@ArmitageJim @premnsikka 1/ David Ames, patriarch of the Ames clan was convicted of #fraud on Wednesday i.r.o. the infamous £226m ‘#HarlequinProperty’ Caribbean property scam, peddled through @TheFCA’s SIPPshittery & @TPRgovuk’s pension liberation scams (ftadviser.com/regulation/202…).

2/ A hotspot of Harlequin Property scam peddling was the #LCF crews manor, with #LCF’s Spencer Golding’s alleged boiler room including a major Harlequin op (

https://twitter.com/ianbeckett/status/1265949914443415558AND

https://twitter.com/ianbeckett/status/1117915108137562115) + was allegedly linked to #LCF crew-mate & ICAEW man …

3/ Michael Peacock (

https://twitter.com/ianbeckett/status/1121070560451149824AND

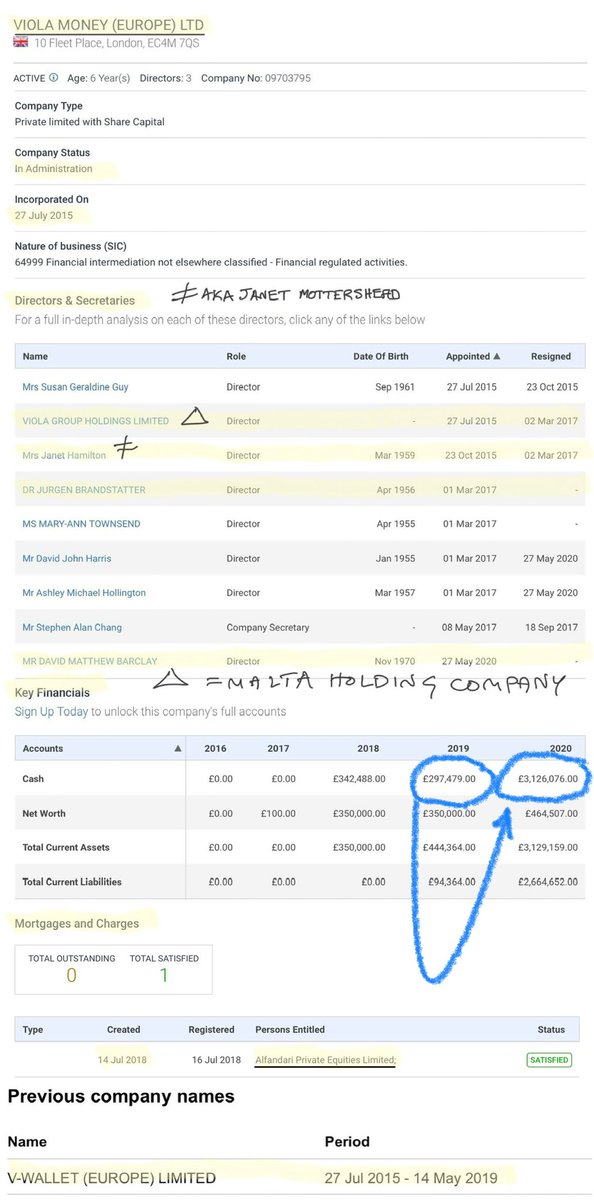

https://twitter.com/ianbeckett/status/1299824696540700673). A long term associate of Spencer Golding was #LCF/#MJSCapital’s (+ Masonic mover & shaker) John Russell-Murphy “JRM”. When Spencer Golding’s alleged boiler room was reportedly credit-card blacklisted …

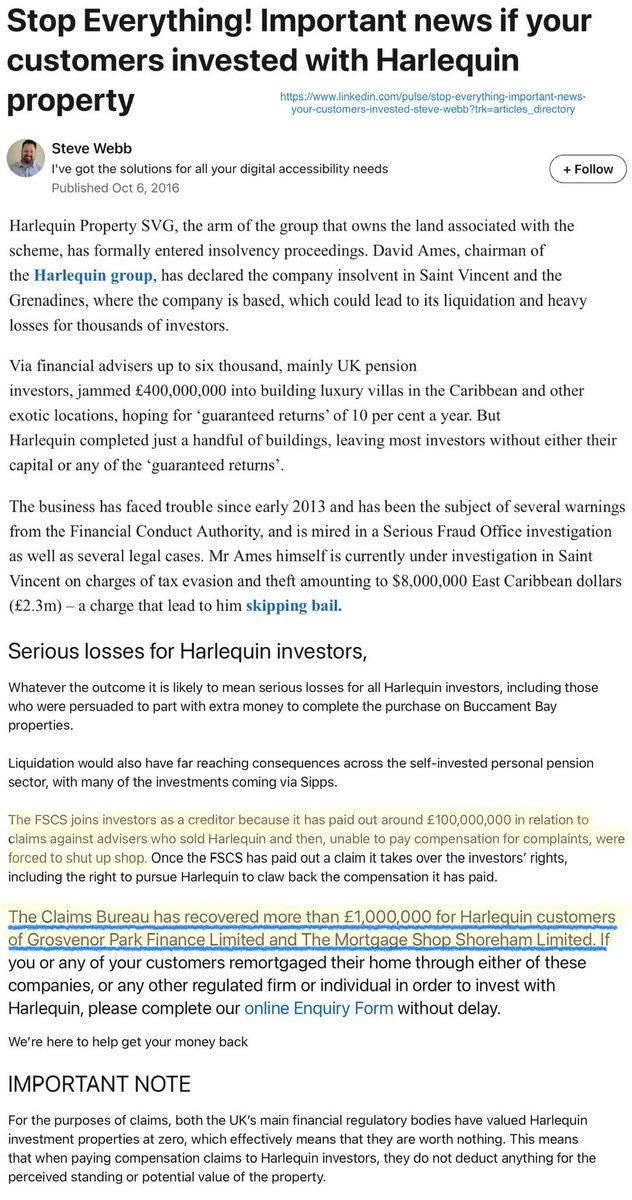

4/, JRM’s op #GPI reportedly fronted as credit-card merchant (incl. Lakeview op 1st item around - timeshare buy bait, offplan property sting). The Lakeview op was respun multiple times by the #LCF crew during the LCF scandal including as a ‘borrower’ + #Cherish/#LibertySIPP op.

https://twitter.com/ianbeckett/status/1354106734227427329

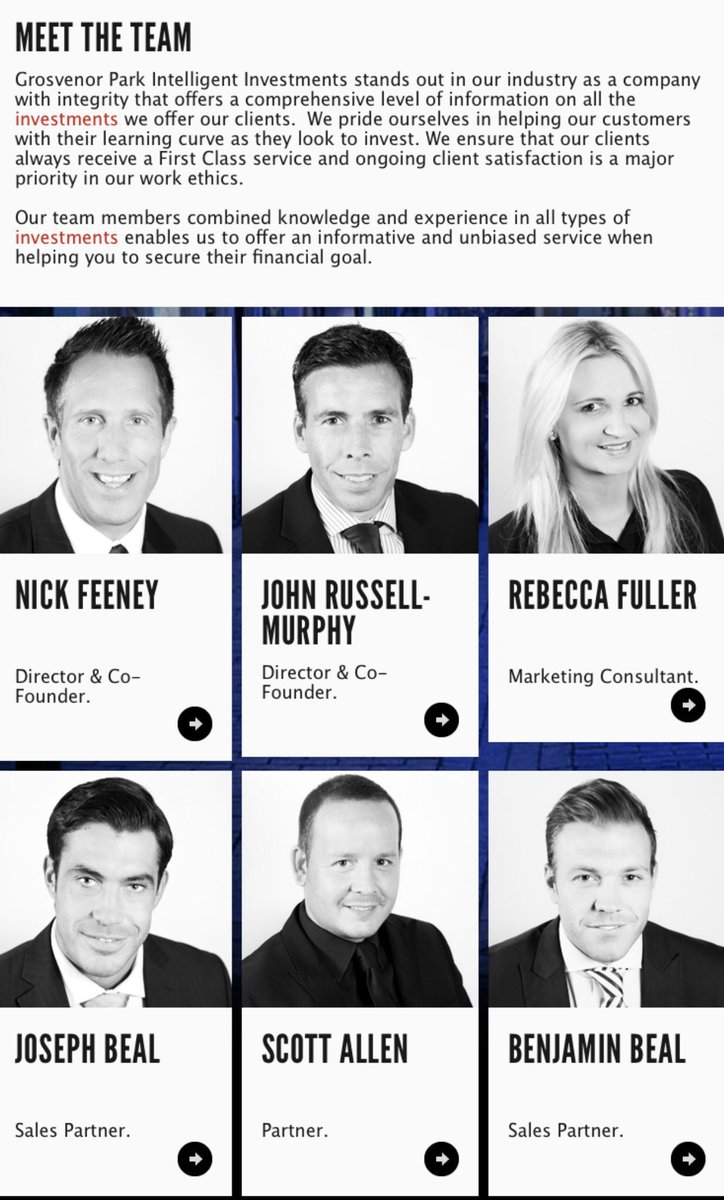

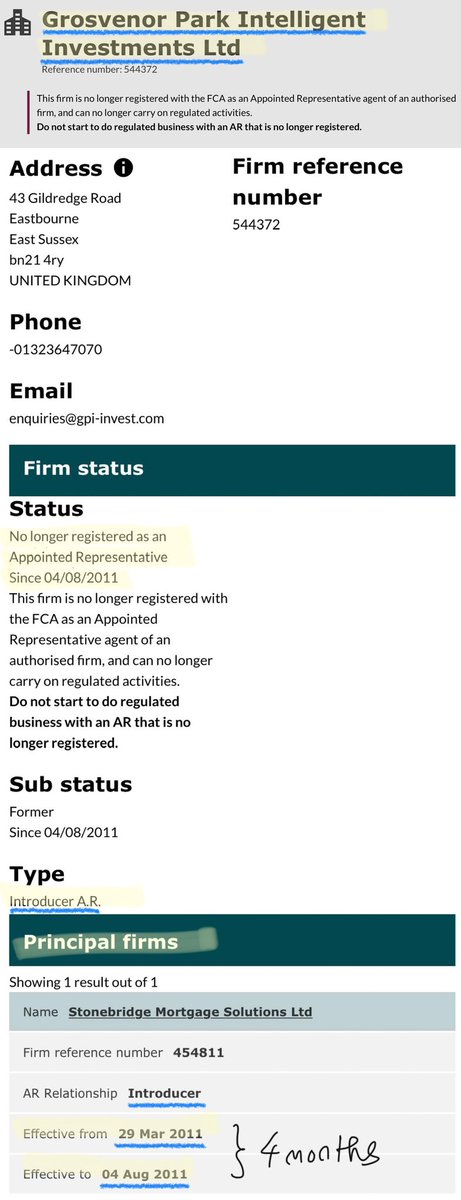

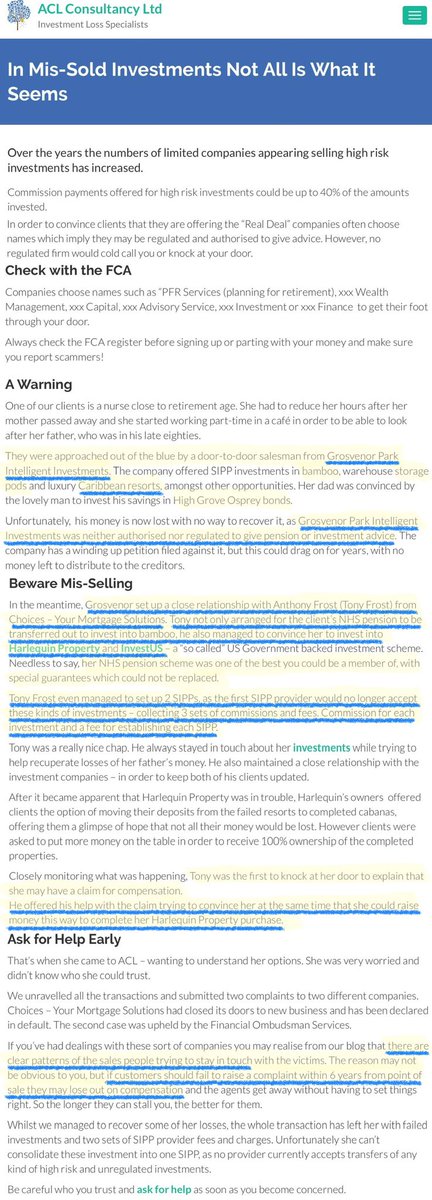

5/ JRM’s ops included the notorious & mostly unregulated: Grosvenor Park Intelligent Investments Ltd (#GPII). #GPII allegedly peddled toxic SIPPshit including unsurprisingly Harlequin Property (

https://twitter.com/ianbeckett/status/1229183514316242945). Saddled up alongside JRM as a director of GPII was …

6/ sometime FCA IFA (via the FCA’s ‘regulatory cat-flap’ - A.R.) Nicholas Feeney: with a penchant for Porsches & ‘loose women’ (

https://twitter.com/ianbeckett/status/1229193177703292935). Authorised (via the FCA’s ‘regulatory cat-flap’ - A.R.) with Nicholas Feeney was another of their Harlequin peddling ops …

7/ (Grosvenor Park Finance Ltd - “GPF”), both authorised by FCA IFA ‘Mortgage Shop (Shoreham) Ltd’, shut down by court order in 2011. FCA CMC ‘The Claims Bureau’ purportedly “recovered more than £1m for Harlequin customers of Grosvenor Park Finance + The Mortgage Shop Shoreham”.

8/ As always, @FSCS/victims picked up the tab. Meanwhile, in Friday’s Times the Feeneys waxed lyrically about their new trans-Atlantic ‘self-help’ business - much like Nicholas Feeney waxed lyrically about ‘Harlequin Property’ in yet another Feeney/JRM Harlequin double act -

9/ Grosvenor Park International Ltd (#GPI), the same SPV the Mail reported fronting as credit card merchant for Spencer Golding’s alleged boiler room op. As Mortgage Shop (Shoreham) Ltd was shut down, so too was GPF/Nicholas Feeney’s ‘regulatory catflap’. Replacing them - …

10/ sometime FCA IFA (via the FCA’s ‘regulatory catflap’ - A.R.): #LCF/#MJSCapital’s Joanne Baldock (T/A GPF) saddled up at GPF (

https://twitter.com/ianbeckett/status/1229197223898079233). Joanne Baldock later saddled up with #LCF’s Simon Hume-Kendall, LCF’s Robert Sedgwick (with @sra_solicitors super-powers) …

11/ & the infamous #SterlingMortimer duo Bowman & Clink (

https://twitter.com/ianbeckett/status/1124083305933148160- no strangers to @UKSFO) to pony up a respin of the Lakeview asset as a fractional timeshare op (

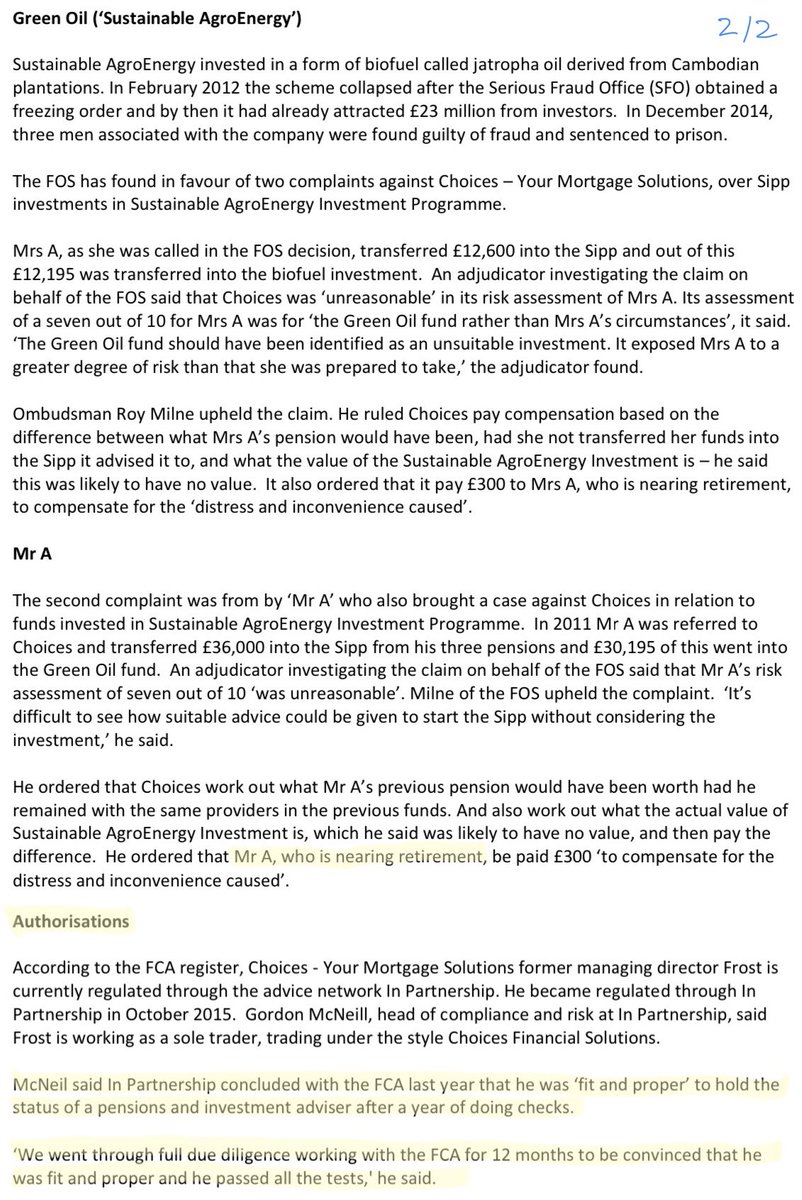

https://twitter.com/ianbeckett/status/1229205757238874119). Everyday was a party day though at chez JRM’s ‘masonic mansion’.

12/ Partying hard with the Baldocks & Russell-Murphys was long time JRM associate ‘Damian Paul Scott’, who unsurprisingly ran an unregulated op ‘Scott’s Wealth Management’ peddling SIPPshit - which unsurprisingly included ‘Harlequin Property’ (

https://twitter.com/ianbeckett/status/1229209271704920064).

13/ JRM, however, was far from a one-trick pony, having other tame FCA IFAs ‘to hand’ to facilitate pension transfers, including the seemingly bulletproof & still today FCA made man:FCA IFA Antony “Tony” Frost, authorised via the FCA’s ‘regulatory catflap’ (A.R.) at the same …

14/ principal as Joanne Baldock. The JRM & ‘Grosvenor Motley Crew’/Tony Frost double act’s (incl. Harlequin) M.O. was documented in an all too familiar sad tale from the FCA’s SIPPshittery. As is de rigueur, when the claims came in, Tony Frost pulled the plug, …

15/ leaving @theFSCS/victims to pick up his tab. Tony Frost’s op ‘Choices - Your Mortgage Solutions Ltd’, used the FCA’s ‘trade-name switcheroo’, trading as ‘MDJ Financial Services’. MDJ Financial Services Ltd was part of a web of unregulated/regulated ops run nearby by …

16/ purportedly some kind of accountants: the ‘Jenkins bros’, David Jenkins being allegedly a long time associate of JRM. The ‘Jenkins bros’ were auth. via the FCA’s ‘regulatory catflap’ (A.R.) + ran ‘MDJ Financial Services’ (auth. via the FCA’s ‘regulatory catflap’ - A.R.) + …

17/ ‘MDJ Services’. David Jenkins also concurrently owned an unregulated op allegedly peddling SIPPshit: ‘Contrast Investments’, which unsurprisingly was a major peddler of ‘Harlequin Property’. Pride of place on their website though went to a carbon credit scam: #IndustryRe, …

https://twitter.com/ianbeckett/status/1229197550000967680

18/ which allegedly partnered with ‘Celestial Green Ventures’, whose ops & spawn were linked variously to JRM & Motley Crew (note correction to tweet 39), JRM’s associates, David Jenkins + #LCF borrower board-member & former PWC man: Mike Starkie.

https://twitter.com/ianbeckett/status/1229200872749633536

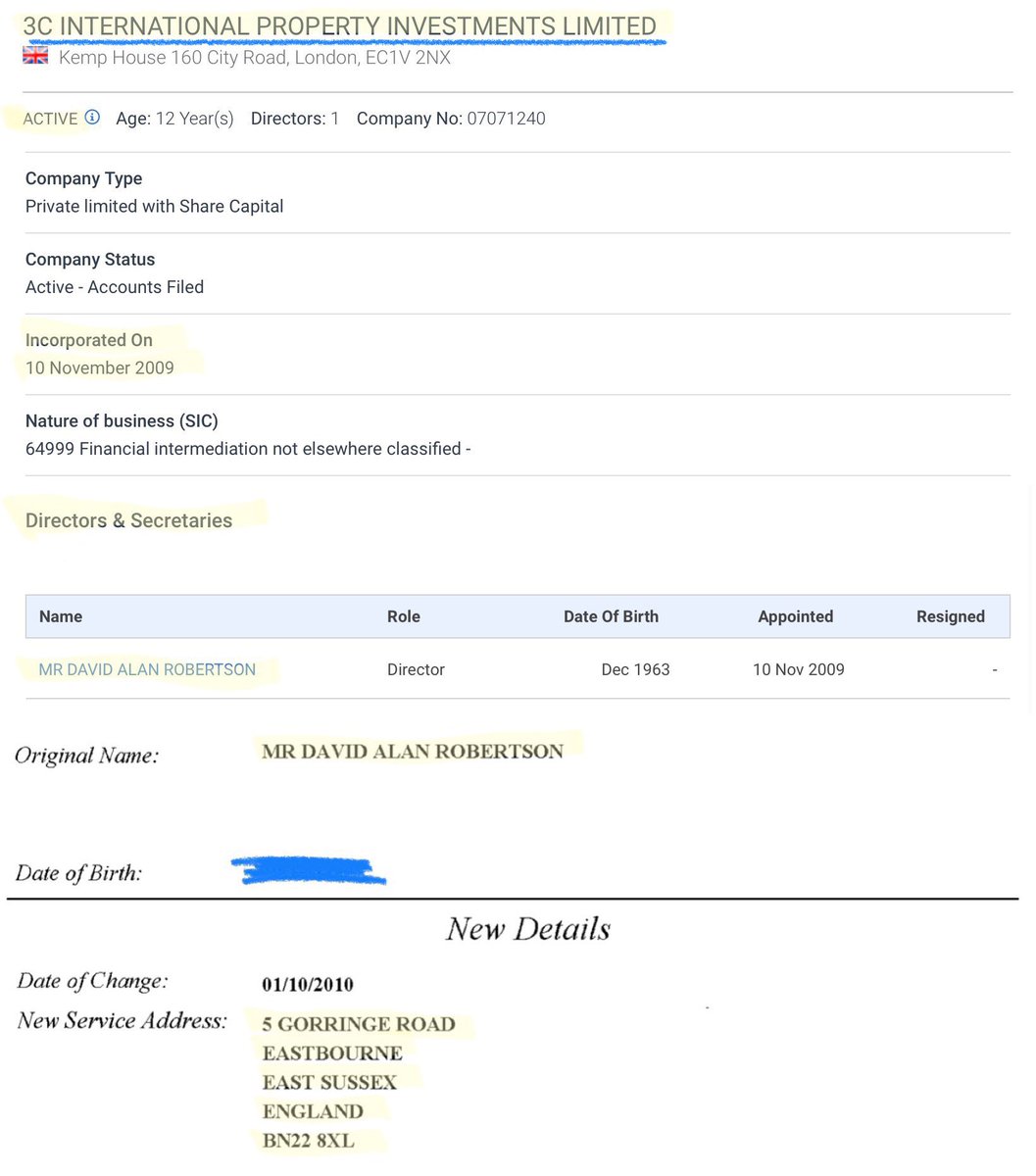

19/ Back to David Jenkins’ MDJ Service’s crib, where in addition to Contrast Investments another alleged Harlequin Property peddler had its registered office: ‘Buy Overseas’. From the LCF crews manor & allegedly peddling Harlequin Property was ‘3C International property Inv’: …

20/ it’s honcho David Robertson, a familiar face as a partner of the FCA’s golden couple ‘the Barrett-Treens’ (with a ‘long history’, including as an agent for the notorious #SustainableAgroEnergy scam - widely peddled in the #LCF crews manor). Colin Barrett-Treen was …

https://twitter.com/ianbeckett/status/1163230806413889536

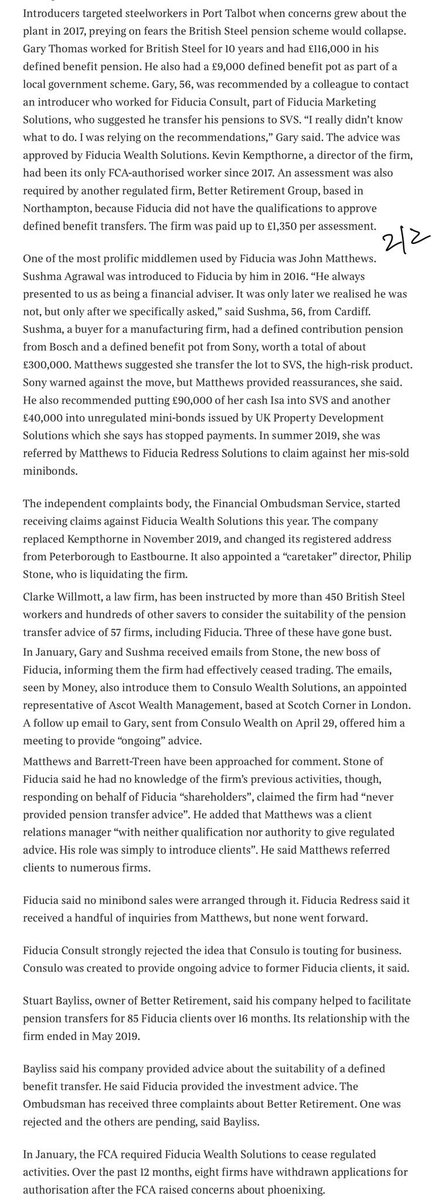

21/ last seen ‘in action’ in the #BritishSteel pensions scandal. Back to JRM & the Grosvenor Motley Crew: Scott Allen later saddled up alongside Joanne Baldock in #LCF, his M.O. laid bare in a LCF scandal victims description of her plight. The Beal bros have a ‘long history’ …

22/ , earlier this year it was handbags at dawn in the High Court as Benjamin Beal & ‘Captain Careless & his Scroogle crew’ (aka #Surge) squared up over who got the boiler-room level sales commissions on the #LCF (+ other) mini-bonds peddled online. Benjamin Beale’s roots …

23/ however, allegedly go back to allegedly another member of the Harlequin creditor list: the unregulated op ‘Intelligent Investment’ (

https://twitter.com/ianbeckett/status/1229163383439732736) whose toxic wares peddled unsurprisingly allegedly included Harlequin Property.

24/ Saddled up at ‘Intelligent Investment’ was sometime FCA IFA (via the FCA’s ‘regulatory catflap’ - A.R.) Sasan ‘Sas’ Parsad, last spotted in a senior IT contract position at RSA’s enormous pensions data-centre (notorious for unencrypted ‘data loss’ & ICO fines).

https://twitter.com/ianbeckett/status/1229167187459530752

25/ Also saddled up at ‘Intelligent Investment’ was US national ‘Glen Glagow’, formerly of another notorious local member of the Harlequin Property creditor list: ‘Axis Property Investment’. Which just leaves ‘Intelligent Partnership’ (the subject of a future expose), …

https://twitter.com/ianbeckett/status/1229170083613872139

26/ which intriguingly reportedly traded as ‘Intelligent Investment’. One of the founders of ‘Intelligent Partnership’ together with the ‘Cherish Chums’ (from the FCA’s uber notorious ‘Solihull Cesspit’) & a couple of ex bankers setup ‘Project Kudos’/Cayman Islands …

https://twitter.com/ianbeckett/status/1229173767471017986

27/ based ‘Hypa Asset Management’, whose offshore wares ‘packaged’ & peddled to the UK included a #LCF ‘Lakeview op’ bond - ‘Lakeview UK Investments PLC’ (the subject of a future expose). Back to where we started & the Ames Clan - the apple never falls far from the tree.

28/ The scion of the Ames clan, ‘Matthew Ames’ went on to reportedly be jailed in 2014 for carrying out a £1.6m carbon credit/forestry ponzi scam (#ForestryForLife). If the blind eyed financial regulator (FCA/FSA) had taken Harlequin’s creditor list, even in 2013 (when …

https://twitter.com/ianbeckett/status/1234483284907876352

29/ Harlequin called in the ‘mysterious world of corporate insolvency’) + shut-down all the nefarious unregulated ops & their secret webs of FCA IFA’s, they would have saved tens if not hundreds of thousands of future victims & £bs in future @FSCS compensation/victims losses.

30/ To make matters worse, the High Court were told a typical bumbling tale of the FCA (‘Harlequin’ was authorised via the FCA’s ‘regulatory catflap’ for several months, so required the FCA’s permission for administration) - clearly asleep at the wheel.

31/31 Background: (

https://twitter.com/ianbeckett/status/1229162663336402947). As always, the blind eyed financial regulator (@theFCA) & its defunct predecessor (#FSA) didn’t see a thing, hear a thing or do much about anything at all.

• • •

Missing some Tweet in this thread? You can try to

force a refresh