The Panic of 1837: Why inflationary money and fractional reserve lending cause boom / bust cycles.

"History doesn't repeat, but it does rhyme."

@LawrenceLepard

A Thread 🧵

Also, #Bitcoin

"History doesn't repeat, but it does rhyme."

@LawrenceLepard

A Thread 🧵

Also, #Bitcoin

The Panic of 1837 was a financial crisis in the United States that touched off a major depression, which lasted until the mid-1840s. Profits, prices, and wages went down, westward expansion was stalled, unemployment went up, and pessimism abounded. Familiar yet?

The panic had both domestic and foreign origins. Speculative lending practices in the West, a sharp decline in cotton prices, a collapsing land bubble, international specie flows, and restrictive lending policies in Britain were all factors.

The run came to a head on May 10, 1837, when banks in New York City ran out of gold and silver. They suspended specie payments and would no longer redeem commercial paper in specie at full face value.

A significant economic collapse followed. Nearly half of all banks failed, businesses closed, prices declined, and there was mass unemployment.

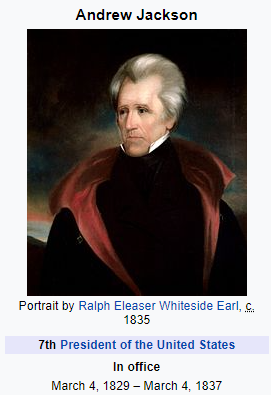

In the United States, there were several contributing factors. In July 1832, President Andrew Jackson vetoed the bill to recharter the Second Bank of the United States, the nation's central bank and fiscal agent.

As a result, state-chartered banks in the West and the South relaxed their lending standards by maintaining unsafe reserve ratios (fractional reserve lending). This lending fuelled a real estate boom until the introduction of the Specie Circular.

The Specie Circular of 1836 mandated that western lands could be purchased only with gold and silver coin. The circular was an executive order issued by Jackson and favored by Senator Thomas Hart Benton of Missouri and other hard-money advocates.

In Benton's view, fiat currency favored rich urban Easterners at the expense of the small farmers and tradespeople of the West. He proposed a law requiring payment for federal land in hard currency only, which was defeated in Congress but later became an executive order.

The sale of public lands increased five times between 1834 and 1836. Speculators paid for these purchases with depreciating paper money. A large portion of buyers used paper money from state banks not backed by hard money.

The devaluation of paper currency only increased with Jackson's proclamation. This sent inflation and prices upwards. Many at the time (and historians subsequently) blamed the Specie Circular for the rise in prices and the following Panic of 1837.

President Jackson believed that it had to be given enough time to work. Lobbying efforts, especially by bankers, increased in an attempt to revoke the Specie Circular.

Others, believed that Jackson's defeat of the Second Bank of the United States was directly responsible for the irresponsible creation of paper money by the state banks which had precipitated this crisis.

FIAT proponents and #MMT enthusiasts often use this example of why the #Gold Standard and Hard Money cause depressions. Hard money policies support a specie standard, usually gold or silver, typically implemented with representative money (ie paper notes/coinage)

But the Panic of 1837 was not an issue with Hard Money, but of fractional reserve banking. Where banks lend out more 'money' than they have based on typical borrowing and lending trends. This of course fails during a bank run as people attempt to redeem their paper money.

Because banks hold in reserve less than the amount of their deposit liabilities, and because the deposit liabilities are considered money in their own right, fractional-reserve banking permits the money supply

to grow beyond the amount of the underlying base money originally created by the central bank. In exceptional situations, the central bank may provide funds to cover the short-term shortfall as lender of last resort (sound familiar?)

Falling off a Hard Money standard allowed the banks to fractionally lend money that fuelled the speculation of land. The Specie Circular caused a land value crash because there wasn't enough Hard Money (ie gold/silver) to cover the fractional reserves lent to speculators.

Unfortunately the banking lobby eventually won. The Hard Money standard fell by the wayside and inflationary currency backed by nothing continues to fuel boom & bust cycles.

Bitcoin solves some problems for the modern age. Introducing a non-state controlled, circular, deflationary currency is important. But where there is greed there will always be misallocations of capital. We don't have all the answers, but at least we have a sound foundation.

For reference to our current monetary crisis, after the Panic of 1837 real consumption increased by 21 percent and real gross national product increased by 16 percent, but real investment fell by 23 percent and the money supply shrank by 34 percent

Note: I am neither an economist, nor a historian. But I like to read and research. Hope you enjoyed a little History lesson as well. I apologise for any mistakes ahead of time.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh