#FCBarcelona have announced the signing of Rapinha from #LUFC for €58m, while a deal to acquire Robert Lewandowski from Bayern Munich for €50m is agreed in principle. The question is how can they possibly afford these players, given their well-documented financial problems?

Only last month president Joan Laporta compared #FCBarcelona to a patient who “was practically dead in financial terms”, while the vice-president for finance Eduard Romeu said that €500m was needed “to save the club”.

This was not surprising, given the magnitude of #FCBarcelona’s financial issues. Although things have moved on since the most recent accounts for the 2020/21 season, it’s worth reviewing these to explain why so many fans are scratching their head at this summer’s spending.

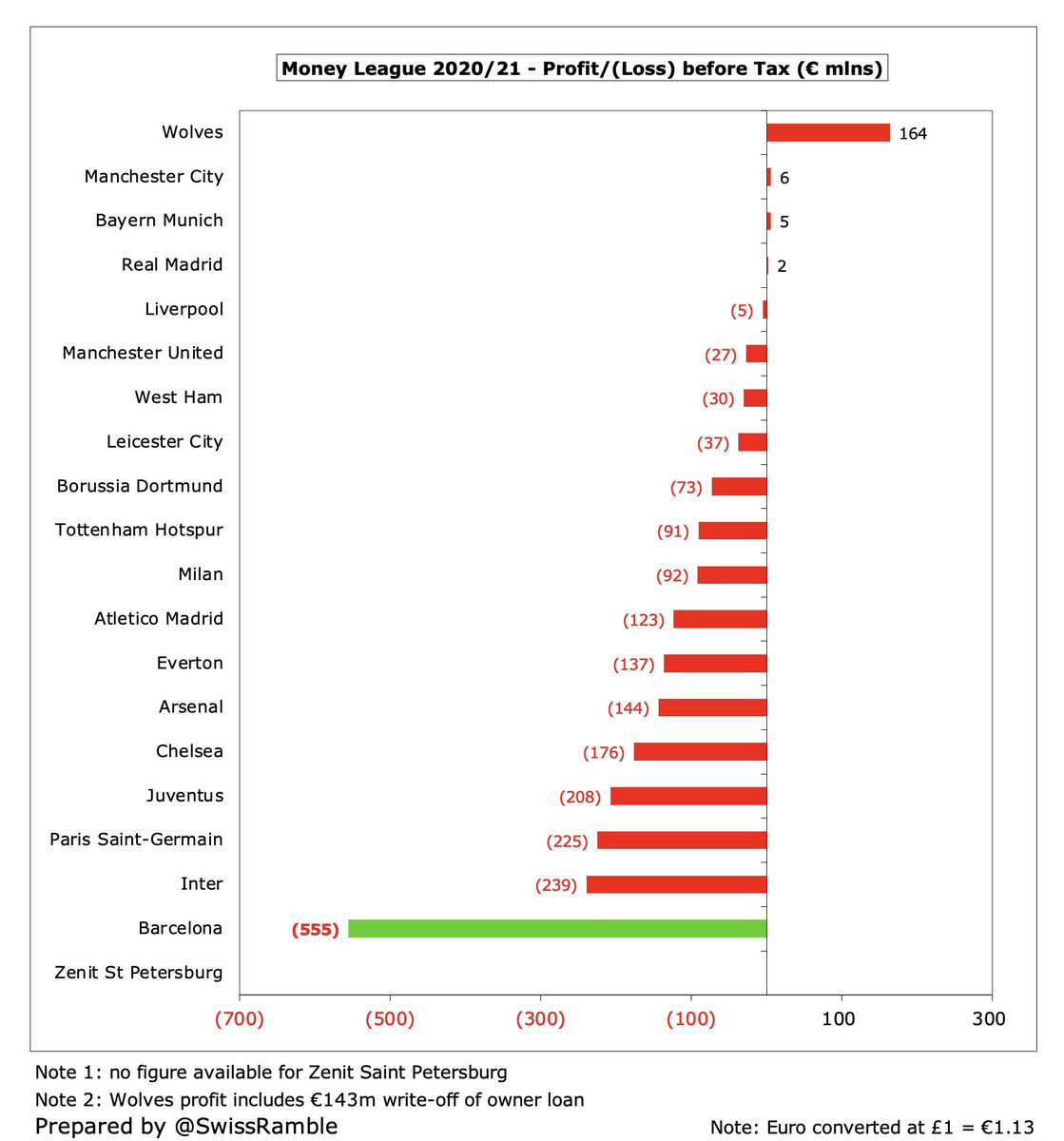

After many profitable years, #FCBarcelona slumped to a €133m pre-tax loss in 2020, followed by a shocking €555m loss in 2021, which was by some distance the worst in Europe. In fact, this was the highest loss ever reported by a football club.

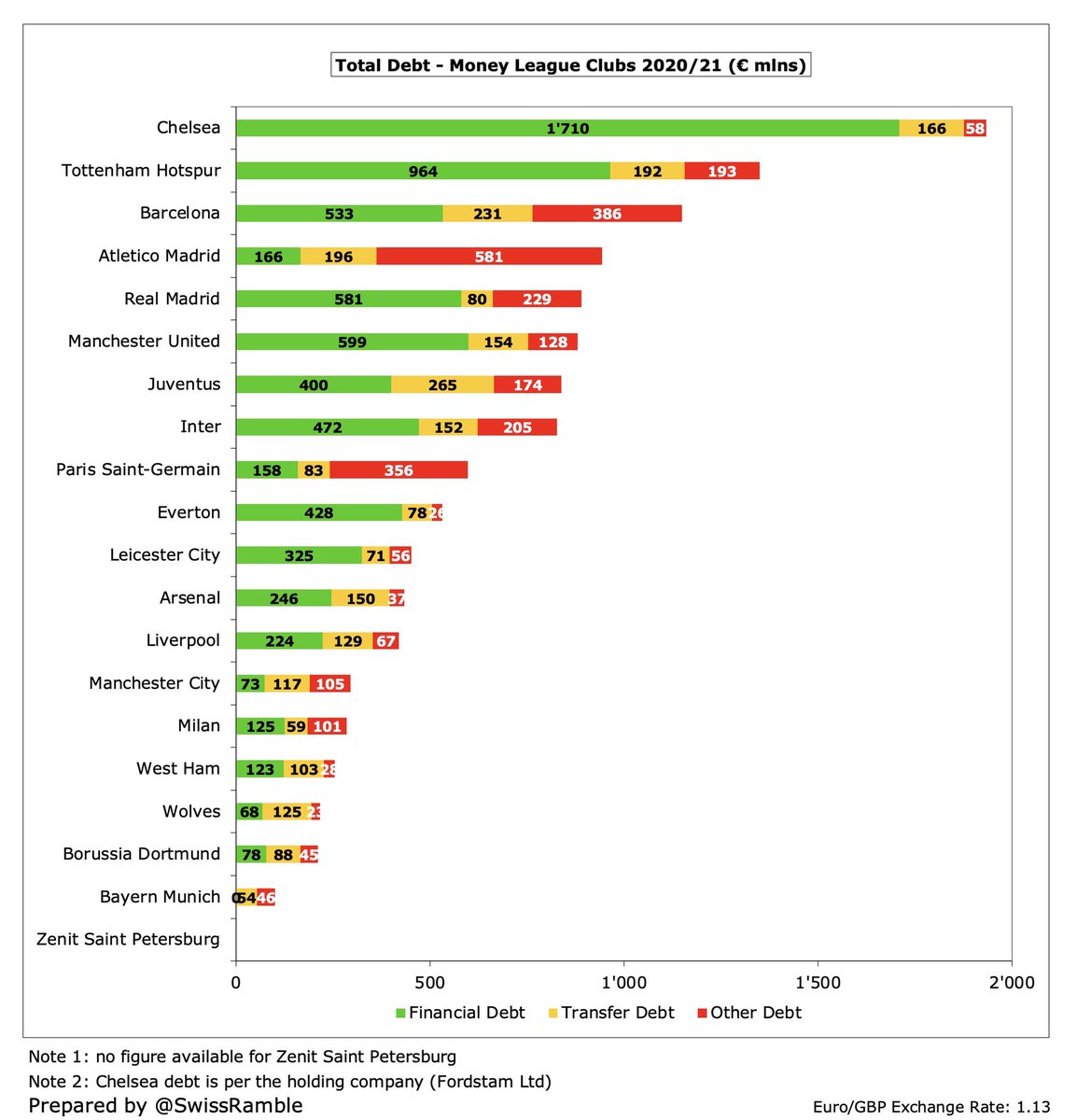

#FCBarcelona total debt (including bank loans, transfer fees, wages, tax authorities and other creditors) has more than tripled in the last 5 years to stand at €1.2 bln, the third highest in Europe, only below #CFC (Abramovich friendly loans) and #THFC (funding a new stadium).

#FCBarcelona have had to pay a heavy price for this debt growth, as interest payments have shot up from just €1m in 2018 to €41m in 2021, which was comfortably the highest in Europe, ahead of #Atleti €30m, #MUFC €23m and #THFC €21m.

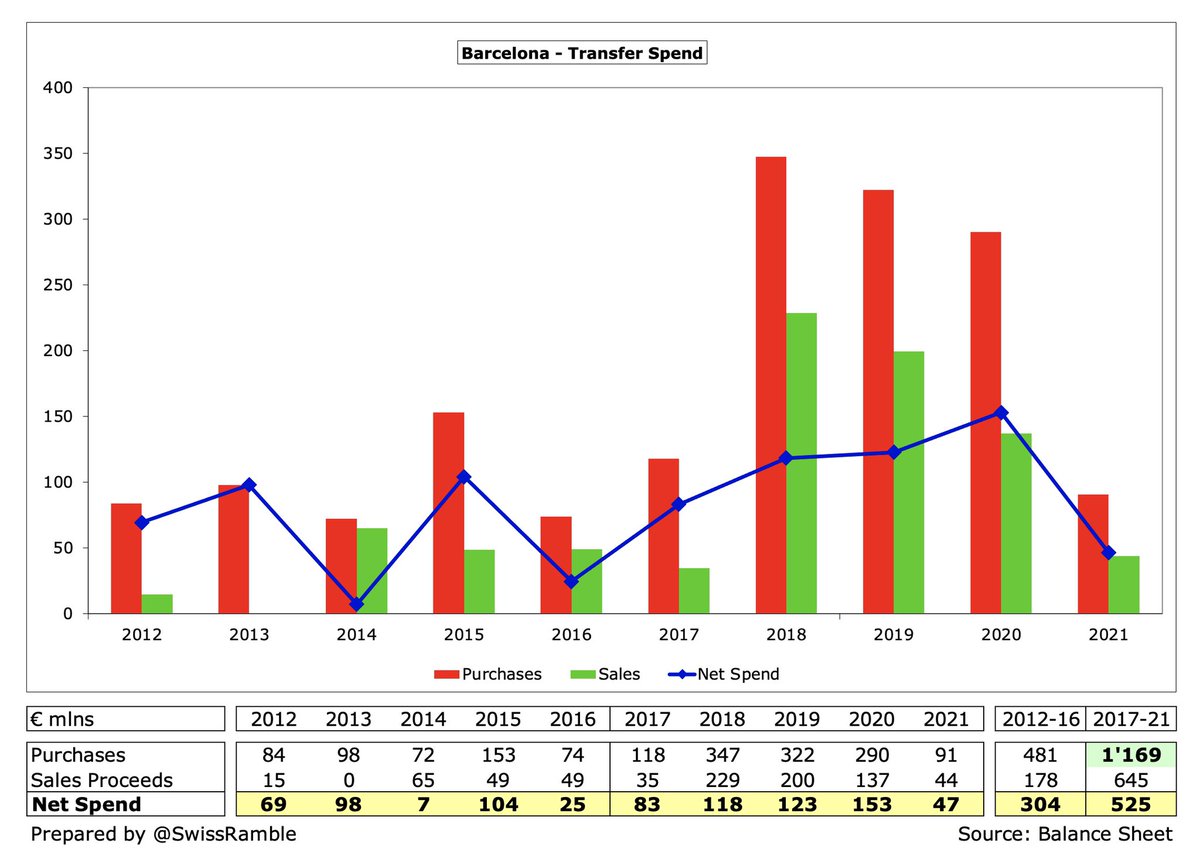

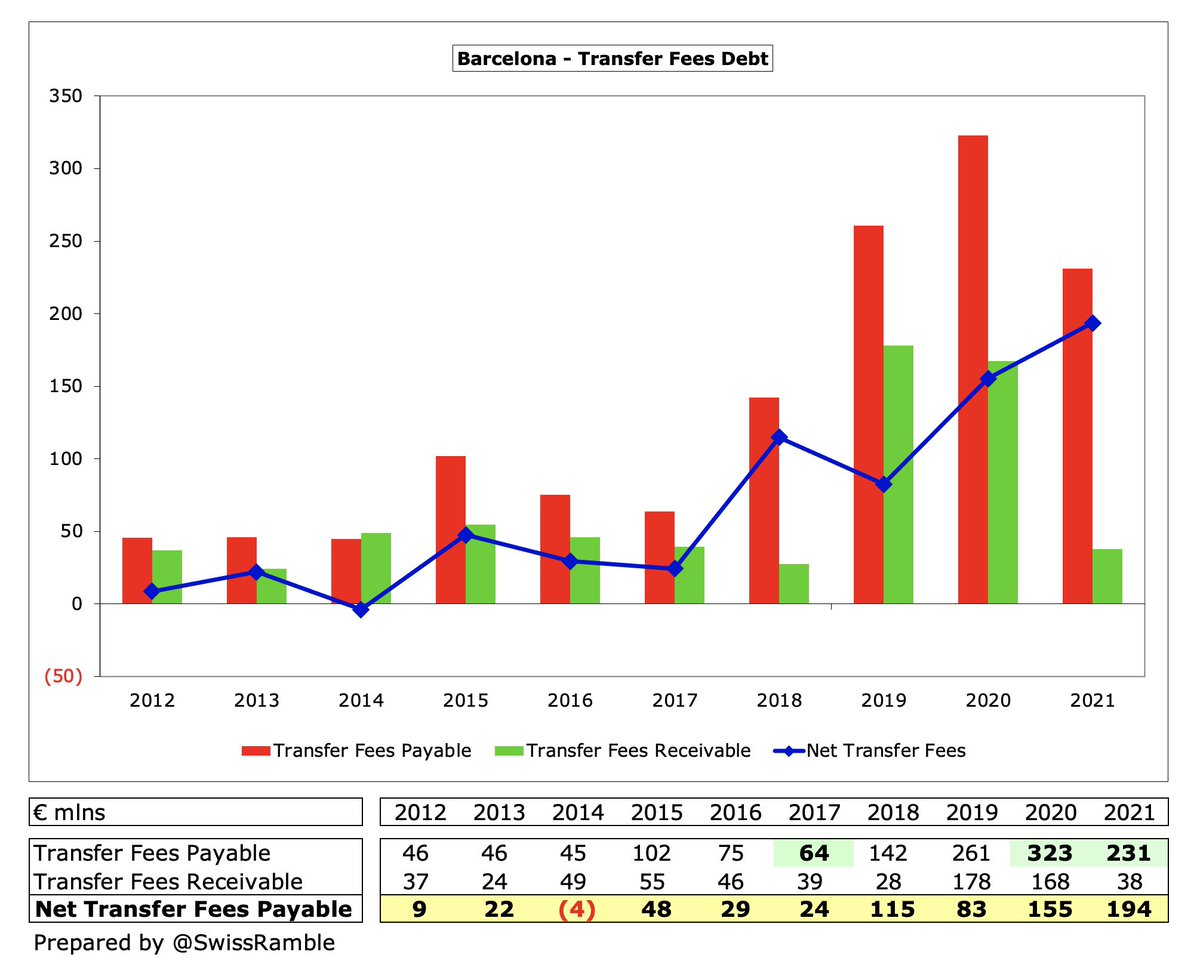

#FCBarcelona debt has largely been used to fund the purchase of new players with €1.2 bln spent on transfers in the 5 years up to 2021, which was only surpassed by Juventus, though was more than big spending #MCFC and #CFC.

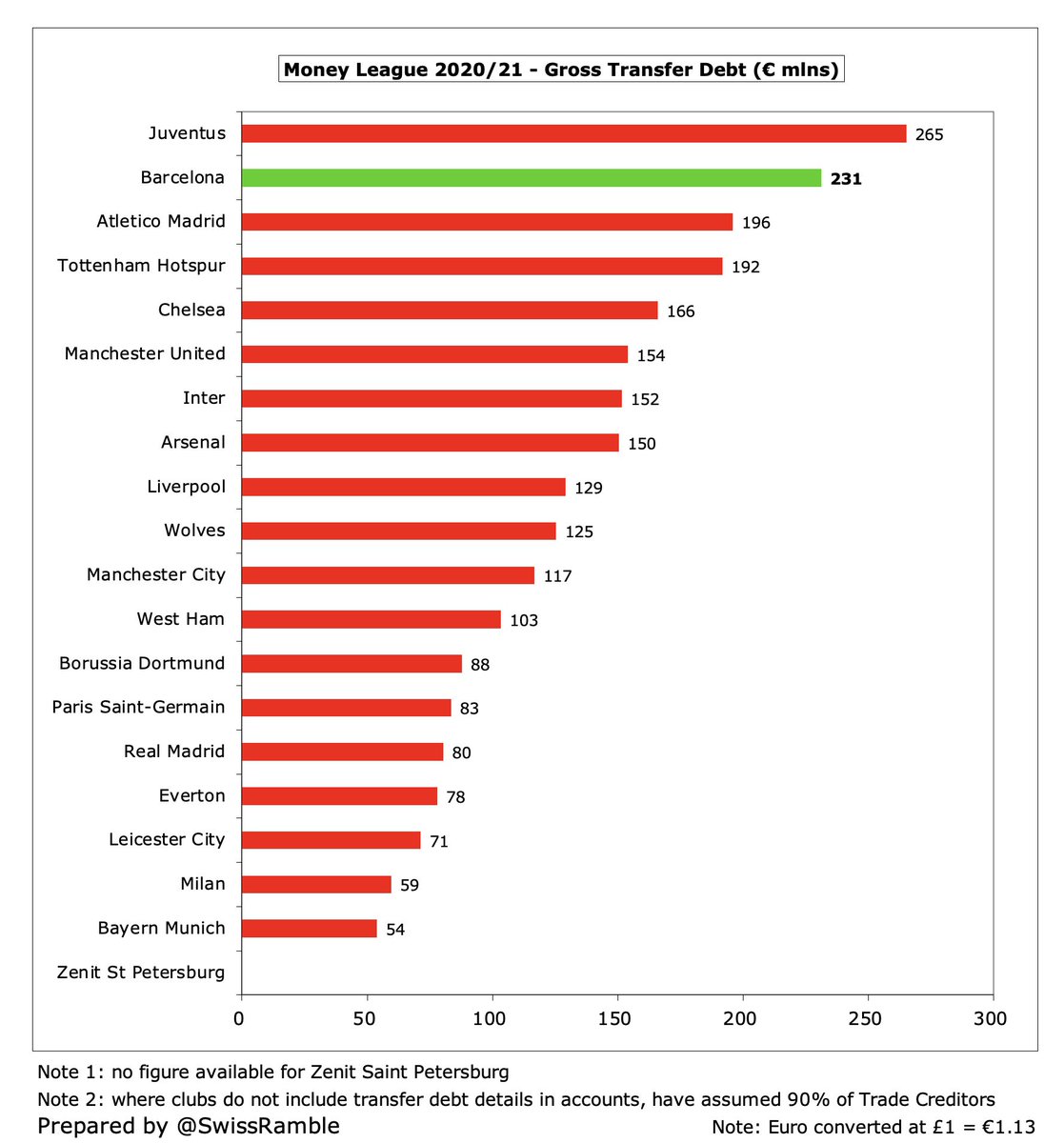

Like all football clubs, one way that #FCBarcelona have managed to sign these players is by paying the transfer fees in stages. Even though they managed to reduce transfer debt to €231m in 2021, this was still the second largest in Europe, again only behind Juventus.

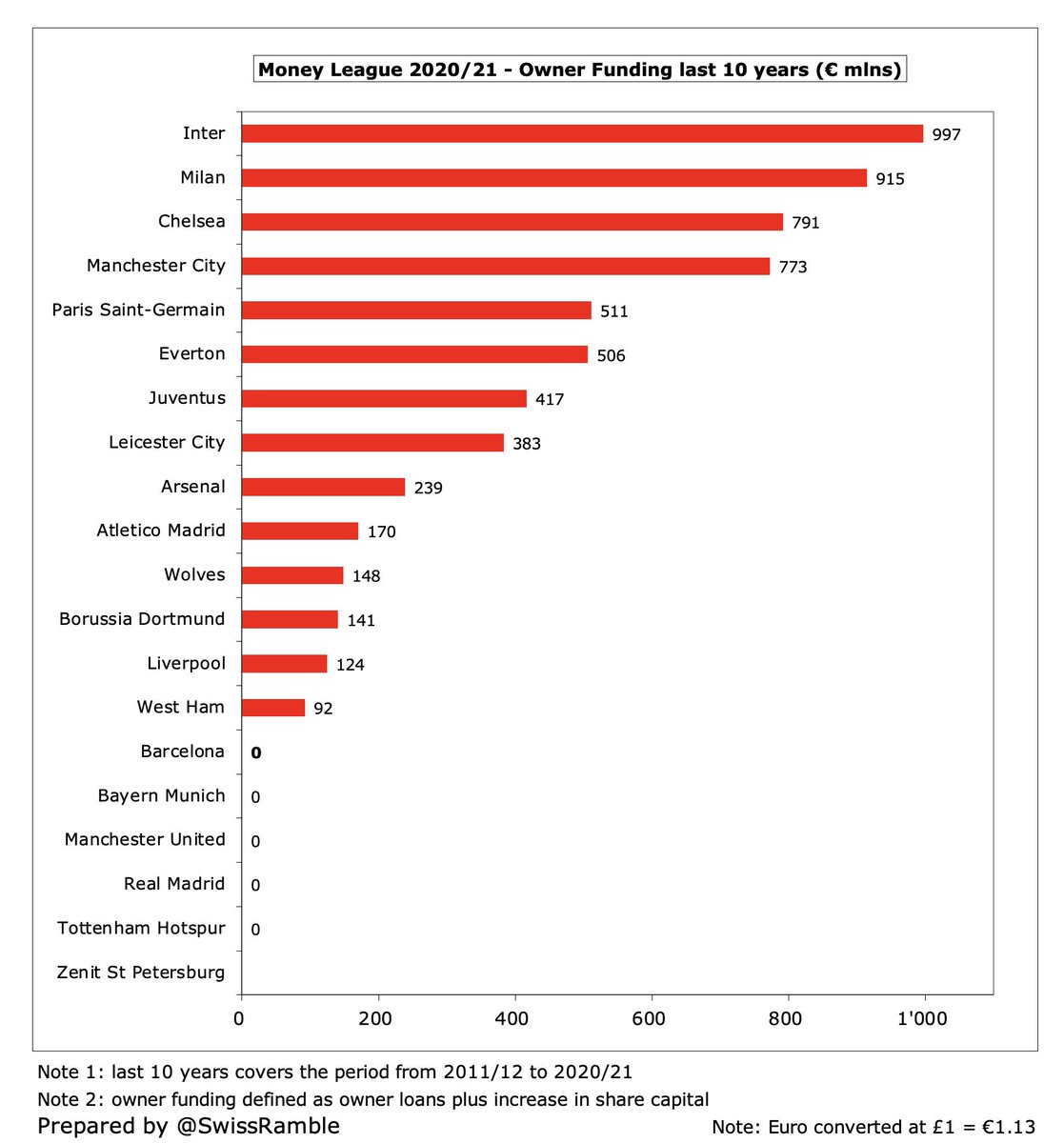

Of course, #FCBarcelona do not benefit from owner funding (loans and share capital), unlike many other leading clubs, whose business model is reliant on benevolent owners, e.g. in the last 10 years Inter and Milan have received over €900m, with #CFC and #MCFC just under €800m.

So the financial situation at #FCBarcelona at the end of the 2020/21 season was pretty terrible, though there are a few signs of encouragement if we dig a little deeper into the numbers.

The good news is that #FCBarcelona debt has been restructured with a 10-year €595m loan at 1.98% replacing old short-term debt. Before the refinancing, this was a major issue, as €596m had to be repaid within 12 months. This was the highest in Europe, much more than other clubs

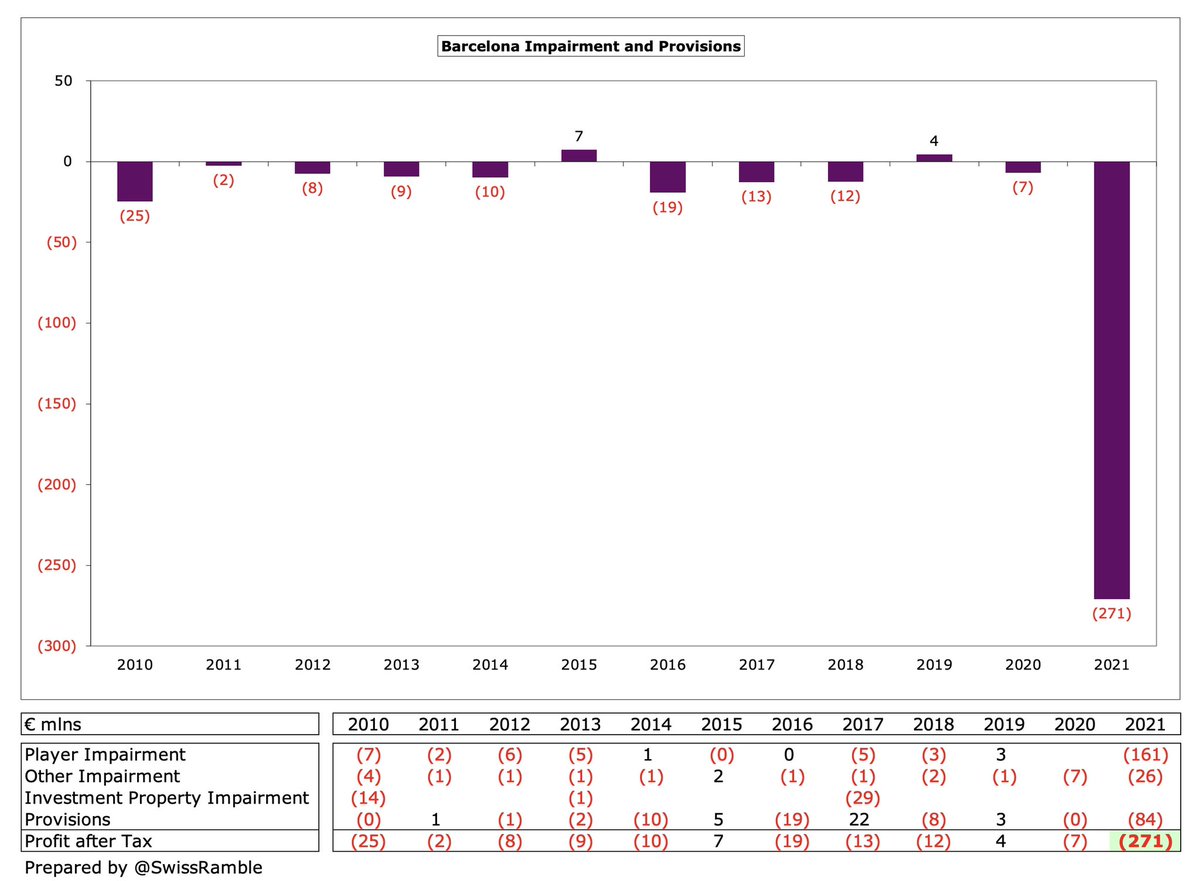

It is also worth noting that #FCBarcelona €555m loss was significantly impacted by €271m once-off costs following the Due Diligence report, including €161m player impairment, €26m other impairment and €84m provisions (law suits, tax cases), which will not be repeated.

As a result of the significant impairment (writing down player values), #FCBarcelona will enjoy two financial advantages going forward: (1) player amortisation will fall; (b) any player sales will generate higher profits.

Similarly, #FCBarcelona loss included a €92m net impact for COVID. The revenue reduction was €219m, mainly stadium €181m and commercial €56m, while expenses were cut €127m (deferred wages €60m, savings from not opening stadium and stores €64m).

This means that #FCBarcelona 2021 underlying loss, i.e. excluding the €271m once-off charges and €92m COVID impact, was “only” €193m, as opposed to the reported €555m. To be clear, this is still an awful figure, but nowhere near as horrific as the headline number.

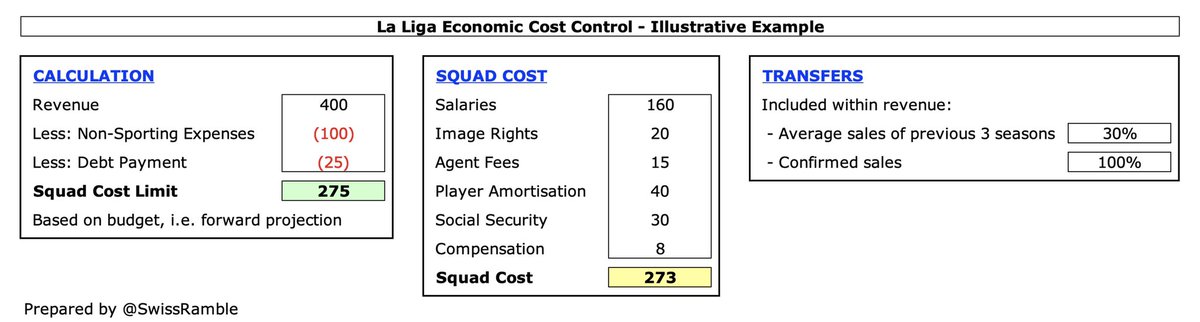

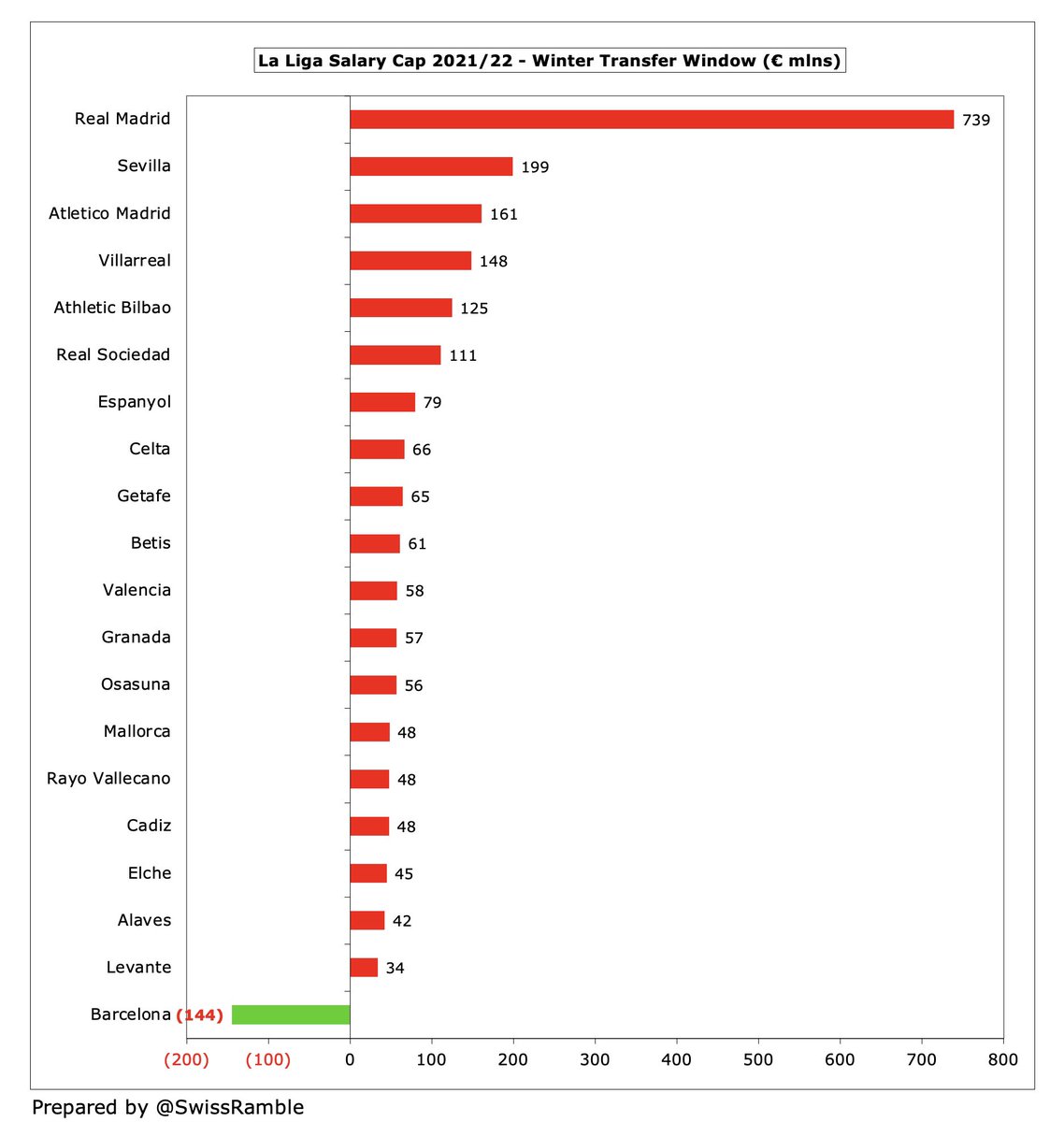

However, the most problematic issue for #FCBarcelona is the salary cap imposed by La Liga’s Economic Cost Control, specifying how much each club is allowed to spend on first team players, reserves, academy, coaches, physios, etc.

Each season La Liga calculates a club’s salary cap as revenue less non-sporting expenses and debt repayments. In contrast to UEFA’s Financial Fair Play rules which look at previous years, La Liga’s regulations are applied in advance, i.e. before any spending takes place.

If a club is over its salary cap, it can only use 25% of any savings made (or transfer gains) on bringing in new players, with the other 75% used to reduce existing liabilities. If the player accounts for more than 5% of squad cost, then amount available to invest rises to 50%.

La Liga president Javier Tebas previously explained, “If #FCBarcelona sell a player for €100m, they can only spend €25m. If they want to bring in a player who costs them €25m a season in salary, they must earn €100m, either by transfer or salary reduction."

However, recently La Liga relaxed the salary cap in two important ways as a result of losses caused by the pandemic. First, the 1:4 rule has become 1:3 for the summer 2022 transfer window, i.e. a club can now use 33% of any savings made or transfer profits on player purchases.

Second, a club can cushion the effect of losses caused by COVID by only having to include a smaller percentage of the losses in its salary cap calculation: 15% in 2022/23, 20% in 2023/24 and 2024/25, and 22.5% in 2025/26 and 2026/27.

However, #FCBarcelona was the only club with a negative €144m salary cap in La Liga in the winter transfer window 2021/22, driven by the huge reported loss (effectively caused by the large provisions). This is even lower than the €98m cap they were given in the summer window.

That said, if #FCBarcelona revenue could bounce back to pre-pandemic levels, then the salary cap would also climb. Two years ago this was the highest in Spain at €671m, even more than Real Madrid’s €641m, so all is not yet lost, albeit an immensely difficult balancing act.

#FCBarcelona’s challenge is illustrated by the fact that La Liga has not yet allowed them to register their new signings, even though the club has already announced the arrivals of Rapinha plus a couple of free transfers: Franck Kessie from Milan & Andreas Christensen from #CFC.

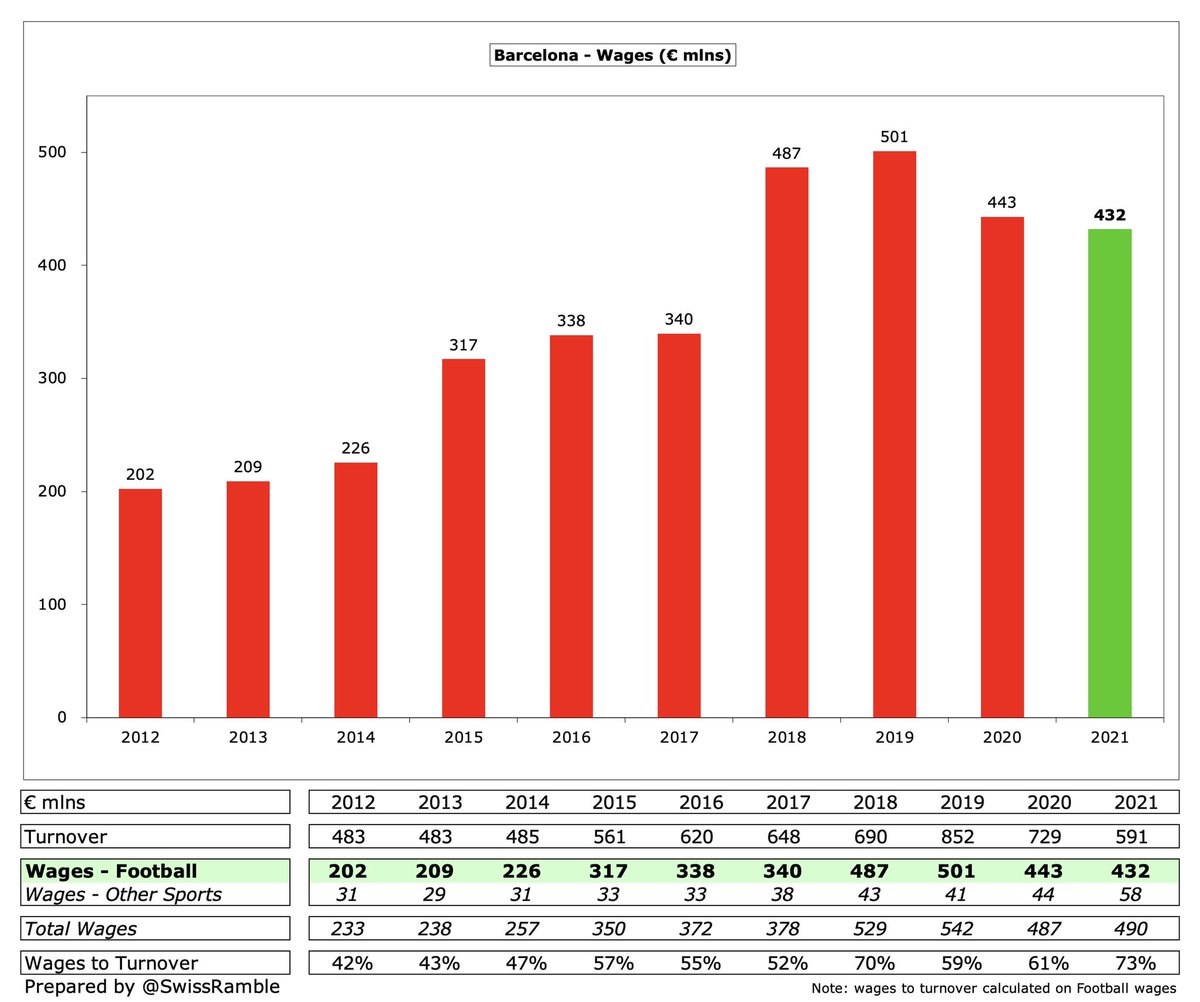

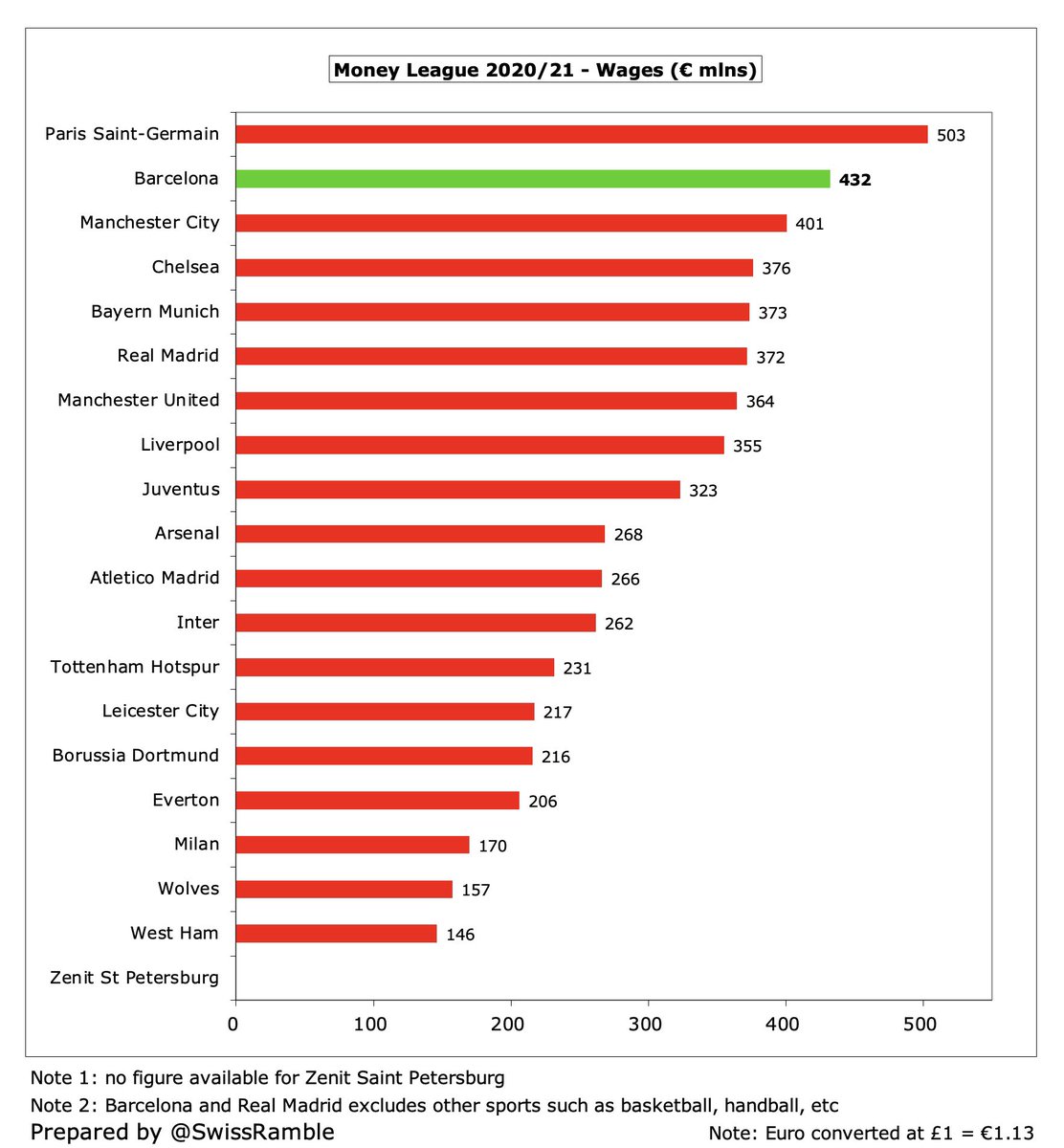

#FCBarcelona wage bill is still miles over the salary cap with the last reported figure being €432m in 2020/21 (excluding other sports), even though this was well down from the €501m peak in 2019. This was second highest in Europe, only surpassed by PSG €503m.

As a result, #FCBarcelona have had to let players leave in order to reduce the wage bill, most notably Messi on a free transfer, but also Coutinho to #AVFC for a cut-price €20m. Others have left on loan, including Griezmann to Atleti, Pjanic to Besiktas and Lenglet to #THFC.

Laporta said, “Certain players have salaries that are not adequate to the limits that the board has set for next season. Some adjustments will have to be made.” New deals for Dembélé and Sergi Roberto were on lower wages, while Piqué, Busquets and Alba accepted cuts last season.

Other tactics include extending player contracts (Umtiti), signing players with low salaries in first year (Aubameyang) and deferring salaries to a later date. All this fancy footwork is designed to enable the registration of new players, e.g. Ferran Torres from #MCFC in January.

One reason why #FCBarcelona posted such a large loss in 2020/21 was generating only €4m profit from player sales, which they will look to address, as this activity produces a “double whammy” in terms of meeting the salary cap: the gain from the sale plus savings on the wage bill

#FCBarcelona have a long list of possible, even desired, departures, e.g. Umtiti, Neto, Sergio Dest, Martin Braithwaite and Riqui Puig. However, unless they sell one of their young talents, such as Pedri or Gavi, the only player that would generate big money is Frenkie de Jong.

Although Laporta has said he does not want de Jong to leave, it’s clearly a possibility, though the attempt to persuade the Dutch midfielder to give up wages he deferred to help the club through its predicament is morally wrong, especially with the club spending on new signings.

It should be remembered that #FCBarcelona are still capable of generating high revenue. Even though it fell by nearly a third in the last two years, their €582m in 2020/21 was still fourth best in the world (albeit they had the highest revenue in both 2019 and 2020).

Before the pandemic struck, #FCBarcelona claimed that they were on track to be the first football club in the world to generate more than €1 billion annual revenue. If they can replicate this performance after COVID diminishes, their salary cap will correspondingly increase.

In fact, #FCBarcelona claimed to have lost nearly half a billion revenue (€447m) in the last two years due to COVID, comprising €203m in 2019/20 plus €244m in 2020/21. This was mainly from match day €248m and commercial €128m.

In particular, #FCBarcelona match day revenue was down €110m in 2020/21, as all home games at the 99,000-capacity Camp Nou stadium were played behind closed doors. In the previous season, they had the highest income in Europe from this revenue stream with €126m.

Similarly, #FCBarcelona suffered the largest year-on-year decrease in commercial revenue in Europe in 2020/21, so their €277m annual income was below Bayern Munich €345m, PSG €337m, real Madrid €322m and #MCFC €308m.

#FCBarcelona have signed a new sponsorship deal with Spotify, but worth noting this covers shirt, stadium naming rights & training kit. Based on the reported €70m, this is actually lower than the previous deals with Rakuten and Beko (though more than the 2021/22 extensions).

However, #FCBarcelona main strategy to “return to a sound financial footing earlier than expected” is to activate “economic levers”. Laporta said this would “bring us back into the black, pay off the debt and make the investments required for our teams to be more competitive”.

This sounds great, but what #FCBarcelona are really doing is selling off some “family silver” to generate short-term profits in order to meet the salary cap, but the price will be future “mortgage” payments (TV rights) or lower revenue (BLM – Barcelona Licensing & Merchandising).

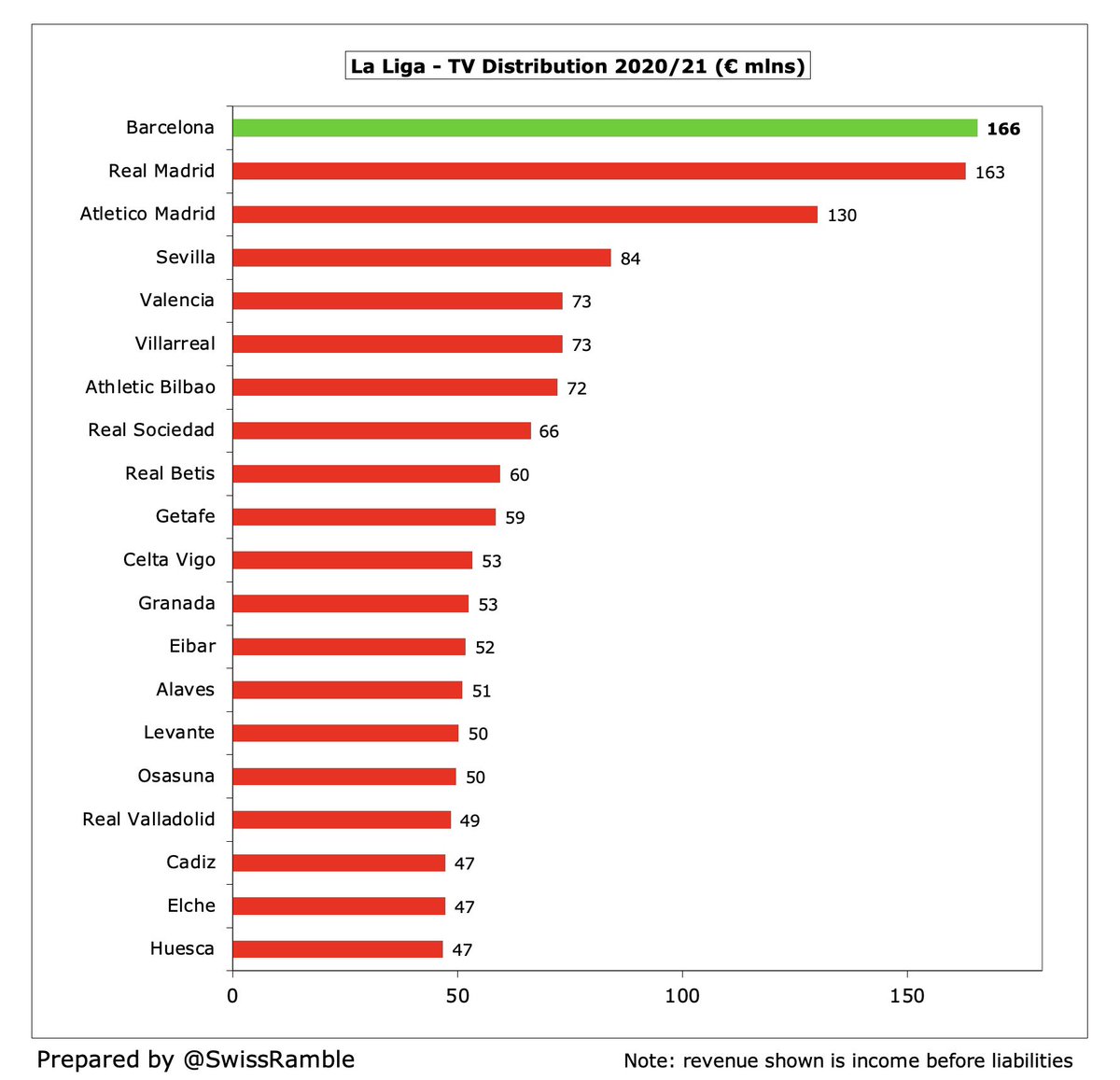

#FCBarcelona have sold 10% of their La Liga TV rights (excluding Champions League) for €207.5m to US investment firm Sixth Street for 25 years. Based on current €166m revenue, that would mean annual payment of €16.6m, so total payment of €414m, i.e. twice the money received.

#FCBarcelona want to sell a further 15% TV rights for €400m, which would generate the €600m required for transfer activity. Romeu said this deal was better than La Liga’s CVC agreement (8.2% over 50 years), as that had no buyback option & prevented the club joining a future ESL

In addition, #FCBarcelona might sell 49.9% of BLM, which they think could generate €200-300m. Romeu said that licensing & merchandising is a significant source of income with major potential, given the strength of the Barca brand, but needed collaboration with strong partners.

There is yet another hurdle for #FCBarcelona to clear, as members have recently approved the ‘Espai Barca’ project to remodel the Camp Nou stadium and develop the surrounding areas, which will require an additional €1.5 bln loan from Goldman Sachs on top of existing debt.

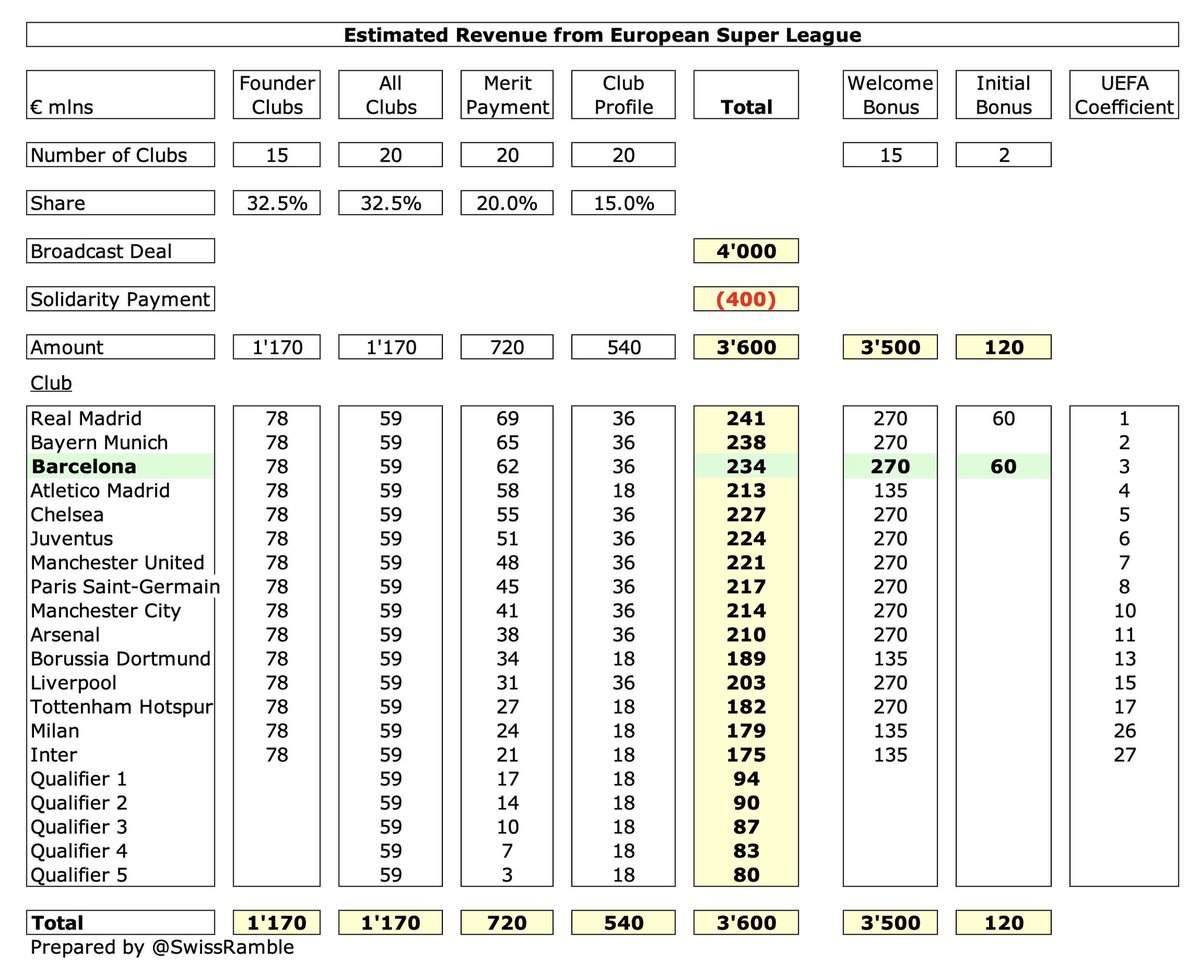

#FCBarcelona have not given up hope of being able to join a European Super League. Given their financial challenges, this is unsurprising, especially when looking at figures reported in the media, which included a €270m welcome bonus plus another €60m for Barca and Real Madrid.

As #FCBarcelona head coach Xavi said, “We have to strengthen to compete for all the trophies.” This requires new signings to help deliver success on the pitch and reverse the recent downward revenue trend, e.g. European TV money dropped from €118m to €69m since 2019.

While these machinations mean #FCBarcelona can probably meet La Liga’s salary cap and therefore sign the likes of Rapinha and Lewandowski, this strategy is clearly a gamble, essentially hoping that it will drive success on the pitch and generate more money in the future.

Even though Laporta claimed, “This will all take place under the criteria of financial sustainability and prudence”, it does feel like this approach of “short-term gain, long-term pain” means that #FCBarcelona have learned precious few lessons from the mistakes of the past.

• • •

Missing some Tweet in this thread? You can try to

force a refresh