Following Bayern Munich’s imperious start to the season, on the back of 10 Bundesliga titles in a row, I thought it might be interesting to look at their finances, even though it’s been a while since they published their 2020/21 accounts #FCBayern

Despite the significant impact of COVID, #FCBayern “achieved sound financial results”, once again posting a pre-tax profit, though down from €17m to €5m (€2m after tax). Revenue (club definition) fell €54m (8%) from €698m to €644m, largely offset by €42m cut in expenses.

#FCBayern revenue hit by COVID driven reductions in match day, down €59m (83%) to €12m, and commercial, down €15m (4%) to €345m, while transfer income dropped €31m to €33m. Broadcasting rose €51m (25%) to €255m, mainly due to money deferred from extended 2019/20 season.

As a technical aside, #FCBayern definition of €644m revenue includes €33m income from player sales. If this is excluded, we get €611m operating revenue, which fell €23m (4%) from prior year’s €634m.

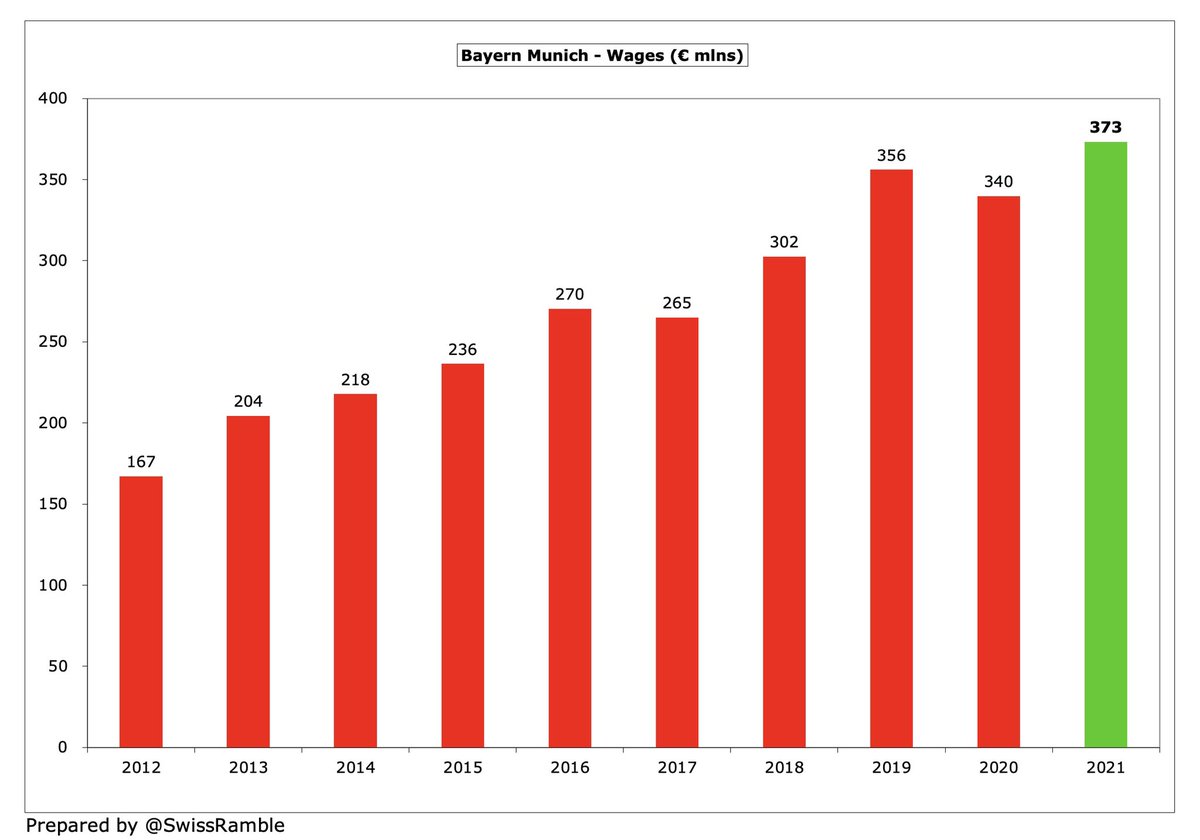

#FCBayern wage bill increased by €33m (10%) from €340m to €373m, while player amortisation also rose €7m (11%) to €69m. However, other expenses fell €82m (32%) to €172m, due to lower costs with games played behind closed doors, and depreciation was down €6m to €22m.

#FCBayern were one of only 3 clubs in the Bundesliga to post a profit in 2020/21, due to “sensible management and not spending more than we earn”, though their €5m was just below RB Leipzig’s €8m. Some clubs lost a huge amount of money, especially Hertha €78m and #BVB €73m.

Clearly COVID has had a significant detrimental effect on football club finances with #FCBayern CFO Jan-Christian Dreesen estimating the revenue loss as €155m, as games were played without fans in attendance, though this was partially offset by the lower cost of staging games.

#FCBayern €5m were one of a small number of European clubs that were profitable in 2020/21, along with #MCFC €6m and Real Madrid €2m. In stark contrast, other clubs had some staggering losses, including Juventus €208m, PSG €225m, Inter €239m and especially Barcelona €555m.

#FCBayern income from player sales almost halved, falling from €64m to €33m, mainly Thiago’s move to #LFC. This was partly due to the transfer market being depressed by COVID, though some clubs still made good money from player trading, e.g. Real Madrid €106m and #MCFC €77m.

Despite the decline in revenue as a result of the pandemic, #FCBayern “earned money in both years and that is a remarkable achievement”. In fact, the Bavarians have now been profitable for an amazing 29 years in a row, generating €241m pre-tax profit in the 4 years before COVID.

#FCBayern have become increasingly reliant on player trading. Although income fell to €33m in 2021, they earned an impressive €154m in the previous 2 years. Few big money sales in 2021/22 (Alaba left on a free), but this season was better, including Lewandowski to Real Madrid.

#FCBayern operating loss (excluding transfer income) narrowed from €50m to €25m, the smallest of clubs in Deloitte Money League. Most clubs lose money at this level, but some particularly large deficits in 2020/21, including Barcelona €509m, PSG €221m and Juventus €216m.

#FCBayern ongoing revenue has fallen by €49m (7%) in the last two years from the club’s €660m peak to €611m, due to the pandemic, which has reduced match day by €81m. The club definition of revenue, including transfer income, has dropped €107m (14%) in this period.

The revenue gap between #FCBayern and #BVB has narrowed in recent years, but was still as much as €274m in 2021 Put another way, Bayern’s €611m revenue was nearly 80% higher than Dortmund’s €338m, which is a huge difference between first and second ranked clubs in a country.

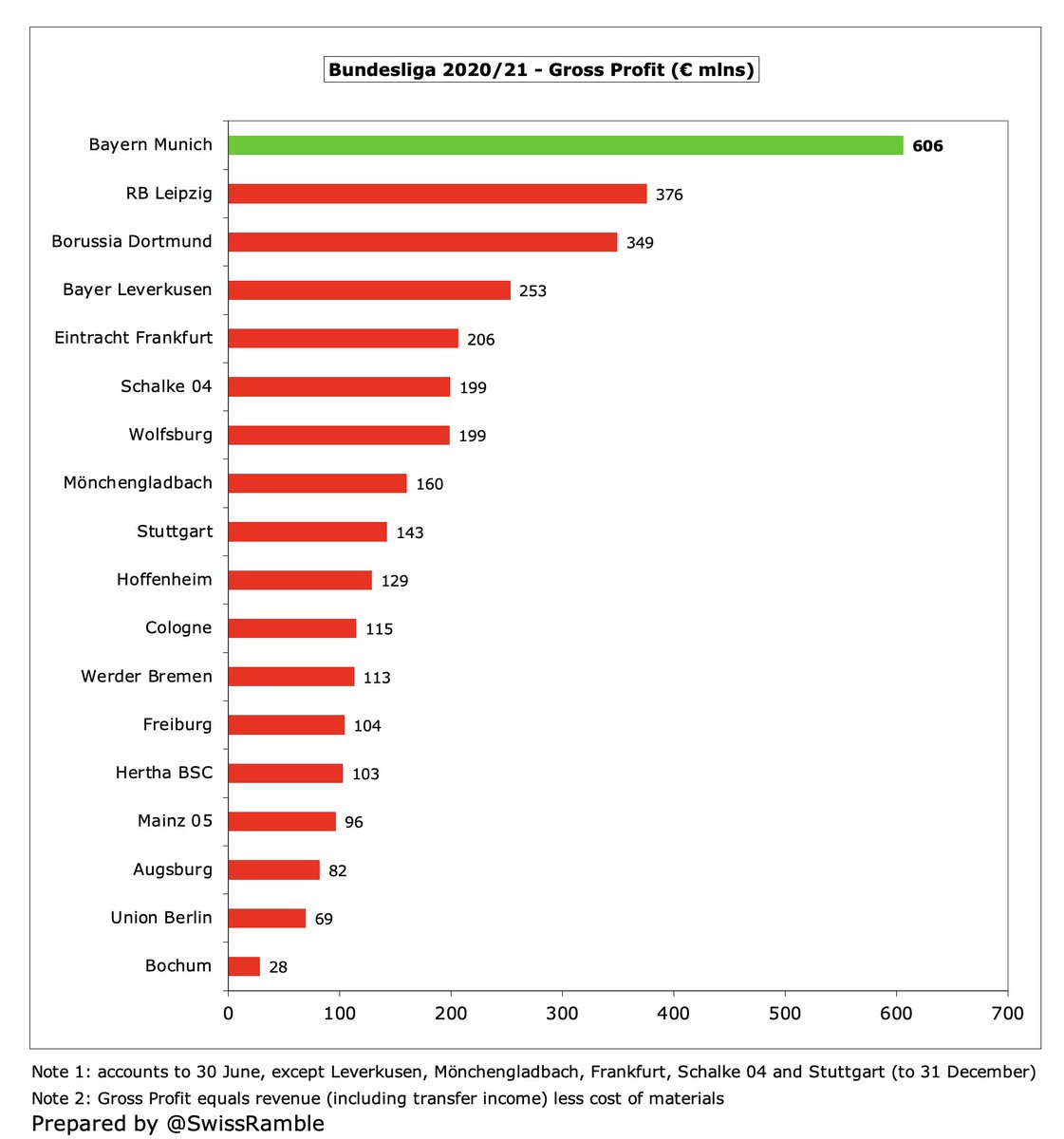

The Bundesliga releases figures for gross profit, which represents revenue (including transfer income) less cost of materials. This gives us some idea of the relative financial power of clubs with Bayern Munich leading the way €606m, far ahead of RB Leipzig €376m & #BVB €349m.

For the second year in a row #FCBayern retained 3rd place in the Deloitte Money League in 2021, with their €611m revenue only surpassed by #MCFC €645m and Real Madrid €641m. Only two other German clubs in the top 30: #BVB €338m and Borussia Mönchengladbach €178m.

However, it should be noted that German clubs were adversely impacted in 2020/21, as the Bundesliga completed its fixtures before the end of 2019/20, so all TV payments were booked in that season, while others (Premier League, Serie A & La Liga) deferred some revenue to 2020/21.

#FCBayern commercial income fell €15m (4%) from €360m to €345m, though the small decrease was a pretty good performance during the pandemic. In fact, this was the highest commercial revenue in Europe, ahead of PSG €337m, Real Madrid €322m and #MCFC €308m.

#FCBayern recently extended Deutsche Telekom shirt sponsorship to 2027, up from €45m to €50m. Similarly, Audi have renewed partnership to 2029 (€40m to €50m). Also have Adidas €60m kit deal to 2030, Qatar Airways sleeve sponsor €10m and Allianz stadium naming rights €6m.

#FCBayern broadcasting revenue rose €51m (25%) to €255m, a club record for this revenue stream, mainly from UEFA TV money, up €54m to €136m, due to income deferred for games played after 2019/20 accounting close. Still far below #MCFC €336m, due to low Bundesliga TV money.

Bundesliga TV money distribution uses 4 criteria: 5-year league performance ranking (70%); 5-year ranking for both divisions (23%); 20-year ranking (5%); and playing time of Germany U23s (2%). In 2020/21 #FCBayern received the highest in Germany with €105m, ahead of #BVB €95m.

The new Bundesliga domestic 4-year TV deal from 2021/22 will be 5% lower than current deal, though clubs said this represented a good outcome in the circumstances. Total €1.4 bln still third best in Europe, though a long way below Premier League €3.9 bln and La Liga €2.1 bln.

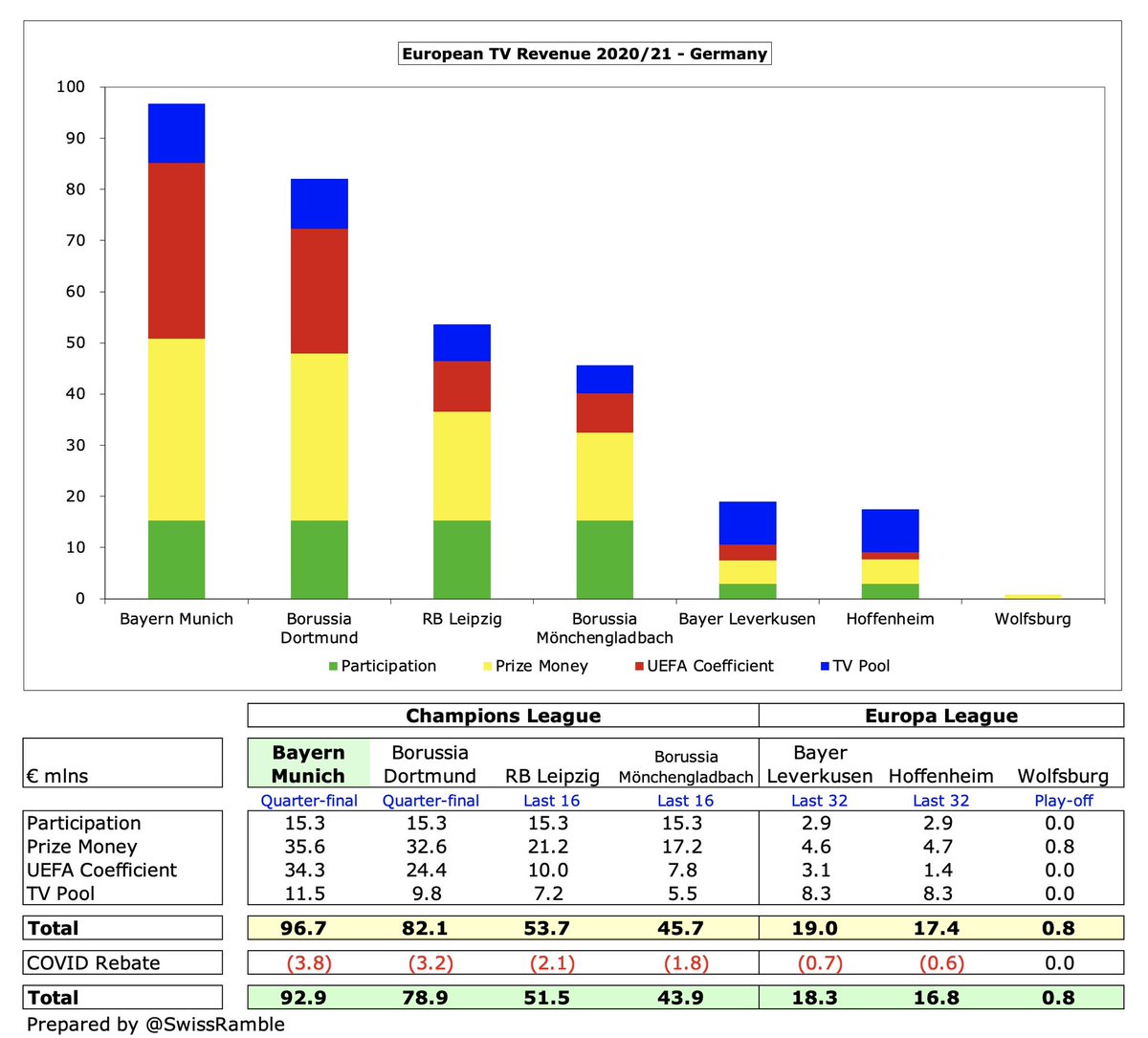

Before any revenue deferrals from 2019/20, #FCBayern earned €93m for reaching the Champions League quarter-finals, down from prior year’s €125m, when they beat PSG in the final to win the competition. Ahead of #BVB €79m, RB Leipzig €52m and Mönchengladbach €44m.

Worth noting the influence on Champions League money of UEFA coefficient payment (based on performances over 10 years), where #FCBayern had the second best ranking of all clubs, giving them €34m (#BVB €24m, Leipzig €10m and Mönchengladbach €8m). Only below Real Madrid €35m.

#FCBayern have earned a hefty €426m from Europe in the last 5 years, much more than other German clubs: #BVB €294m, RB Leipzig €171m, Leverkusen €111m and Mönchengladbach €84m. From 2021/22 the German TV rights were reportedly 70% higher (DAZN, Amazon & ZDF).

#FCBayern match day income (per the Money League definition) fell from €72m to just €12m, as all home games were played behind closed doors. This revenue stream was as high as €104m three years ago, i.e. before COVID.

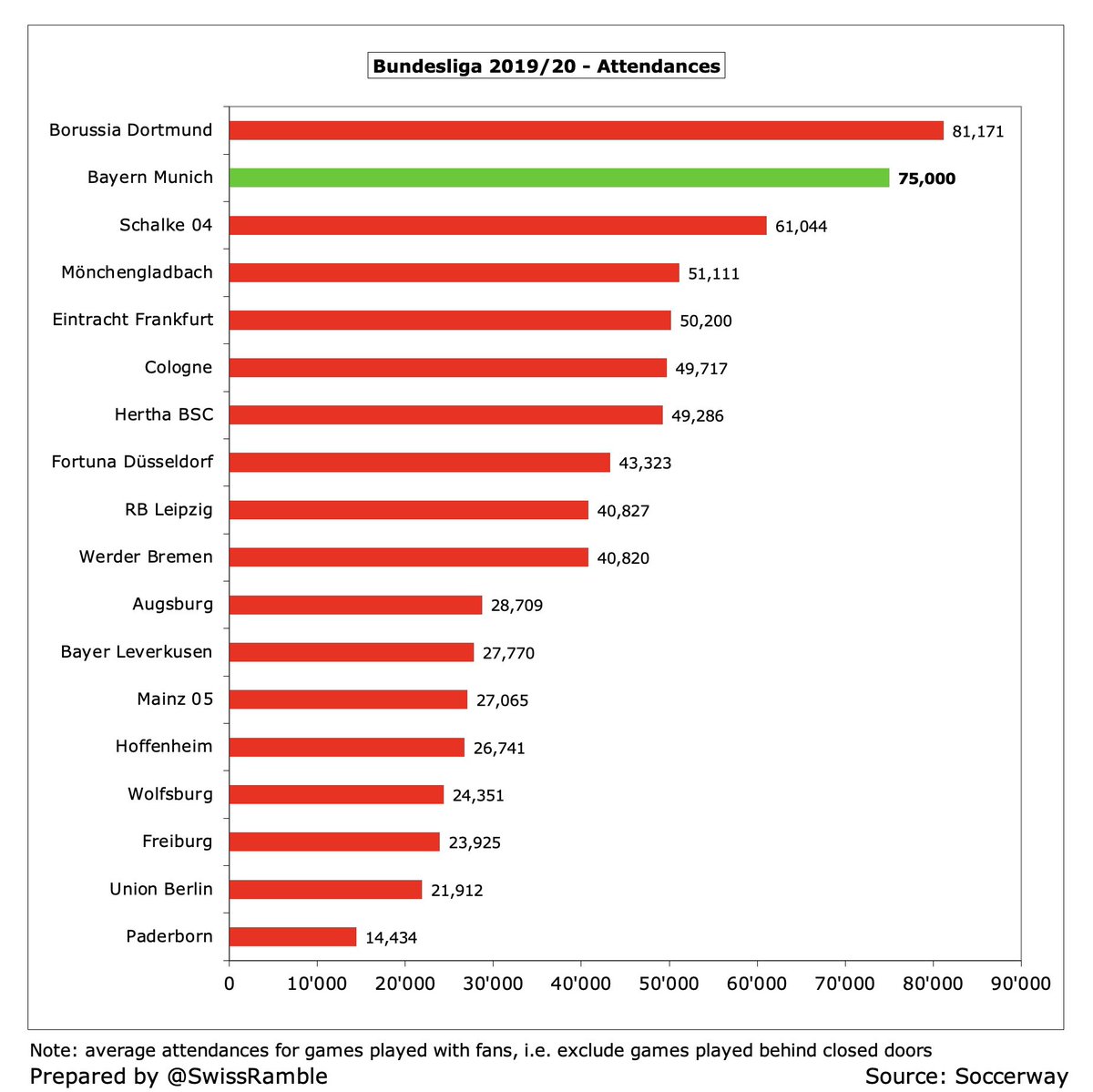

#FCBayern had the second highest crowds in Germany in 2019/20 with 75,000 (for games played with fans), so would have been happy that stadiums re-opened last season, albeit at various stages attendances were capped at 25,000, while a few games were played without fans.

#FCBayern wage bill rose €33m (10%) from €340m to €373m, which means that wages have risen by €108m (41%) since 2017. One reason for the increase in 2021 was the players taking a voluntary salary cut in the previous season. By far the highest wages in Germany.

#FCBayern enjoy a major competitive advantage in Germany, as their €373m wage bill is a hefty €158m (73%) more than #BVB €216m, the highest ever gap. This difference is much higher than a similar comparison in England, Spain and Italy, only smaller than PSG’s lead in France.

Although #FCBayern executives have complained that “only clubs owned by billionaires can compete”, their €373m wage bill is not too shabby. In fact, it was the fifth highest in Europe in 2020/21, only beaten by PSG €503m, Barcelona €432m, #MCFC €401m and #CFC €376m.

#FCBayern wages to turnover ratio increased (worsened) from 54% to 61%, obviously impacted by COVID revenue losses, though this was still one of the best figures in Europe, only behind #THFC 57% and Real Madrid 58%, but miles better than the likes of PSG 88%.

#FCBayern player amortisation, the annual cost of writing-off transfer fees, rose 11% from €63m to €69m, though this was much lower than other leading European clubs, who spend much more in the transfer market, e.g. #CFC €183m, Juventus €177m and #MCFC €165m.

Based on Transfermarkt, #FCBayern have had €422m gross spend in the last 5 years (up to this summer’s transfer window), which is slightly higher than €393m in the preceding 5-year period. This season includes de Ligt (Juventus), Mané (#LFC), Tel (Rennes) and Gravenberch (Ajax).

#FCBayern €422m gross spend in last 5 years is just behind #BVB €425m and not too far ahead of RB Leipzig €376m, though their €162m net spend is highest in the Bundesliga, above Wolfsburg €139m & Hertha €69m. This might not seem a lot, but most German clubs have net sales.

#FCBayern bank debt (to finance the stadium) was paid off 16 years ahead of schedule in 2014, having been as high as €167m in 2009, while cash increased from €40m to €114m in 2021. The club’s traditional high liquidity helped them navigate the pandemic without taking on debt.

#FCBayern’s ability to compete at the highest levels while remaining debt-free is impressive, especially in comparison to some other elite clubs in Europe, such as #CFC €1.7 bln (Abramovich funding), #THFC €964m (new stadium) and #MUFC €599m (Glazers’ leveraged buy-out).

Having no interest payments has given #FCBayern a healthy competitive advantage. To place this into perspective, five leading clubs paid more than €20m interest in 2020/21: Barcelona €37m, Atletico Madrid €30m, #MUFC €23m, #THFC €20m and Inter €20m.

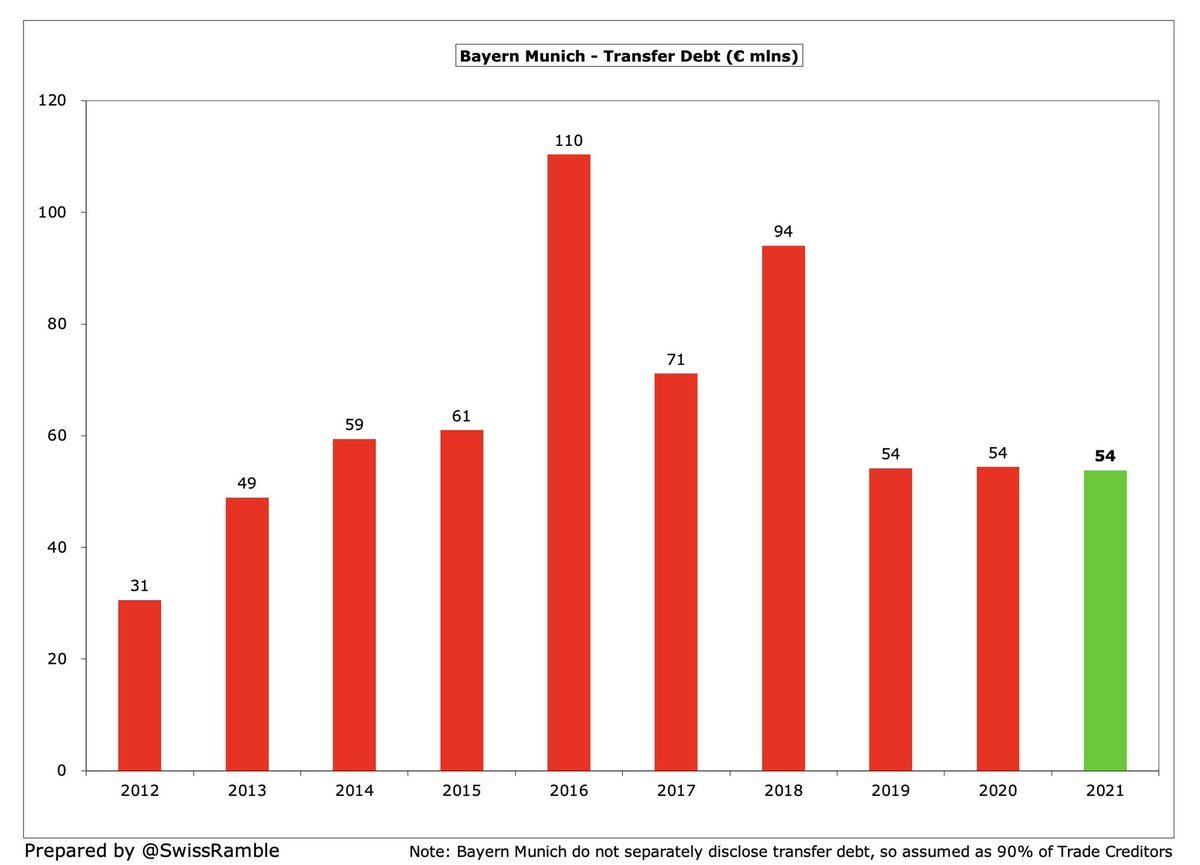

#FCBayern don’t separately report transfer debt, but assuming this to be 90% of Trade Creditors, this was unchanged at £54m for the third year in a row, less than half of €110m in 2016. The lowest amount owed of top European clubs, far below Juventus €265m and Barcelona €231m.

#FCBayern have been boosted by strategic partnerships with 3 major German companies (Adidas, Allianz & Audi), who all have an 8.33% stake in the club with the other 75% owned by the fans. Their sponsorships are worth €116m a year. Dividends cut from €15m to €3m due to COVID.

#FCBayern have been strong advocates of FFP rules. Should benefit from UEFA’s new squad cost control ratio of player wages, transfers & agent fees, limited to 70% of revenue & profit on player sales (implemented over 3 seasons: 90% in 2023/24, 80% in 2024/25 and 70% in 2025/26).

#FCBayern CFO said, “The club is on solid foundations, which have been steadily strengthened in recent years.” They have managed to ride out the challenges posed by COVID, while achieving an enviable balance between competitiveness on the pitch and financial sustainability.

Chief executive, Oliver Kahn, added, “In the Bundesliga at the moment we are very dominant at #FCBayern. But this is not our problem, this is a problem of our competitors.” That is undoubtedly true, but difficult for others to address, given Bayern’s huge financial advantages.

• • •

Missing some Tweet in this thread? You can try to

force a refresh