1/ The role of mark3t mak3rs:

Exchanges are like Ebay

A place where buyers & sellers can find each other

MMs “providing liquidity” just means they are the trader who is willing to take the other side of your trade

Sometime they’ll get too long or too...

Exchanges are like Ebay

A place where buyers & sellers can find each other

MMs “providing liquidity” just means they are the trader who is willing to take the other side of your trade

Sometime they’ll get too long or too...

2/ ...short a position and may choose to either cut their losses (which is rare) or simply park orders until they can find traders at the prices they’re looking for

So when you see shtdel has $65 billion in “assets sold not yet purchased”, it means they are...

So when you see shtdel has $65 billion in “assets sold not yet purchased”, it means they are...

3/ ...holding on to orders (internalizing them) until conditions come along that will allow them to make the profits off spreads that they want

Traditionally, there is risk for a mark3t mak3r in making markets. So what did the Shortseller Enrichment Commission do? Well...

Traditionally, there is risk for a mark3t mak3r in making markets. So what did the Shortseller Enrichment Commission do? Well...

4/ ...they created a number of loopholes within the rules & regulations that would all them to kick cans if they ever got in trouble on their positions, allowing them to coordinate with their institutional friends & use their big chip stack to push retail out 1 by 1 until...

5/ ...markets were moved to where they needed them to be to close out

Then came along the 4pes... Tutes had to take away the buy button bc the market got too far away from their position to withstand

It bought them time to where now their goal is to wait until you get tired...

Then came along the 4pes... Tutes had to take away the buy button bc the market got too far away from their position to withstand

It bought them time to where now their goal is to wait until you get tired...

6/ ...and leave your position, allowing them to get your shares & close out

While yes, SHFs are exposed, but shtdel gave melvin $2B, not bc they really like them, but bc if melvin went belly up, so would the MMs

Melvin “closing out” in June was a PR stunt to trick sentiment...

While yes, SHFs are exposed, but shtdel gave melvin $2B, not bc they really like them, but bc if melvin went belly up, so would the MMs

Melvin “closing out” in June was a PR stunt to trick sentiment...

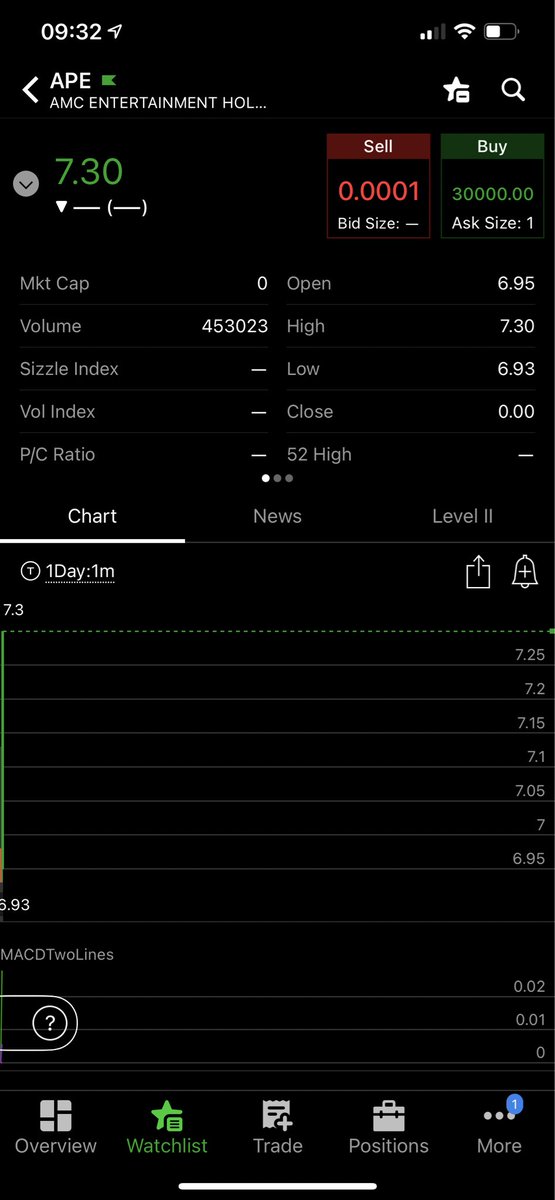

7/ We’re seeing ungodly amount of sp00fing and other forms of fr4ud happening everyday bc MMs got the green-light from the Shortseller Enrichment Commission to do what is necessary to try & fix this mess

However the clock has been running since Jan 2021 (which has definitely...

However the clock has been running since Jan 2021 (which has definitely...

8/ ...had a lot more time on it than anyone ever imagined) but its finite nonetheless

As long as we dont give up, we will eventually reach the finish line. Nobody knows when that’ll be, but it is inevitable @ the end of the day

Know your 3n3my

Know what you f1ght for

#amc #ape

As long as we dont give up, we will eventually reach the finish line. Nobody knows when that’ll be, but it is inevitable @ the end of the day

Know your 3n3my

Know what you f1ght for

#amc #ape

• • •

Missing some Tweet in this thread? You can try to

force a refresh