The rates conversation is - should be - complex.

Some thoughts, in an interest rate 🧵

#ausbiz #rates #RBA

1/n

Some thoughts, in an interest rate 🧵

#ausbiz #rates #RBA

1/n

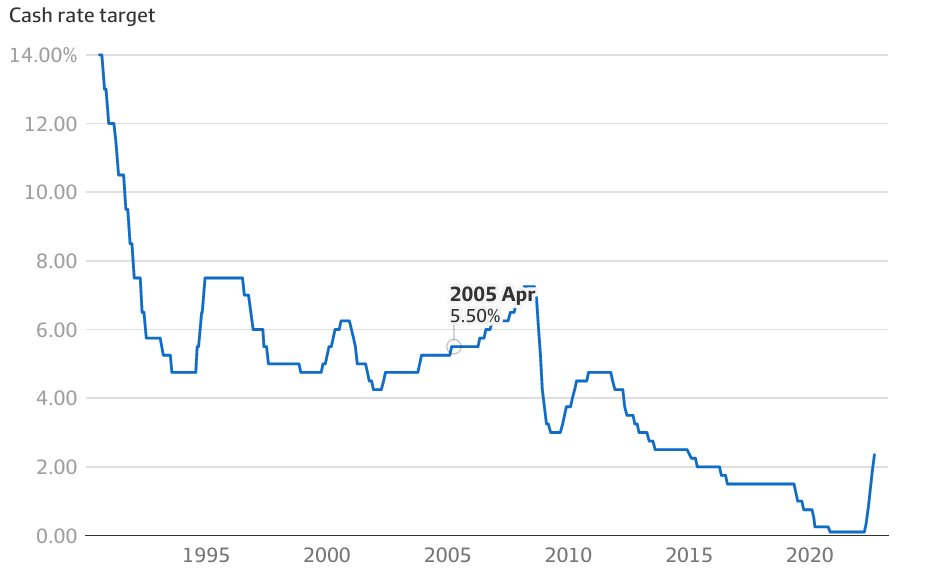

There's a decent 'chart crime' - or at least a meaningful misdemeanour - on the AFR's homepage this morning:

2/n

2/n

It's rectified in the article:

BUT... that's not even close to the full picture:

(source: afr.com/policy/economy…)

3/n

BUT... that's not even close to the full picture:

(source: afr.com/policy/economy…)

3/n

The period between 2010 and 2021 resulted in an explosion in prices, and household indebtedness, thanks to lower rates.

Rate reductions were required, especially post-GFC, but the requirement was, in part, because government did too little, leaving the RBA to carry the can.

4/n

Rate reductions were required, especially post-GFC, but the requirement was, in part, because government did too little, leaving the RBA to carry the can.

4/n

And now it's time to pay the piper for policy failures and straight-out mistakes, some of which were more avoidable than others. Here's what they were, in rough chronological order:

5/n

5/n

The overarching policy failure: the federal government was gutless, leaving the RBA, too often, as the only adults in the room.

Once a month, they take stock of the data *and the policy settings* and, like a football fullback, try to plug the gaps and clean up the mess

6/n

Once a month, they take stock of the data *and the policy settings* and, like a football fullback, try to plug the gaps and clean up the mess

6/n

Rates were too low, pre-COVID. In part because of that government gutlessness / politicking, and in part because everyone was scared of pushing us back into recession.

Governments wouldn't restore budget structural balance. The RBA wouldn't get back to neutral rates.

7/n

Governments wouldn't restore budget structural balance. The RBA wouldn't get back to neutral rates.

7/n

And, in 2019, the banking regulator, APRA *inexplicably* cut the lending buffer (which requires banks to use a higher-than-current interest rate to qualify borrowers and work out how much they can afford to borrow)!

8/n

8/n

Then, when rates went down - appropriately, if from too low a level - when COVID hit, government and regulators made the problem worse by not recognising the new low rates were going to suck people in and push prices up.

Or, less generously, not caring (enough)

9/n

Or, less generously, not caring (enough)

9/n

The RBA's second-biggest mistake was in not seeing inflation coming, even when the signs were clear, overseas. Assuming we were somehow special/immune was, frankly, silly, but moreover, imprudent, when caution was required. An understandable mistake, perhaps, but a bad one.

10/n

10/n

The bigger mistake? The RBA was very clear in its statement that it didn't intend to raise rates until necessary, and it forecast that those conditions would prevail in 2024.

*It never promised or said that it wouldn't raise until then.* That's a media shorthand mistake.

11/n

*It never promised or said that it wouldn't raise until then.* That's a media shorthand mistake.

11/n

That said, the RBA failed in its subsequent communications. It had every opportunity to use any and all communication channels to make the point more clearly, but chose not to. That meant borrowers were misinformed.

12/n

12/n

That said, it wasn't the only body - government or regulator - who could (should!) have acted, by word or deed, to limit the financial risks that homebuyers were unwittingly taking.

13/n

13/n

Speaking of which, APRA, the banking regulator, finally acted in October last year, increasing the lending buffer by a tiny amount.

It was way too little. The 'buffer' should be used counter-cyclically to dampen house price movements, while letting rates impact spending

14/n

It was way too little. The 'buffer' should be used counter-cyclically to dampen house price movements, while letting rates impact spending

14/n

So...

-- Government was MIA, and worse, was cheerleading housing

-- The RBA missed the opportunities: to increase rates pre-COVID, to increase them more quickly as the economy recovered from the COVID shock, and to communicate clearly

15/n

-- Government was MIA, and worse, was cheerleading housing

-- The RBA missed the opportunities: to increase rates pre-COVID, to increase them more quickly as the economy recovered from the COVID shock, and to communicate clearly

15/n

-- APRA made things worse in 2019 then was asleep at the wheel in 2020 and 2021, when borrowers took out 7-figure mortgages at 2% rates (and when prices rose 24% in 2021 alone!)

-- Banks were happily writing (some) loans that they - and their shareholders *may* rue

16/n

-- Banks were happily writing (some) loans that they - and their shareholders *may* rue

16/n

Yes, borrowers share responsibility to some degree. But given the information / sophistication asymmetry, the primary responsibility (and most of the blame) should sit with those who have the regulatory and legislative responsibility to act.

17/n

17/n

But a reminder: The RBA's role is NOT to manage house prices, other than as an input into economic growth, inflation and employment.

That responsibility is with government.

And the responsibility for prudent lending is with APRA.

18/n

That responsibility is with government.

And the responsibility for prudent lending is with APRA.

18/n

The RBA absolutely should reckon with itself for its failures and mistakes over the past 8 years.

But if we make that the sole/major focus of review, we not only let others off, scot-free, but we don't learn the most important lessons (and will repeat the failures).

19/19

But if we make that the sole/major focus of review, we not only let others off, scot-free, but we don't learn the most important lessons (and will repeat the failures).

19/19

• • •

Missing some Tweet in this thread? You can try to

force a refresh