A Detailed Thread on Candlesticks you NEED to know 🧵

These candlestick patterns can be a leading factor in a trend change before many know it’s even happening 👇🏼

These candlestick patterns can be a leading factor in a trend change before many know it’s even happening 👇🏼

1. Bullish Inverted Hammer

Strong reversal candle in a downtrend and as you can see above this one led as the market bottom leading up for a 65 point move after.

Always want to find it after a big red candle.

Strong reversal candle in a downtrend and as you can see above this one led as the market bottom leading up for a 65 point move after.

Always want to find it after a big red candle.

2. One of my favorite setups is the Harami, in this case it was a bearish harami. This candle is near the top of the previous large green candle & would be vice versa for the bulls if it was on bottom of a previous large red candle with same sized wicks on both ends. 30+ points

3. Gravestone Doji. A DEADLY candle as you can see here where we had a 200+ point sell off of it… sellers take over here after an uptrend and starts the trend reversal to the downside. Long higher wick with a Doji type close near bottom of candle.

4. Spinning Top reversal here after a strong red candle or green candle forming at the end of the candle usually leads for a minimum 75-100% retrace of that previous candle. In this case a 60+ point move 🚨

Here you can also see a bearish spinning top that led to downside

Here you can also see a bearish spinning top that led to downside

Also regarding those last posts you can also categorize some as Morning Doji Star and or Evening Doji Star reversals!

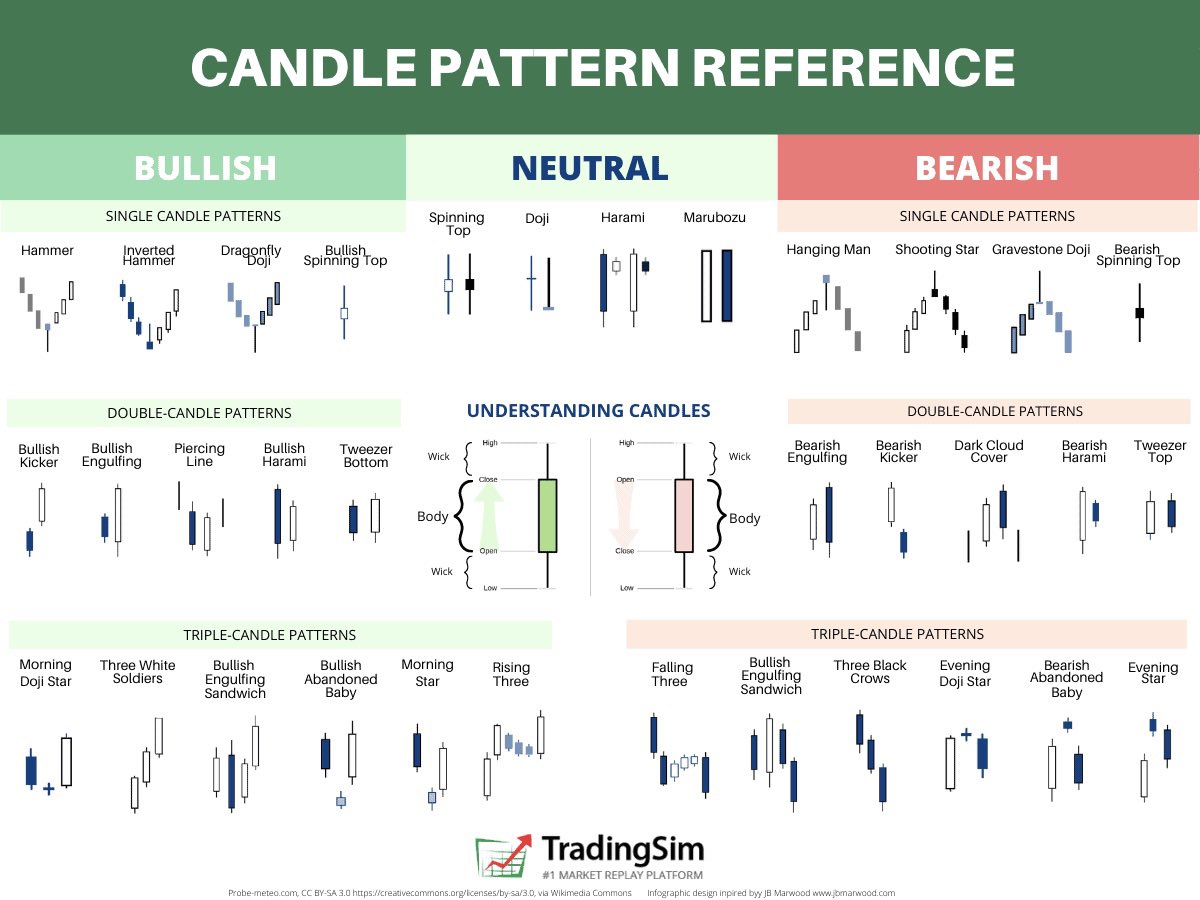

I HIGHLY SUGGEST YOU GUYS CHECK OUT AND KEEP THIS CHART WITH YOU

I HIGHLY SUGGEST YOU GUYS CHECK OUT AND KEEP THIS CHART WITH YOU

Be sure to LIKE, RETWEET and FOLLOW for more THREADS ❤️

Join us at discord.gg/Xdj5rVSR FREE LIVE TRADING TOMORROW 🚀

Join us at discord.gg/Xdj5rVSR FREE LIVE TRADING TOMORROW 🚀

#stocks #options #investing #technical #technicalanalysis #daytrader #daytrading #stockmarket #candlesticks

• • •

Missing some Tweet in this thread? You can try to

force a refresh