1/ THREAD: A Guide to #CNFTs

The following is an updated guide on how to get started with #Cardano NFTs and the best resources to use along your way.

The goal is to provide an intuitive and simplistic explanation of Cardano NFTs while answering many of the common FAQs

The following is an updated guide on how to get started with #Cardano NFTs and the best resources to use along your way.

The goal is to provide an intuitive and simplistic explanation of Cardano NFTs while answering many of the common FAQs

2/ Table of Contents:

Content in this thread will cover the following topics and can be found using the provided tweet #.

Each tweet will be labelled in the top right.

Content in this thread will cover the following topics and can be found using the provided tweet #.

Each tweet will be labelled in the top right.

3/ Funding a Wallet

In order to begin to trade #CNFTs, you will first need to have Cardano's native currency $ADA.

This section will outline the process you will need to take to acquire the currency, create an external wallet, and transfer funds to that wallet.

In order to begin to trade #CNFTs, you will first need to have Cardano's native currency $ADA.

This section will outline the process you will need to take to acquire the currency, create an external wallet, and transfer funds to that wallet.

4/ Purchase $ADA on a centralized exchange.

The easiest and most efficient way to fund an external wallet is to purchase ADA from a well-known exchange.

The best exchange to use will depend on your country and region. Check out the list below and find one that best suits you.

The easiest and most efficient way to fund an external wallet is to purchase ADA from a well-known exchange.

The best exchange to use will depend on your country and region. Check out the list below and find one that best suits you.

5/ Create an External wallet

External wallets, such as @NamiWallet and @eternlwallet allow you to interact with Dapps which will be needed in order to buy/sell NFTs.

Most beginners will find Eternl to be the best option as it supports mobile, greatly simplifying the process

External wallets, such as @NamiWallet and @eternlwallet allow you to interact with Dapps which will be needed in order to buy/sell NFTs.

Most beginners will find Eternl to be the best option as it supports mobile, greatly simplifying the process

6/ To create an Eternl wallet, go to eternl.io or download the mobile app.

When creating a new wallet, you will be supplied with a "Seed Phrase", ENSURE that you store this phrase in a safe location as it is your only backup to your wallet

When creating a new wallet, you will be supplied with a "Seed Phrase", ENSURE that you store this phrase in a safe location as it is your only backup to your wallet

7/

Once your wallet is created, you can go to the tab represented by an Arrow in a Box, to find your deposit address.

Cardano addresses begin with 'addr' followed by a sequence of numbers. Always confirm the last 5 digits of your address when pasting it to avoid issues.

Once your wallet is created, you can go to the tab represented by an Arrow in a Box, to find your deposit address.

Cardano addresses begin with 'addr' followed by a sequence of numbers. Always confirm the last 5 digits of your address when pasting it to avoid issues.

8/ The external address can then be pasted in the "withdrawal" section back on the exchange you purchased $ADA on.

Some exchanges may require you to wait a day or two before withdrawing, and on occasion, the actual withdrawal can take a few hours.

Some exchanges may require you to wait a day or two before withdrawing, and on occasion, the actual withdrawal can take a few hours.

9/ Marketplaces

Once your wallet is funded, you will then be able to interact with Smart Contract marketplaces on the #Cardano Blockchain.

Once your wallet is funded, you will then be able to interact with Smart Contract marketplaces on the #Cardano Blockchain.

10/

There are a few different types of marketplaces.

Some, like @jpgstoreNFT provide a vast selection of NFTs.

@artano__io provides a marketplace for more unique 1/1 artworks

Some projects like @spacebudzNFT supply their own marketplace used to trade their own NFTs.

There are a few different types of marketplaces.

Some, like @jpgstoreNFT provide a vast selection of NFTs.

@artano__io provides a marketplace for more unique 1/1 artworks

Some projects like @spacebudzNFT supply their own marketplace used to trade their own NFTs.

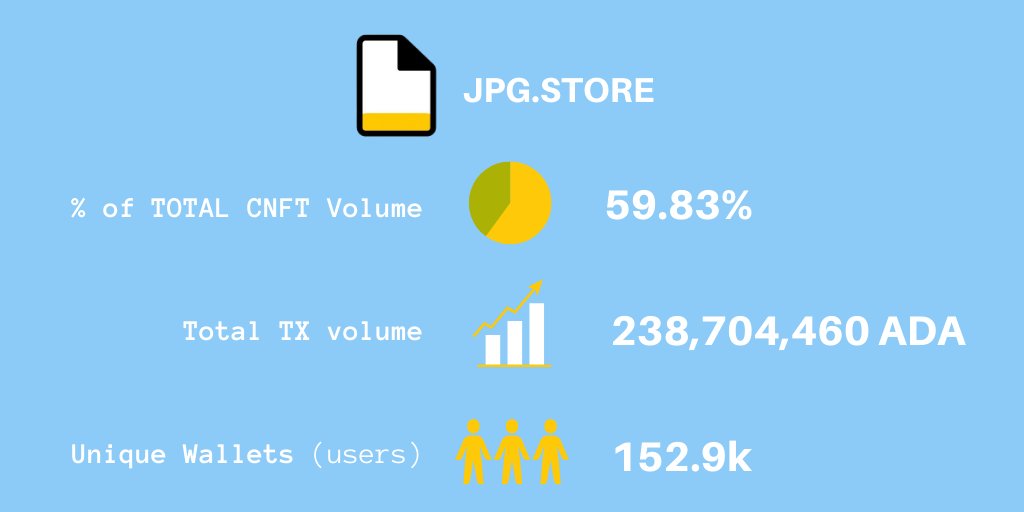

11/ JPG.STORE

@jpgstoreNFT currently dominates the market and is where you will conduct 99% of your NFT transactions. Their platform provides a space for any and every NFT project to list their collections and is most comparable to what @opensea is for #Ethereum

@jpgstoreNFT currently dominates the market and is where you will conduct 99% of your NFT transactions. Their platform provides a space for any and every NFT project to list their collections and is most comparable to what @opensea is for #Ethereum

12/ Buying and Selling

Buying and selling on jpg.store is an extremely easy and simplistic process.

> Connect wallet in top right

> Navigate to the NFT you wish to buy or list

> Complete tx

Buying and selling on jpg.store is an extremely easy and simplistic process.

> Connect wallet in top right

> Navigate to the NFT you wish to buy or list

> Complete tx

13/ Searching

Searching for NFTs on JPG.store could not be easier!

Their platform provides users with in-depth search tools to find NFTs that meet your criteria in terms of both traits and price ranges.

Searching for NFTs on JPG.store could not be easier!

Their platform provides users with in-depth search tools to find NFTs that meet your criteria in terms of both traits and price ranges.

14/ #CNFT Dapps

A recent evolution of the CNFT eco-system is the introduction of complementary dapps that provide additional infrastructure and services for CNFT holders.

This niche is still small but is growing quickly on the #cardano blockchain

A recent evolution of the CNFT eco-system is the introduction of complementary dapps that provide additional infrastructure and services for CNFT holders.

This niche is still small but is growing quickly on the #cardano blockchain

15/ Tradingtent.io

@trading_tent provides #CNFT users with a smart contract escrow system, making trading NFTs riskless and efficient! Their platform leverages smart contracts to remove the middle man from CNFT trades through an extremely easy-to-use UI/UX.

@trading_tent provides #CNFT users with a smart contract escrow system, making trading NFTs riskless and efficient! Their platform leverages smart contracts to remove the middle man from CNFT trades through an extremely easy-to-use UI/UX.

16/ Fluidtokens.com

@FluidTokens provides a way for #CNFT holders to use their NFTs as collateral when taking loans.

This provides a quick and simple solution to get liquidity fast without having to sell your NFTs to do so.

@FluidTokens provides a way for #CNFT holders to use their NFTs as collateral when taking loans.

This provides a quick and simple solution to get liquidity fast without having to sell your NFTs to do so.

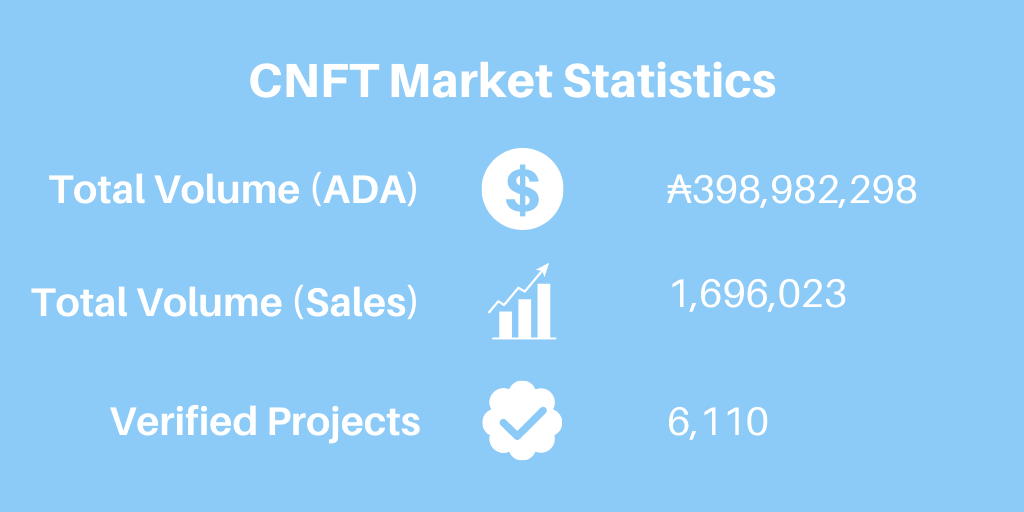

17/ CNFT Analytics

Analytics and statistics are important aspects to making any investment.

The following section outlines some of the best resources to use when researching #CNFTs and provides a rough overview of #Cardano's NFT market.

Analytics and statistics are important aspects to making any investment.

The following section outlines some of the best resources to use when researching #CNFTs and provides a rough overview of #Cardano's NFT market.

18/ CNFTjungle.io

@CNFTJungle is one of the greatest assets in the #CNFT space.

The platform provides users with project analytics, rarity search features, and even paid services for #NFT sniping.

@CNFTJungle is one of the greatest assets in the #CNFT space.

The platform provides users with project analytics, rarity search features, and even paid services for #NFT sniping.

19/ Opencnft.io

@opencnft is an ulterior method to finding statistics on the overall #CNFT market, #Cardano NFT leaderboards and individual asset history.

@opencnft is an ulterior method to finding statistics on the overall #CNFT market, #Cardano NFT leaderboards and individual asset history.

21/ Community Highlight

This section outlines some of the most sought-after and impressive projects in the #cnft space. The projects outlined by no means cover all the amazing work done here, but present solid projects at multiple price ranges.

This section outlines some of the most sought-after and impressive projects in the #cnft space. The projects outlined by no means cover all the amazing work done here, but present solid projects at multiple price ranges.

22/ @spacebudzNFT (Top entry)

Spacebudz is the OG project in the #Cardano space and represents the effort and work that has gone in to get us to where we are today.

The project holds the highest floor in the #CNFT space.

Spacebudz is the OG project in the #Cardano space and represents the effort and work that has gone in to get us to where we are today.

The project holds the highest floor in the #CNFT space.

23/ @claymates (Mid-tier entry)

Clay Nation represents the innovation that has occurred in the #CNFT space and is a project that has broken the mould and achieved countless achievements along the way.

They are partnered with @SnoopDogg and @champmedici in #bakednation

Clay Nation represents the innovation that has occurred in the #CNFT space and is a project that has broken the mould and achieved countless achievements along the way.

They are partnered with @SnoopDogg and @champmedici in #bakednation

24/ @UglybrosNFT (Budget entry)

Ugly Bros is unique in that each NFT is handcrafted and made with purpose. The team behind Ugly has done A LOT for the #CNFT community and continues to make an impact each and every day.

Ugly Bros is unique in that each NFT is handcrafted and made with purpose. The team behind Ugly has done A LOT for the #CNFT community and continues to make an impact each and every day.

25/ End

That conclusions the thread in #CNFTs but is not where we can stop learning and education.

Please feel free to ask questions below as there is no way to cover EVERYTHING in a single thread.

Likes and shares are appreciated to spread awareness

- Steele 💙

That conclusions the thread in #CNFTs but is not where we can stop learning and education.

Please feel free to ask questions below as there is no way to cover EVERYTHING in a single thread.

Likes and shares are appreciated to spread awareness

- Steele 💙

26 /Share you #CNFTs!

Let’s see your CNFTs below!

Post a photo of your favourite NFT, tag your favourite project.

Rep your communities in the comments! :)

Here’s some of mine…

Let’s see your CNFTs below!

Post a photo of your favourite NFT, tag your favourite project.

Rep your communities in the comments! :)

Here’s some of mine…

• • •

Missing some Tweet in this thread? You can try to

force a refresh