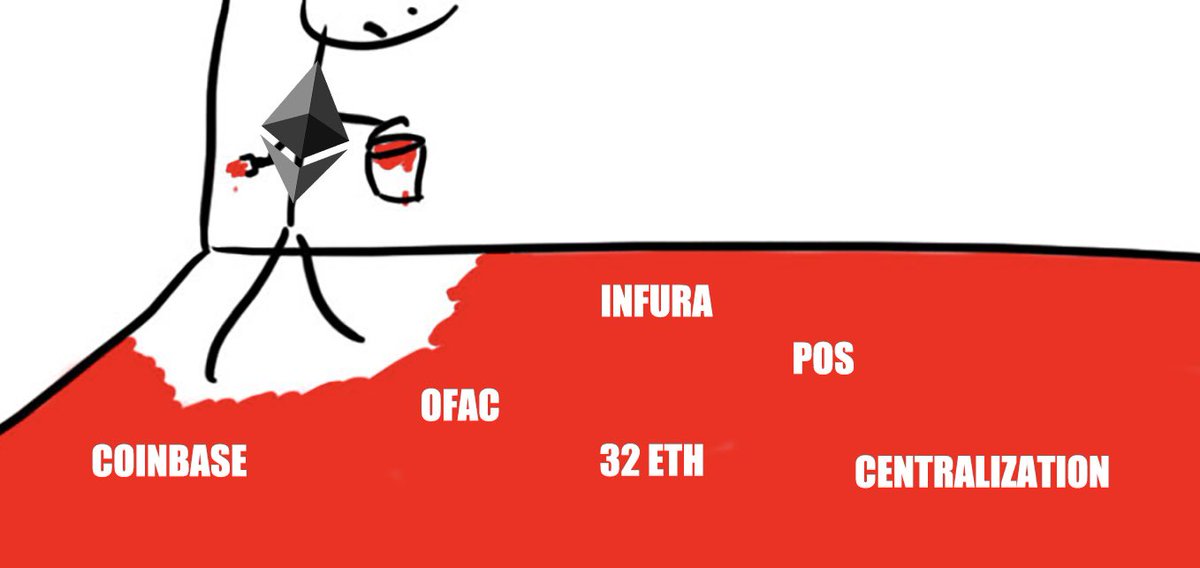

#Ethereum’s problems are caused by constantly optimizing for tokenomics over decentralization, security, and resilience. It looks like the Merge and POS will lead to complete regulatory capture by centralized exchanges & staking platforms, and there’s no way out for them. 🧵👇

So how did they get here? Deciding on a 32 ETH requirement to stake as part of the protocol (in order to lockup supply and maximize tokenomics). That pretty much made POS as centralized as possible, and plus they don’t have the #Bitcoin culture of not your keys, not your coins.

So now you have 66% of validators that need to adhere to OFAC regulations. And the ETH they have deposited to stake can’t be withdrawn because the withdraw functionality wasn’t coded - because tokenomics. 📈

But wait! Ethereans can just #UASF like those Bitcoin Maxi’s right? Like totally show Coinbase who’s the boss!

No. First, Ethereans don’t run their own nodes and second, most services depend on Infura, but that’s not the main problem.

I’ll preface this next part and state that arresting developers for writing code is horrible and sets a terrible precedent. That said…

To #UASF you need software to run. Now all Ethereum forks have cool city names like Istanbul, London, Berlin, etc. Let’s call this hypothetical Ethereum UASF fork “Pyongyang.” Pyongyang would prevent Coinbase and the 66% majority from censoring OFAC sanctioned transactions.

Another way of saying “prevent the censoring of OFAC sanctioned transactions” could be “helping evade sanctions.” Maybe we forgot about Virgil. So anyways, who is going to code Pyongyang up? The Tornado Cash guy was arrested so the Pyongyang devs will likely be arrested too.

Who’s going to run Pyongyang? The guys signaling with “X 🏴”? Are they going to link their Pyongyang node to their .eth account too? Coinbase, Kraken, Bitcoin Suisse, and the others making up the 66% majority are definitely not running Pyongyang.

Alright so an Ethereum #UASF is off the table.

“But we can just slash Coinbase and others if they dare comply!”

“But we can just slash Coinbase and others if they dare comply!”

I may be a Pathetic Bitcoin Maxi™ but I did spend 10 minutes researching and found there is no mechanic to slash Coinbase. There is no code to detect and punish anyone for censoring transactions. The Slashing mechanic only works to punish downtime or double-signing.

So we’re again back to needing the Pyongyang fork which no one will code up or run. Even if Pyongyang could exist, there’s no way for users to withdraw ETH. And even if they could withdraw, it doesn’t matter because only Infura matters.

Assuming all the stars magically aligned and there was a way for Ethereum users to slash Coinbase etc, what does that mean? It means the minority stakeholders would have a mechanism to arbitrarily punish the majority. That’s not going to work in the long run.

And this is why we call #Ethereum a #shitcoin. It’s an exercise in futility, riddled with atrocious design choices, and engineered for the sole purpose of pumping the token.

Have a nice day. 🦄

• • •

Missing some Tweet in this thread? You can try to

force a refresh