How #Crypto will unlock $100B+ of value in mortgage-backed securities

BEWARE: A very boring🧵ahead (Nerds only!)👇

BEWARE: A very boring🧵ahead (Nerds only!)👇

Here we dig in to a #Crypto use case written by @humancapitol provided by @packyM

https://twitter.com/packyM/status/1556627307858624513?s=20&t=SxLBPCziJBDrRRdgMMBi4w

This can be applied to any asset that gets securitized, so lets start with the basics of what this means:

Securitization = pooling assets so they can be repackaged into interest-bearing securities

i.e mortgages, cars, or other loans

There is a MAJOR problem

Securitization = pooling assets so they can be repackaged into interest-bearing securities

i.e mortgages, cars, or other loans

There is a MAJOR problem

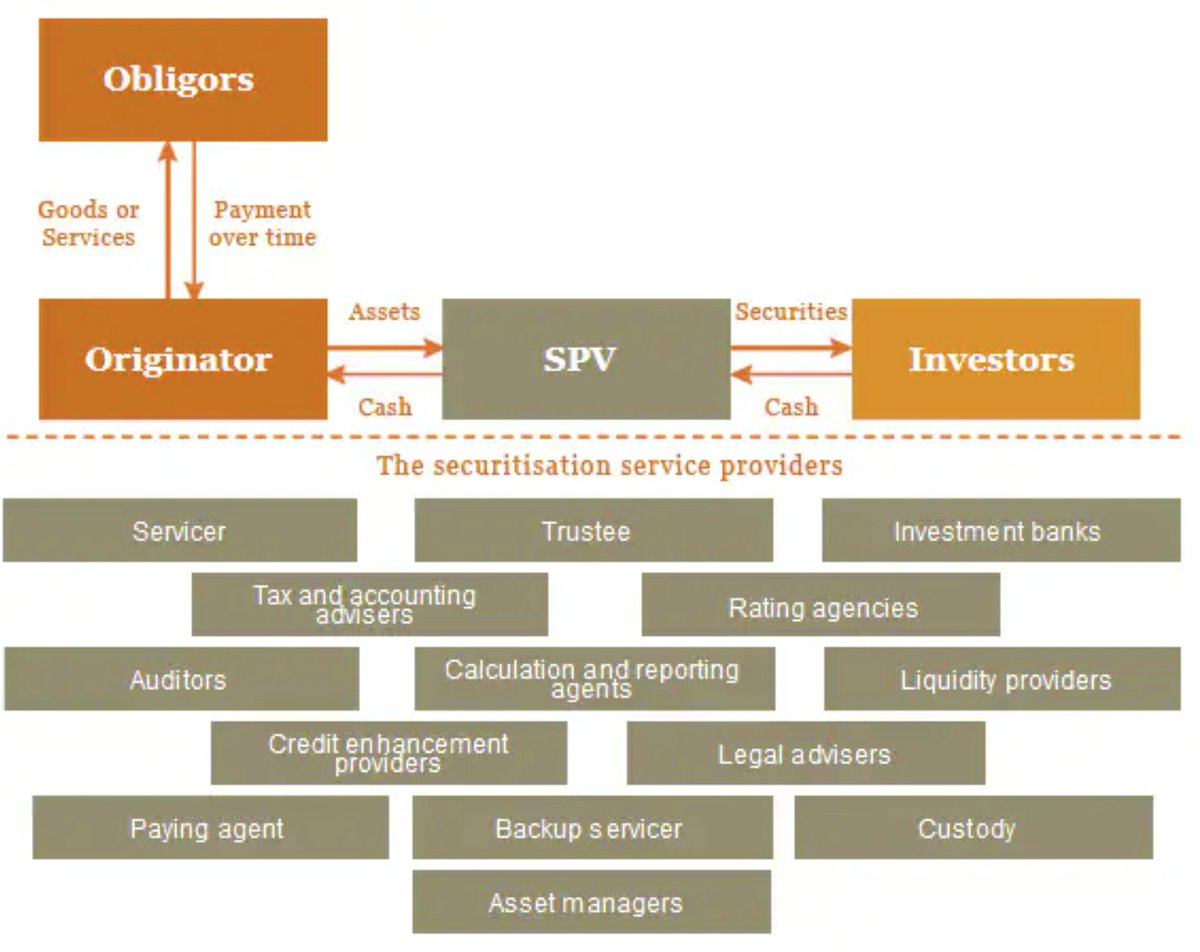

There are up to 14 middlemen in the process of securitization, that all need a cut

@PwC gives a great visual

@PwC gives a great visual

This can add up to 1% over the life of the security

Take the 14 TRILLION dollar securitization market and that accounts for $140B or...

$5,000 savings PER YEAR for a family with a $500,000 mortgage

Not to mention the fees associated with obtaining a mortgage

Take the 14 TRILLION dollar securitization market and that accounts for $140B or...

$5,000 savings PER YEAR for a family with a $500,000 mortgage

Not to mention the fees associated with obtaining a mortgage

Blockchain enables a cheaper cost of capital though efficiencies and removing friction / middlemen

How does this actually work?

Lets start with how a mortgage payment gets into the hands of an investor today

👇

How does this actually work?

Lets start with how a mortgage payment gets into the hands of an investor today

👇

Payment processing

• Borrower sends $$ to originator

• Servicer remits payment

• Agent tracks loan performance

• Agent calculates amount to send

• Agent wires $$ to tranche

• Clearing system sends $$ to broker

• Broker pays investors

• Auditors review

• Borrower sends $$ to originator

• Servicer remits payment

• Agent tracks loan performance

• Agent calculates amount to send

• Agent wires $$ to tranche

• Clearing system sends $$ to broker

• Broker pays investors

• Auditors review

Now with a smart contract implementation:

• Borrower sends $$ to originator

• $$ converts to stablecoin

• Program tracks performance

• Program distributes payments

Why do we need a blockchain?

• Borrower sends $$ to originator

• $$ converts to stablecoin

• Program tracks performance

• Program distributes payments

Why do we need a blockchain?

1) Interoperability -- Our existing infrastructure comprises to siloed databases -- terms, credit profiles, and collateral information are not standardized

Middlemen need to find and read the data to ensure different systems can communicate

Middlemen need to find and read the data to ensure different systems can communicate

2) Liquidity -- The blockchain increases transparency -- loan terms and performance are readily available to investors with greater granularity

Remember the housing crisis? Firms packaged loans into tranches that reduced transparency

Transparency⬆️ Investors⬆️ Liquidity⬆️

Remember the housing crisis? Firms packaged loans into tranches that reduced transparency

Transparency⬆️ Investors⬆️ Liquidity⬆️

3) Auditability -- When transactions take place, they are timestamped and immutable

Repayments and terms are automatically tracked

If a borrower misses a payment, the smart contract can automatically send a notice

Repayments and terms are automatically tracked

If a borrower misses a payment, the smart contract can automatically send a notice

We are seeing the early stages of this happening already

@CoreVestFinance recently announced it was using @liquidmortgage for a $313M securitization for a single family renter loan

Investors can view loan repayment data daily instead of every 6 weeks

@CoreVestFinance recently announced it was using @liquidmortgage for a $313M securitization for a single family renter loan

Investors can view loan repayment data daily instead of every 6 weeks

Each loan is represented as a digital asset sitting in a wallet

As loans get repaid, the balance in the wallet reduces

The loan document is logged on-chain with a hash so it doesn't release private data

As loans get repaid, the balance in the wallet reduces

The loan document is logged on-chain with a hash so it doesn't release private data

Investors only need to do diligence on loan origination

It removes the need for diligence when the loan changes hands

They are automating the process one step at a time!

It removes the need for diligence when the loan changes hands

They are automating the process one step at a time!

Another company, @centrifuge, is experimenting with real world asset loans on chain

An asset holder can lock an #NFT into the system that represents a real world asset

Financing amounts are determined by an on-chain pricing scorecard

Upon repayment, the NFT is unlocked

An asset holder can lock an #NFT into the system that represents a real world asset

Financing amounts are determined by an on-chain pricing scorecard

Upon repayment, the NFT is unlocked

This is a huge untapped #crpyto market that has potential to impact so many lives, getting cheaper access to capital. I am excited to see how this sector of crypto develops

I write about businesses building real use cases in #web3. Follow / RT for more!

I write about businesses building real use cases in #web3. Follow / RT for more!

https://twitter.com/MrCryptoXD/status/1555922194085150720?s=20&t=mXmjq3TKsZbpSyZRLEkuRw

• • •

Missing some Tweet in this thread? You can try to

force a refresh