1/ How will the Ethereum merge impact the #crypto ecosystem?

In this thread, we look into 3 questions on staking, institutional adoption, and mining to determine the potential impact on crypto markets. bit.ly/3QmSaxF

In this thread, we look into 3 questions on staking, institutional adoption, and mining to determine the potential impact on crypto markets. bit.ly/3QmSaxF

3/ Staking could become an even more attractive proposition following The Merge for a few reasons.

4/ For one, users will likely become more comfortable staking once PoS is officially in place and PoW is left in the past.

5/ The switch to PoS will also make Ethereum more eco-friendly, which could make investors with sustainability commitments more comfortable with the asset. This especially applies to institutional investors, which leads to our second question.

6/ Will institutional investors specifically begin or ramp up their Ethereum staking activity?

7/ Ether’s price could decouple from other cryptocurrencies following The Merge, as its staking rewards will make it similar to a bond or commodity with a carry premium.

8/ Some predict that between staking rewards and transaction fees distributed to validators, stakers can expect Ether yields of 10-15% annually, making Ethereum staking an enticing bond alternative for institutional investors.

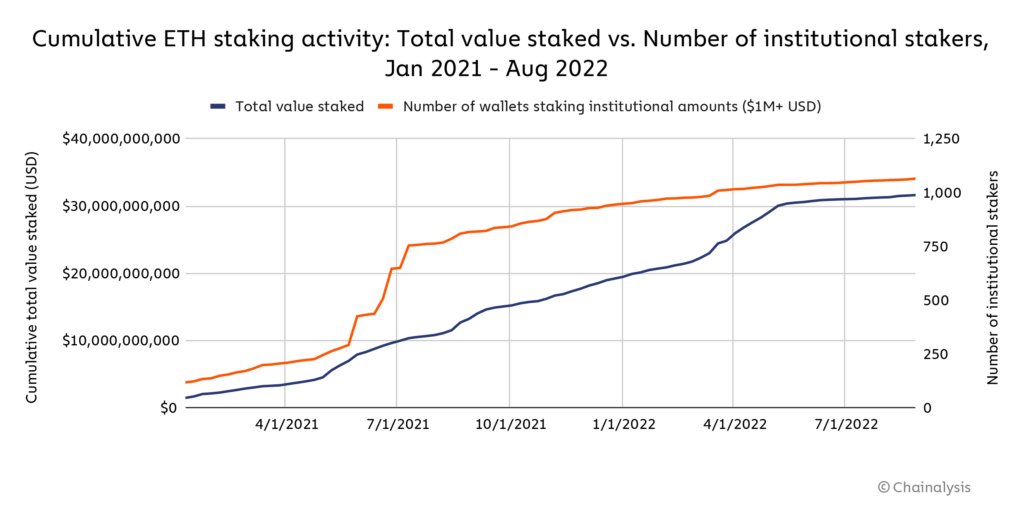

9/ The data shows that the number of wallets staking $1 million or more worth of Ether — which we’ll refer to as institutional stakers — has been steadily increasing already.

10/ Our last question: Will Ethereum’s switch to PoS also necessitate changes in mining activity?

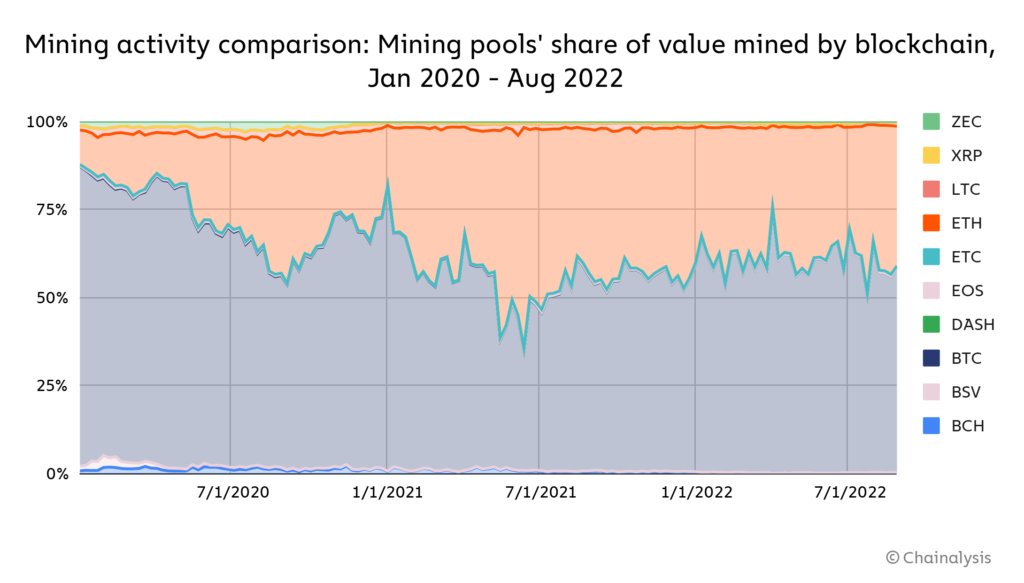

11/ Many miners and mining pools mine assets across several different blockchains, dynamically distributing their hashrate between #blockchains based on market trends. Generally, though, most mining focuses on Bitcoin and Ethereum.

12/ After The Merge, hashrate dedicated to Ethereum mining will either disappear or disperse to other blockchains. However, don’t expect that hashrate to move to Bitcoin.

13/ Why? The equipment used to mine Ethereum won’t cut it for Bitcoin. Most Ethereum miners use computer processors known as GPUs, while Bitcoin miners use more powerful processors called ASICs.

14/ While GPUs are too weak to profitably mine Bitcoin, the Ethereum blockchain was designed to be ASIC-resistant, meaning it requires a type of hashing that cannot be performed by ASICs. That means Ethereum’s switch to PoS is a huge blow to GPU miners.

15/ Ethereum currently makes up 97% of all GPU mining activity, and all remaining GPU-mineable coins have a collective market cap of just $4.1 billion, a mere 2% of Ethereum’s. That’s not enough to support GPU miners. So, where will those GPUs go?

16/ Read more about these on-chain metrics to get more insights into the merge’s potential impact on crypto markets. bit.ly/3QmSaxF

• • •

Missing some Tweet in this thread? You can try to

force a refresh