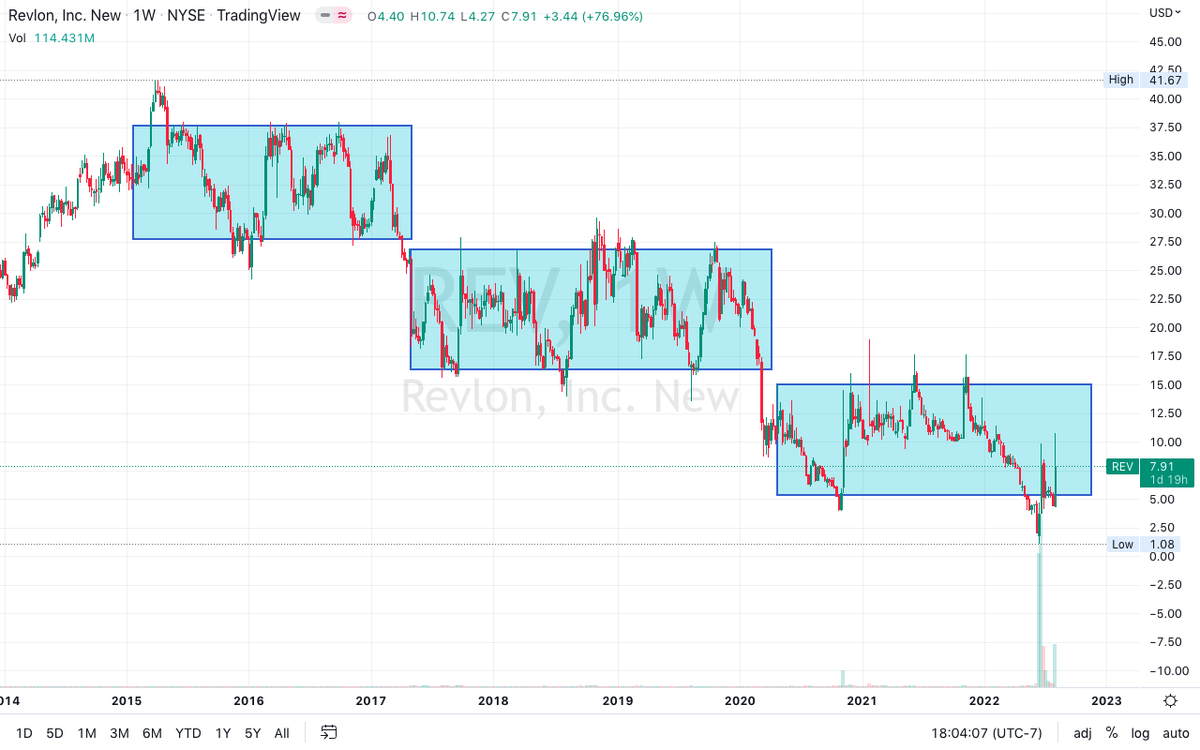

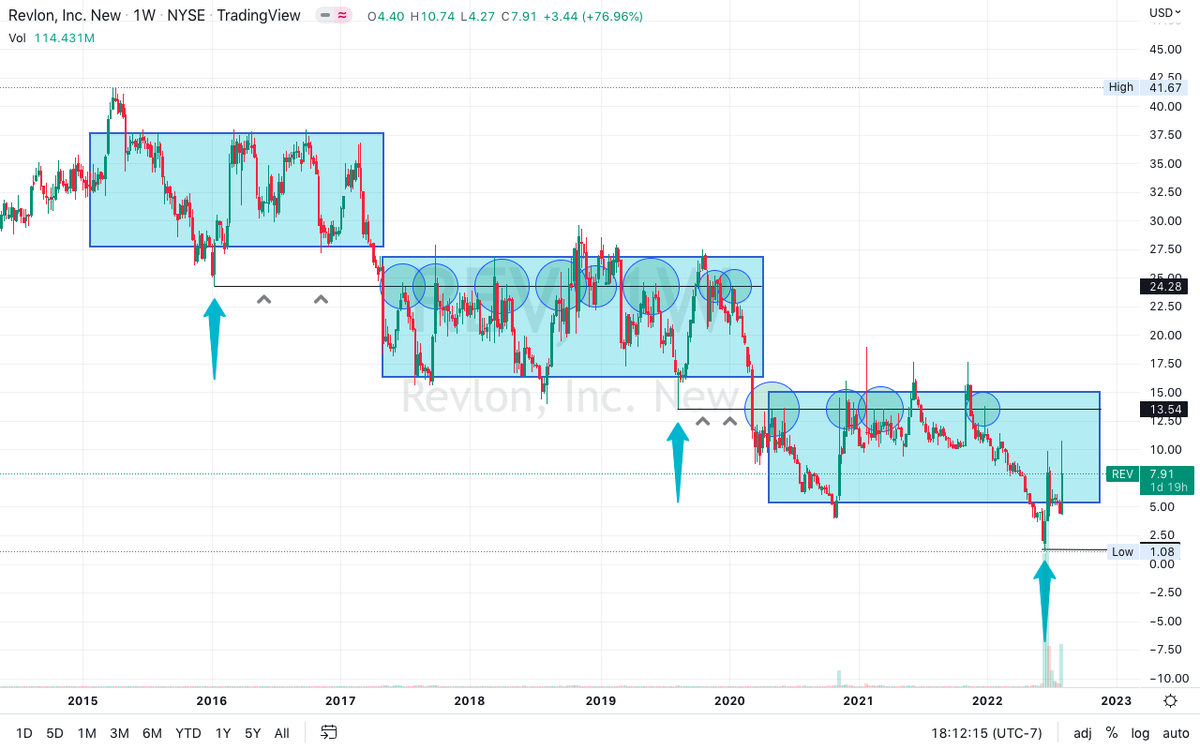

$REV-Continuation PT 2: the #bullflag we mentioned in yesterdays TA looks to be playing nicely. We would need to break through the daily SMA200 and confirm support to move to the upside... cont

$REV-Continuation PT 3: I expect a continuation down to the 0.618 #fibonacci ratio ($7.05) to bounce passed the 0.786 ($8.68) to continue onto the 1 fib ($10.75). Confirming support at the $10.75 level can take us to interesting levels... cont

$REV-Continuation PT 4: There is massive confluence @ the 1.618 Golden ratio ($14.65). In order for me to show you exactly how that ratio can be met we'd have to change the perspective of the weekly capitulation phases... Cont

$REV-Continuation PT 5: In reviewing yesterdays analysis i came across a MASSIVE descending channel. The top of this channel is confluent with the 1.618 golden ratio. Due to this find, i decided to also measure the top of our current capitulation phase... cont

$REV-Continuation PT 6: To my surprise, our current iteration also has a top of the $14.65 #fib ratio and the descending channel. We can see that #rev has the power to rally to the top of these channels based on previous price action.... cont

$REV-Continuation PT 7: A reasonable mount of time to realize this channel top would be by October 3rd, 2022. The charts are suggesting a future possible rally. Any negative catalyst can change this outlook and have us realize our third capitulation phase... cont

$REV-Continuation PT 8: Although the phases suggest continuation down, the phases are also based on weekly candles, meaning there is still time to rally before a massive sell off. Please keep in mind that nothing is certain. I'm bullish btw. Thank you as always

-ArcaB

-ArcaB

@Dozer8210 @Kazi5isAlive i have a new outlook for you to review. I may have missed this last night but we caught it now.

• • •

Missing some Tweet in this thread? You can try to

force a refresh