This might give you a flavour of why I think continues to be a BEAR MARKET RALLY !!

https://twitter.com/SamanthaLaDuc/status/1555623518070530048

The Hulbert Nasdaq Newsletter Sentiment Index tracking the average recommended allocation to stocks by short-term market timers (Traders) is back to "extreme levels of bullish optimism." Some individual investors are even more bullish than that.' You think ONLY India has rallied?

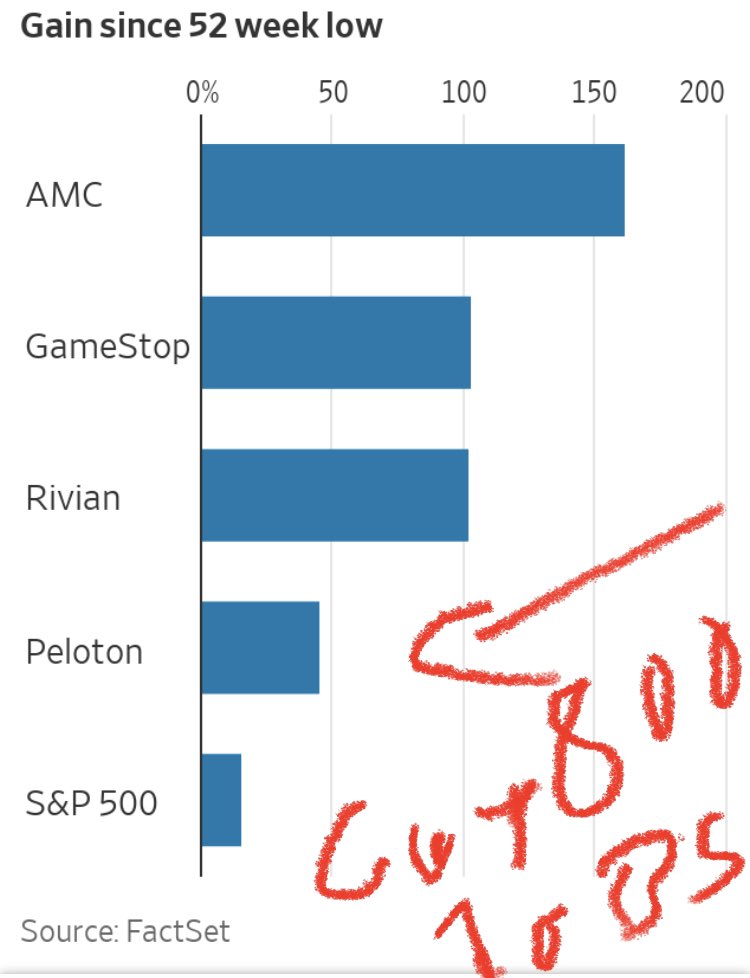

MORE PROOF of why this is a EXTREME SHORT COVERING bear mkt Rally....

JPM Strat:"the short covering has been the main driver of late & is now one of the most extreme in the past 5 years on a 20d basis (-3z). The covering has pushed net flows into more positive territory as well"

JPM Strat:"the short covering has been the main driver of late & is now one of the most extreme in the past 5 years on a 20d basis (-3z). The covering has pushed net flows into more positive territory as well"

I HONESTLY Felt that NIFTY would top out at 17400 levels.... Clearly I have been wrong on that due to the way shorts are still yet to fully cover in the US Market... there is tons of stream in the US market ... and they rally, so will India. Continue to say, its NOT FUNDAMENTALS

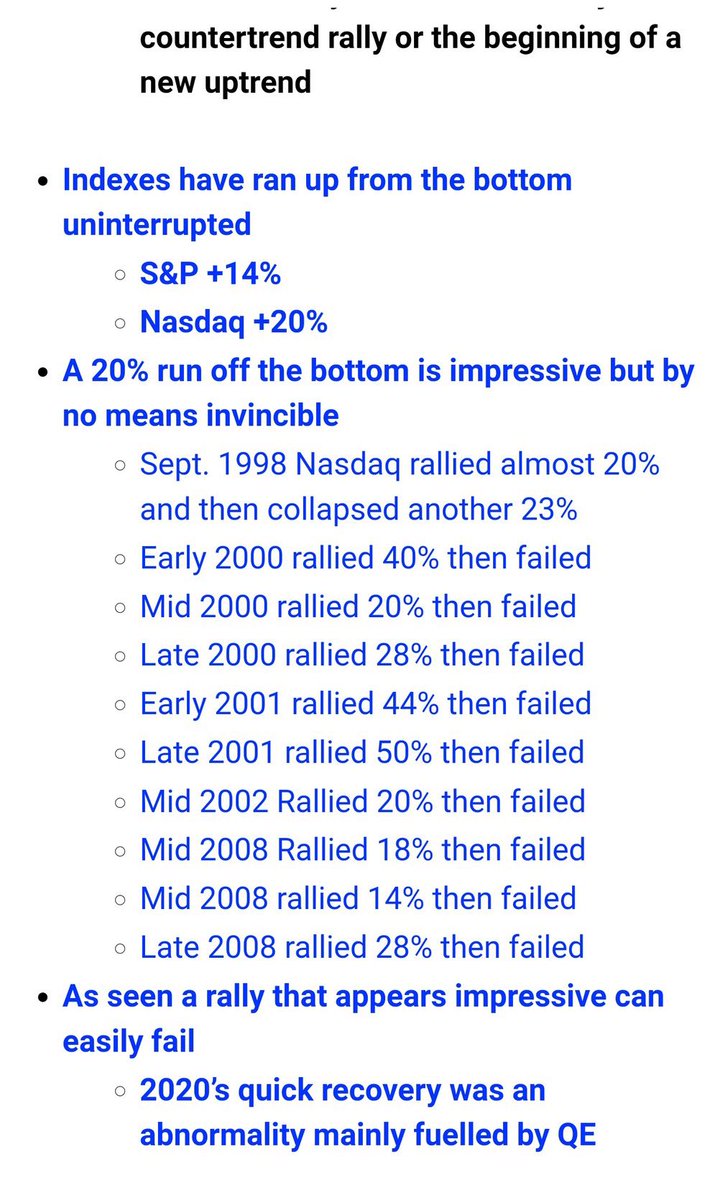

I find it STRANGE that people actually believe that this 20%+ Rally in the NIFTY50 is a BULL MARKET Start.... when they Admit that Earnings overall has been cut... And also BULL MARKET Rallys of 20% cant happen in 35-40 days..

#JustAsking How Come NONE of the BULLS are speaking about the INR rallying back to Rs75/$ ?

How about I lose 10% on the INR and Gain 15% on the market ? #JustSaying

How about I lose 10% on the INR and Gain 15% on the market ? #JustSaying

So here is something interesting by @MichaelJBurry__ on Bear Market Rally’s…

According to GS Prime, this rally has now become the 3rd biggest hedge fund short covering event in the last decade.

• • •

Missing some Tweet in this thread? You can try to

force a refresh