1- #ConnectingTheDots Checking in on #Housing following recent data

Question 1: What will happen to HOUSE PRICES?

Let's keep things simple - there is a RECORD number of houses under construction...

Question 1: What will happen to HOUSE PRICES?

Let's keep things simple - there is a RECORD number of houses under construction...

5- CONCLUSION: Historically, overheated housing markets often balanced through long periods of FLAT PRICES (e.g. L.A. 1989-1997, Germany 1995-2005)

However, distortions in US housing market are so EXTREME that in my view price DECLINES are very likely

However, distortions in US housing market are so EXTREME that in my view price DECLINES are very likely

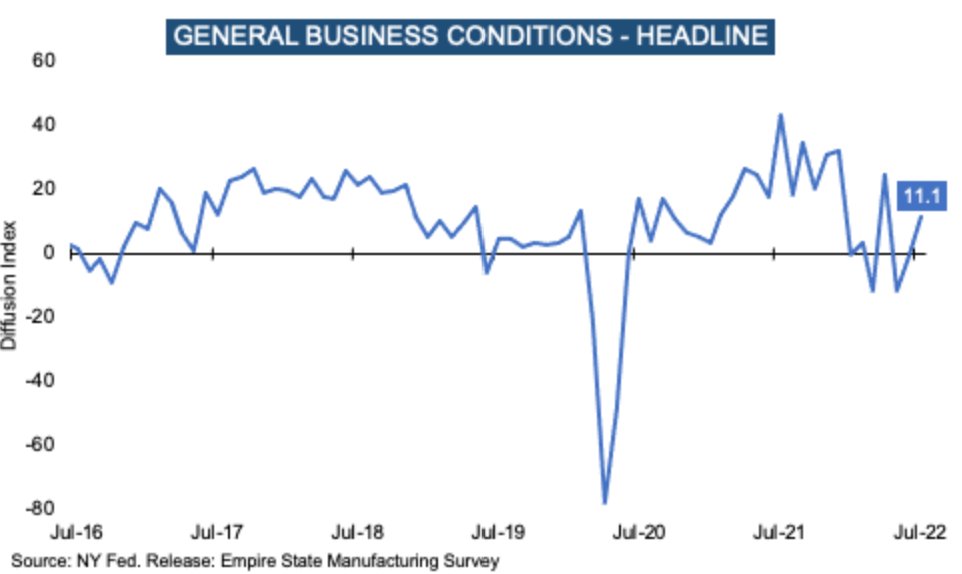

6. Question 2: What does a slowdown in #Housing mean for GDP GROWTH?

As a result of the huge delta in BID-ASK between buyers and sellers, home sales have COLLAPSED

As a result of the huge delta in BID-ASK between buyers and sellers, home sales have COLLAPSED

7- This will slow the sector tremendously. A return to the relative share of FIXED RESIDENTIAL INVESTMENT as % GDP to 2008/9 lows seems plausible = a ~1% drag on GDP from here

8- This is limited on its own, but causes a RIPPLE throughout the economy. Less #Housing = fewer paint jobs, less furniture, fewer Ford pickups etc. etc.

So the 1% drag will be AMPLIFIED. It won't be as bad though as 2008/9 (back then 3.5% GDP drag from #Housing alone!)

So the 1% drag will be AMPLIFIED. It won't be as bad though as 2008/9 (back then 3.5% GDP drag from #Housing alone!)

9- Finally, the last decade provided TAILWINDS from mortgages REFINANCES, as interest rates fell to ever lower levels. That is gone

9- CONCLUSION: The slowdown in #Housing likely creates a considerable drag on GDP growth. However, it will be nowhere near as bad as 2008/9

Historically, this slowing has taken 6-8 quarters to unfold. We are currently ~1 quarter in

End.

Historically, this slowing has taken 6-8 quarters to unfold. We are currently ~1 quarter in

End.

• • •

Missing some Tweet in this thread? You can try to

force a refresh