There are 5 important parts you need to think of before setting up a trade:

(Thread)

1. Determine the directional bias of the trade (Long or Short).

Some key questions you should ask yourself are:

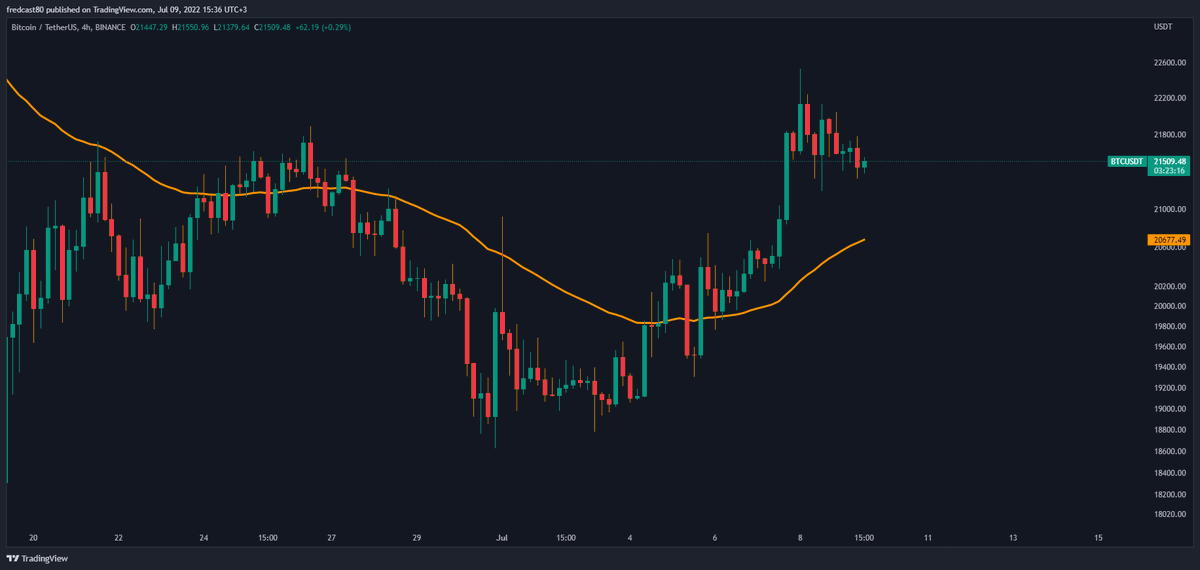

Is the candle in a key support/resistance?

Is it above or below a moving average?

(Thread)

1. Determine the directional bias of the trade (Long or Short).

Some key questions you should ask yourself are:

Is the candle in a key support/resistance?

Is it above or below a moving average?

Is the price action bullish (higher highs and higher lows) or bearish (lower highs and lower lows)?

Is there any candlestick pattern in the support/resistance?

Is the price on a key Fibonacci Level?

Is there any candlestick pattern in the support/resistance?

Is the price on a key Fibonacci Level?

2. Are you trading with the trend (trend continuation) or counter trend (support/resistance rejection).

Depending on the candlestick pattern action in the key level, you should decide whether you trade a breakout (trend continuation) or rejection (counter trend).

Depending on the candlestick pattern action in the key level, you should decide whether you trade a breakout (trend continuation) or rejection (counter trend).

3. The entry.

The most effective and conservative method of entering is after the retracement, in the second impulse. Drawing some lines might help you here (first impulse, retracement and second impulse).

The most effective and conservative method of entering is after the retracement, in the second impulse. Drawing some lines might help you here (first impulse, retracement and second impulse).

4. Determine the Stop Loss of the trade.

Try to respect the wicks above (short trade) or below (long trades) as well as the ATR (Average True Range). SL is as important as the entry. You will hate if you are stopped out and then the trade goes into your direction.

Try to respect the wicks above (short trade) or below (long trades) as well as the ATR (Average True Range). SL is as important as the entry. You will hate if you are stopped out and then the trade goes into your direction.

5. Take profit (TP).

You should always assure at least 1:1 risk reward. i.e. if your SL is 2% away from the entry, the minimum TP you should consider is 2%.

You should always assure at least 1:1 risk reward. i.e. if your SL is 2% away from the entry, the minimum TP you should consider is 2%.

Split TP's into 2 is also a good idea.

Remember, if you don't take profits from the market, the market will take profits from you. ✌️

#Crypto #BTC #ETH #altcoins #cryptotrading

Remember, if you don't take profits from the market, the market will take profits from you. ✌️

#Crypto #BTC #ETH #altcoins #cryptotrading

3. The Stop Loss (SL).

• • •

Missing some Tweet in this thread? You can try to

force a refresh