Some (among which @MacroAlf and @biancoresearch) suggest the FFR needs to be > YoY #CPI for the #Fed to stop hiking bc this was always the case.

Is that true?

Let's demystify this.

A thread.

1/14

Is that true?

Let's demystify this.

A thread.

1/14

https://twitter.com/MacroAlf/status/1566930676926103558

One of their (@MacroAlf, @biancoresearch) main assumptions is the #Fed needs to lower #CPI to 2%.

LT #CPI average (1914-present) is 3.3% which is 63%! higher than 2%.

The #Fed prefers core #PCE as a measure of #inflation bc it's generally much less volatile than #CPI.

2/14

LT #CPI average (1914-present) is 3.3% which is 63%! higher than 2%.

The #Fed prefers core #PCE as a measure of #inflation bc it's generally much less volatile than #CPI.

2/14

As repeatedly said, the #Fed targets core #PCE at 2% not #CPI.

Currently #CPI is almost twice as high as core #PCE.

In theory, it's possible for #CPI to be c4% when core #PCE drops to 2% but their gap will likely narrow as both go down towards the end of 2022 and in 2023.

3/14

Currently #CPI is almost twice as high as core #PCE.

In theory, it's possible for #CPI to be c4% when core #PCE drops to 2% but their gap will likely narrow as both go down towards the end of 2022 and in 2023.

3/14

It is true what @biancoresearch and @MacroAlf said about the #Fed never (at least in the period we have the data for) stopping hiking while #CPI was above FFR.

Does this really mean the #Fed will do the same this time like they suggest?

Let's delve into this.

4/14

Does this really mean the #Fed will do the same this time like they suggest?

Let's delve into this.

4/14

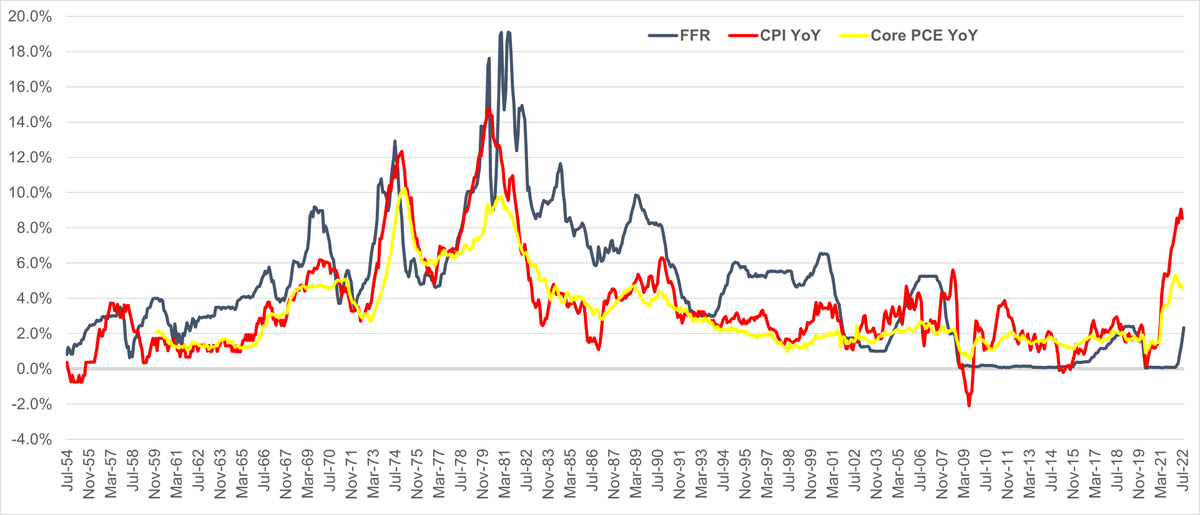

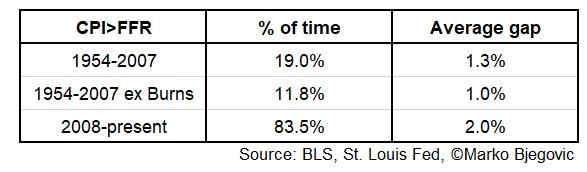

What is immediately noticeable looking at this chart is the difference in periods before and after 2008.

1) Before 2008 the #Fed was reluctant to allow #CPI going above FFR with that happening only 19% of the time (12% of the time excluding Arthur Burns' chairmanship)

5/14

1) Before 2008 the #Fed was reluctant to allow #CPI going above FFR with that happening only 19% of the time (12% of the time excluding Arthur Burns' chairmanship)

5/14

Arthur Burns is, at hindsight, widely considered to had made mistakes in 1970s allowing #inflation to ramp up much higher than necessary.

2) After 2008 #CPI has mostly run above FFR with that happening a whopping 84% of the time.

6/14

2) After 2008 #CPI has mostly run above FFR with that happening a whopping 84% of the time.

6/14

Except time, there is also a difference in intensity between those 2 periods with figures shown in the table.

Excluding Arthur Burns' chairmanship, gap between FFR and #CPI was twice as large on average after 2008 compared to the period prior to 2008.

7/14

Excluding Arthur Burns' chairmanship, gap between FFR and #CPI was twice as large on average after 2008 compared to the period prior to 2008.

7/14

Why the #Fed tdy is more tolerant of #CPI>FFR?

1) deflationary pressures after the GFC bc liquidity largely ends up at businesses that innovate and increase productivity, meaning economy is more efficient

2) #CPI is rising due to factors largely out of the #Fed's control

8/14

1) deflationary pressures after the GFC bc liquidity largely ends up at businesses that innovate and increase productivity, meaning economy is more efficient

2) #CPI is rising due to factors largely out of the #Fed's control

8/14

The 2nd reason was confirmed by the #Fed officials, most recently @neelkashkari when he said this #inflation was not wage driven.

This effectively means we cannot look at it through prism of the Philips curve and NAIRU that many still do.

9/14

bloomberg.com/news/articles/…

This effectively means we cannot look at it through prism of the Philips curve and NAIRU that many still do.

9/14

bloomberg.com/news/articles/…

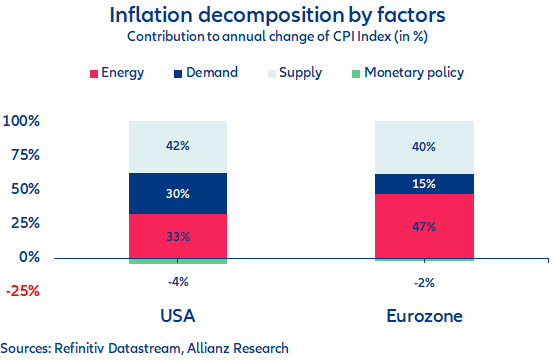

The largest part of this #inflation are energy, food and supply-side factors that are all out of the #Fed's control.

According to Allianz Research 75% of the #CPI is out of the #Fed's control.

It's unclear where food was placed but I would argue, that % is even higher.

10/14

According to Allianz Research 75% of the #CPI is out of the #Fed's control.

It's unclear where food was placed but I would argue, that % is even higher.

10/14

There is another reason for the #CPI to be > FFR:

3) QT

QT means shrinking the #Fed's B/S, currently at $95B p/m or $2.2T in total.

This is according to the Atlanta #Fed equivalent of a 29-74 bps hike.

11/14

3) QT

QT means shrinking the #Fed's B/S, currently at $95B p/m or $2.2T in total.

This is according to the Atlanta #Fed equivalent of a 29-74 bps hike.

11/14

1) Assuming a mid of 51.5 bps and

2) considering FFR normally runs about 200 bps below #CPI (page 7 of this thread), then

#CPI at or below 4.8% puts it in positive territory over current FFR.

If the #Fed hikes by 25 or 50 this month then even >5% #CPI would be enough.

12/14

2) considering FFR normally runs about 200 bps below #CPI (page 7 of this thread), then

#CPI at or below 4.8% puts it in positive territory over current FFR.

If the #Fed hikes by 25 or 50 this month then even >5% #CPI would be enough.

12/14

These threads take a lot of time and effort to write.

If you like the content, please retweet to help me spread the message.

13/14

If you like the content, please retweet to help me spread the message.

13/14

So the #Fed knows there is only so much they can do about this #inflation.

At current FFR of 2.33% #CPI needs to come below 4.8% to justify rate cuts, not at c9% like @MacroAlf and @biancoresearch suggest.

With current #inflation trajectory we'll be there by end of 2022.

14/14

At current FFR of 2.33% #CPI needs to come below 4.8% to justify rate cuts, not at c9% like @MacroAlf and @biancoresearch suggest.

With current #inflation trajectory we'll be there by end of 2022.

14/14

• • •

Missing some Tweet in this thread? You can try to

force a refresh