#USDC thread!

I felt left out with all the unsubstantiated rumors flying around; considering i'm known for using other people's data against them, and crypto's... Opaque.

Buuuut, i'm stubborn. And i remembered i hadn't heard anything about the Circle SPAC for a while.

I felt left out with all the unsubstantiated rumors flying around; considering i'm known for using other people's data against them, and crypto's... Opaque.

Buuuut, i'm stubborn. And i remembered i hadn't heard anything about the Circle SPAC for a while.

That's the cleanest dirty shirt when it comes to Circle's inner workings, considering they legally have to disclose everything some way or another, even if it's buried.

So i went looking for the SEC filings on the SPAC. Found em here: sec.report/CIK/0001876042

There are updates!

So i went looking for the SEC filings on the SPAC. Found em here: sec.report/CIK/0001876042

There are updates!

It's the last few updates that are of interest to me. Most recently in June, Circle filed to extend their deal date to December, so it's highly likely we won't see the SPAC this year (they can extend until January), if ever.

Below that, is an amended S-4 filing, from May 6th.

Below that, is an amended S-4 filing, from May 6th.

These S-4 filings contains everything on both companies required to be disclosed for the merger. With all the DeFi news around May, nobody noticed the filing.

So what i decided to do is to compare the S-4 from last December to the one from May.

Specifically - the Risk section.

So what i decided to do is to compare the S-4 from last December to the one from May.

Specifically - the Risk section.

This because, while numbers can be fudged to be confusing, changes in the risk section can allude to changes behind the scenes - or sometimes they just tell you, but who the hell reads ~70 PAGES of risks (page 34 to 105).

Let alone twice to detect changes.

Let alone twice to detect changes.

....i have no life. And i'm still gonna take a vacation. But i digress.

That's what i did, put em side by side in browser windows and switched back and forth to detect text changes. I think i got all the Circle ones (checked out at the Concord section really).

Some are.. Spicy.

That's what i did, put em side by side in browser windows and switched back and forth to detect text changes. I think i got all the Circle ones (checked out at the Concord section really).

Some are.. Spicy.

So let's begin. Screenshots are chronological and i've included the page numbers where viable:

Language warning for competitors was added, and much more CBDC language was found in this version. They also warn for delays in redemptions under extreme demand now.

Language warning for competitors was added, and much more CBDC language was found in this version. They also warn for delays in redemptions under extreme demand now.

This one's interesting. Not the entire text is new but the situation's updated.

It seems they are in a dispute with their (former) financial advisor. They already were, but the agreement was terminated - and then FT alleges it was done ineffectively. Smells like a date in court.

It seems they are in a dispute with their (former) financial advisor. They already were, but the agreement was terminated - and then FT alleges it was done ineffectively. Smells like a date in court.

Circle's trying to become a bank, which they already were - but now substantial language has been added about possible delays. Thus it's likely this isn't gonna be happening anytime soon, if at all.

Though to be fair this language should've been in from the start.

Though to be fair this language should've been in from the start.

This one's spicy considering what the #voyager guys just found out, the recent rumors, and this being a pre-LUNA trouble filing.

The paragraph (on page 43) was already there in December, but some text was added which i've highlighted.

WHAT #USDC reserves in omnibus structures?!

The paragraph (on page 43) was already there in December, but some text was added which i've highlighted.

WHAT #USDC reserves in omnibus structures?!

The risk of loss text is new as well. Could be a clarification. Could be some sweat hitting the keyboard.

Next one could be spicy, or just a clarification. More of a question again of why the text wasn't in the December version to begin with.

Next one could be spicy, or just a clarification. More of a question again of why the text wasn't in the December version to begin with.

Next one shows that Circle's starting to get worried about the environmental impact of crypto. Added an ESG paragraph.

Another spicy one. Added the old text for comparison since it's a small but important change.

Previously they mentioned customer assets NOT recognized on the balance sheet. Now, they suddenly mention $738.4 million recognized ON their balance sheet.

Dipping into customer funds?

Previously they mentioned customer assets NOT recognized on the balance sheet. Now, they suddenly mention $738.4 million recognized ON their balance sheet.

Dipping into customer funds?

Which makes the next one all the more important. They updated the text under their "We have a history of losses" section.

So, in December 2021, they recognized $738 million of customer funds ON their balance sheet, WHILE they're running at a $508.7 million loss? tsk tsk.

So, in December 2021, they recognized $738 million of customer funds ON their balance sheet, WHILE they're running at a $508.7 million loss? tsk tsk.

Another spicy one. This entire subsection is new.

They now mention interest rate risk (no wonder in December bonds hadn't blown out yet). They also mention $28.5M of interest income while USDC ended 2021 with ~$42B in USDC.

I wonder how the last 6 months affected them.

They now mention interest rate risk (no wonder in December bonds hadn't blown out yet). They also mention $28.5M of interest income while USDC ended 2021 with ~$42B in USDC.

I wonder how the last 6 months affected them.

And now, for what i guess is *the most spicy change*:

They assure redemptions for Circle customers ONLY. It literally says, there's no assurance that there will continue to be an active market for ANY participants, UNLESS they're a circle customer.

This is again emphasized.

They assure redemptions for Circle customers ONLY. It literally says, there's no assurance that there will continue to be an active market for ANY participants, UNLESS they're a circle customer.

This is again emphasized.

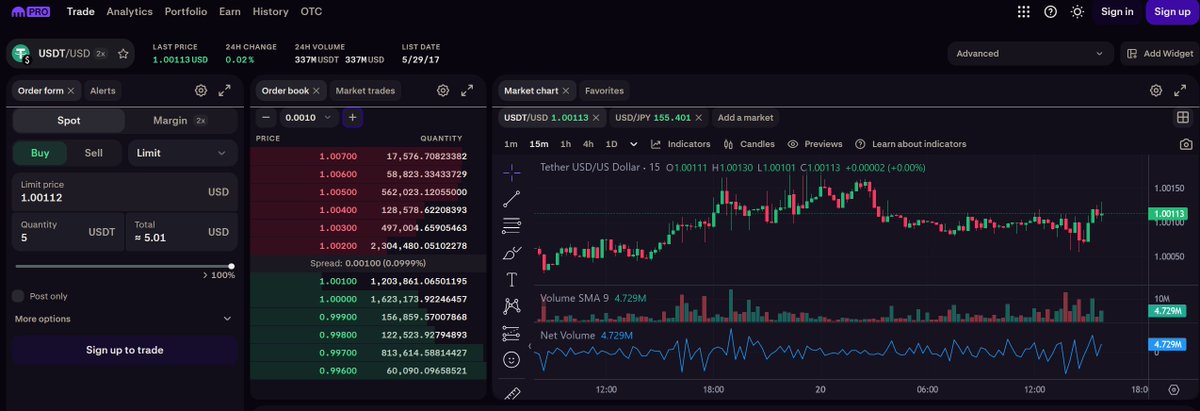

So i smell a rat and think they're pulling a #Tether (Or $SLV, pick whichever you like). Who they mean by customers isn't defined in the S-4.

So who are they? You, me, retail? Well, let's see who's listed under Circle's "customer stories":

circle.com/en/customer-st…

So who are they? You, me, retail? Well, let's see who's listed under Circle's "customer stories":

circle.com/en/customer-st…

Basically, as long as they haven't defined exactly WHO their customers are, those assurances don't mean shit - but they DO mean something to everybody who ISN'T part of that group, as you are now all effectively unsecured creditors.

Because a senior secured group was created.

Because a senior secured group was created.

More language about losses on US treasuries (which i've been speculating on for a while, considering they should've held tens of billions of treasuries through the recent bond trouble).

Most interesting here is Circle runs at a loss - so they have no cash to fill the hole with.

Most interesting here is Circle runs at a loss - so they have no cash to fill the hole with.

They can always raise more funding at a reduced valuation i suppose.

Remember - they made $28M of interest on $42B of reserves with a $508M operating loss and ~$85m total revenue; and this deal values them at $9 BILLION - double the last one.

These numbers are WeWork silly.

Remember - they made $28M of interest on $42B of reserves with a $508M operating loss and ~$85m total revenue; and this deal values them at $9 BILLION - double the last one.

These numbers are WeWork silly.

More CBDC language. They're more worried bout the Fed than their critics it seems.

This one's pretty spicy too. Circle actually asserts, that should an *extreme* bankrun happen such as 100% liquidation - the US treasury market might freeze up and they'll take a loss on the bonds

This one's pretty spicy too. Circle actually asserts, that should an *extreme* bankrun happen such as 100% liquidation - the US treasury market might freeze up and they'll take a loss on the bonds

It wouldn't require 100% of their reserves. All it requires is for losses to exceed whatever's left to be redeemed. A steady stream of redemptions would get hairy if it goes on long enough. Considering losses compound too.

And USDC's a national security risk now. How fun.

And USDC's a national security risk now. How fun.

Next one's pretty fun, considering they added a whole paragraph on detecting employee misconduct that wasn't there before.

Why? Something to do with the accounting misstatements from mid last year? Seems like Circle's learning as they go. TBF they do admit to having 0 experience

Why? Something to do with the accounting misstatements from mid last year? Seems like Circle's learning as they go. TBF they do admit to having 0 experience

Last one! Cause i started going crosseyed and i think i got all the major changes.

Seems they're also worried to be seen as a investment company under the 1940 act as that'd change their accounting methods and all their forward statements.

Guess what needs to happen then?

Seems they're also worried to be seen as a investment company under the 1940 act as that'd change their accounting methods and all their forward statements.

Guess what needs to happen then?

That's it! Hopefully this shows the rookies coming into the critic space how it's done (welcome btw! Apply to the union for your FUD council stipend). You bring data, and preferably theirs. Plenty to be found there.

CC @Bitfinexed @DoombergT @CasPiancey

Bonus! Growth estimates:

CC @Bitfinexed @DoombergT @CasPiancey

Bonus! Growth estimates:

• • •

Missing some Tweet in this thread? You can try to

force a refresh