Long thread on what's going on in the chinese real estate market

1/11

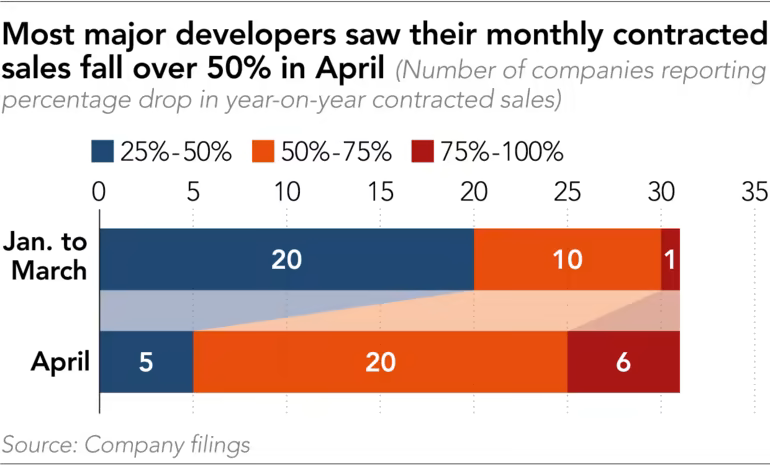

Sales of developers have plummeted. Of 31 listed Chinese developers 26 cited falls of at least 50% in April (YoY).

#stocks #realestate #China #Lockdown #Crash $SPY $SPX $NDX

Link: asia.nikkei.com/Business/Marke…

1/11

Sales of developers have plummeted. Of 31 listed Chinese developers 26 cited falls of at least 50% in April (YoY).

#stocks #realestate #China #Lockdown #Crash $SPY $SPX $NDX

Link: asia.nikkei.com/Business/Marke…

2

"Real estate accounts for about 25% of China’s GDP and has been a key driver of growth. Beijing needs to strike the right balance in supporting Evergrande while at the same time not enabling a moral hazard"

forbes.com/sites/earlcarr…

"Real estate accounts for about 25% of China’s GDP and has been a key driver of growth. Beijing needs to strike the right balance in supporting Evergrande while at the same time not enabling a moral hazard"

forbes.com/sites/earlcarr…

3

China state-backed builder Greenland asked for a delay in repayment by a year, "a rare sign of stress at a state-linked firm".

financenews.upexampaper.com/china-state-ba…

China state-backed builder Greenland asked for a delay in repayment by a year, "a rare sign of stress at a state-linked firm".

financenews.upexampaper.com/china-state-ba…

4

Significant impact on the overall China credit market. The dollar-bond default rate hit a record-breaking 4.5%

bloomberg.com/professional/b…

Significant impact on the overall China credit market. The dollar-bond default rate hit a record-breaking 4.5%

bloomberg.com/professional/b…

5

“Given the pick up in stresses, we raise our FY22 China Property HY default rate forecast to 31.6% (from 19.0% previously), which was our previous bear case assumption" - Goldman Sachs

“Given the pick up in stresses, we raise our FY22 China Property HY default rate forecast to 31.6% (from 19.0% previously), which was our previous bear case assumption" - Goldman Sachs

6

“The key problem remains the overall decline in sales and prices, which is creating an annualized shortfall in developers’ revenue of around 3%-4% of GDP compared with last year."

“The key problem remains the overall decline in sales and prices, which is creating an annualized shortfall in developers’ revenue of around 3%-4% of GDP compared with last year."

7

"Interest rate cuts may help at the margin, but only after the threat of lockdowns is lifted, and probably only in major cities as well.” - Logan H. Wright, partner and general director, China Markets Research, Rhodium Group

"Interest rate cuts may help at the margin, but only after the threat of lockdowns is lifted, and probably only in major cities as well.” - Logan H. Wright, partner and general director, China Markets Research, Rhodium Group

8

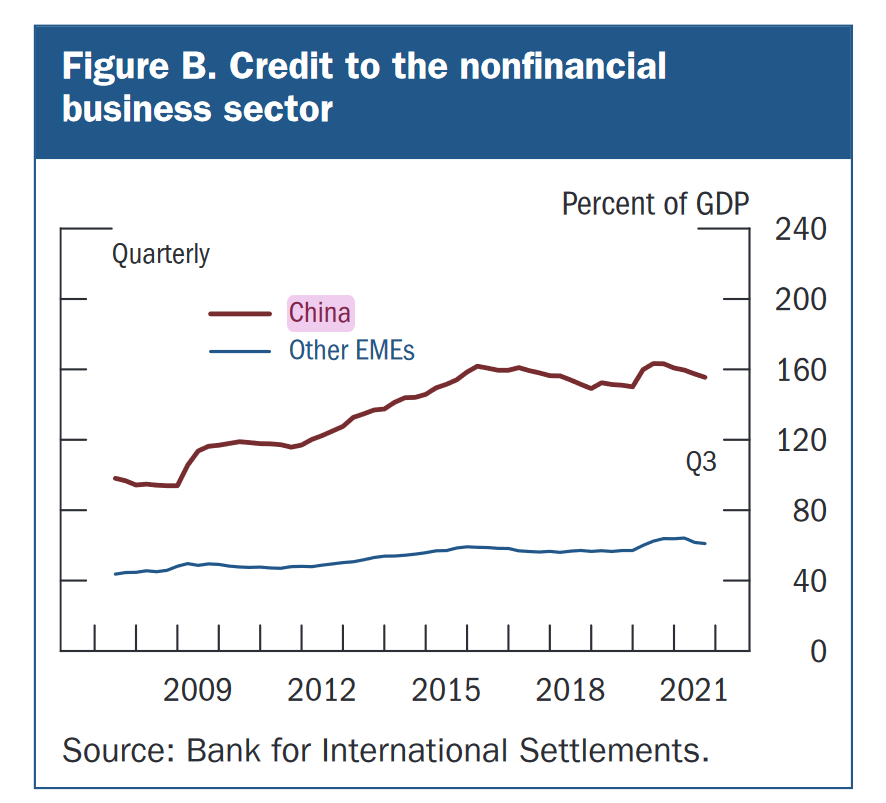

"Credit to Chinese businesses has increased even faster, supporting GDP growth, but the resulting leverage in the corporate sector makes it increasingly vulnerable to shocks. Nonfinancial business credit in China has reached about 160 percent of GDP" - FED

"Credit to Chinese businesses has increased even faster, supporting GDP growth, but the resulting leverage in the corporate sector makes it increasingly vulnerable to shocks. Nonfinancial business credit in China has reached about 160 percent of GDP" - FED

9

"Corporate indebtedness has become particularly high in China’s real estate sector—which has been a key engine of China’s rapid growth."

"Corporate indebtedness has become particularly high in China’s real estate sector—which has been a key engine of China’s rapid growth."

10

"In the past few years, the Chinese government has tightened regulation of property markets, including

the imposition of new constraints on home purchases, banks’ ... mortgage lending in some markets. Not long after these initiatives were implemented, property sales slowed"

"In the past few years, the Chinese government has tightened regulation of property markets, including

the imposition of new constraints on home purchases, banks’ ... mortgage lending in some markets. Not long after these initiatives were implemented, property sales slowed"

11

"Chinese property developers in the offshore dollar

market are trading at increasingly distressed levels. Although the Chinese government has managed to contain its effects so far, a significant worsening of the downturn in property markets could

affect China’s fin. system"

"Chinese property developers in the offshore dollar

market are trading at increasingly distressed levels. Although the Chinese government has managed to contain its effects so far, a significant worsening of the downturn in property markets could

affect China’s fin. system"

• • •

Missing some Tweet in this thread? You can try to

force a refresh