1/ #EGLD market update! 🙌 @ElrondNetwork ⚡

I wish I had better news to share, but the bull has been beaten out of me! 😆 I'm still #hodling and farming away on @MaiarExchange, but the seas may soon get rocky... 👉🎭 Preparing begins with setting expectations! 🧠 Let's go! 🧵

I wish I had better news to share, but the bull has been beaten out of me! 😆 I'm still #hodling and farming away on @MaiarExchange, but the seas may soon get rocky... 👉🎭 Preparing begins with setting expectations! 🧠 Let's go! 🧵

2/ I'm still perma-bull b/c no matter what happens this market can shift on a dime. The goal is to *capture the average* & hold position until the bull market returns. It takes patience, but bear market rallies can come out of nowhere & cause FOMO...

https://twitter.com/the_economystic/status/1544080454856294406?s=20&t=ev5yPASbjs_Z5yRtj_mJJA

3/ FOMO is what U feel when you have cash on the sidelines waiting to re-enter the market. The market can bounce or even sustain a sizeable rally, enticing U to re-enter: U fear you will miss the gains! These rallies suck ppl back in only to lose steam & retrace, losing U money.

4/ Capturing the average means focusing on controlling what U have control over. Emotions can take us to wild places, so create timelines & develop consistent behavioral patterns with trades. In doing so U will learn to reject emotional impulses and sail smoothly. ⛵

5/ That said, let's get into it. 👏

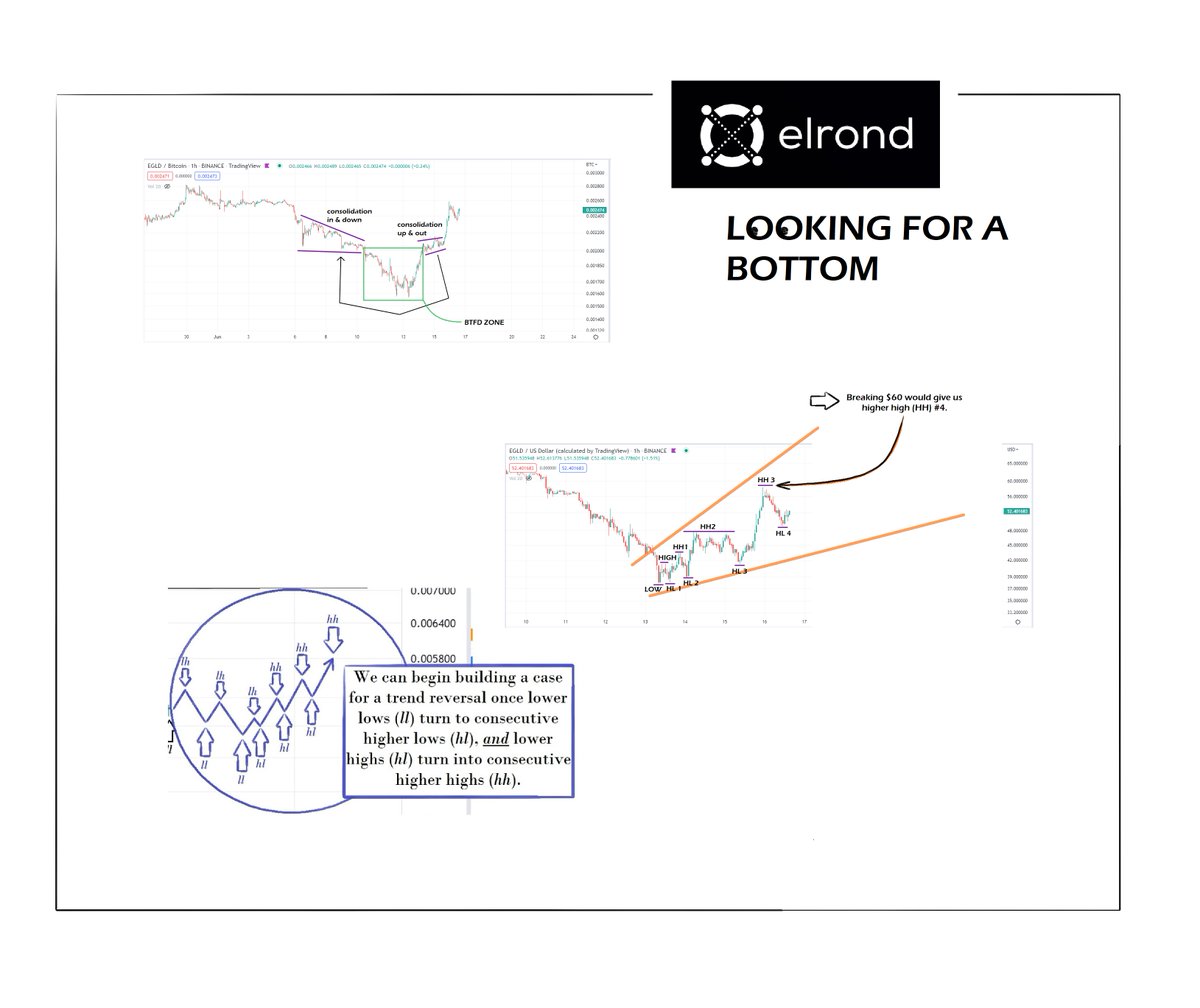

Giving it to U straight just the way I see things: bias is to the downside. 😖 From valley to peak, the last month's bounce yielded over 90% gains, but an ascending triangle tends with bias to downside (purple lines)...

Giving it to U straight just the way I see things: bias is to the downside. 😖 From valley to peak, the last month's bounce yielded over 90% gains, but an ascending triangle tends with bias to downside (purple lines)...

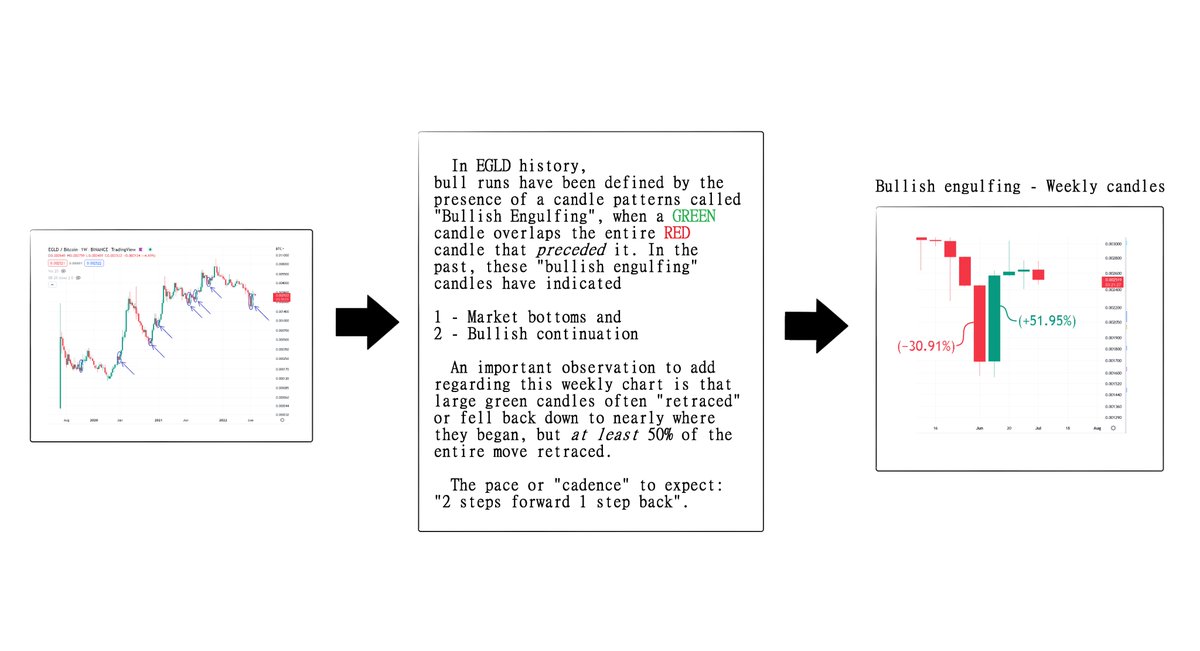

6/ Earlier today I shared a look at how the Weekly candles achieved a "bullish engulfing" pattern - a pattern that has historically indicated market bottoms & reversals. Unfortunately until proven otherwise, we must set expectations that the downtrend will only continue...

7/ Truth remains that market bottoms *always* feel like "this is the end". ☠️

One of the previous times $EGLD had a bullish engulfing pattern on the weekly was in fact a market bottom (indicated below). It's vital to trust that the market:

- WILL buy dips &

- will NOT sell. 💎

One of the previous times $EGLD had a bullish engulfing pattern on the weekly was in fact a market bottom (indicated below). It's vital to trust that the market:

- WILL buy dips &

- will NOT sell. 💎

8/ Zooming into the action, it appears a head & shoulders reversal may be in action. The calculated result of this pattern actuating is laid out below: from head to break of shoulder line is equidistant to break of shoulder line to the resulting bottom, ~25% down from here.

9/ Let's compare today's bullish engulfing pattern to that previous bullish engulfing pattern from exactly 1 year ago, July 2021...

10/ Last summer the market capitulated farther and farther, until July 2021 when after weeks of selling the market began a sprint that topped at +80%. After this rally exhausted, a grueling -37% retracement began. At the top it felt like the bull rally was ready to go again! ...

11/ If history repeats itself, we may see price retrace the entire move it just made.

👉 Technical analysis is about collecting several viewpoints to create calculated expectations. Combine history from July 2021 w/ the head & shoulders top and the story starts to sync up.

👉 Technical analysis is about collecting several viewpoints to create calculated expectations. Combine history from July 2021 w/ the head & shoulders top and the story starts to sync up.

12/ Be wary before adding more to your position here. It seems blatant that we're due for a retracement of that huge +90% bounce we saw over the last 30 days.

👉What I do NOT recommend is selling now to hope to buy more lower. That's a very tricky play. ⚠️ & not good behavior.

👉What I do NOT recommend is selling now to hope to buy more lower. That's a very tricky play. ⚠️ & not good behavior.

13/ Even in prior bull runs these bullish engulfing patterns turn around to retrace recent gains. What this is effectively doing is "testing" those recently buyers of the asset to see whether they have the guts to #hodl as the market bleeds. That's why it's called "retest". 👍

14/ For now, the key level to pass is the recent highs. This is the target! Below I've laid out several paths that a sideways market may take.

On one side I feel like there's good reason to expect recent lows to be retested. The market still seems too skeptical... 😖

On one side I feel like there's good reason to expect recent lows to be retested. The market still seems too skeptical... 😖

15/ The easy prediction to make here is that price will agree with the calculation for the head and shoulders to bring price lower to begin testing recent lows...

16/ As U should know by now, price in just a sentiment indicator, so the market could change it's mind quickly. As I have been watching #btc, my perma-bull within tells me that the market at large is due for a *sizeable* rally to float us up and out of this range...

17/ The market at large has been going through a significant season of selling. Each time the Bollinger bands tighten, the resolution has been further downside. I think 3rd times the charm & this BB tighten will yield some relief.

https://twitter.com/the_economystic/status/1545147265253183488?s=20&t=ev5yPASbjs_Z5yRtj_mJJA

18/ This "Adam and Eve" formation is still in play, and analysts I follow like @BobLoukas follow 60-day cycles & are calling for a local bottom to be placed ±7 days to July 10th (today).

https://twitter.com/the_economystic/status/1545139748359983104?s=20&t=ev5yPASbjs_Z5yRtj_mJJA

19/ I'm offering a balanced perspective, so maybe it's a bottom indicator itself that I myself @the_economystic am posting bearish predictions for the short-term future?? 🙄🙄

I hope U take the time to read my advice on building your own success!

I hope U take the time to read my advice on building your own success!

https://twitter.com/the_economystic/status/1546238311420686336?s=20&t=ev5yPASbjs_Z5yRtj_mJJA

20/ A trick that I have to help remove my own bias is to ✔️ the box for "invert scale" on @tradingview.

It helps me see the data from a different perspective & helps silence the perma-bull within me. Take a look below and ask yourself what stands out to you!

It helps me see the data from a different perspective & helps silence the perma-bull within me. Take a look below and ask yourself what stands out to you!

21/ I've been in crypto since 2017, so I've been thru market bottoms a few times now! The next bull rally unsuspectingly emerges out of the bear market. 👏

👉Taking more profits next bull run begins NOW. It seem crazy but it may change your life. 🤯

👉Taking more profits next bull run begins NOW. It seem crazy but it may change your life. 🤯

https://twitter.com/the_economystic/status/1545093791463313408?s=20&t=ev5yPASbjs_Z5yRtj_mJJA

22/ The message within this thread aligns with the expectations I set June 20th. The rally became exhausted as it ran into those levels of previous rejection, so now the expectation is to retest those previous levels of support...

https://twitter.com/the_economystic/status/1538998074248339458?s=20&t=ev5yPASbjs_Z5yRtj_mJJA

23/ Analyzing relative strength helps to build confidence to boldly buy the downtrend, and fact remains that amount of $EGLD staked has increased significantly over the past 60 days. There are more players competing to buy $EGLD as there's less of it.

https://twitter.com/PodcastElrond/status/1543413287915700224?s=20&t=ev5yPASbjs_Z5yRtj_mJJA

24/ The best way to play this market = long-term: maintaining exposure, increasing your position by staking 🪙 #EGLD & farming 🧑🌾 on @MaiarExchange. It pays to play!! ✅ Hold strong & remember the strength U have thru resilience to sell + buying more if U can. 💪 $EGLD will moon!

25/ As always, any tweet U like or find helpful plz share with a quick #retweet or quote tweet! Talk about your own experiences or strategies! Spreading the word about @ElrondNetwork is something we can all do while helping each other & cultivating community! 🙌🌎⚡#EGLD

• • •

Missing some Tweet in this thread? You can try to

force a refresh