Founder/CEO of Arkomina | Investor | Macroeconomist | Stock Picker | Not investment advice (see disclaimer) | https://t.co/RKwv0ZOS4v

5 subscribers

How to get URL link on X (Twitter) App

https://x.com/MBjegovic/status/1745151798971674961?s=20

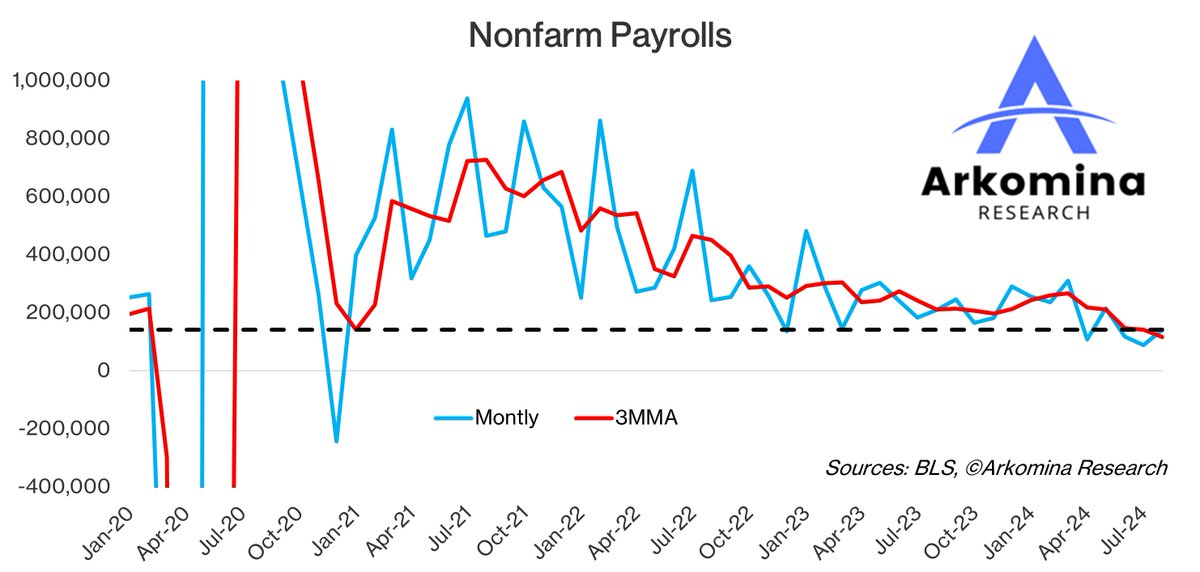

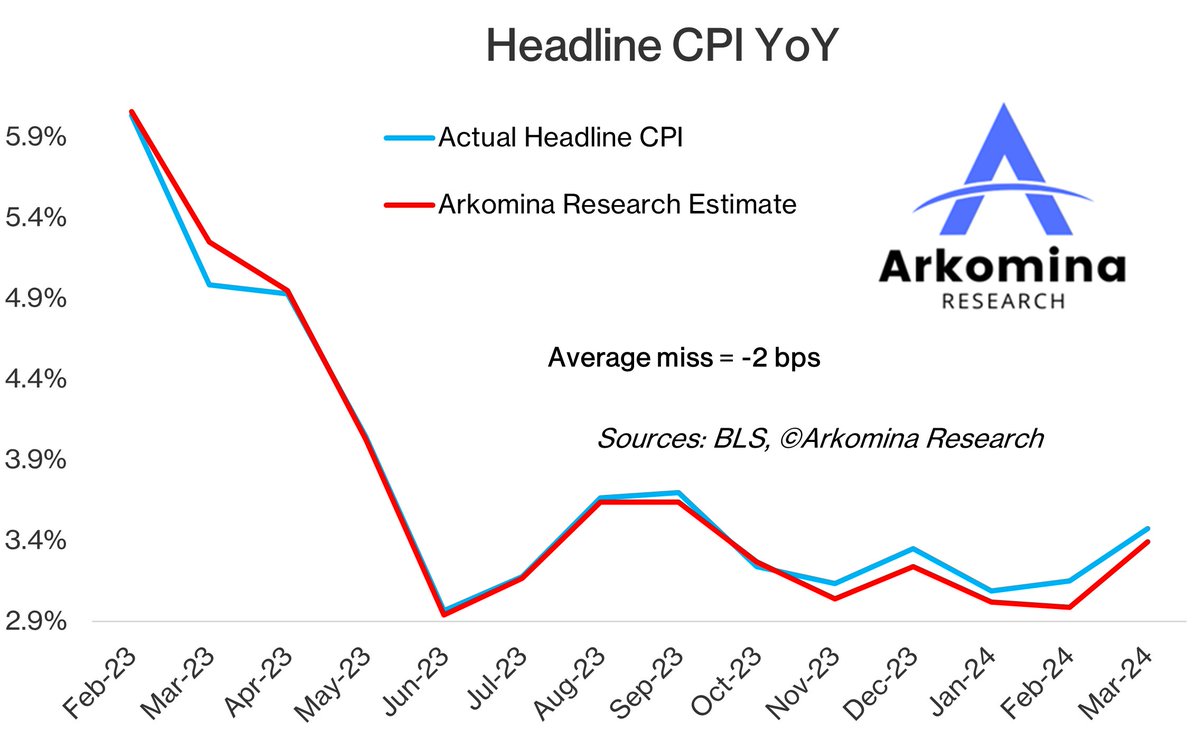

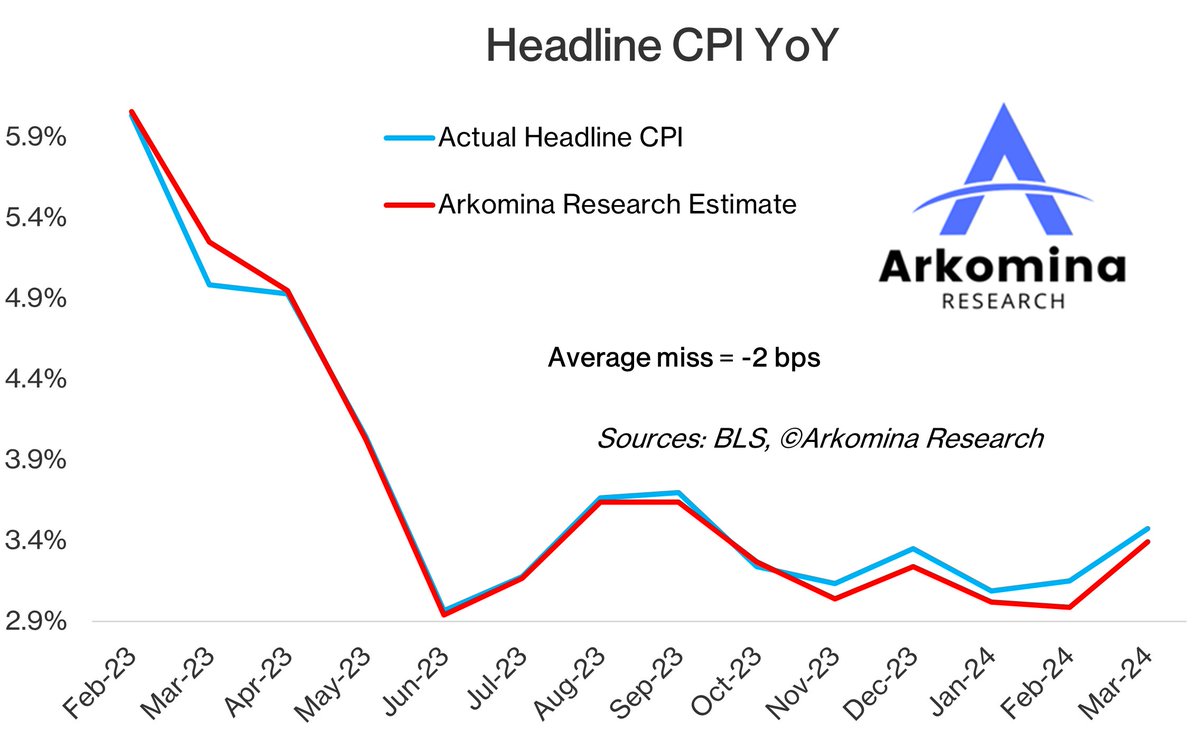

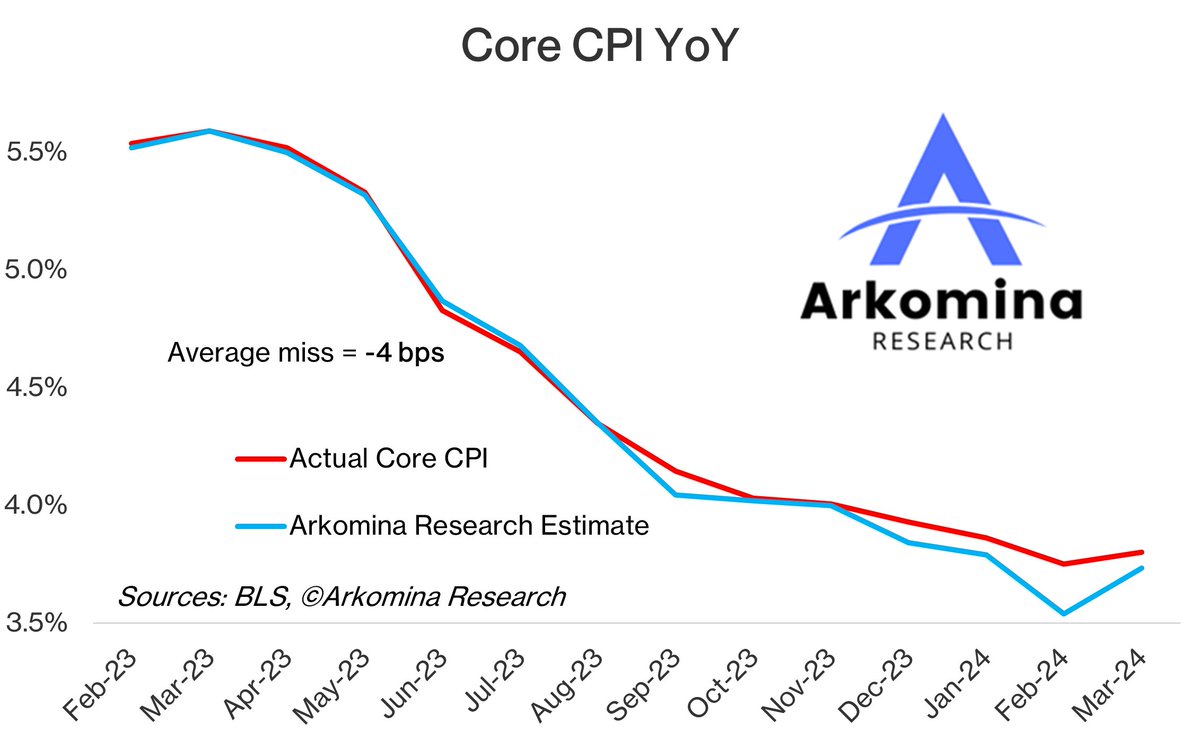

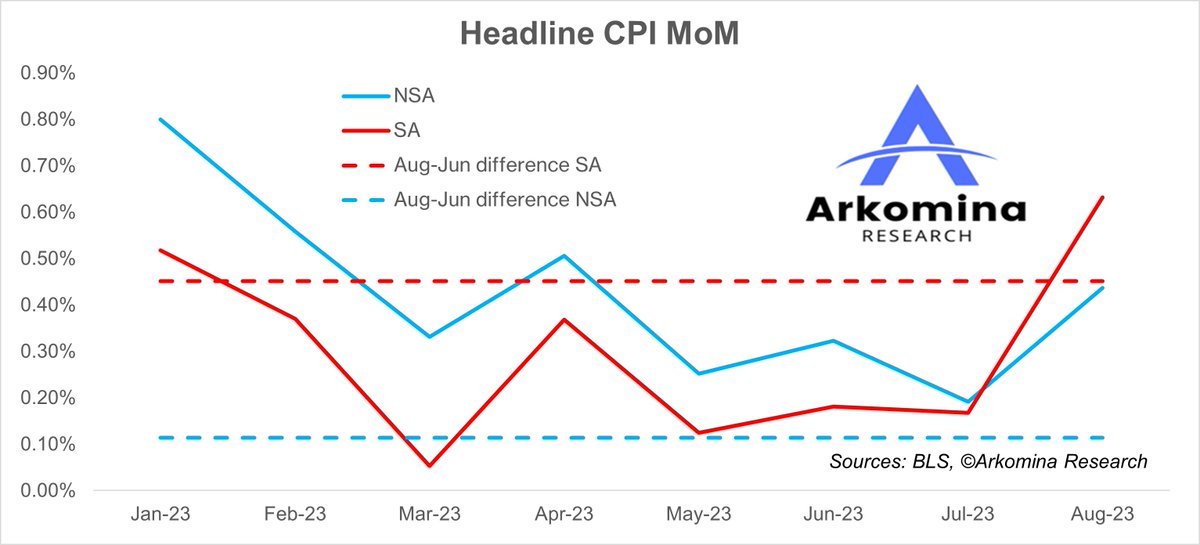

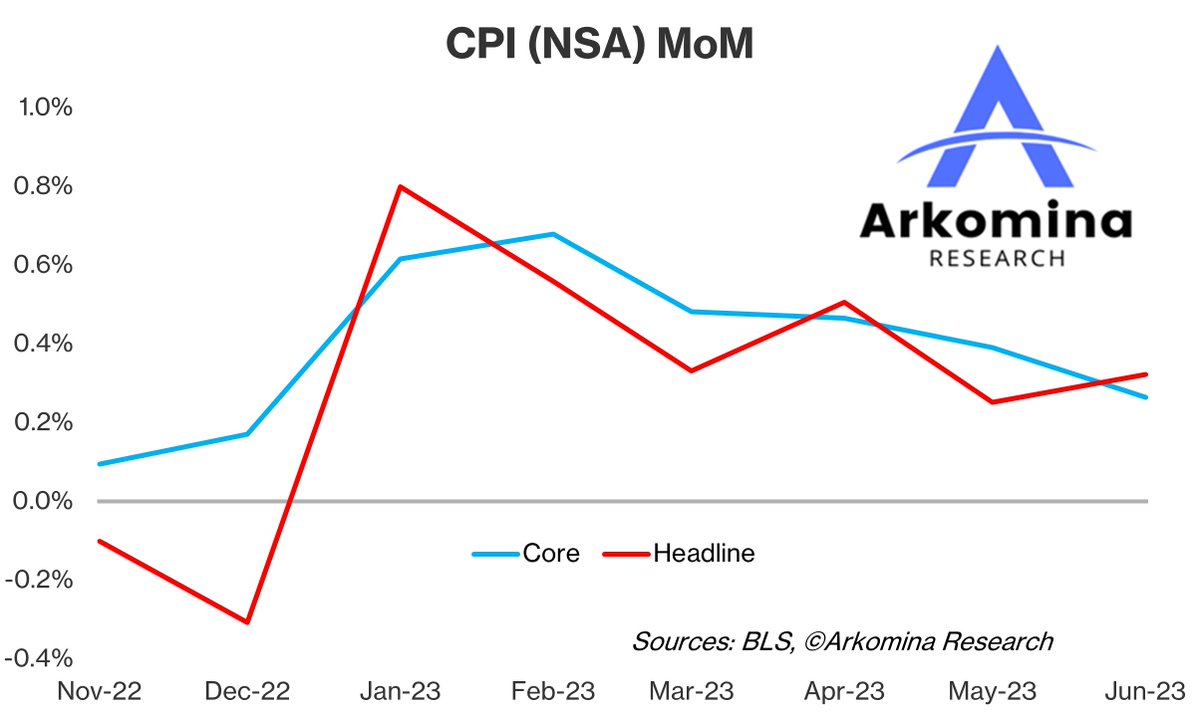

When the #Fed gets misled by inaccurate numbers like #JOLTS or lagging numbers like #CPI/#PCE one thing is certain - they will overdo it, no matter which direction they go.

When the #Fed gets misled by inaccurate numbers like #JOLTS or lagging numbers like #CPI/#PCE one thing is certain - they will overdo it, no matter which direction they go.

https://twitter.com/MBjegovic/status/1687528818959908872?s=20

https://twitter.com/MBjegovic/status/1678813550460928000?s=20

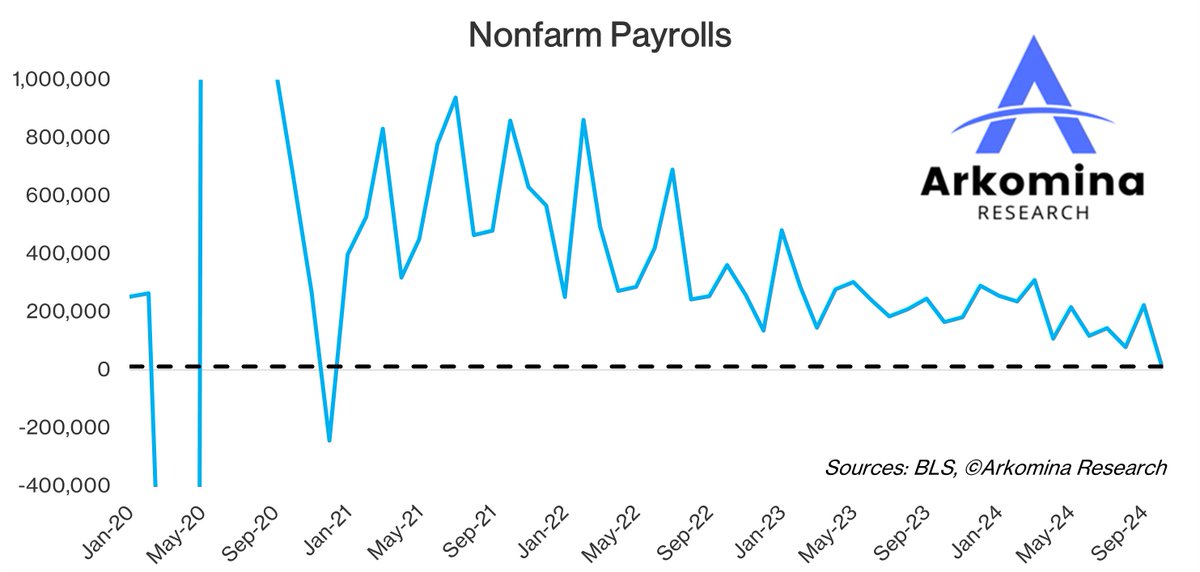

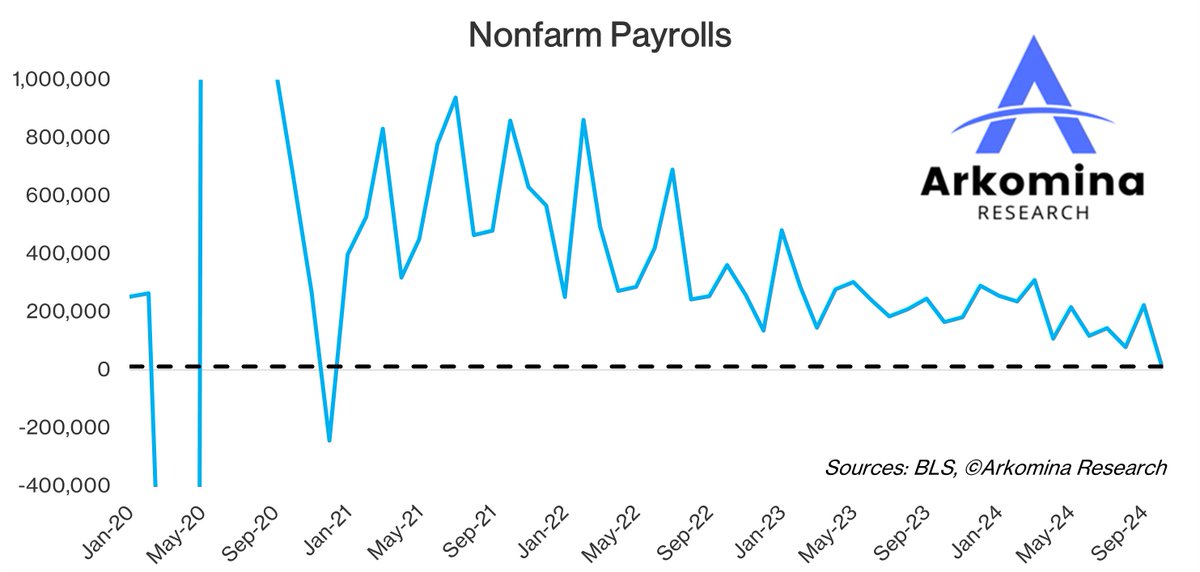

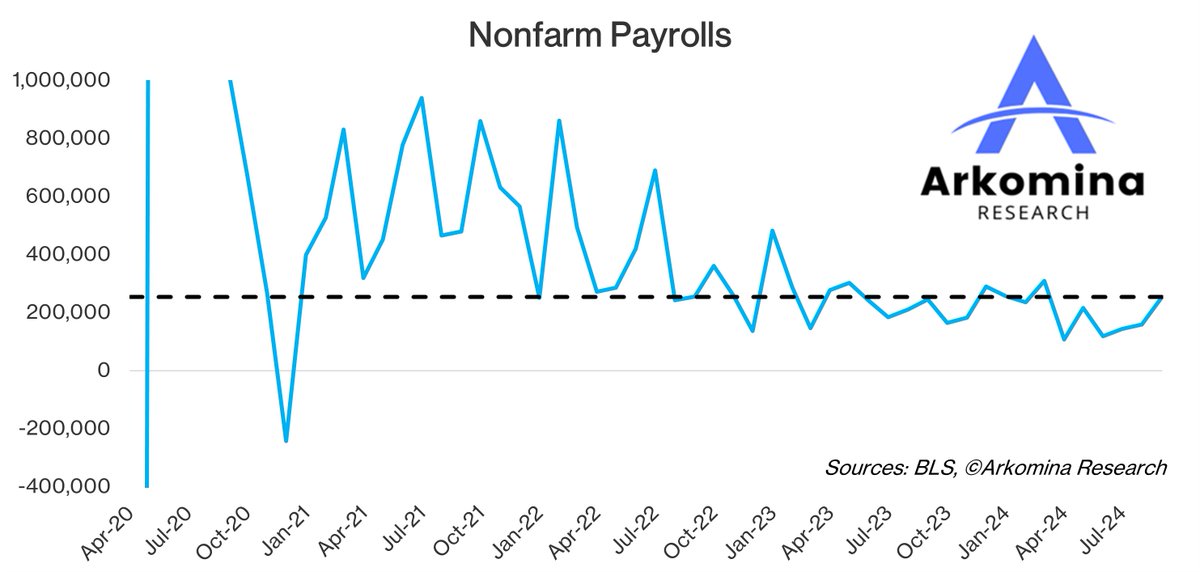

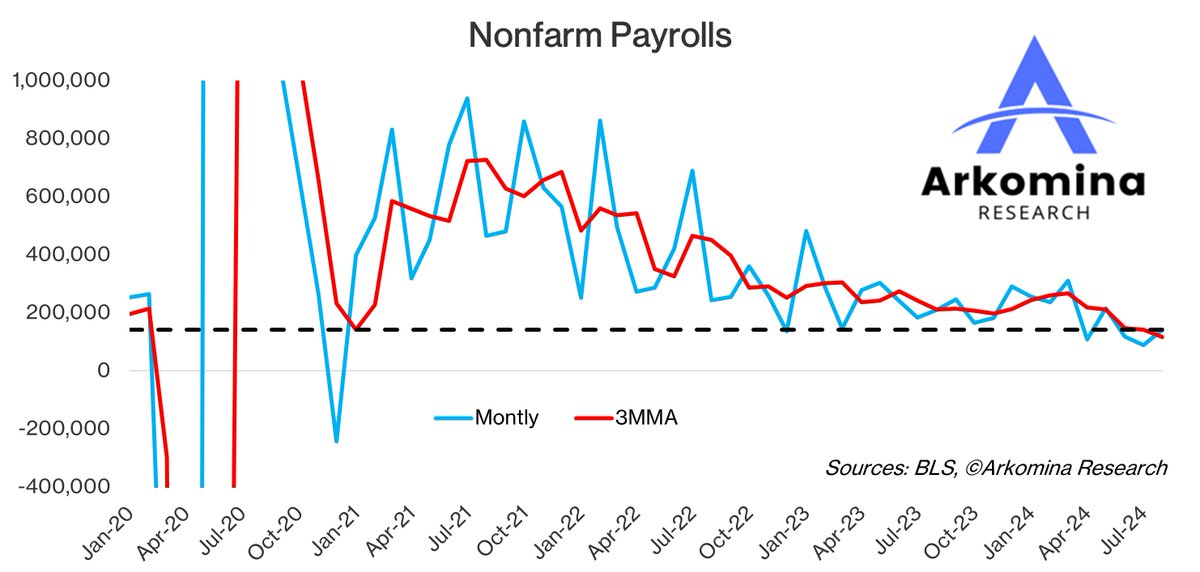

https://twitter.com/zerohedge/status/1664602070706470913?s=20NFP rose for the 29th M in a row with +339K which is 149K above consensus (+190K).