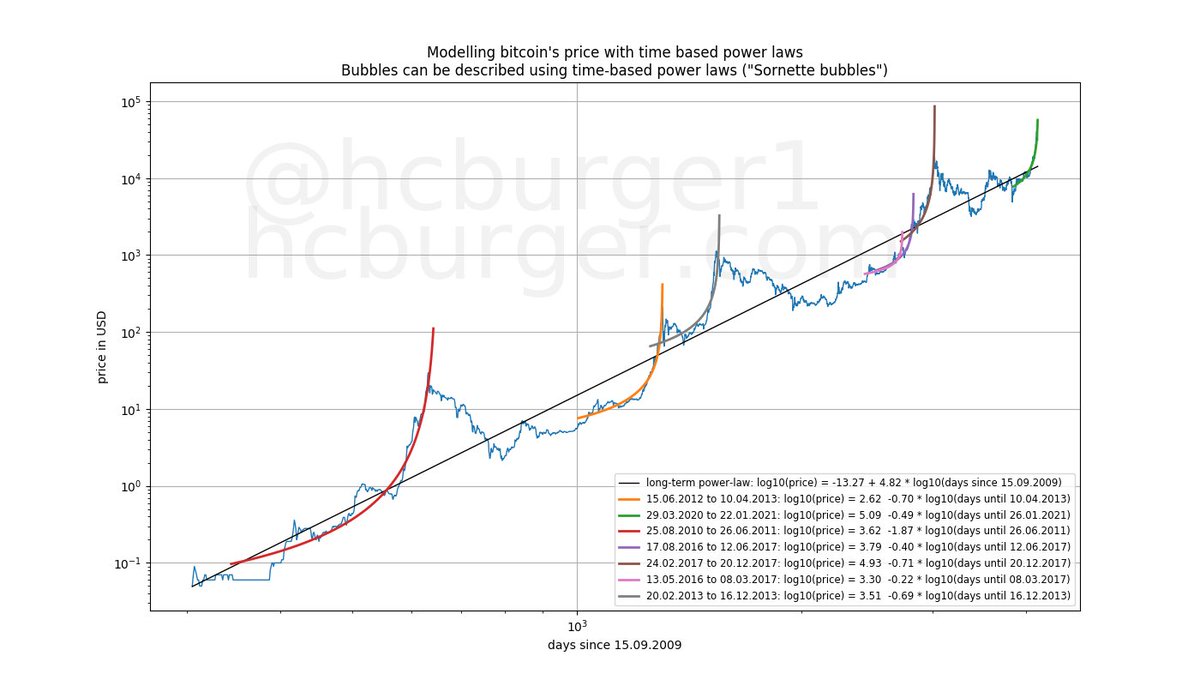

How is the time-based power-law for #btc price affected by new data? On the left, the model fit on the data available at the time I published the model (hcburger.com/blog/powerlaw). On the right, the model fit on all data up to today. Barely any change! Good!

The fact that the two fits are virtually identical means that the price action between September 2019 and now was perfectly in line with the 2019 model's expectations. From the model's point of view, nothing very interesting has happened! The new model is even a tad more bullish.

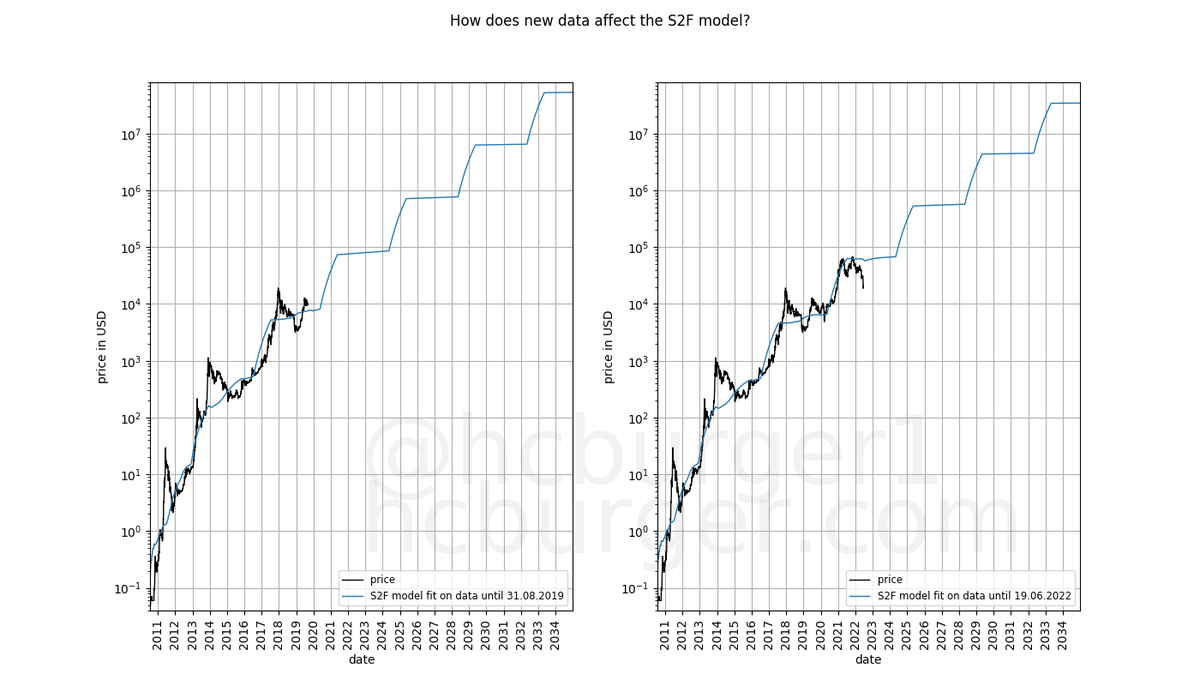

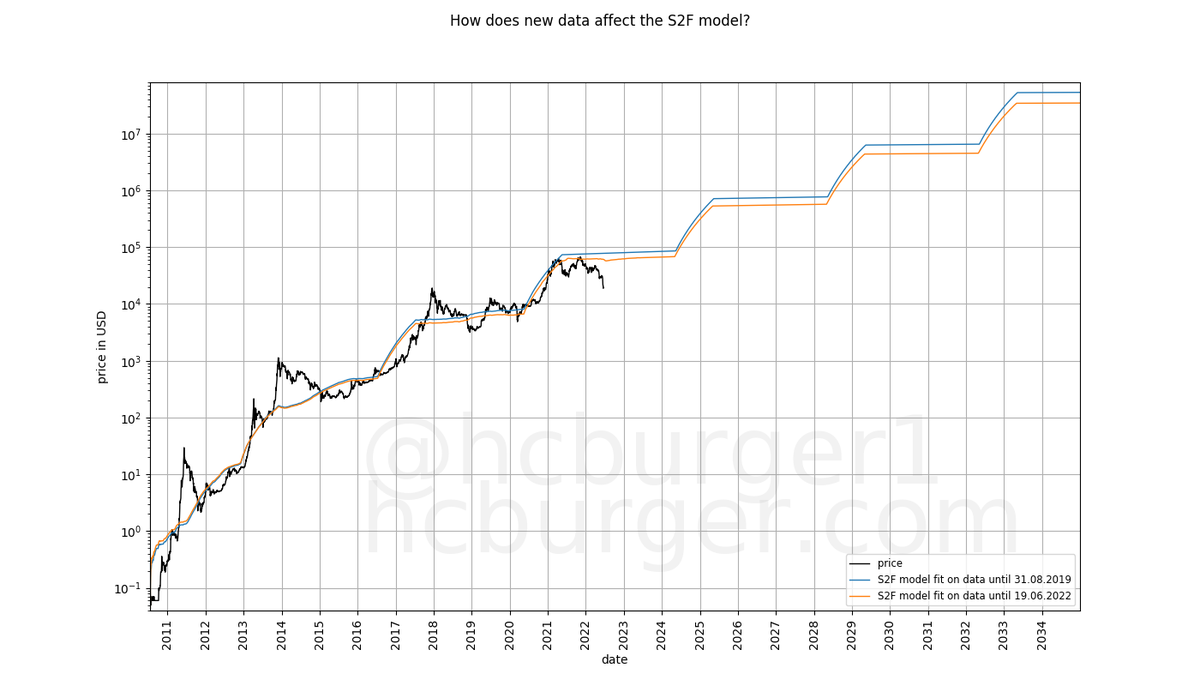

What about the S2F model? The price has so far been below the forecasts made by the model. Hence, we expect that re-fitting the S2F model should yield lower forecasts. And this is indeed the case! The longer the price stays below forecasts, the stronger this effect.

Any model will adjust its forecasts when refit on new data. But it's better if the forecast adjustments are small, and sometimes positive and sometimes negative. It's a bad sign if the adjustments are large and always in the same direction.

@InTheLoopBTC and I predicted that the S2F model would be affected by this in early 2020:

medium.com/quantodian-pub…

medium.com/quantodian-pub…

The fact that the time-based power-law is so stable over time means that the power-law corridor of 2019 need not be changed in spite of new data being available. The price is behaving according to plan.

medium.com/quantodian-pub…

medium.com/quantodian-pub…

• • •

Missing some Tweet in this thread? You can try to

force a refresh