Here’s your complete guide to...🧵

TRADING using MULTIPLE TIMEFRAMES (MTF) 📈

Most of the successful traders use MTF & just by knowing what’s happening in different TFs you increase your chances of winning.

Ok, so how can one use MTF to trade?

Let’s go...

👍Like & 🔁Retweet

TRADING using MULTIPLE TIMEFRAMES (MTF) 📈

Most of the successful traders use MTF & just by knowing what’s happening in different TFs you increase your chances of winning.

Ok, so how can one use MTF to trade?

Let’s go...

👍Like & 🔁Retweet

Rule 1⃣: Define your Trading/Investing Style

You can be a

➡️ Long term investor

➡️ Positional trader

➡️ Swing trader

➡️ Intraday trader

Let's take the example of a Positional trader for this 🧵

You can be a

➡️ Long term investor

➡️ Positional trader

➡️ Swing trader

➡️ Intraday trader

Let's take the example of a Positional trader for this 🧵

Rule 2⃣: Identify the LONG TERM TREND on Monthly charts!

The long term chart helps you identify the long term trend & pivotal points in trend changes

In the below #NEULAND chart, you can see the stock has been in a long term uptrend since 2001.

The long term chart helps you identify the long term trend & pivotal points in trend changes

In the below #NEULAND chart, you can see the stock has been in a long term uptrend since 2001.

Rule3⃣: Wait for a BUY SIGNAL on the Weekly chart!

In this chart once you get a buy signal on CCI and RS, take a look at the chart and you will observe the change in trend and breakout.

Now you know this is probably a resumption of the long term trend that started in 2001.

In this chart once you get a buy signal on CCI and RS, take a look at the chart and you will observe the change in trend and breakout.

Now you know this is probably a resumption of the long term trend that started in 2001.

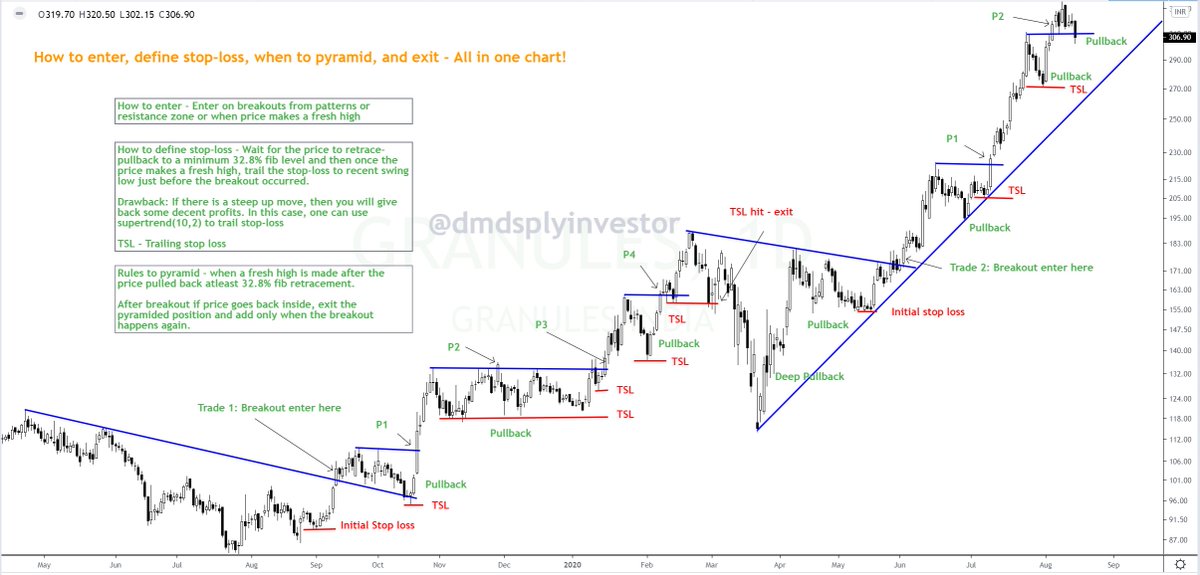

Rule 4⃣: Now it is time to hit that 'BUY' button.

But how to IDENTIFY THE ENTRY POINT?

Switch to the 'Daily' chart & buy either on

➡️Retest of breakout zone

➡️Or on the breakout after a short consolidation after 3-5 days

But how to IDENTIFY THE ENTRY POINT?

Switch to the 'Daily' chart & buy either on

➡️Retest of breakout zone

➡️Or on the breakout after a short consolidation after 3-5 days

But, wait... Are you a swing trader? 🤔

Don't worry, here is a what u should probably follow!

➡️W chart - Trend

➡️D chart - Scan

➡️4/1 hr chart - Buy

This is how you use 3 Timeframes (M/W/D) to identify the Major trend, pin down on a stock & also buy at the right entry point.

Don't worry, here is a what u should probably follow!

➡️W chart - Trend

➡️D chart - Scan

➡️4/1 hr chart - Buy

This is how you use 3 Timeframes (M/W/D) to identify the Major trend, pin down on a stock & also buy at the right entry point.

Rule 5⃣: If you loved this simple MTF strategy don't forget to...

👍Like & 🔁Retweet

And, don't forget to follow my handle 👇twitter.com/dmdsplyinvestor

I share insights like these on my #Youtube channel and a trade idea every week!

Subscribe now👇

👍Like & 🔁Retweet

And, don't forget to follow my handle 👇twitter.com/dmdsplyinvestor

I share insights like these on my #Youtube channel and a trade idea every week!

Subscribe now👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh