NEW REPORT: Europe can ELIMINATE reliance on Russian #NaturalGas by augmenting #REPowerEU plans w/temporary boost in coal & recalibrated gas storage.

ZERO Lab modeled 🇪🇺+🇬🇧 gas & electric grids & find several paths to secure full independence from 🇷🇺 gas: zenodo.org/record/6811676…

ZERO Lab modeled 🇪🇺+🇬🇧 gas & electric grids & find several paths to secure full independence from 🇷🇺 gas: zenodo.org/record/6811676…

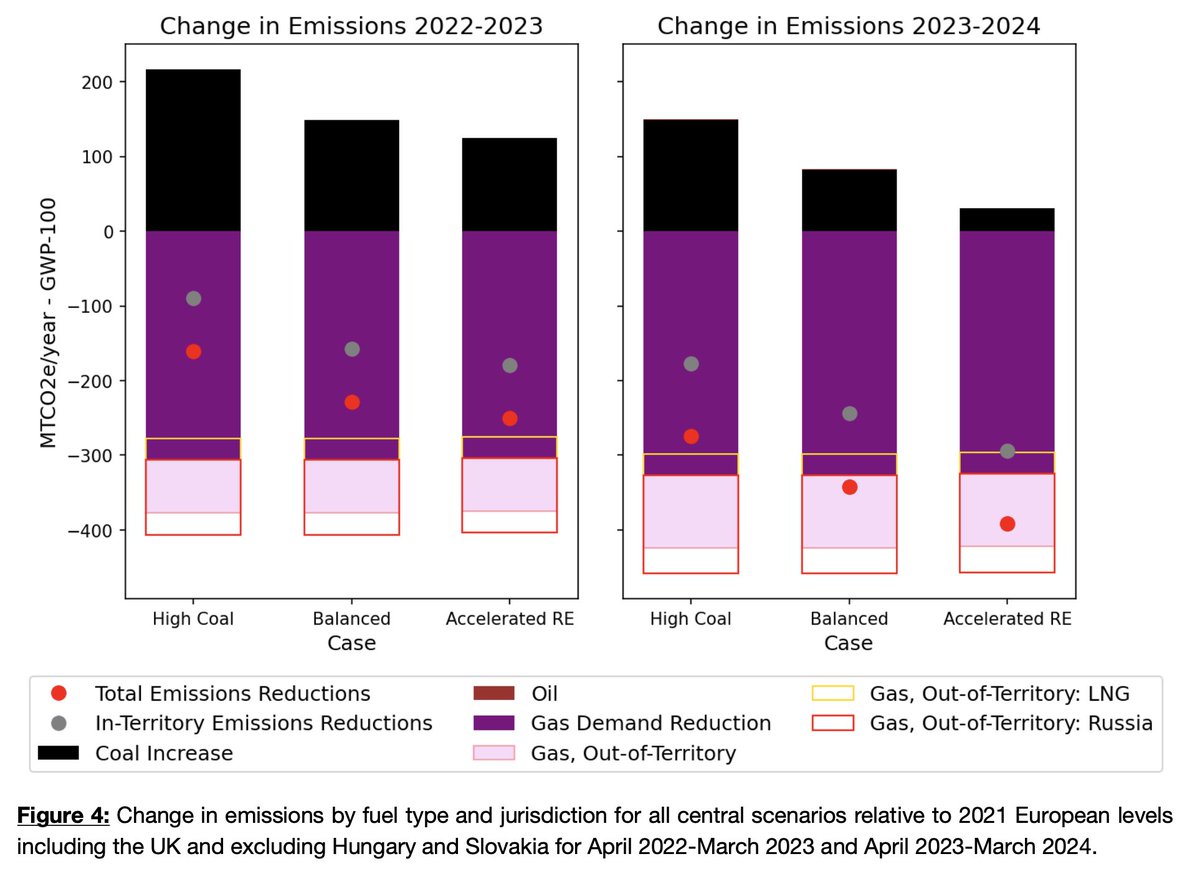

2. Success depends on larger reductions in gas-fired electricity generation by temporarily increasing coal use (a trend we're already seeing reuters.com/world/europe/e…), reducing electricity demand & accelerating renewable energy deployment. Multiple combos of these three can work.

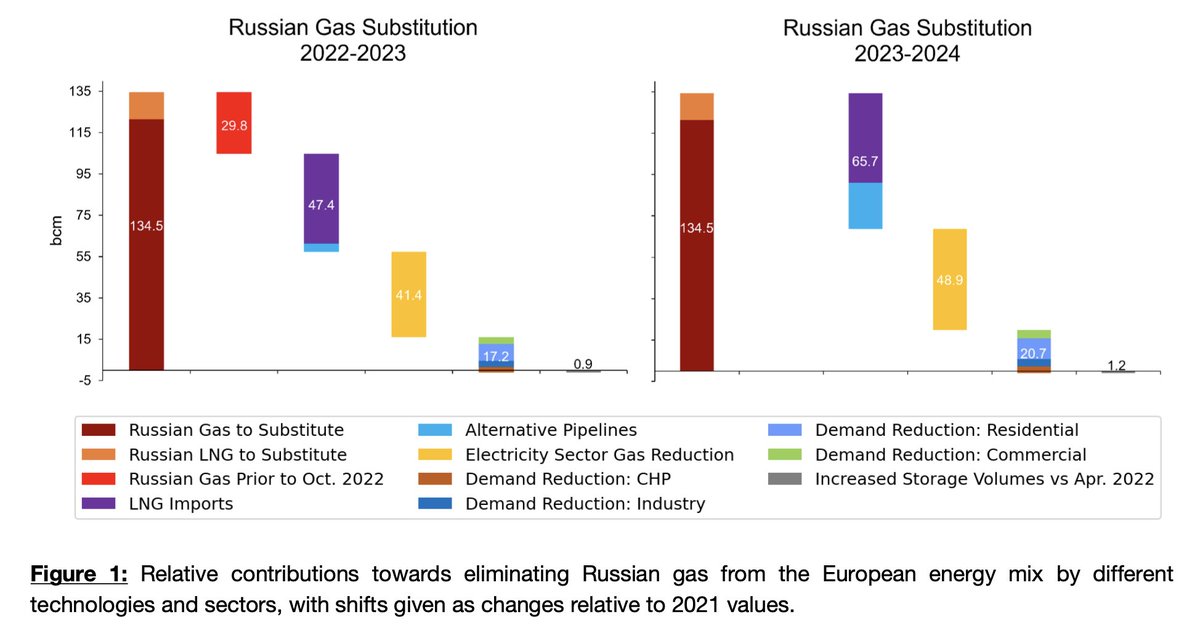

3. Despite increased reliance on coal for electricity generation, all successful gas independence scenarios result in significant declines in European greenhouse gas emissions as lower gas demand offsets emissions from increased coal combustion.

4. In addition to reducing gas use in electricity generation, the overall strategy for European independence from Russian natural gas depends on increased pipeline gas & liquified natural gas imports from alternative sources & reducing gas demand in heating and industry.

5. Europe also needs to rethink its gas storage targets. EU regulations currently require gas stores to be 90% full by winter (abcnews.go.com/International/….), but equal levels of energy security can be achieved w/lower storage volumes since total gas use will fall under this strategy.

6. Our report identifies multiple combinations of these actions that can successfully eliminate Europe’s dependence on Russian gas, giving policymakers leeway to craft a preferred approach based on national priorities. There's more than one way to get free of Russian gas!

7. These actions would be sustained for the next two winters. Emergency measures, incl. demand reduction & increased coal generation, would be steadily replaced by increased renewables, electrified heating & LNG imports & would not imperil Europe’s longer-term energy transition.

8. We began this analysis in the immediate aftermath of Russia's unprovoked invasion of Ukraine. In particular @wilson_ricks @Michael48831282 & @NehaSPatankar volunteered spare time to conduct detailed analysis of European gas & electric grids, global energy markets, etc.

9. We focused in immediately on natural gas, recognizing that it would be the most difficult challenge for Europe AND the most significant economic weapon left to defund the Kremlin's war effort. The reason: unlike oil, ~90% of Russian gas flows to Europe via pipeline not sea.

10. That makes it much more difficult for Europe to secure alternative gas supplies than for oil or coal. It also explains why REpowerEU (ec.europa.eu/commission/pre…) plans to reduce Russian gas use by 2/3rds this year but only aims to achieve complete independence “well before 2030”

11. Yet until fully independent from Russian gas, Europe will be critically vulnerable if the Kremlin cuts off gas flows (

https://twitter.com/GeorgZachmann/status/1545024713172336640?t=NiQFPaLuTkGUlqENqqJQwA&s=19), particularly in winter, when it would both economically devastating & potentially deadly for Europeans that depend on gas for heat.

12. A partial but incomplete reduction in Russian gas use thus gives the Kremlin incredible leverage over Europe, which it has already begun to exercise but choking off gas flows to certain European countries, as @GeorgZachmann details @Bruegel_org

https://twitter.com/GeorgZachmann/status/1545024717496766465

13. But the leverage goes both ways!

If Europe can successfully sever itself from Russian gas, it is effectively impossible for Russia to find alternative buyers for its gas.

If Europe can successfully sever itself from Russian gas, it is effectively impossible for Russia to find alternative buyers for its gas.

14. Russian exports via LNG and pipelines to the east are far less than current production, meaning that if Europe stops buying, the prices Russia earns for remaining exports would collapse and revenues for the Kremlin's war effort would plummet.

15. That's key, because while Europe & UK have pledged & delivered military & financial support to Ukraine, they have also paid Russia nearly $70 (€66) billion for fossil fuels since the start of the war, including $31 (€29) billion for natural gas alone crea.shinyapps.io/russia_counter/

16. Much of this funding flows directly to the Kremlin via Russian state-owned energy companies, which supply about 45% of Russia's government revenue in 2021 (and surely a higher share today)—meaning that Europe is literally funding both sides of the conflict in Ukraine.

17. Energy exports also provide Russia with its last major source of foreign currency exchange (which is why its demanding European buyers pay bills in rubles marketwatch.com/story/orsted-r…), playing a critical role in helping the Russian economy weather impacts of financial sanctions.

18. All of this raises the urgency & importance of securing European energy independence and security, particularly the elimination of Russian gas imports as soon as possible. And that's why ZERO Lab put together this analysis.

19. What we did here: modeled European natural gas and electricity systems at a high temporal resolution and country-level spatial resolution to assess the feasibility and potential impact of a near-complete embargo on imports of Russian natural gas to Europe beginning in October

20. We use a 37-zone model of the European ENTSO-E electricity system (based on open source Pypsa-EUR, thanks to @nworbmot's team, ported to our GenX model genxproject.github.io/GenX/) to assess the impact of reductions in gas-fired electricity generation on the European grid.

21. These results ensure electricity reliability and quantify electricity sector gas consumption, which is passed into a model of the ENTSO-G gas network, which optimizes imports, storage & pipeline transport between countries to minimize gas supply shortfalls for 28 countries.

22. More on what we did in screenshot below. The models & data for both the gas & electric grids are open source & available for those who want to dig in or build on this analysis at zenodo.org/record/6811676… (some data still uploading now).

#FreeTheModels #OpenMod

#FreeTheModels #OpenMod

23. Check out the full report and a short FAQ and please share, especially with European colleagues!

(And my apologies for dropping this after 5pm on Friday in Berlin/London etc.)

CC @janrosenow @DrSimEvans @laurimyllyvirta @LionHirth @nworbmot @Bruegel_org @GeorgZachmann

<End>

(And my apologies for dropping this after 5pm on Friday in Berlin/London etc.)

CC @janrosenow @DrSimEvans @laurimyllyvirta @LionHirth @nworbmot @Bruegel_org @GeorgZachmann

<End>

• • •

Missing some Tweet in this thread? You can try to

force a refresh