Leeds United and Burnley have written to the Premier League, threatening to take legal action for their failure to punish Everton for what they believe to be a serious breach of the regulations. Relegation would have significant financial consequences. #EFC #LUFC #BurnleyFC

If a club breaches the Premier League’s Profitability and Sustainability rules, it can face sanctions ranging from fines to points deductions. #LUFC and #BurnlyyFC would argue that #EFC have enjoyed a competitive advantage, as the league has not sanctioned their high spending.

#EFC are adamant that they are in line: “'We have worked so closely with the Premier League to make sure we are compliant. We are comfortable we have complied with the rules. External auditors have told us what we can and cannot claim against the pandemic.”

So let’s take a look at whether #EFC are right to be so confident of their position, as there are many factors to be considered in the calculations for a club to meet the Premier League’s Profitability and Sustainability target.

On the face of it, things don’t look too good for #EFC, as they have reported pre-tax losses above £100m in each of the last three years, adding up to a horrific £373m.

In fact, #EFC £373m losses over the last three years are by far the worst in the Premier League, around £150m more than the next highest losses, which were made by #CFC £222m. All clubs have been adversely impacted by the COVID pandemic, but Everton’s deficit is striking.

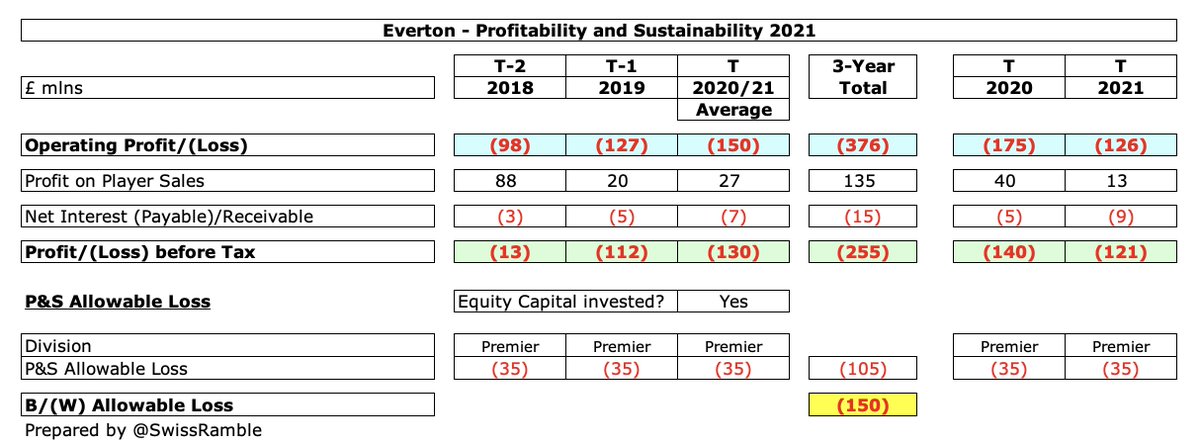

The Premier League Profitability and Sustainability (P&S) rules allow a £5m loss a year, which can then be boosted by £30m equity injection, giving allowable losses of £35m a year. This works out to £105m over the 3-year monitoring period.

However, the Premier League have relaxed the regulations in order to help neutralise the adverse impact of COVID, so the 2022 monitoring period will assess the seasons 2019/20 and 2020/21 as a single (average) period.

This is important, as it means that #EFC loss over the adjusted three-year monitoring periods is “only” £255m, as opposed to the £373m reported over the last three years between 2018/19 and 2020/21. That said, it is still £150m above the P&S £105m limit.

But the reported losses are not the ones used for the P&S calculation, as clubs are allowed to make deductions for “good” expenditure, including infrastructure, academy, community and women’s football. I estimate that these are worth around £41m to #EFC.

In addition, #EFC have incurred £29m costs on their new stadium in this period, which can also be deducted. Another £20m was spent in 2020/21, but that was capitalised, as there is now more certainty around project completion (planning permission granted), so did not hit the P&L.

Therefore, #EFC can deduct a total of £70m from their reported expenses, comprising £41m allowable deductions plus £29m for development costs on the new stadium (which will be capitalised when this is operational).

If we deduct this £70m from the P&S loss of £255m, #EFC net loss is reduced to £185m, though this is still £80m above the P&S target of £105m.

Worth noting that #EFC commercial income significantly increased in 2019/20, due to a £30m payment from USM (where owner Farhad Moshiri is a shareholder) for an option on new stadium naming rights. For now, let’s assume that the Premier League is happy with this innovative deal.

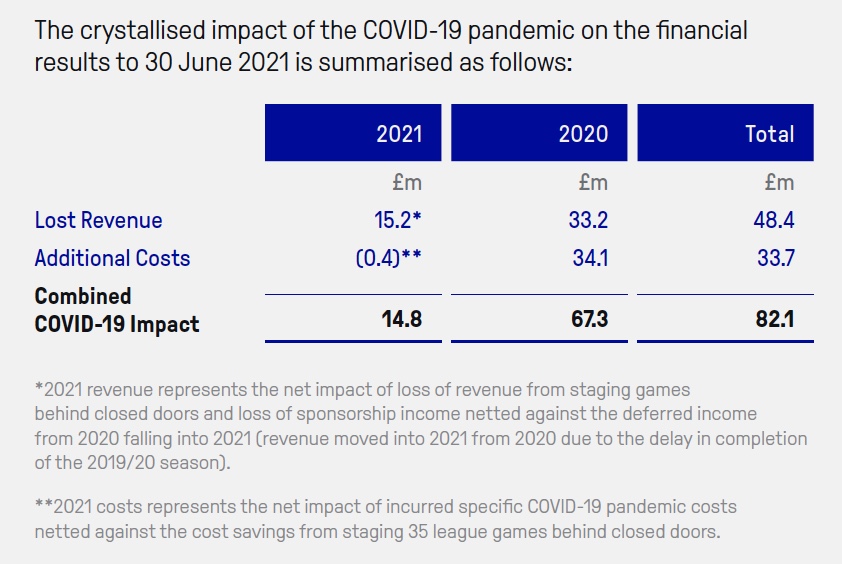

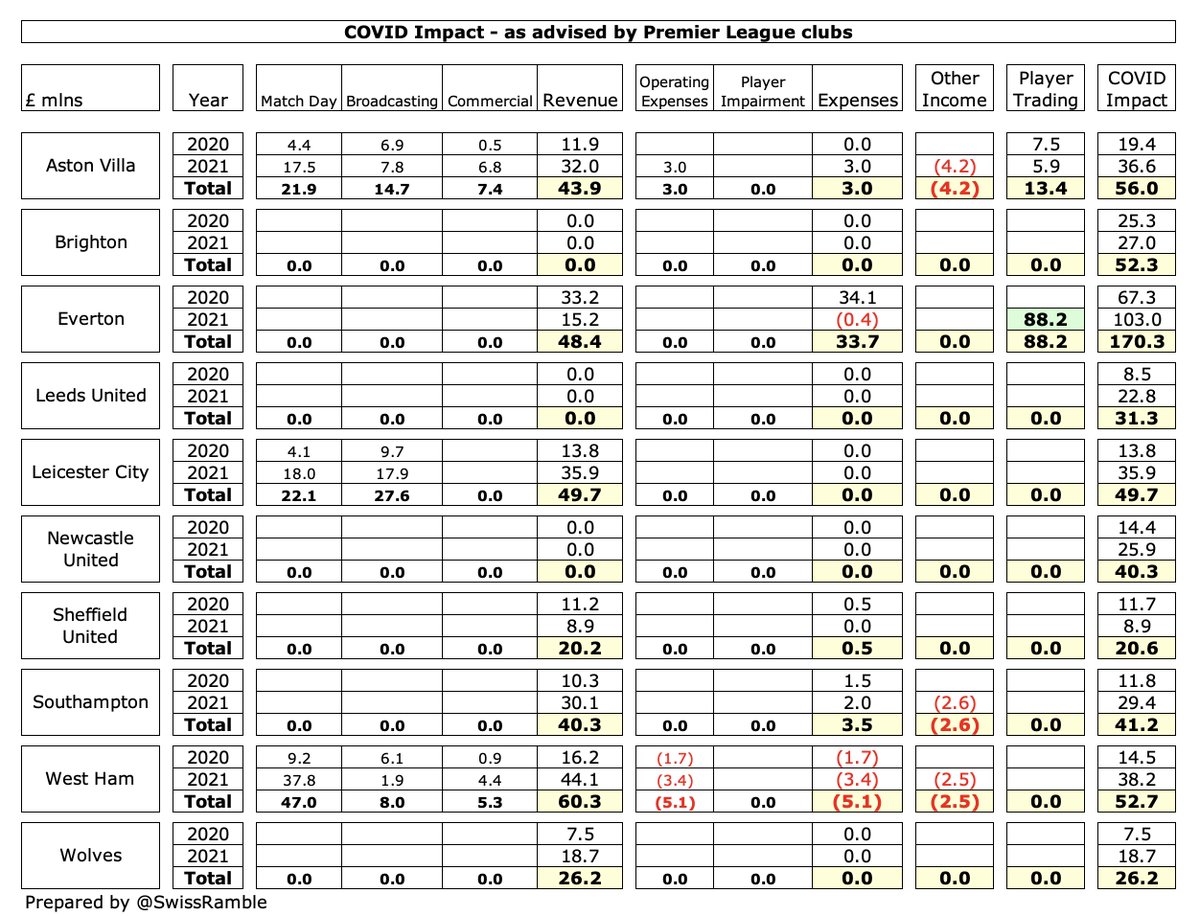

#EFC said that COVID has caused £170m losses over the last 2 years (£103m in 2021) with a further £50m to be added (based on market analysis), though the accounts only list £82m impact, split between 2020 £67m and 2021 £15m (net of deferring £26m revenue from 2020 to 2021).

Based on #EFC strategic report, we can analyse the £82m COVID impact between £48m revenue loss (match day £22m, broadcaster rebate £9m, commercial £17m) and £34m additional expenses (player impairment £42m, onerous contracts £12m, offset by £20m savings for games without fans).

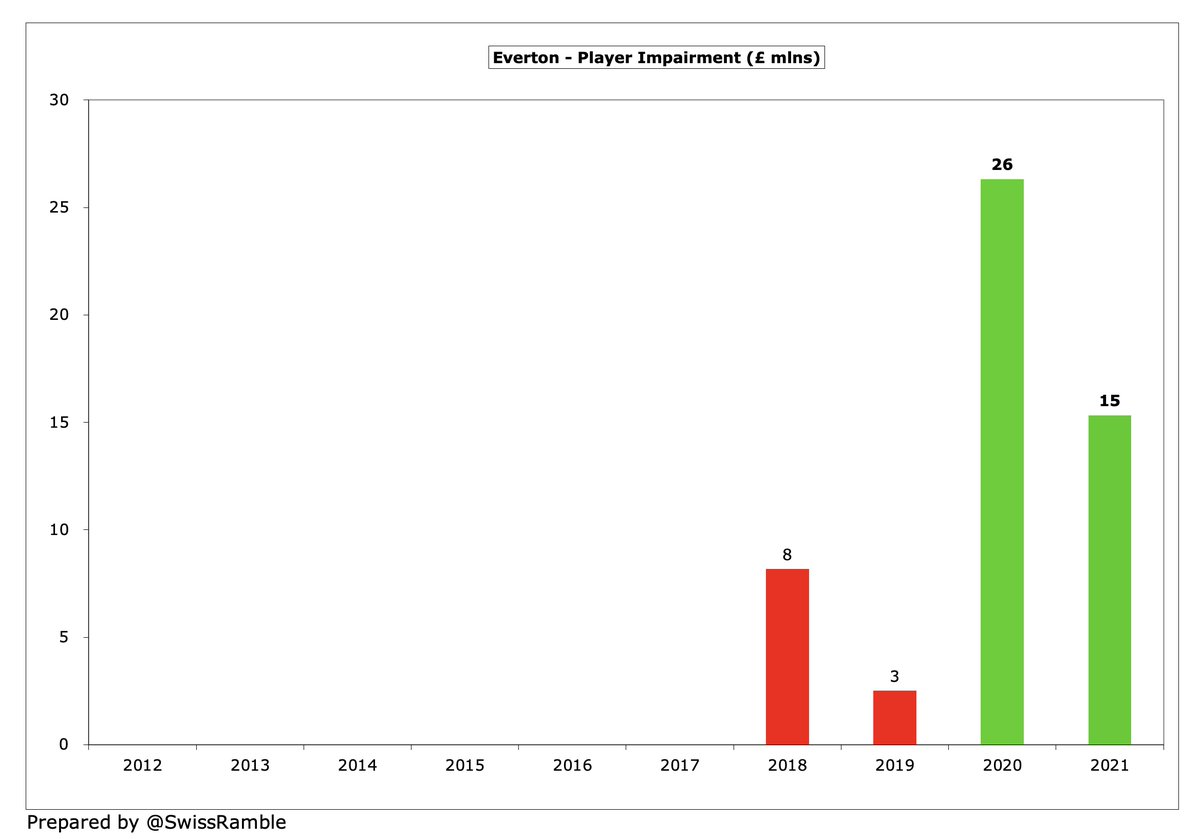

So the #EFC analysis includes £42m player impairment to reflect lower values in a COVID-impacted transfer market, which is twice as much as the next highest club in the Premier League – and a good indication of the club’s poor recruitment.

The Premier League also allows clubs to adjust for COVID losses in the P&S calculation. Based on the £82m impact detailed in the accounts, averaged to £41m for 2019/20 and 2020/21, the net loss is further reduced to £144m. However, this would still be £39m above the £105m target.

#EFC remaining £88m COVID impact to reach the £170m losses claimed by the club is attributed to a significant deterioration in the transfer market, leading to an inability to generate higher player sales profits plus more costs incurred (wages and amortisation).

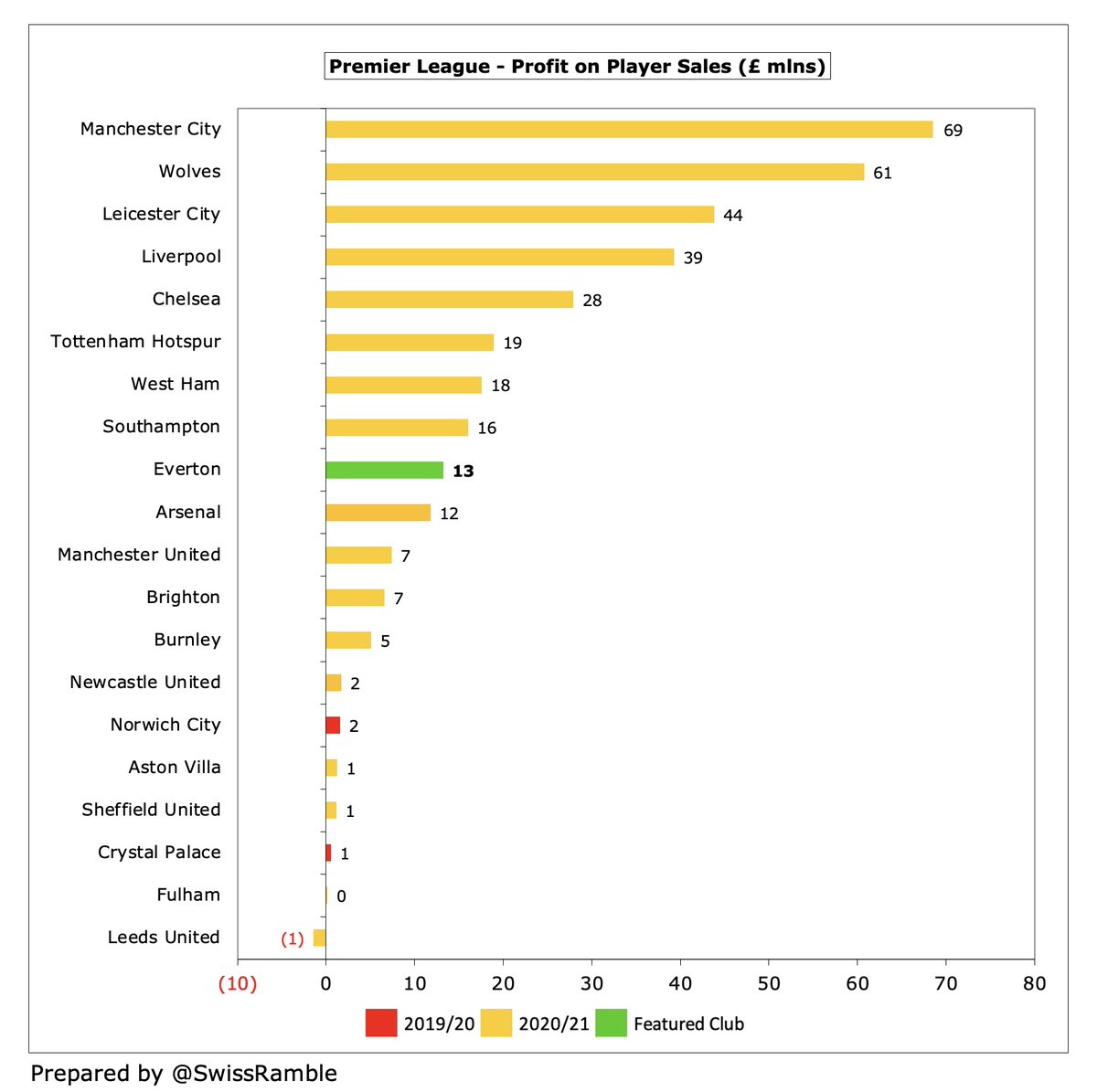

The question is how realistic is #EFC claim that their losses would be £88m lower if the transfer market had not been depressed? Interestingly, this figure is the same as the club’s record profit from player trading in 2018, though their next highest gain is only £52m.

Furthermore, some clubs still managed to generate decent profits from player sales in the same transfer market in 2020/21, especially #MCFC £69m, #WWFC £61m and #LCFC £41m. In fact, the average profit of £19m for Premier League clubs is not that much lower than other years.

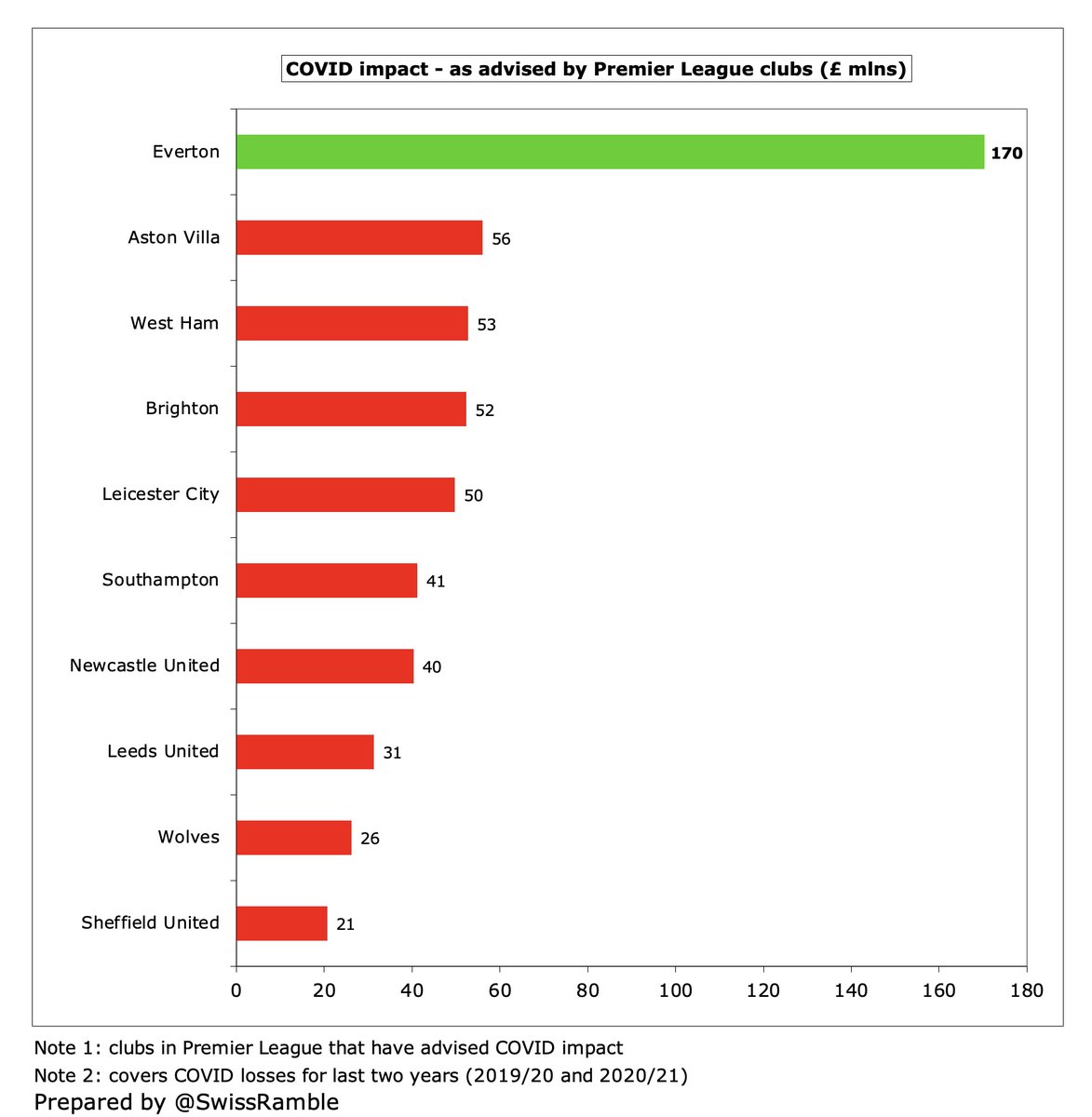

Not all Premier League clubs have advised how much money they lost to COVID over the last two years, but #EFC £170m is more than three times as much as those that have, e.g. #AVFC £56m, #WHUFC £53m, #BHAFC £52m and #LCFC £50m, so they are a big outlier.

No other club has claimed anything like #EFC £88m for player trading COVID losses. Most have not reported anything at all, while the next highest is #AVFC with only £13m.

What about the two clubs accusing #EFC of financial shenanigans? Are they OK in terms of Profitability and Sustainability rules, or is this a case of “don’t throw stones when you’re in a glass house?”

Unsurprisingly, #Burnley FC are absolutely fine, as they have traditionally been one of the most self-sufficient clubs. In fact, they have posted a small £2m profit over the last three years, even before making any allowable deductions.

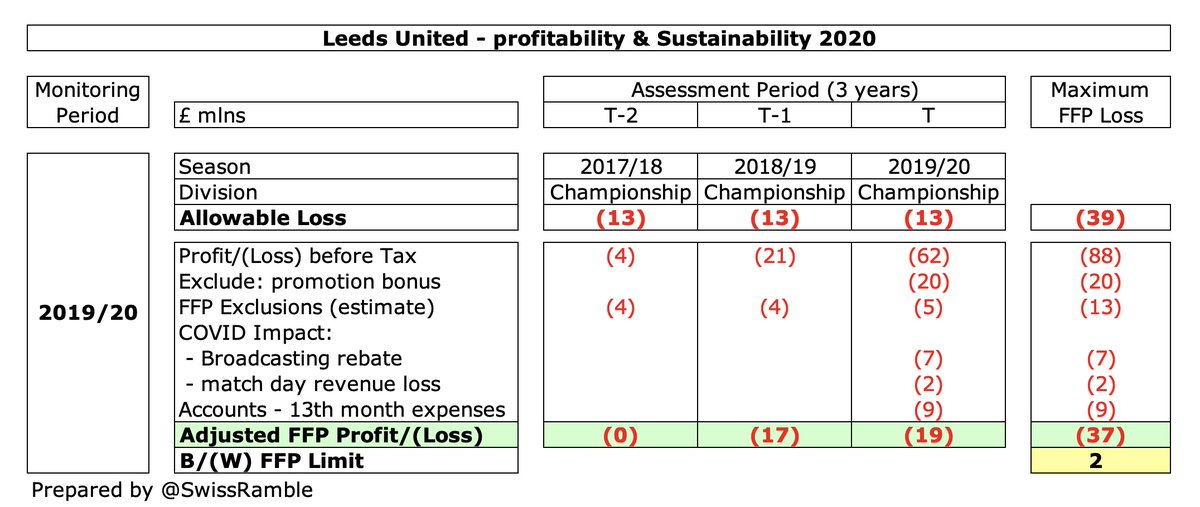

#LUFC are also well within the P&S limit after making allowable deductions and considering COVID impact (only £31m). It was much tighter the previous season in the Championship, but Leeds were just about OK after deducting promotion bonus and adjusting for 13th month expenses.

It is difficult to know how this will play out, though it does look like #EFC have a case to answer. Leeds United and Burnley have asked for an independent inquiry, which they want to be fast-tracked, though it is debatable whether the Premier League will make a quick decision.

• • •

Missing some Tweet in this thread? You can try to

force a refresh