Week 12 of our "What is Series"🧑🎓

What is a DAO???🤔

A #DAO or a Decentralized autonomous organization is governed by code to ensure it's transparent, democratic and not influenced by a central entity.

So how do they work???

What is a DAO???🤔

A #DAO or a Decentralized autonomous organization is governed by code to ensure it's transparent, democratic and not influenced by a central entity.

So how do they work???

DAOs are created using smart contracts, allowing members to vote on initiatives by simply owning tokens of the DAO.

As a result, decisions can be implemented from the ground up, making all transactions transparent and secure once it's broadcast to the blockchain.

As a result, decisions can be implemented from the ground up, making all transactions transparent and secure once it's broadcast to the blockchain.

So why use a #DAO?

1. Decentralization- Collective decision making

2. Participation - Anyone can join or create proposals

3. Publicity- All votes and transactions are public

4. Community- Working together for a common goal

1. Decentralization- Collective decision making

2. Participation - Anyone can join or create proposals

3. Publicity- All votes and transactions are public

4. Community- Working together for a common goal

Use cases

Each DAO was created with their own goals/objectives in mind. It can be anything from deciding trading fees for @Uniswap, simply trying to buy the constitution with @ConstitutionDAO or simply giving out FREE PIZZA with @Pizza_DAO.

The possibilities are endless.

Each DAO was created with their own goals/objectives in mind. It can be anything from deciding trading fees for @Uniswap, simply trying to buy the constitution with @ConstitutionDAO or simply giving out FREE PIZZA with @Pizza_DAO.

The possibilities are endless.

Exploits

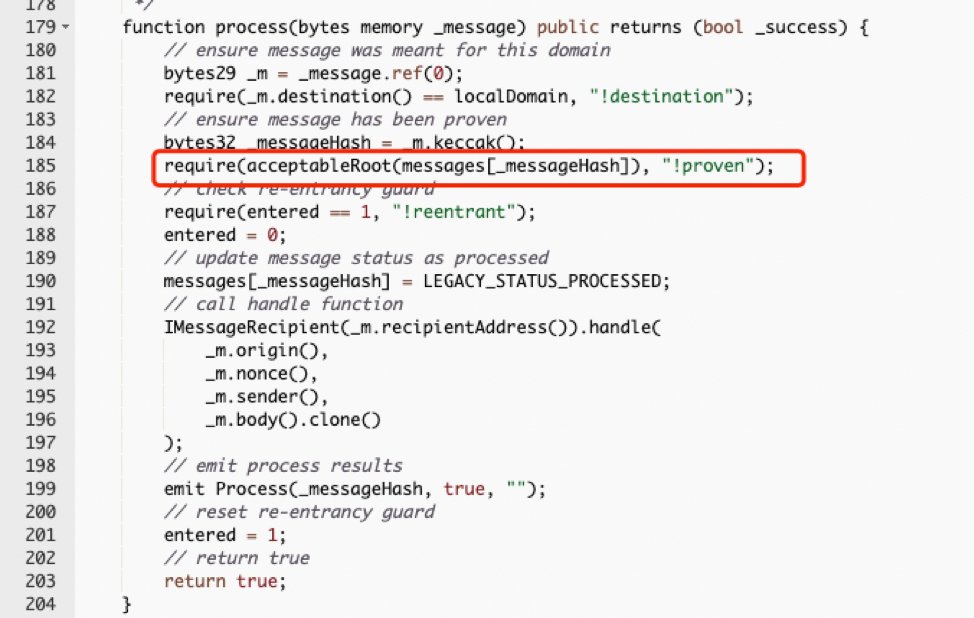

DAOs can also be exploited since they’re created using smart contracts. The DAO had an exploit in it's code that lead to the #Ethereum blockchain being forked.

Although incidents like this can't be completely eliminated, they can be greatly reduced with audits.

DAOs can also be exploited since they’re created using smart contracts. The DAO had an exploit in it's code that lead to the #Ethereum blockchain being forked.

Although incidents like this can't be completely eliminated, they can be greatly reduced with audits.

To learn more about our audits, check out: slowmist.com

Follow us next week in our “What is Series” as we go over what is a #rugpull and how to spot them.

Follow us next week in our “What is Series” as we go over what is a #rugpull and how to spot them.

• • •

Missing some Tweet in this thread? You can try to

force a refresh