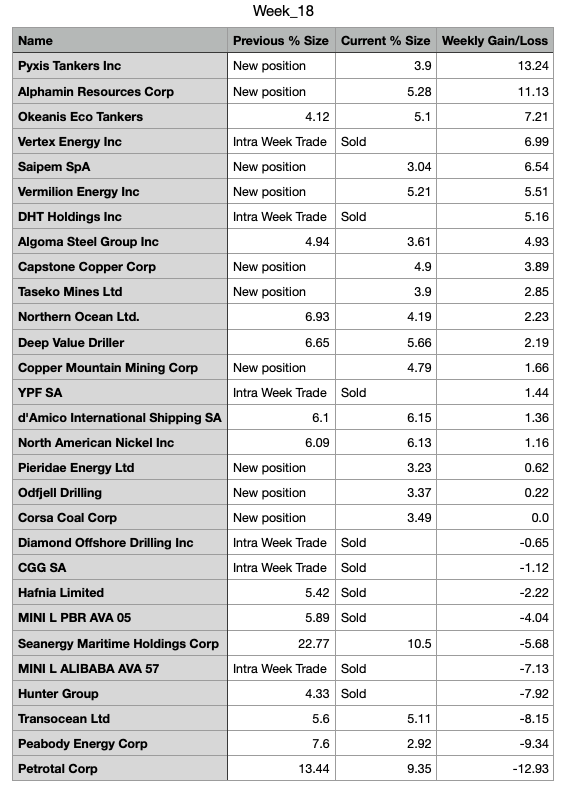

If you're not loading up on #coal as hedgies dump for the typical end of quarter ESG window dressing, you're doing it wrong.

$BTU $CEIX $ARCH $AMR

$BTU $CEIX $ARCH $AMR

https://twitter.com/CorneliaLake/status/1542528267810271233

The terminal value for most US thermal coal producers just got extended dramatically, which means they definitely shouldn't be pricing in prices going to $0 after 2024 & trade at ~1x p/e

Imagine dumping thermal #coal (& by extension met coal due to reasons stated before) because oil is going down despite Russia ensuring every single coal plant in EU getting restarted ASAP.

https://twitter.com/fbirol/status/1542503585195233280

• • •

Missing some Tweet in this thread? You can try to

force a refresh