thread with my analysis about the $BTC Death Cross:

1.

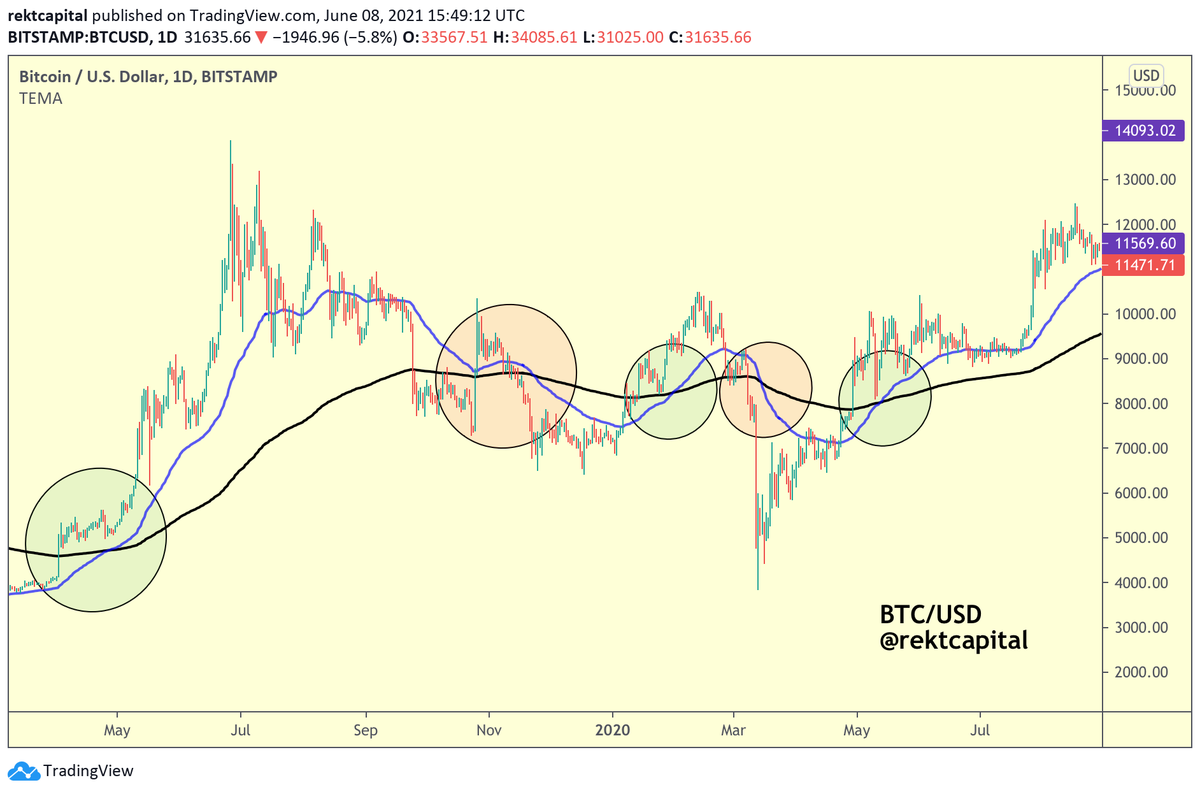

A bullish Golden Cross occurs when the 50 EMA (blue) crosses OVER the 200 EMA (black)

Golden Crosses precede lots of upside in #BTC's price (green)

A bearish Death Cross occurs when the 50 EMA crosses UNDER the 200 EMA (red)

Death Crosses precede lots of downside for $BTC

A bullish Golden Cross occurs when the 50 EMA (blue) crosses OVER the 200 EMA (black)

Golden Crosses precede lots of upside in #BTC's price (green)

A bearish Death Cross occurs when the 50 EMA crosses UNDER the 200 EMA (red)

Death Crosses precede lots of downside for $BTC

2.

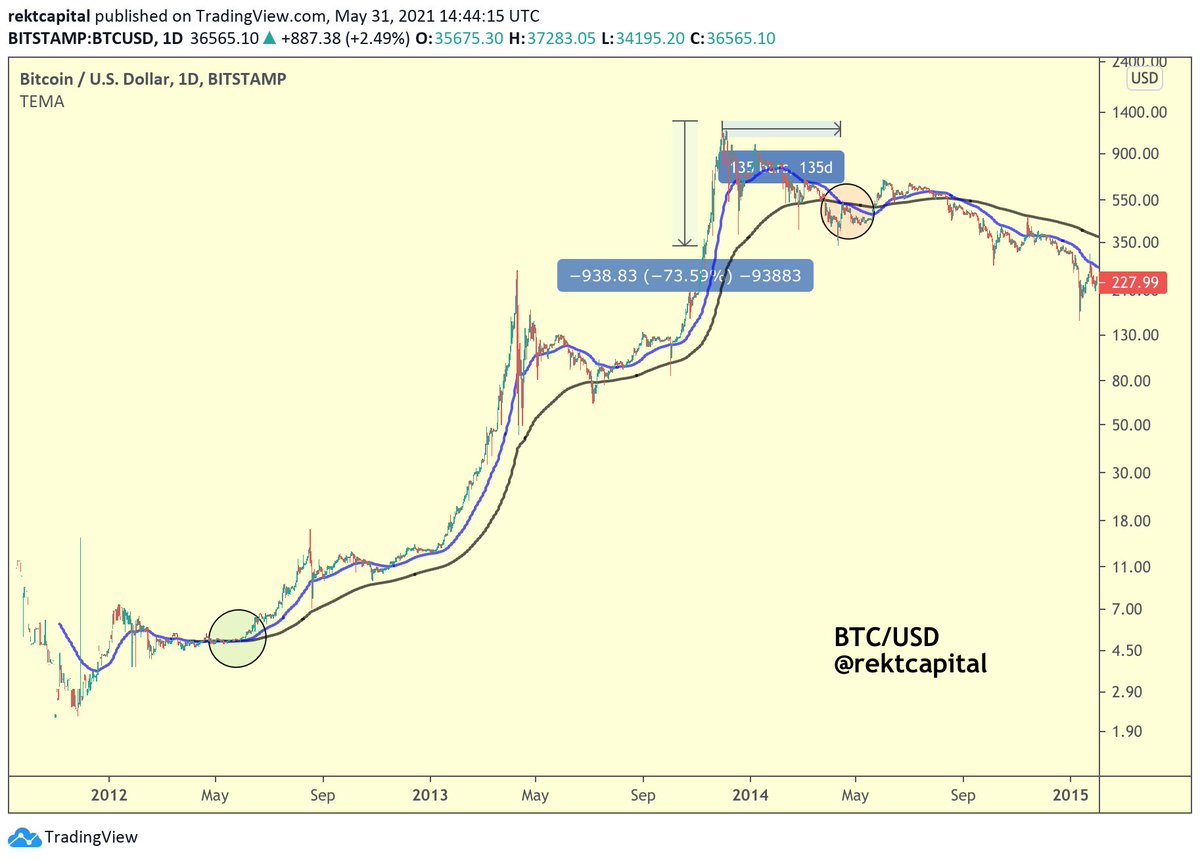

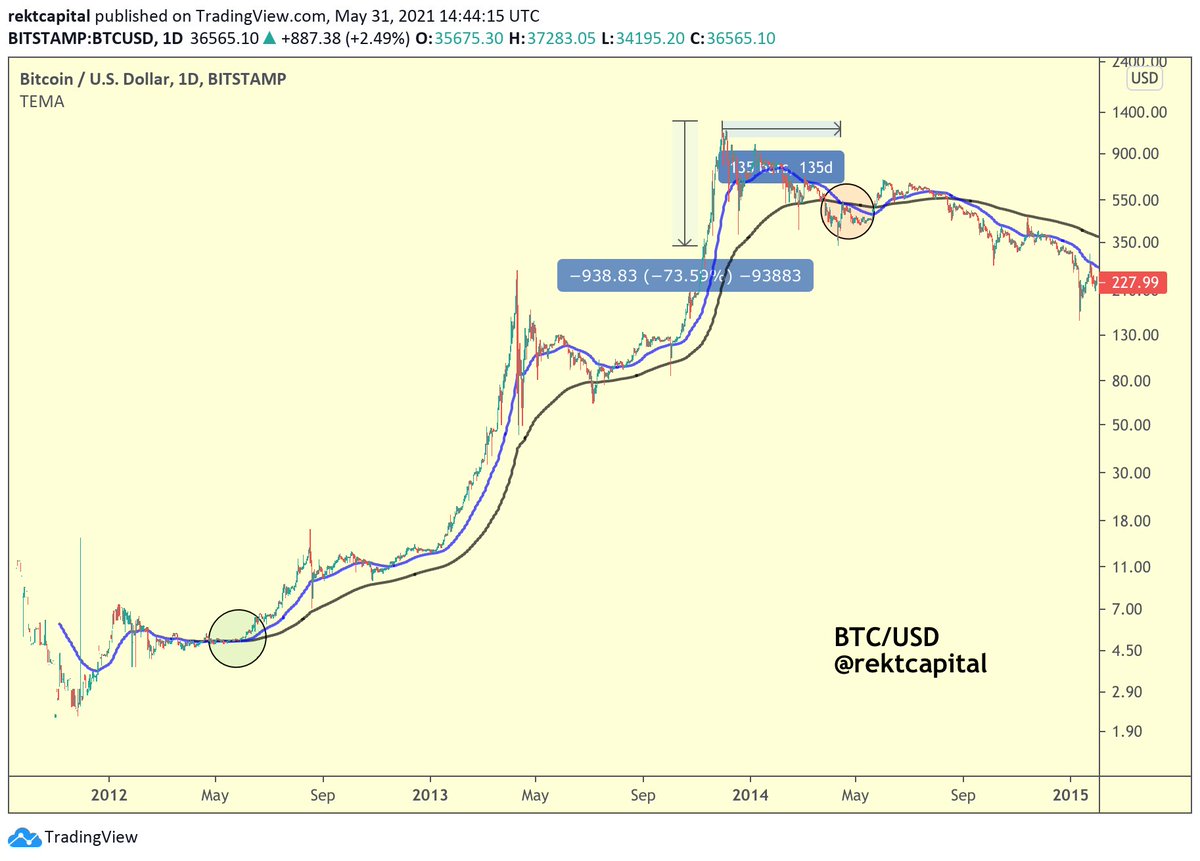

But notice how it takes a significant amount of time for #BTC to actually perform a bearish Death Cross (red)

When $BTC peaked in 2013, it took 135 days for the Death Cross to occur

That's over 4 months

And during those 4+ months...

#Bitcoin dropped -73%

But notice how it takes a significant amount of time for #BTC to actually perform a bearish Death Cross (red)

When $BTC peaked in 2013, it took 135 days for the Death Cross to occur

That's over 4 months

And during those 4+ months...

#Bitcoin dropped -73%

3.

The Death Cross occurs with some lag

So by the time it happens - a lot of downside will have already happened

That said, the Death Cross confirms a bearish trend and precedes even more downside

And in 2013, the Death Cross preceded an additional -71% drop...

The Death Cross occurs with some lag

So by the time it happens - a lot of downside will have already happened

That said, the Death Cross confirms a bearish trend and precedes even more downside

And in 2013, the Death Cross preceded an additional -71% drop...

4.

In sum, when #BTC peaked in 2013...

BTC dropped -73% in 135 days until the Death Cross happened

And when the Death Crossover actually occurred - $BTC dropped an additional -71% in the months that followed

In sum, when #BTC peaked in 2013...

BTC dropped -73% in 135 days until the Death Cross happened

And when the Death Crossover actually occurred - $BTC dropped an additional -71% in the months that followed

5.

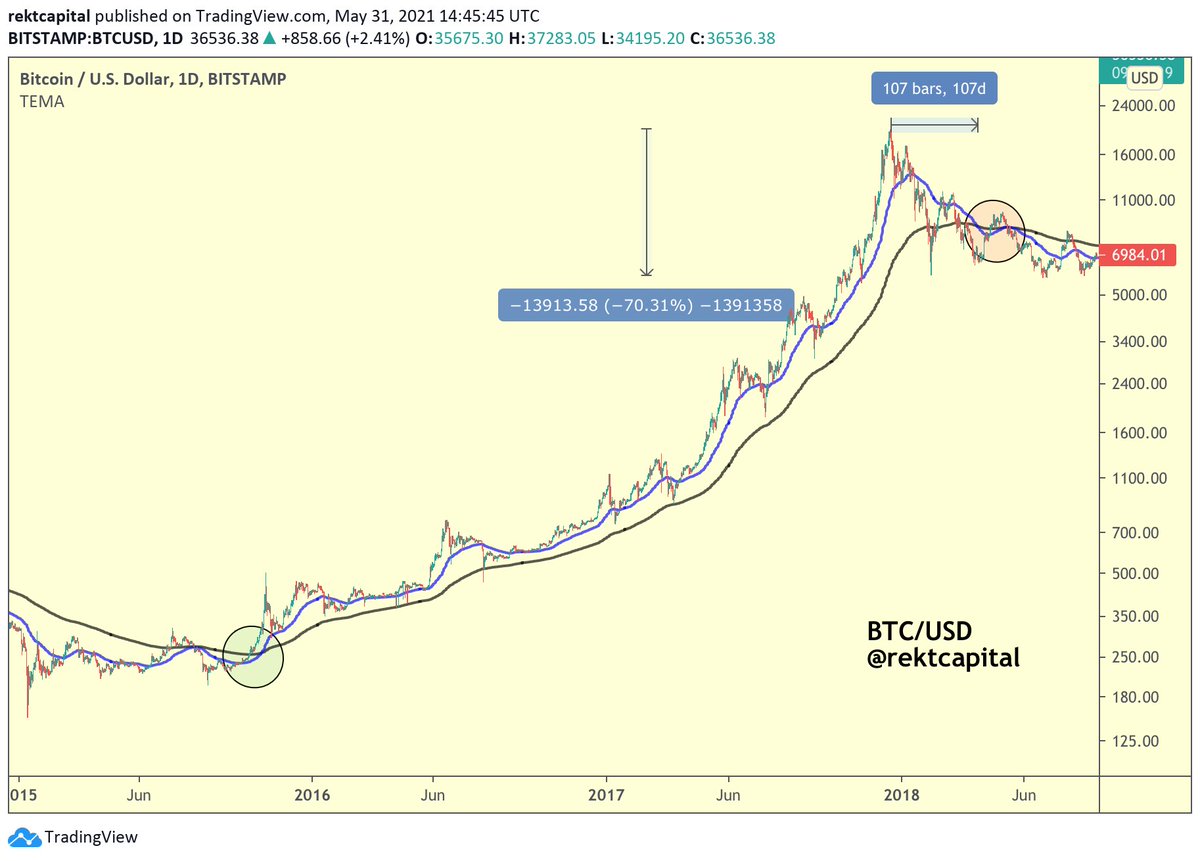

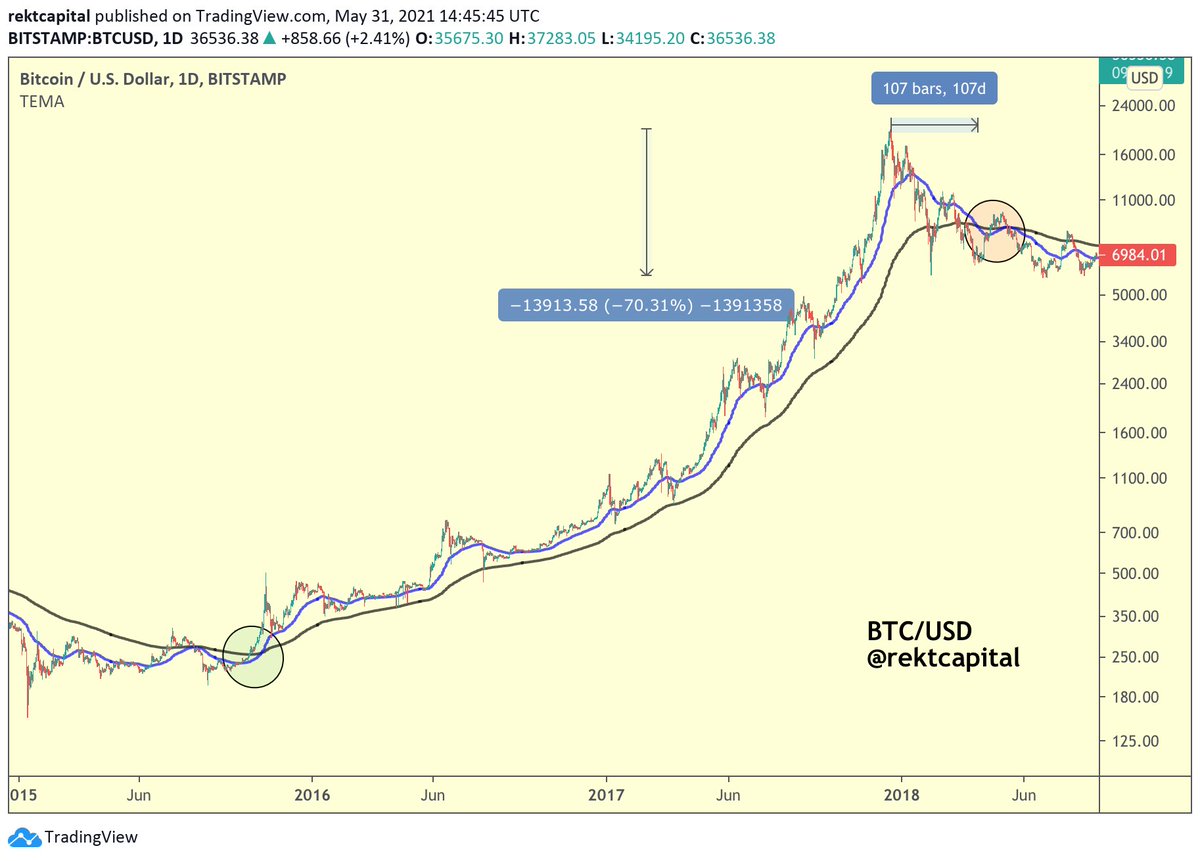

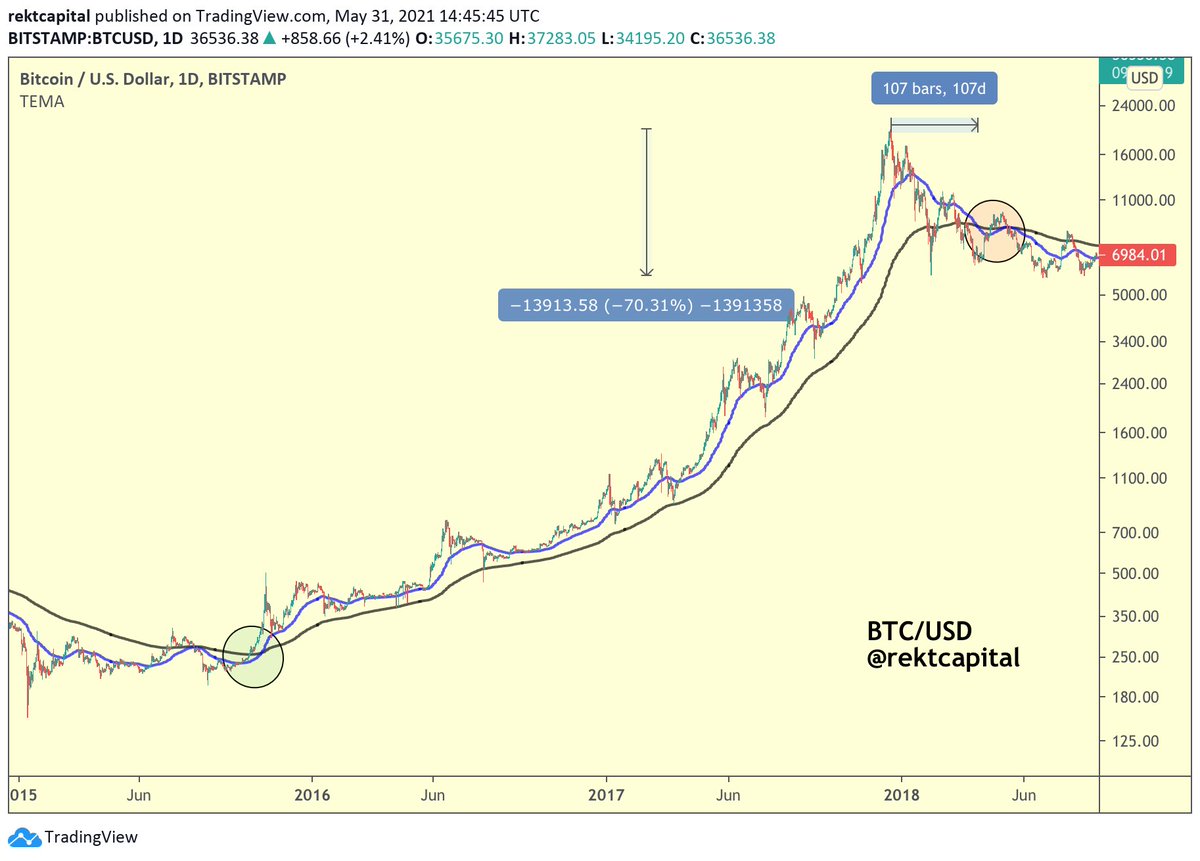

Let's take another period into account:

When $BTC peaked in 2017, it took 107 days for the Death Cross to occur

That's 3.5 months

And during those 3+ months...

#Bitcoin dropped -70% from the $20,000 peak

Let's take another period into account:

When $BTC peaked in 2017, it took 107 days for the Death Cross to occur

That's 3.5 months

And during those 3+ months...

#Bitcoin dropped -70% from the $20,000 peak

6.

Yes, #BTC dropped -70% before the Death Cross actually occurred

But once the Death Cross happened, $BTC experienced an additional -65% correction to the downside

The Death Cross once again confirmed even more downside

Yes, #BTC dropped -70% before the Death Cross actually occurred

But once the Death Cross happened, $BTC experienced an additional -65% correction to the downside

The Death Cross once again confirmed even more downside

7.

In sum, when #BTC peaked in 2017...

BTC dropped -70% in 107 days until the Death Cross happened

And when the Death Crossover actually occurred - $BTC dropped an additional -65% in the months that followed

In sum, when #BTC peaked in 2017...

BTC dropped -70% in 107 days until the Death Cross happened

And when the Death Crossover actually occurred - $BTC dropped an additional -65% in the months that followed

8.

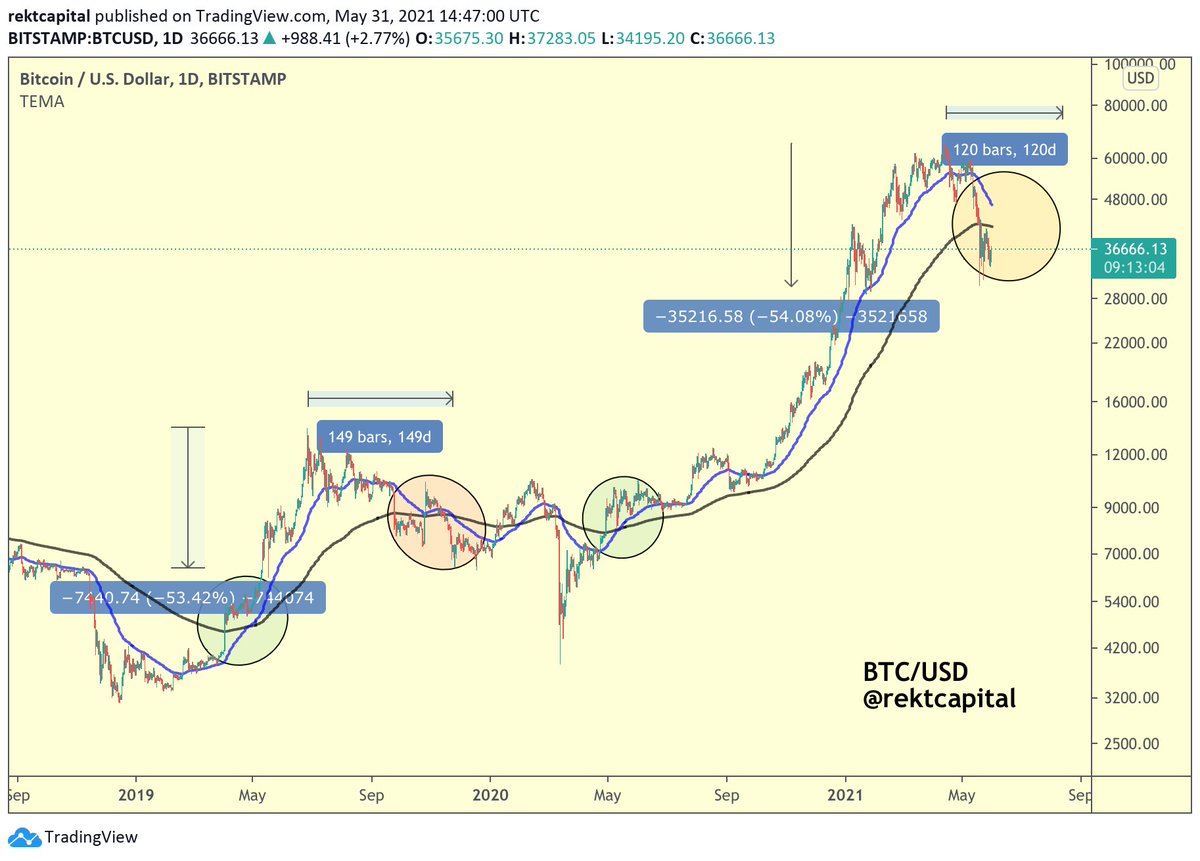

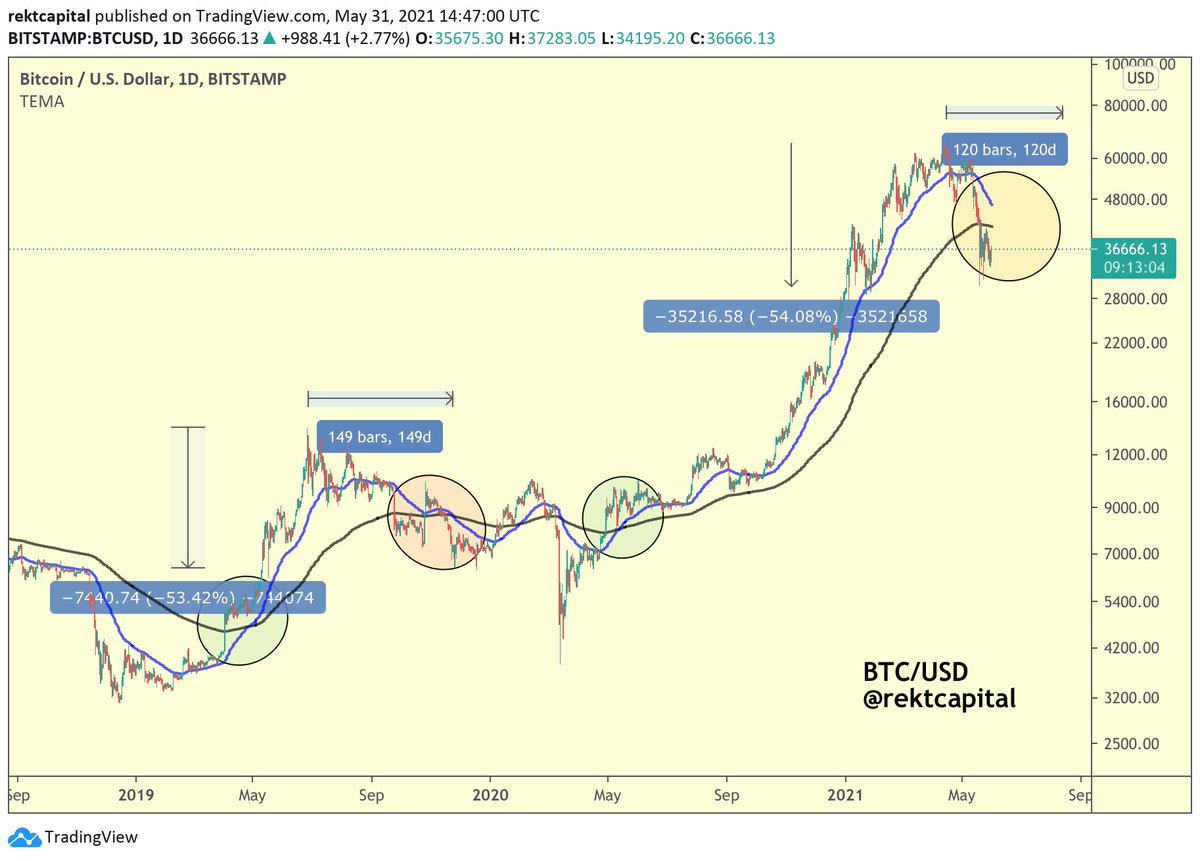

Let's now take a look at another historical Death Cross period:

When $BTC peaked in June 2019, it took 149 days for the Death Cross to occur

It took BTC 5 months to perform a Death Cross

But until that Death Cross occurred, #BTC's price had already dropped by -53%

Let's now take a look at another historical Death Cross period:

When $BTC peaked in June 2019, it took 149 days for the Death Cross to occur

It took BTC 5 months to perform a Death Cross

But until that Death Cross occurred, #BTC's price had already dropped by -53%

9.

But once the Death Cross took place, #BTC dropped an additional -55% to the downside

In sum when $BTC peaked in June 2019, BTC first dropped -53% before the Death Cross took place

And once that Death Cross occurred, an additional -55% retrace happened for #Bitcoin

But once the Death Cross took place, #BTC dropped an additional -55% to the downside

In sum when $BTC peaked in June 2019, BTC first dropped -53% before the Death Cross took place

And once that Death Cross occurred, an additional -55% retrace happened for #Bitcoin

10.

In sum, when $BTC peaked in June 2019...

Price had already dropped by -53% before the Death Cross

Once the Death Cross happened, #BTC retraced an extra -55% before bottoming in early 2020

Very similar retracement periods prior to and after the Death Crossover

In sum, when $BTC peaked in June 2019...

Price had already dropped by -53% before the Death Cross

Once the Death Cross happened, #BTC retraced an extra -55% before bottoming in early 2020

Very similar retracement periods prior to and after the Death Crossover

11.

Of course, a few DCs that occurred during late 2019 & early 2020 didn't precede much downside

In fact, the March 2020 DC marked out the generational bottom for #BTC

In a macro accumulation phase, EMAs tend to oscillate closely and perform trend-meaningless EMA crossovers

Of course, a few DCs that occurred during late 2019 & early 2020 didn't precede much downside

In fact, the March 2020 DC marked out the generational bottom for #BTC

In a macro accumulation phase, EMAs tend to oscillate closely and perform trend-meaningless EMA crossovers

12.

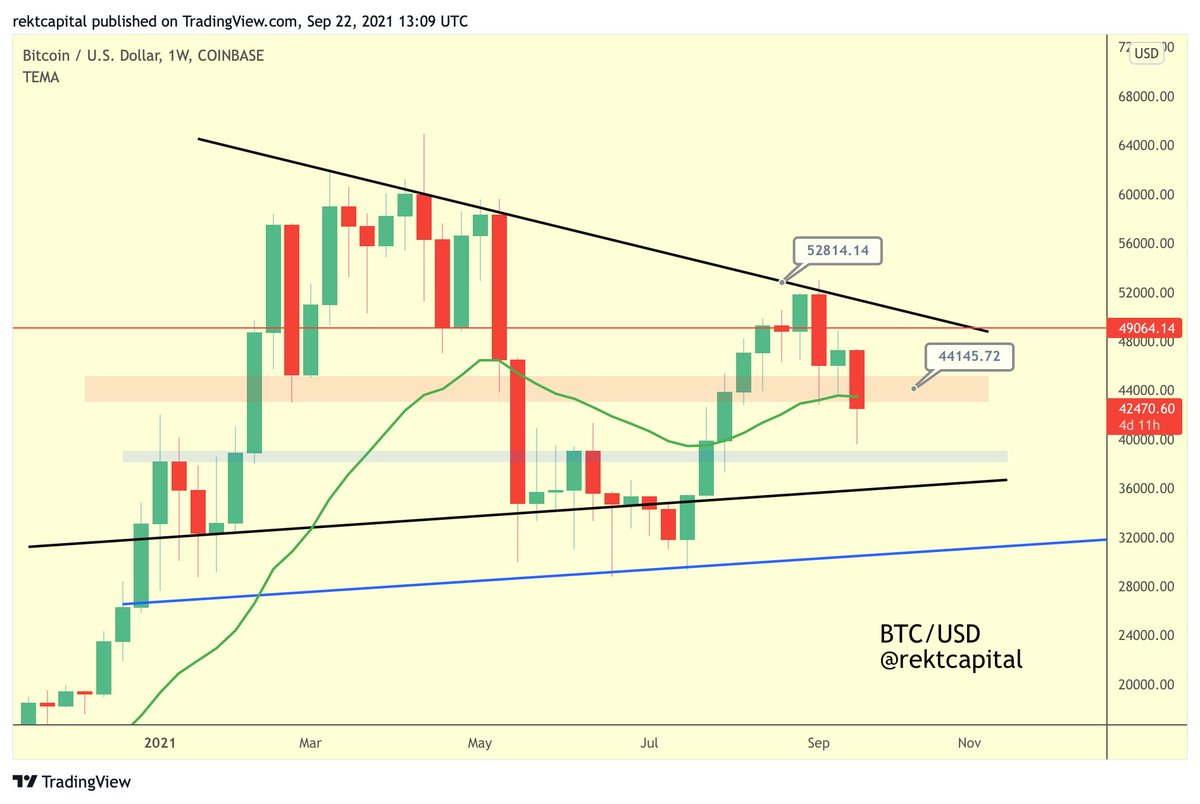

Moreover, July 2021 once again showed that #BTC Death Crosses can precede generational bottoms

When $BTC peaked in May 2021, it took 69 days for the Death Cross to occur, a little over 3 months

But until that Death Cross occurred, BTC's price had already dropped by -55%

Moreover, July 2021 once again showed that #BTC Death Crosses can precede generational bottoms

When $BTC peaked in May 2021, it took 69 days for the Death Cross to occur, a little over 3 months

But until that Death Cross occurred, BTC's price had already dropped by -55%

13.

Firstly, the July 2021 #BTC Death Cross occurred 69 days after the May 2021 crash

That's much quicker than history would suggest

Historically, Death Crosses have occurred 107-135 days after the $BTC peak

But in July 2021, BTC actually rallied +141% after the Death Cross!

Firstly, the July 2021 #BTC Death Cross occurred 69 days after the May 2021 crash

That's much quicker than history would suggest

Historically, Death Crosses have occurred 107-135 days after the $BTC peak

But in July 2021, BTC actually rallied +141% after the Death Cross!

14.

In sum, when #BTC peaked in May 2021...

BTC had already dropped by -55% pre-Death Cross

But once the Death Cross occurred, it actually marked out a generational bottom for $BTC and rallied +141%

Much like in March 2020, the July 2021 Death Cross occurred at the bottom

In sum, when #BTC peaked in May 2021...

BTC had already dropped by -55% pre-Death Cross

But once the Death Cross occurred, it actually marked out a generational bottom for $BTC and rallied +141%

Much like in March 2020, the July 2021 Death Cross occurred at the bottom

15.

Therefore, March 2020 & July 2021 deviated from the historical tendency that suggests that #BTC Death Crosses tend to precede further deep downside

But it looks like the most recent January 2022 $BTC Death Cross is a return to form

Here's why...

#Crypto #Bitcoin

Therefore, March 2020 & July 2021 deviated from the historical tendency that suggests that #BTC Death Crosses tend to precede further deep downside

But it looks like the most recent January 2022 $BTC Death Cross is a return to form

Here's why...

#Crypto #Bitcoin

16.

Firstly, January '22 #BTC Death Cross occurred 63 days post BTC peak

Very similar to July '21 Death Cross which occurred 69 days post-peak

Historically $BTC Death Crosses 107-135 days post-peak

But both 2021 & 2022 show an acceleration in the time it takes to Death Cross

Firstly, January '22 #BTC Death Cross occurred 63 days post BTC peak

Very similar to July '21 Death Cross which occurred 69 days post-peak

Historically $BTC Death Crosses 107-135 days post-peak

But both 2021 & 2022 show an acceleration in the time it takes to Death Cross

17.

Secondly but most importantly - the January '22 #BTC Death Cross has preceded deeper downside

$BTC is currently down almost -36% since the Death Cross

It looks like this Jan '22 Death Cross is back to respecting general historical Death Cross tendencies

#Bitcoin

Secondly but most importantly - the January '22 #BTC Death Cross has preceded deeper downside

$BTC is currently down almost -36% since the Death Cross

It looks like this Jan '22 Death Cross is back to respecting general historical Death Cross tendencies

#Bitcoin

18.

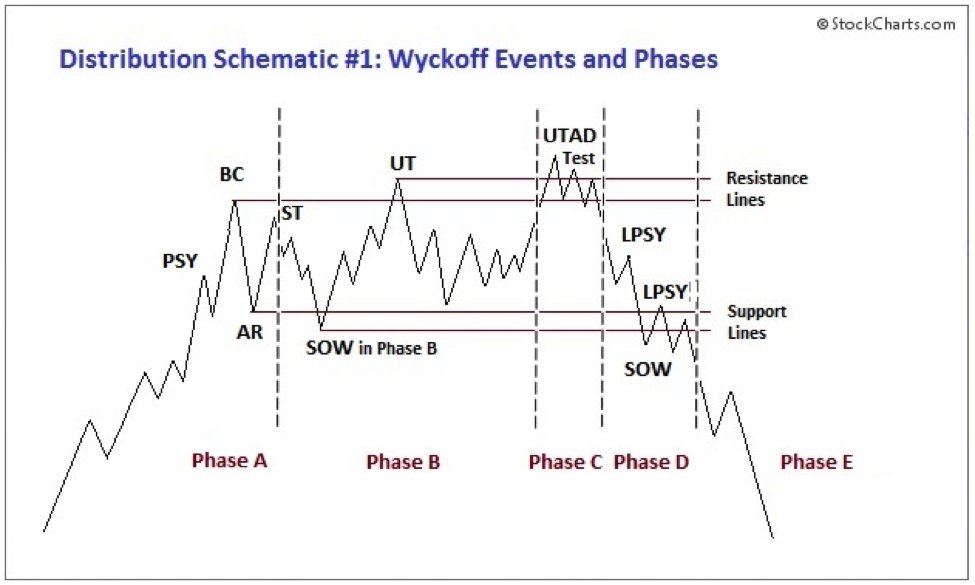

So what could this mean for #BTC going forward?

To answer that question, let's keep in mind the following key Death Cross tendency:

"More often than not, the depth of a $BTC correction pre-Death Cross is similar to retrace depth post-Death Cross"

#Crypto #Bitcoin

So what could this mean for #BTC going forward?

To answer that question, let's keep in mind the following key Death Cross tendency:

"More often than not, the depth of a $BTC correction pre-Death Cross is similar to retrace depth post-Death Cross"

#Crypto #Bitcoin

19.

Summary:

2013:

• #BTC drops -73% pre-Death Cross

• BTC drops extra -70% post-DC

2017:

• -70% pre-DC

• -65% post-DC

2019:

• -53% pre-DC

• -55% post-DC

2020:

• -63% pre-DC

• +1581% post-DC

2021:

• -56% pre-DC

• +141% post-DC

2022:

• -43% pre-DC

• ? post-DC

Summary:

2013:

• #BTC drops -73% pre-Death Cross

• BTC drops extra -70% post-DC

2017:

• -70% pre-DC

• -65% post-DC

2019:

• -53% pre-DC

• -55% post-DC

2020:

• -63% pre-DC

• +1581% post-DC

2021:

• -56% pre-DC

• +141% post-DC

2022:

• -43% pre-DC

• ? post-DC

20.

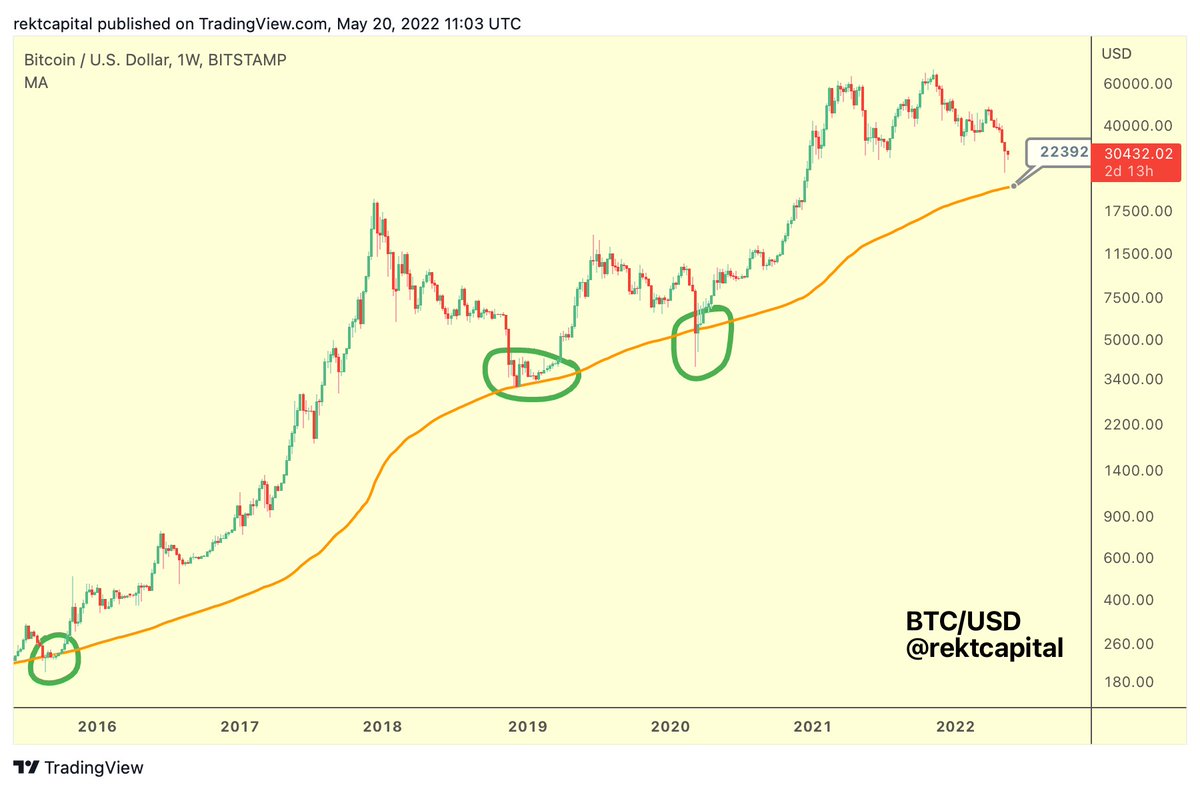

So since #BTC has crashed -43% since November '21 prior to the Death Cross...

$BTC could retrace a bit more to reach an overall retracement of -43% post-Death Cross, should this historical tendency continue to repeat

This would result in a ~$22,700 $BTC

#Crypto #Bitcoin

So since #BTC has crashed -43% since November '21 prior to the Death Cross...

$BTC could retrace a bit more to reach an overall retracement of -43% post-Death Cross, should this historical tendency continue to repeat

This would result in a ~$22,700 $BTC

#Crypto #Bitcoin

21.

This would suggest that the #BTC bottom is not yet in

But let's go one step further for the sake of discourse

$BTC has crashed -55%, -65%, and -71% after a Death Cross in the past

What if history were to repeat itself with a -55% crash?

#Bitcoin would bottom at ~$18000

This would suggest that the #BTC bottom is not yet in

But let's go one step further for the sake of discourse

$BTC has crashed -55%, -65%, and -71% after a Death Cross in the past

What if history were to repeat itself with a -55% crash?

#Bitcoin would bottom at ~$18000

22.

What price point would #BTC reach if BTC were to repeat a -65% crash post-Death Cross?

This would result in a ~$13,800 $BTC

#Crypto #Bitcoin

What price point would #BTC reach if BTC were to repeat a -65% crash post-Death Cross?

This would result in a ~$13,800 $BTC

#Crypto #Bitcoin

23.

And what would #BTC reach if BTC were to repeat a -71% crash post-Death Cross?

This would result in a ~$11,500 $BTC

Curiously, a retracement would constitute a -84.5% correction from the overall November 2021 peak

An -84.5% correction is an average Bear Market correction

And what would #BTC reach if BTC were to repeat a -71% crash post-Death Cross?

This would result in a ~$11,500 $BTC

Curiously, a retracement would constitute a -84.5% correction from the overall November 2021 peak

An -84.5% correction is an average Bear Market correction

24.

What's interesting about the scenario of a -43% post-Death Cross crash however is that it would result in a $22000 #BTC

Which ties in with the 200-SMA (orange) which tends to offer fantastic opportunities with outsized ROI for $BTC investors (green circles highlight this)

What's interesting about the scenario of a -43% post-Death Cross crash however is that it would result in a $22000 #BTC

Which ties in with the 200-SMA (orange) which tends to offer fantastic opportunities with outsized ROI for $BTC investors (green circles highlight this)

25.

This type of extensive analysis is something I tend to share in the Rekt Capital Newsletter

If you liked this thread - you'll love the newsletter

Feel free to sign up for regular cutting-edge insights on #BTC and Altcoins:

rektcapital.substack.com

$BTC #Crypto #Bitcoin

This type of extensive analysis is something I tend to share in the Rekt Capital Newsletter

If you liked this thread - you'll love the newsletter

Feel free to sign up for regular cutting-edge insights on #BTC and Altcoins:

rektcapital.substack.com

$BTC #Crypto #Bitcoin

• • •

Missing some Tweet in this thread? You can try to

force a refresh