1/n

Do we actually believe in a #Bitcoin pump soon?

The answer is: yes.

We get loads of comments like: "not in this recession" or "the economy is so bad, not gonna happen."

Here's what we think about this. Let's take a look at this #recession

Do we actually believe in a #Bitcoin pump soon?

The answer is: yes.

We get loads of comments like: "not in this recession" or "the economy is so bad, not gonna happen."

Here's what we think about this. Let's take a look at this #recession

2/n

Typically, recessions have two things in common:

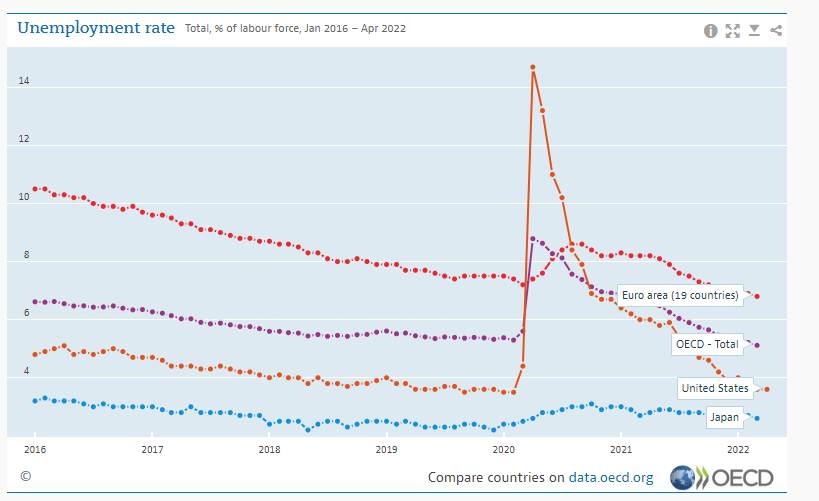

A) Unemployment rates hike or are at peak levels

B) The economy is weak (low Gross Domestic Product, GDP)

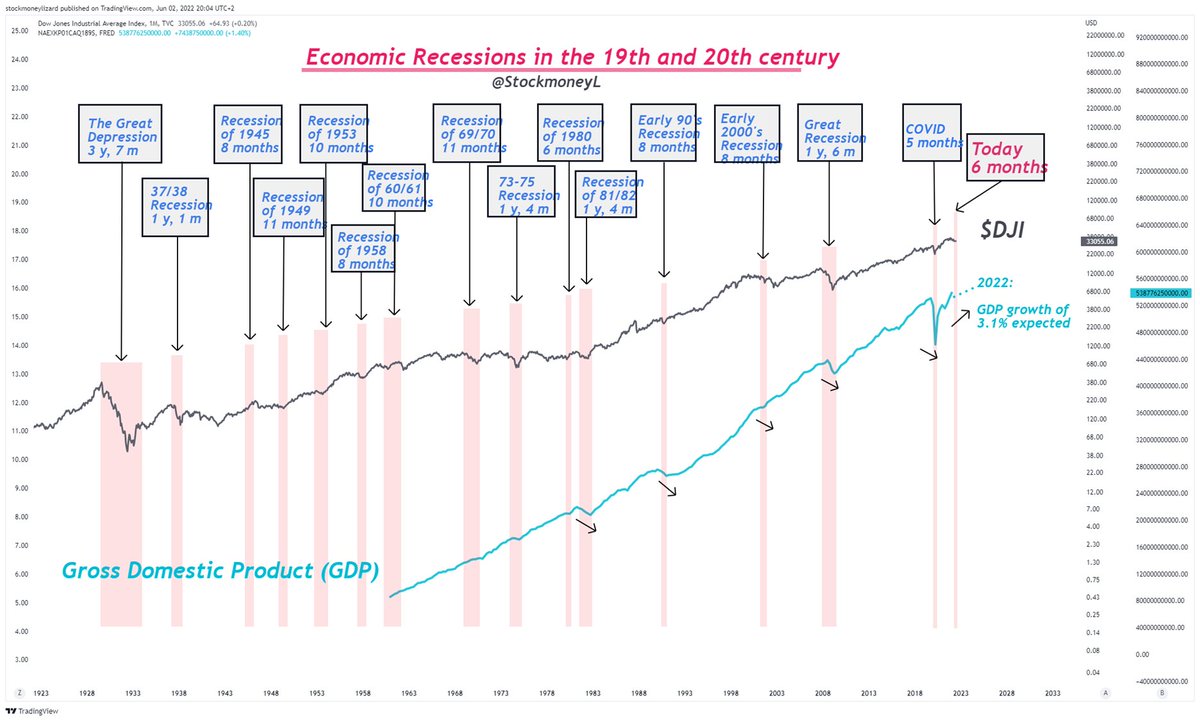

Let's take a look at all recessions during the 19th and 20th century.

Typically, recessions have two things in common:

A) Unemployment rates hike or are at peak levels

B) The economy is weak (low Gross Domestic Product, GDP)

Let's take a look at all recessions during the 19th and 20th century.

Recessions usually last 6 - 18 months.

As you can see in the chart, unemployment rates are hiking or at peak levels during these recessions.

After the COVID recession, unemployment rates have constantly been declining!!

As you can see in the chart, unemployment rates are hiking or at peak levels during these recessions.

After the COVID recession, unemployment rates have constantly been declining!!

4/n As far as GDP is concerned, we are currently witnessing GROWTH (A growth of 3.1% is expected for this year, source: (cnbc.com/2022/05/25/cbo…. )

6/6

Conclusion: We are not saying these are easy times. But sometimes it helps to stay calm and do some research. This may help to see things in a different light.

That's why we remain #bullish for the markets.

Conclusion: We are not saying these are easy times. But sometimes it helps to stay calm and do some research. This may help to see things in a different light.

That's why we remain #bullish for the markets.

• • •

Missing some Tweet in this thread? You can try to

force a refresh