A #RealYield trend on #CT was started this week by DeFi natives @IntrinsicDeFi & @MrGrumpyNFT.

What does this mean? It means DeFi 3.0 protocols like @GMX_IO, that are low or non-inflationary, pay protocol revenue to stakers in non-native tokens like $ETH.

🧵👇

What does this mean? It means DeFi 3.0 protocols like @GMX_IO, that are low or non-inflationary, pay protocol revenue to stakers in non-native tokens like $ETH.

🧵👇

Derivative exchanges like @GMX_IO & $GNS benefit token holders because trading profit thrives in volatility.

The House 🃏generally wins.

Consider the $GMX net P&L below. This results in a 70% revenue distribution to $GMX's collateral vault, $GLP, & 30% 💰 to $GMX stakers.

👇

The House 🃏generally wins.

Consider the $GMX net P&L below. This results in a 70% revenue distribution to $GMX's collateral vault, $GLP, & 30% 💰 to $GMX stakers.

👇

During a 🦀, @GMX_IO loses value bc traders are unlikely to open new positions due to lack of volatility. This can lead to ⬇️ token price short term.

However, as volatility goes up, for example, around release of the US FOMC minutes 7/6/22, trading volume + OI ⬆️=💰

👇

However, as volatility goes up, for example, around release of the US FOMC minutes 7/6/22, trading volume + OI ⬆️=💰

👇

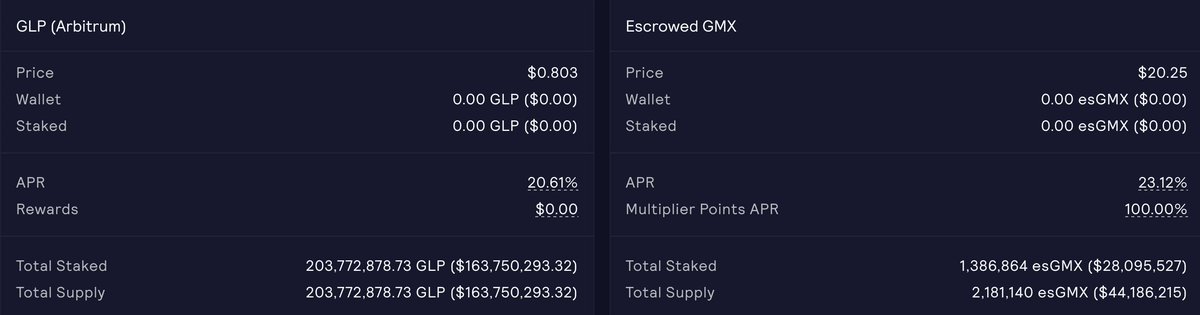

Revenue over the last 3 months has been in a down trend for $GMX stakers compared to a bull market. However, periods of high volatility have resulted in high fees to stakers with APR ranging consistently between 20-40% in $ETH & $esGMX.

👇

👇

Although OI is $GMX's primary source of revenue, growing secondary revenue sources include:

1) #Arbitrum swaps via DEX aggregator integration

2) MEV shared with @Keeper_DAO

👇

1) #Arbitrum swaps via DEX aggregator integration

2) MEV shared with @Keeper_DAO

👇

Future revenue sources for $GMX include synthetic derivatives & the launch of X4 for greater capital efficiency. Work on synths has already begun by the dev team w/X4 currently pending development after synths. medium.com/@gmx.io/x4-pro…

👇

👇

It is worth noting that the $GMX circulating supply is around 7.7m & max supply is 13.25m. There are approx 2.2m escrowed $GMX tokens.

Supply on exchanges is diminishing w/only 400k $GMX on @Uniswap & net outflows increasing daily per @nansen_ai.

👇

Supply on exchanges is diminishing w/only 400k $GMX on @Uniswap & net outflows increasing daily per @nansen_ai.

👇

As $esGMX tapers thru the remainder of 2022, expect a supply crunch to continue to develop as long term stakers are incentivize to hodl thru the 🐻 market to earn lucrative multiplier points to ⬆️ their $ETH revenue share.

Notably, price & volume are seeing a recent uptrend.

Notably, price & volume are seeing a recent uptrend.

I expect the rise of hedging strats + ⬆️ awareness of hedging for the @GMX_IO collateral vault, $GLP, is likely to result in ⬆️ OI as the platform grows. Strats include:

1⃣ Stop Loss/Limit orders

2⃣ @dopex_io Atlantic Options

3⃣ @TracerDAO Power Perpetuals - nonliquidatable

👇

1⃣ Stop Loss/Limit orders

2⃣ @dopex_io Atlantic Options

3⃣ @TracerDAO Power Perpetuals - nonliquidatable

👇

TLDR pt1: I believe @GMX_IO is a base layer DeFi dApp on #Arbitrum that is likely to see ⬆️ revenue & trading activity as the year progresses.

👉Tapering emissions by Dec is likely to result in a supply crunch w/price appreciation.

👉Tokenomics encourage long term accumulation

👉Tapering emissions by Dec is likely to result in a supply crunch w/price appreciation.

👉Tokenomics encourage long term accumulation

TLDR pt2:

👉Launch of synths & X4 + growing secondary sources of revenue via swaps/MEV is bullish for long term protocol sustainability.

👉The L2 narrative is likely to benefit $GMX on #Arbitrum greatly after the launch of Nitro this summer. $AVAX $GLP growth is also at an ATH.

👉Launch of synths & X4 + growing secondary sources of revenue via swaps/MEV is bullish for long term protocol sustainability.

👉The L2 narrative is likely to benefit $GMX on #Arbitrum greatly after the launch of Nitro this summer. $AVAX $GLP growth is also at an ATH.

🎗️Disclosure: As always, DYOR & NFA.

I am biased bc I am long $GMX. I started DCA'ing at $28 & bought the bottom at $12. I continue to buy bc I believe $GMX will outperform even in the 🐻.

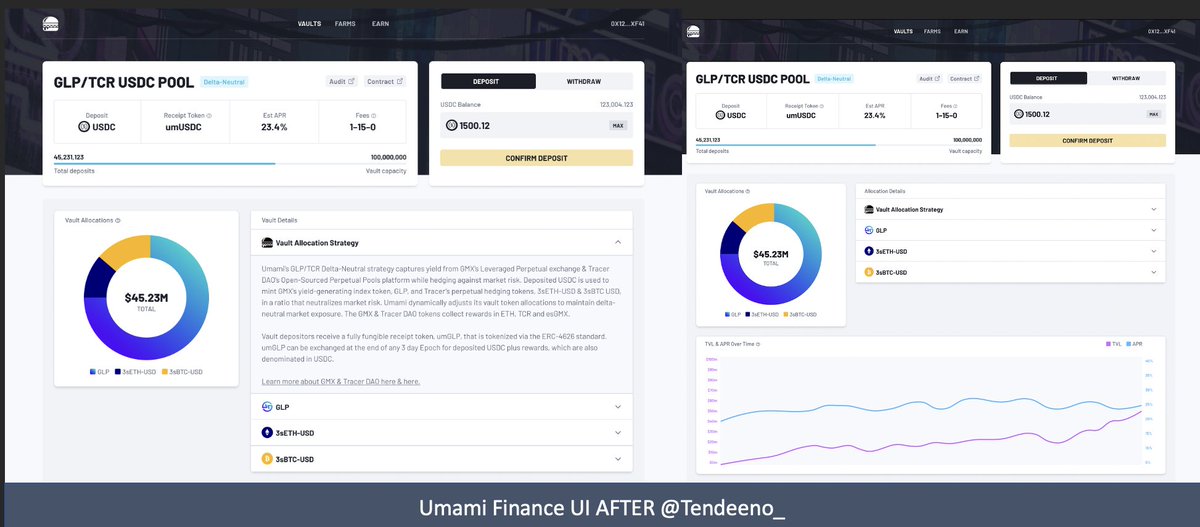

I also hodl $UMAMI which is a delta minimized yield aggregator built ontop of $GLP. 🍌

I am biased bc I am long $GMX. I started DCA'ing at $28 & bought the bottom at $12. I continue to buy bc I believe $GMX will outperform even in the 🐻.

I also hodl $UMAMI which is a delta minimized yield aggregator built ontop of $GLP. 🍌

• • •

Missing some Tweet in this thread? You can try to

force a refresh