1- #ConnectingTheDots Lots of focus on what the Fed will do next, and whether inflation comes down

That is the WRONG debate

Yes, inflation has PEAKED. Yes, it will come DOWN

But why is the 10-Year is UP, despite declining inflation expectations?

That is the WRONG debate

Yes, inflation has PEAKED. Yes, it will come DOWN

But why is the 10-Year is UP, despite declining inflation expectations?

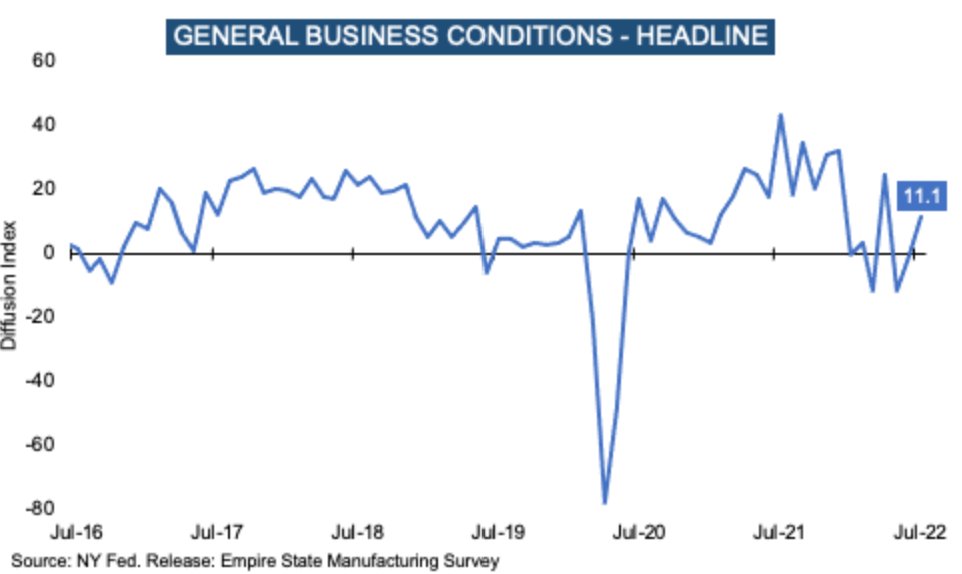

2- Industrial data is CRATERING - Yesterday's US Composite PMI at 45, fastest contraction in 13 years

Yet, COMMODITIES and OIL trend UP

If US PMIs are at 45 and Oil is at 95 $/bbl, where will Oil be when the cycle turns UP again?

Yet, COMMODITIES and OIL trend UP

If US PMIs are at 45 and Oil is at 95 $/bbl, where will Oil be when the cycle turns UP again?

3- Add to that a ballooning US deficit in years to come

Who's gonna BUY all those bonds issued to finance it?

Banks maxed out, China/Japan reduce, who's left?

Who's gonna BUY all those bonds issued to finance it?

Banks maxed out, China/Japan reduce, who's left?

4- Conclusion: The REAL debate is about the dramatic structural changes to the economy

They will still be there, whatever Powell says at JACKSON HOLE, and whether it's a 50 or 75bps hike next

End.

They will still be there, whatever Powell says at JACKSON HOLE, and whether it's a 50 or 75bps hike next

End.

• • •

Missing some Tweet in this thread? You can try to

force a refresh