Alert! Starting the #SuperHodl trial on @SovrynBTC for those with access to Zero!

Want to join the trial of #SuperHodl by manually doing all the work? You'll see it takes some clicks. Every day. But then, you may see how it works and appreciate it :)

A thread!

Want to join the trial of #SuperHodl by manually doing all the work? You'll see it takes some clicks. Every day. But then, you may see how it works and appreciate it :)

A thread!

Follow all steps in the thread below to start-up your line of credit, swap to XUSD, buy some #bitcoin and deposit XUSD to a lending pool for interest.

1) Go to live.sovryn.app/zero and login with your wallet (this example uses Metamask)

2) Click Open Line of Credit

2) Click Open Line of Credit

1) Add the amount of collateral you want to start with. Example of 0.08 RBTC is given.

2) Adjust the Borrow amount until the collateral ratio is 250%

3) Check that the collateral ratio is 250%

4) Click Confirm

2) Adjust the Borrow amount until the collateral ratio is 250%

3) Check that the collateral ratio is 250%

4) Click Confirm

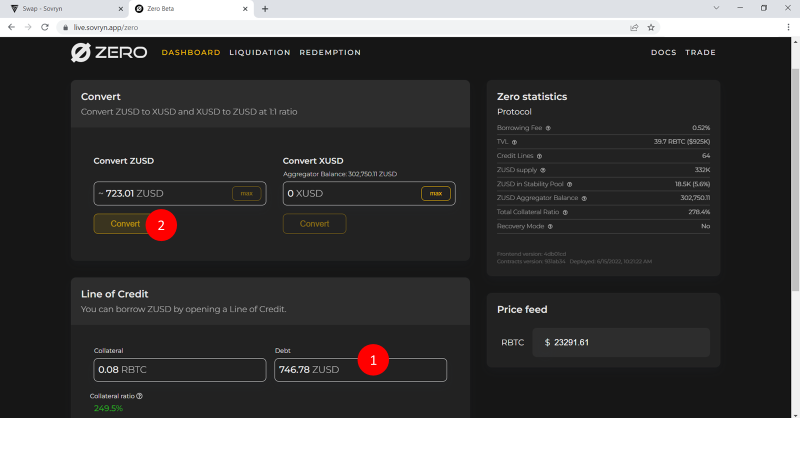

1) Check that the LoC (=Line of Credit) is opened. Note you have 23.78USD extra debt, due to the liquidation reserve (20 USD) and borrowing fee (0.52% in this case)

2) Convert the available ZUSD to XUSD by clicking Convert on the ZUSD side

2) Convert the available ZUSD to XUSD by clicking Convert on the ZUSD side

1) Sign the first transaction by clicking Confirm. Before it confirms, another one pops up.

2) Sign the second transaction by clicking Confirm.

2) Sign the second transaction by clicking Confirm.

1) Go to live.sovryn.app/swap

2) or live.sovryn.app and click Trade->Swap. Select the XUSD -> RBTC pair

3) Add 6.4% of your XUSD to the Trade Amount.

-> Why this amount? Because #SuperHodl Says So.

4) Click Advanced Settings

2) or live.sovryn.app and click Trade->Swap. Select the XUSD -> RBTC pair

3) Add 6.4% of your XUSD to the Trade Amount.

-> Why this amount? Because #SuperHodl Says So.

4) Click Advanced Settings

1) Make sure slippage is low by selecting near the minimum.

2) Close the Advanced Settings box by clicking the X.

2) Close the Advanced Settings box by clicking the X.

1) Sign the first transaction by clicking Confirm. Before it confirms, another one pops up.

2) Sign the second transaction by clicking Confirm.

2) Sign the second transaction by clicking Confirm.

You have completed your deposit. Note the amount in Your Deposit. Your reserve will now start accruing interest.

That's all, folks! Now you are all set to start following my steps, day by day. Check back tomorrow!

Note this is all on your own responsibility - Beta software, not financial advice, and all that. I'm just a Twitter pleb..

If you want to share, feel free to RT!

Just #HODL!

Note this is all on your own responsibility - Beta software, not financial advice, and all that. I'm just a Twitter pleb..

If you want to share, feel free to RT!

Just #HODL!

Please give me your feedback if this was a clear thread or can be improved?

Also please let me know if you're joining in on the fun, I could possibly keep a list and tag people so you all get a notification once the daily update is live.

(Target time: 23:30PM CET daily)

Also please let me know if you're joining in on the fun, I could possibly keep a list and tag people so you all get a notification once the daily update is live.

(Target time: 23:30PM CET daily)

Extra extra!

If you are new to this, find the tweet below as an intro / explainer to #superhodl.

Let me know if it would help to update this? Note the simulated data in there is outdated by now.

If you are new to this, find the tweet below as an intro / explainer to #superhodl.

Let me know if it would help to update this? Note the simulated data in there is outdated by now.

https://twitter.com/sovereignorigin/status/1496264167870840840?t=taQzoYhnQOi0gdA60EshFA&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh