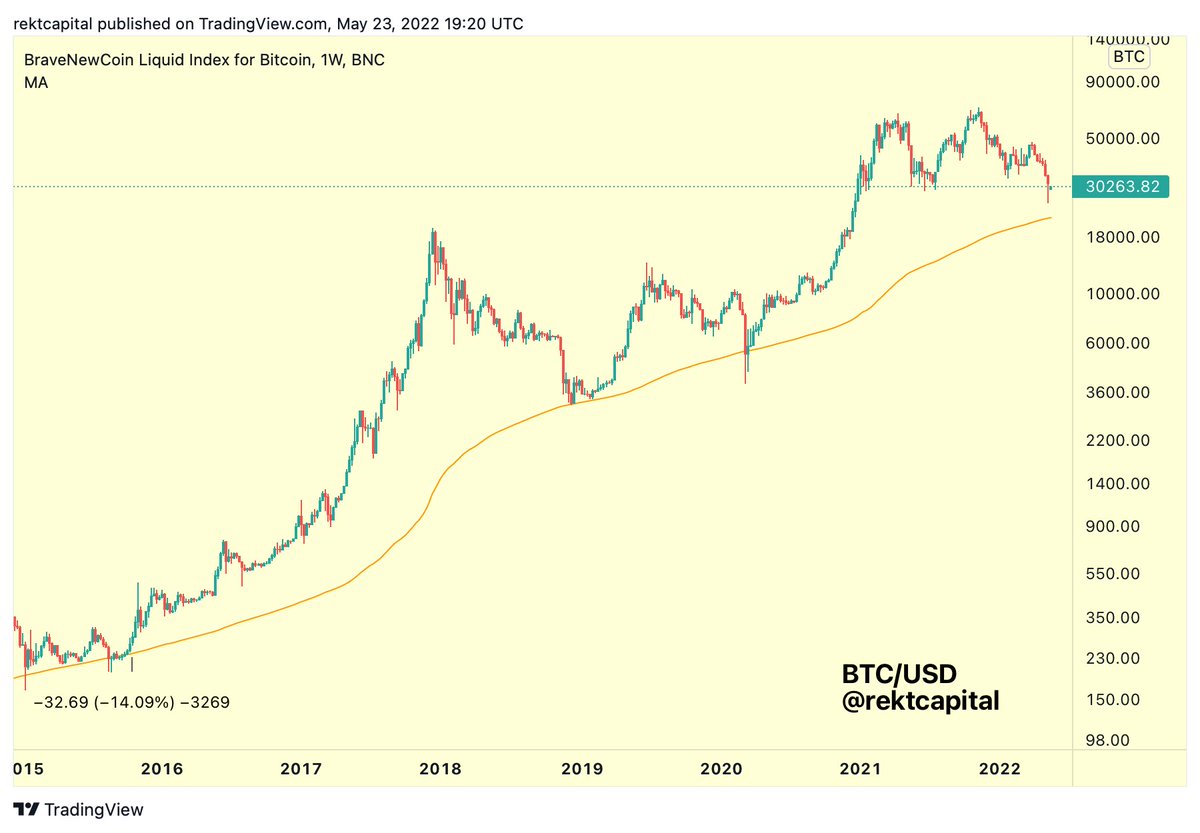

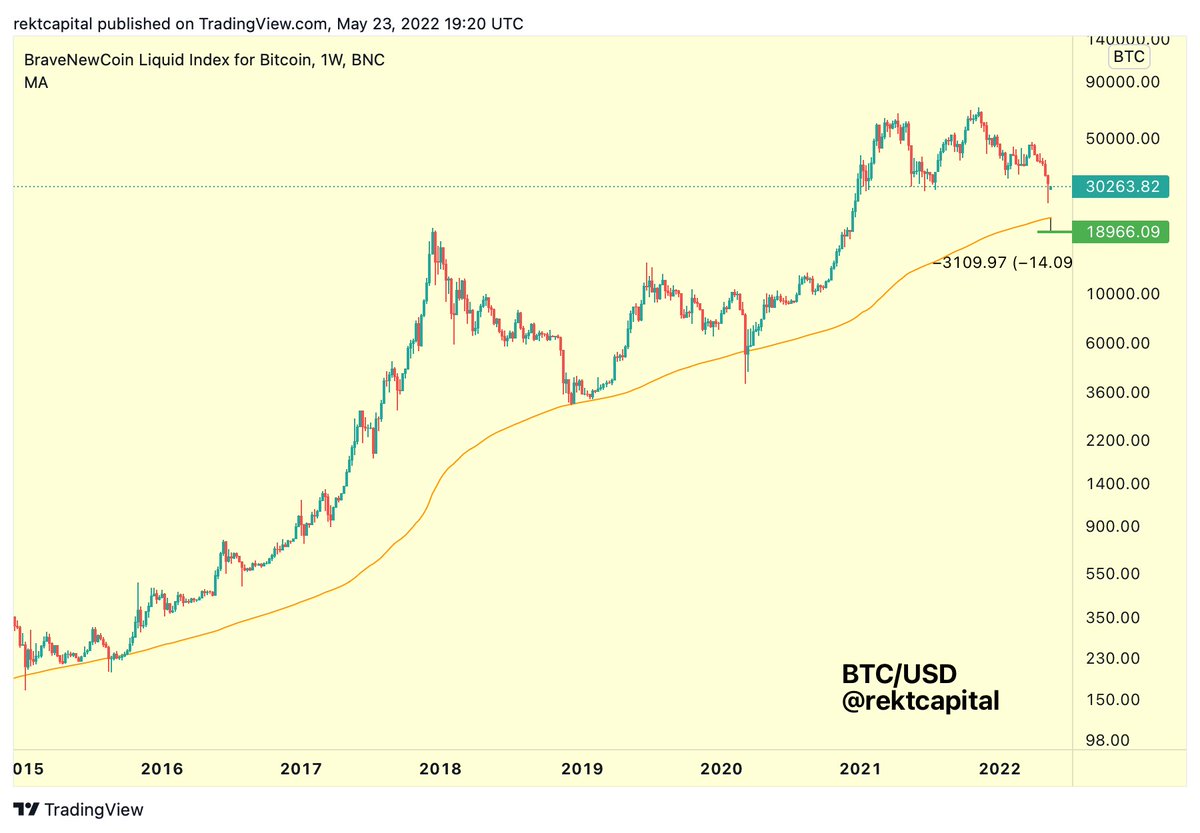

Historically, #BTC tends to bottom at or below the 200-MA (orange)

The 200-MA thus tends to offer opportunities with outsized ROI for $BTC investors (green)

Wicks below it are the point of peak opportunity

So how much does BTC wick below the 200-MA?

A thread

#Crypto #Bitcoin

The 200-MA thus tends to offer opportunities with outsized ROI for $BTC investors (green)

Wicks below it are the point of peak opportunity

So how much does BTC wick below the 200-MA?

A thread

#Crypto #Bitcoin

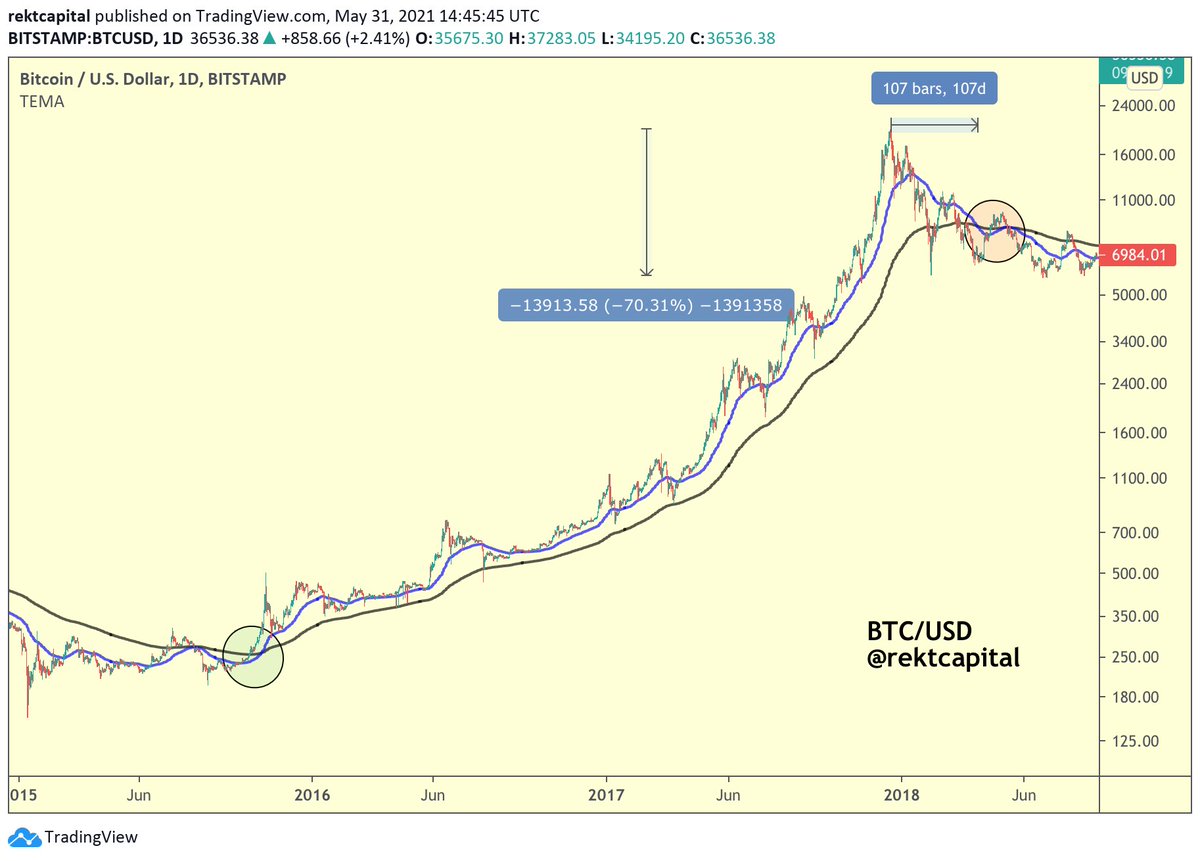

1.

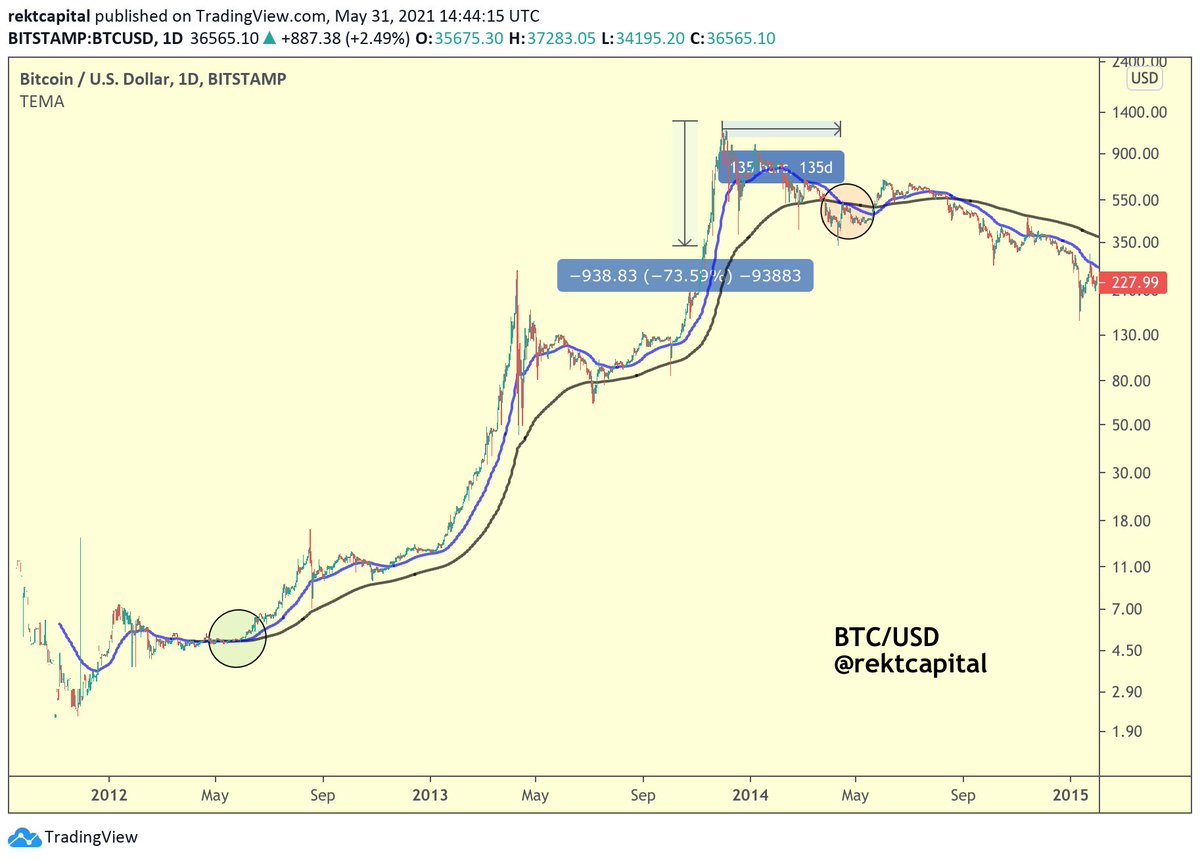

Downside wicks below the 200-MA represent peak financial opportunity for long-term #BTC investors

But these downside wicks also represent Extreme Fear and Maximum Pessimism in market sentiment

In early 2015, $BTC downside wicked below the 200-MA by -14%

#Crypto #Bitcoin

Downside wicks below the 200-MA represent peak financial opportunity for long-term #BTC investors

But these downside wicks also represent Extreme Fear and Maximum Pessimism in market sentiment

In early 2015, $BTC downside wicked below the 200-MA by -14%

#Crypto #Bitcoin

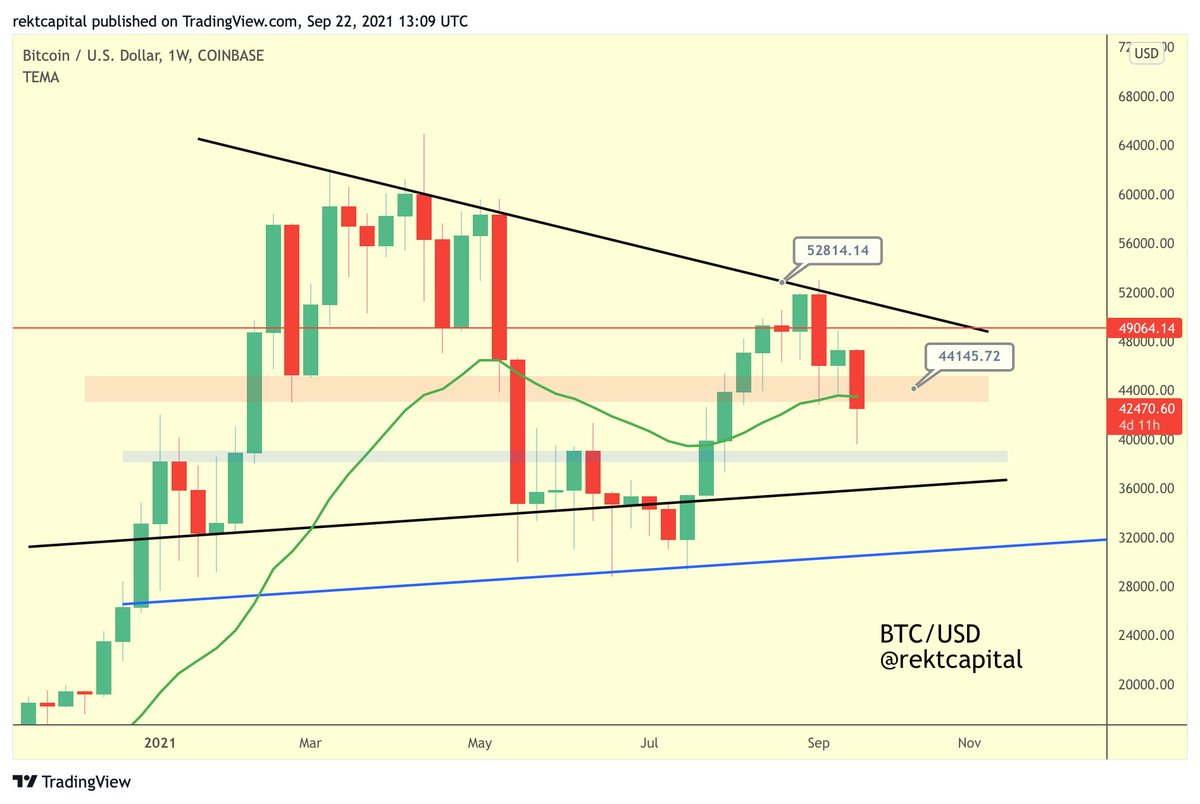

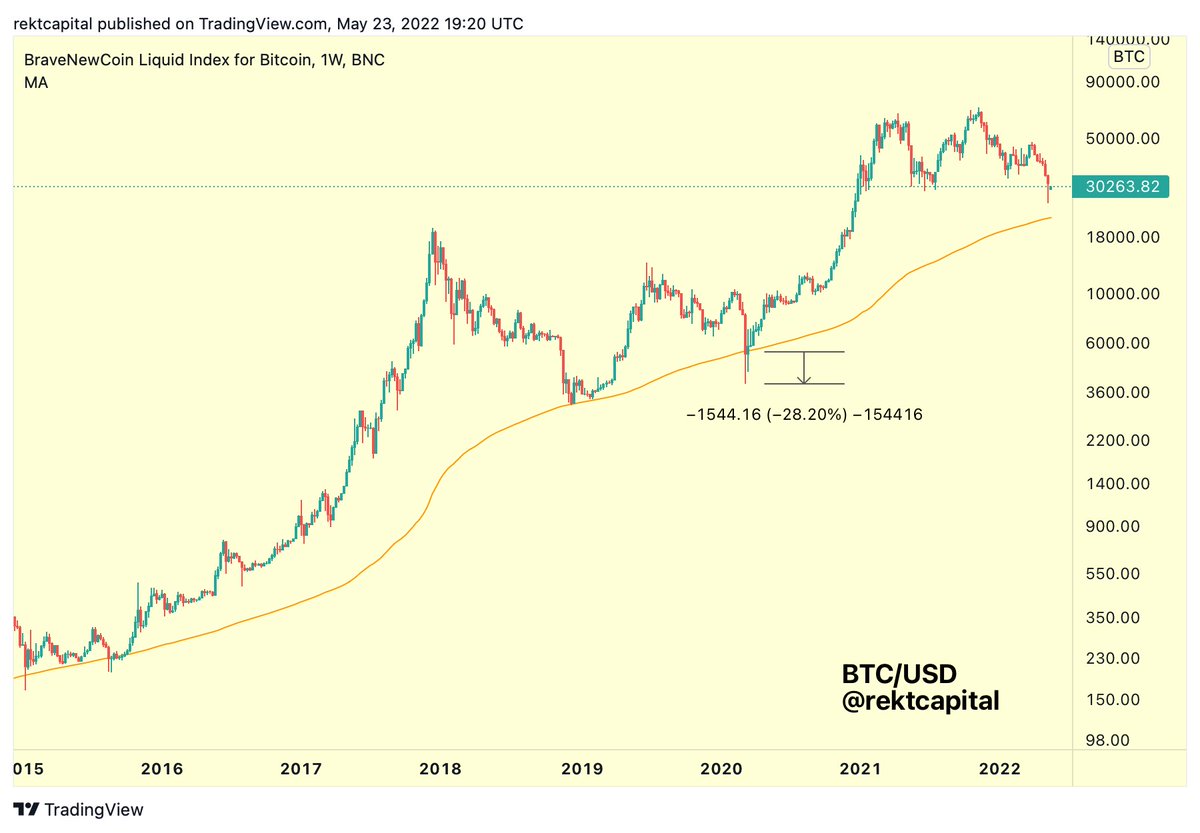

3.

In 2017/2018, #BTC actually formed a generational bottom precisely at the 200-MA support

No downside wicks below the MA occurred

However in March 2020, $BTC downside wicked below the 200-MA by -28%

#Crypto #Bitcoin

In 2017/2018, #BTC actually formed a generational bottom precisely at the 200-MA support

No downside wicks below the MA occurred

However in March 2020, $BTC downside wicked below the 200-MA by -28%

#Crypto #Bitcoin

4.

Historically, #BTC tends to perform downside wicks below the 200-MA

These $BTC downside wicks represent peak financial opportunity for long-term investors

These wicks tend to be -14% to -28% deep

#Crypto #Bitcoin

Historically, #BTC tends to perform downside wicks below the 200-MA

These $BTC downside wicks represent peak financial opportunity for long-term investors

These wicks tend to be -14% to -28% deep

#Crypto #Bitcoin

5.

At the time of this thread, the 200-MA for #BTC represents a price point of ~$22000

Price has not yet reached the 200-MA support

$BTC #Crypto #Bitcoin

At the time of this thread, the 200-MA for #BTC represents a price point of ~$22000

Price has not yet reached the 200-MA support

$BTC #Crypto #Bitcoin

6.

In fact, #BTC would need to drop at least an additional -28% from current prices to bottom at the 200-SMA

$BTC #Crypto #Bitcoin

In fact, #BTC would need to drop at least an additional -28% from current prices to bottom at the 200-SMA

$BTC #Crypto #Bitcoin

7.

If #BTC reaches the 200-MA support in the coming months...

Could $BTC perform a downside wick below it?

Since 2015, the 200-MA has been touched on 4 occasions to form generational Bear Market bottoms

And 3 out of 4 of those Bear Market bottoms ended with downside wicking

If #BTC reaches the 200-MA support in the coming months...

Could $BTC perform a downside wick below it?

Since 2015, the 200-MA has been touched on 4 occasions to form generational Bear Market bottoms

And 3 out of 4 of those Bear Market bottoms ended with downside wicking

8.

#BTC tends to wick -14% to -28% below the 200-MA

And since the $BTC 200-MA now represents the price point of ~$22000...

A -14% downside wick below the 200-MA would result in a ~$19000 Bitcoin

#Crypto #Bitcoin

#BTC tends to wick -14% to -28% below the 200-MA

And since the $BTC 200-MA now represents the price point of ~$22000...

A -14% downside wick below the 200-MA would result in a ~$19000 Bitcoin

#Crypto #Bitcoin

9.

And if #BTC were to repeat the March 2020 downside wicking depth below the 200-MA

$BTC would revisit the ~$15500 price point

#Crypto #Bitcoin

And if #BTC were to repeat the March 2020 downside wicking depth below the 200-MA

$BTC would revisit the ~$15500 price point

#Crypto #Bitcoin

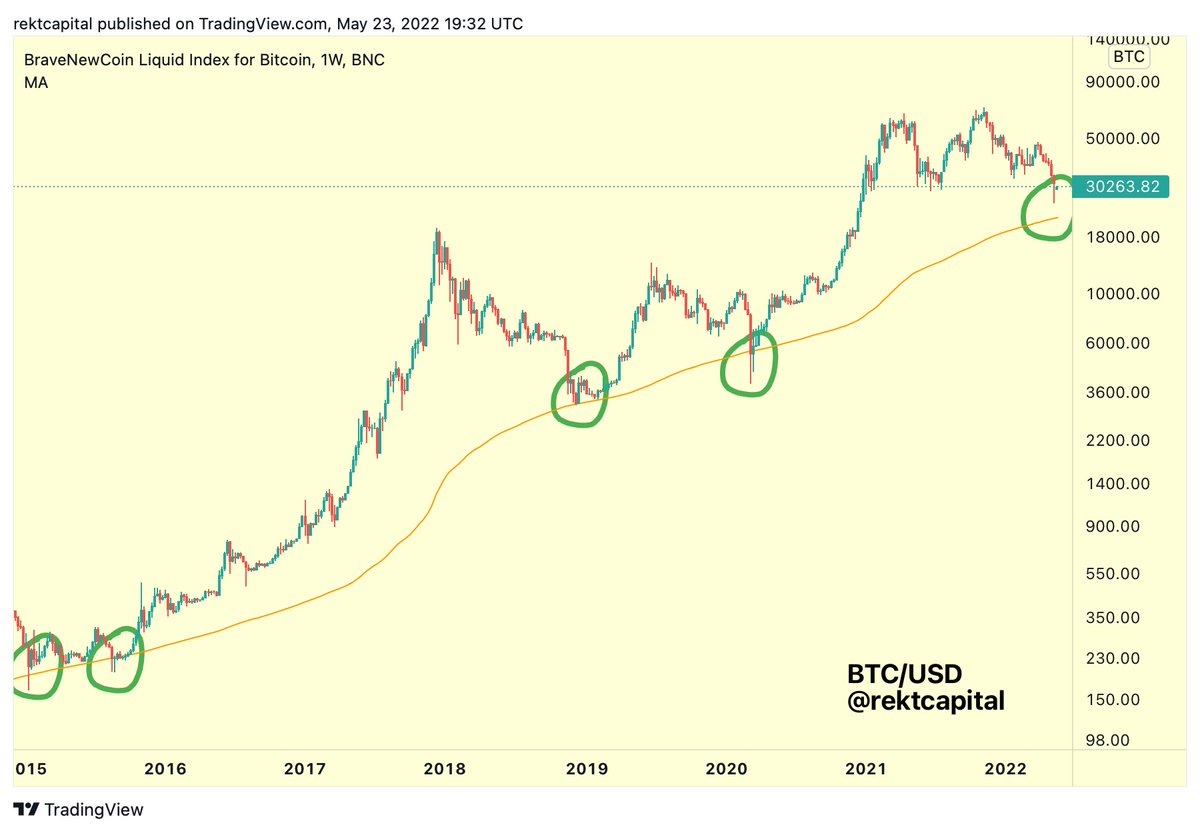

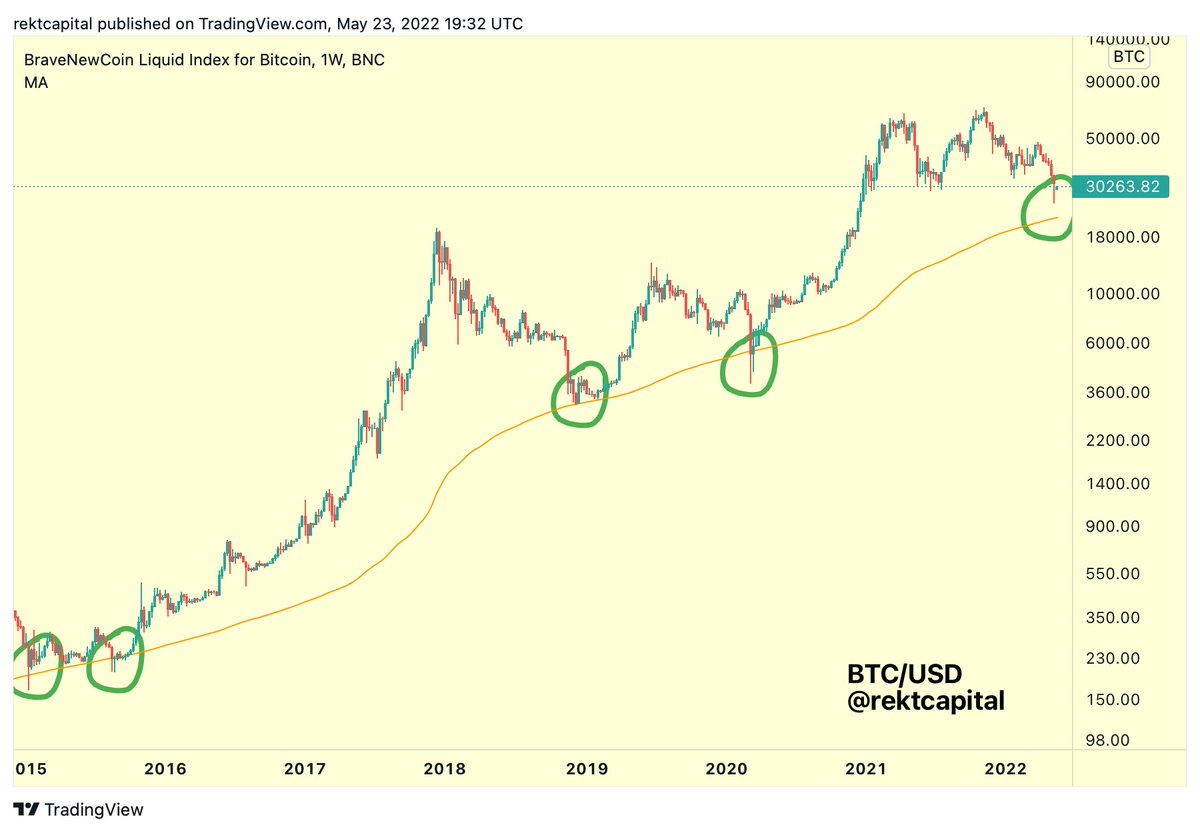

10.

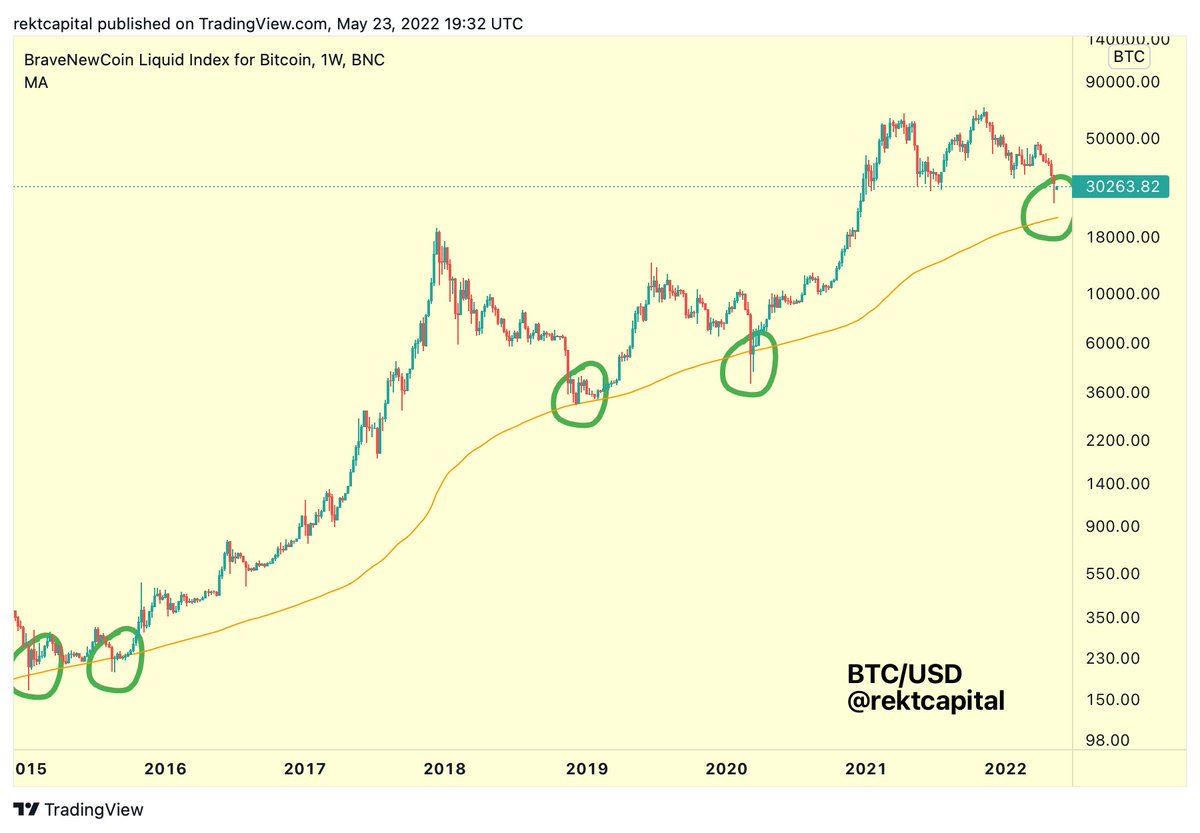

#BTC is slowly approaching the 200-MA

Historically, the 200-MA tends to offer fantastic opportunities with outsized ROI for long-term $BTC investors (green circles)

Should BTC indeed reach the 200-MA support...

It would be wise to pay attention

#Crypto #Bitcoin

#BTC is slowly approaching the 200-MA

Historically, the 200-MA tends to offer fantastic opportunities with outsized ROI for long-term $BTC investors (green circles)

Should BTC indeed reach the 200-MA support...

It would be wise to pay attention

#Crypto #Bitcoin

11.

I usually share this type of level-headed, unbiased analysis in the Rekt Capital Newsletter

If you liked this thread - you'll love the newsletter

Feel free to sign up for regular cutting-edge insights on #BTC and Altcoins:

rektcapital.substack.com

$BTC #Crypto #Bitcoin

I usually share this type of level-headed, unbiased analysis in the Rekt Capital Newsletter

If you liked this thread - you'll love the newsletter

Feel free to sign up for regular cutting-edge insights on #BTC and Altcoins:

rektcapital.substack.com

$BTC #Crypto #Bitcoin

• • •

Missing some Tweet in this thread? You can try to

force a refresh