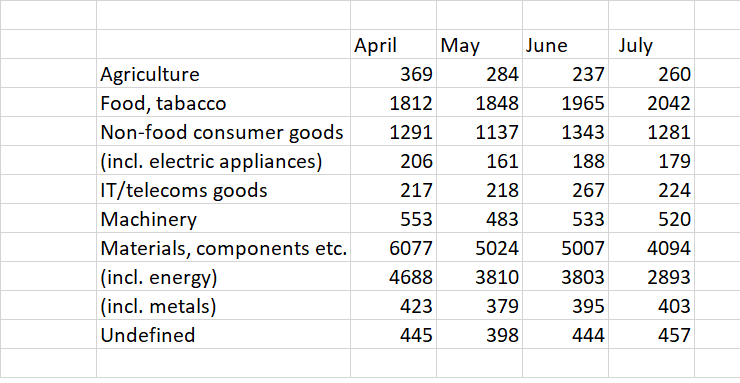

1/ #Russia's Finance Ministry stopped publishing detailed data #budget spending in April. But with a few calculations, it's possible to get a pretty good picture of what's going on. Due to the war, #defense spending until July was at least ~1.2tn RUB (~20bn USD) higher than 2021.

2/ This also means that defense spending until July was >1tn higher than planned. Of course this does not account for changes in Russia's stocks of weapons and ammunition. Refilling those will be much more expensive, but it was not yet visible in the budget until July 2022.

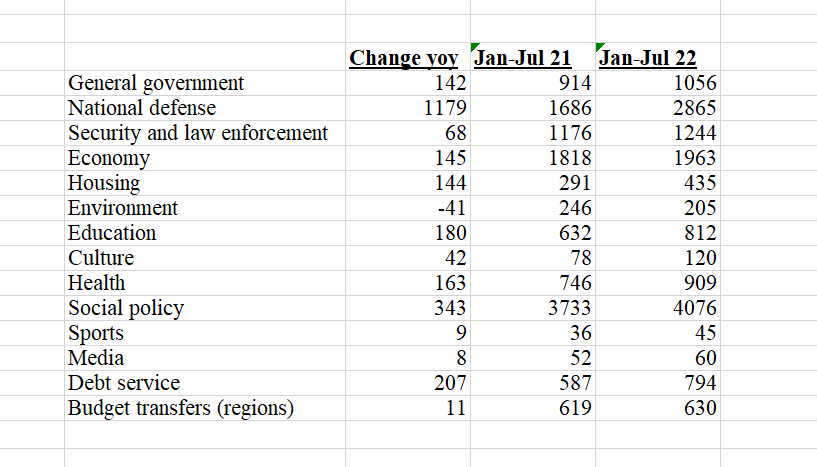

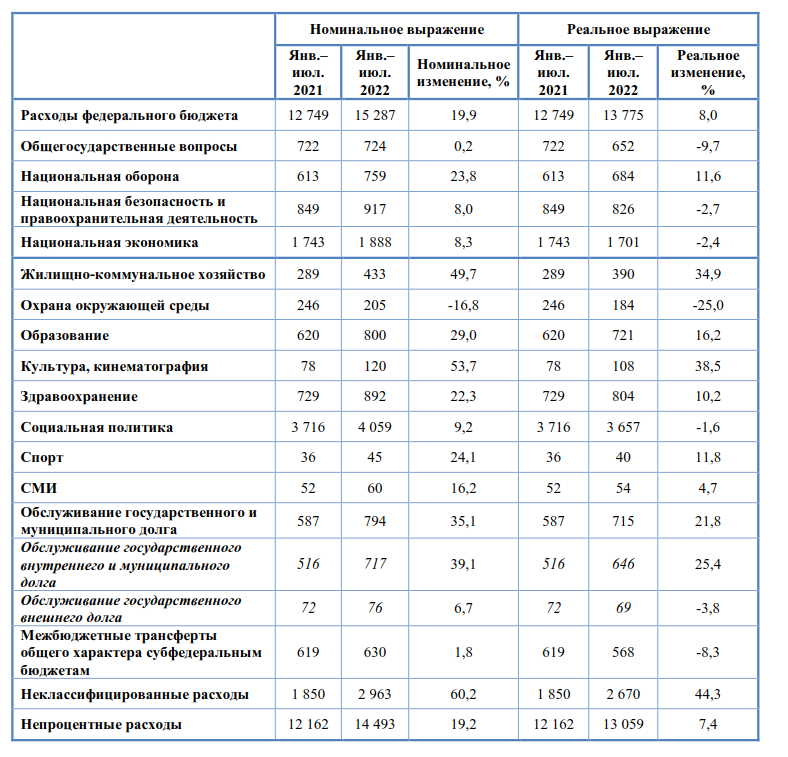

3/ Here is how defense spending can be calculated: Russia does not publish detailed monthly spending data, but they still publish a current snapshot on ongoing spending on "budget.gov.ru". The data here is incomplete, a huge chunk is missing.

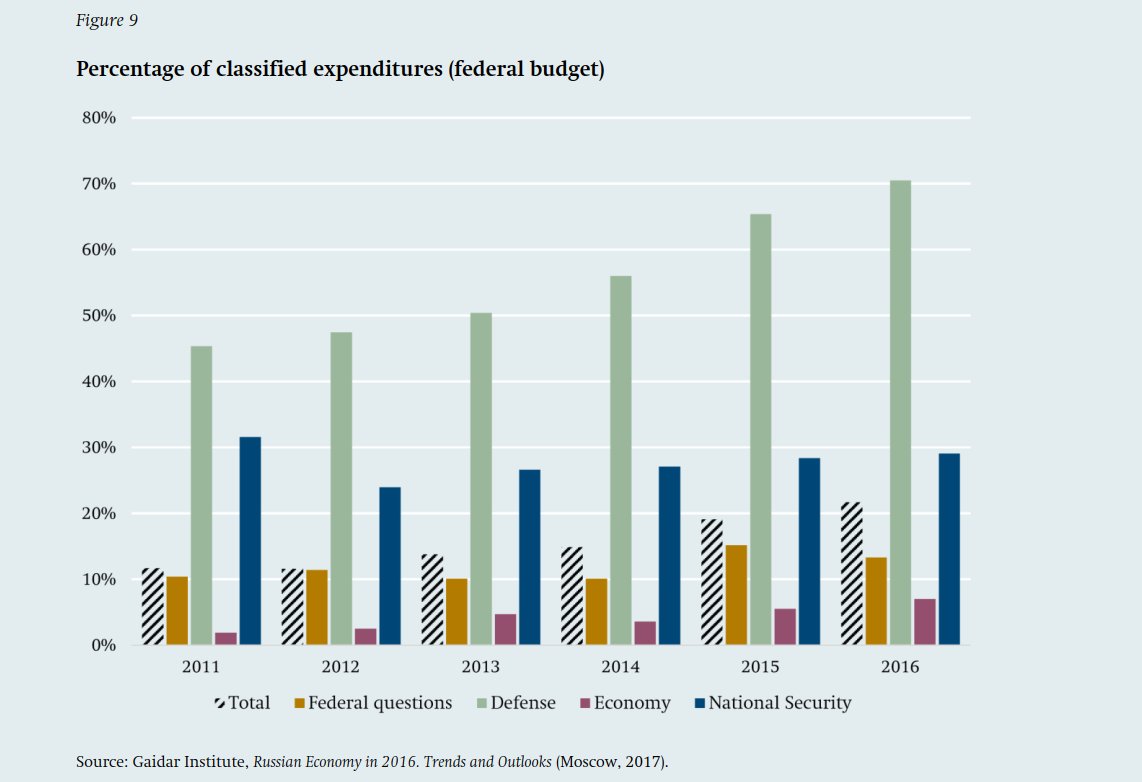

4/ What is missing is (apparently) the classified spending. Before April, the MinFin published the budget lines including classified spending. But we know very well where the classified spending usually goes to, and we know its amount (WAY up this year).

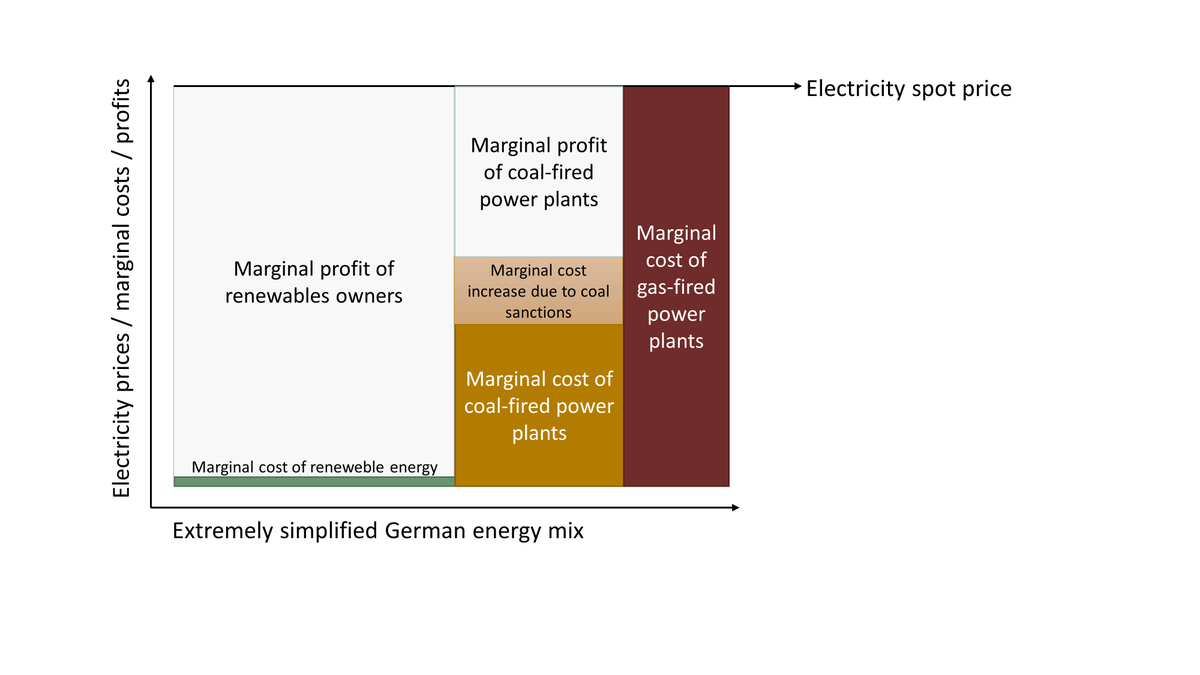

5/ Most of classified spending - unsurprisingly - goes to National Defense. For example, all spending on arms procurement is classified. There is some classified spending in National Security, Economy, and General Govmt, but that is about it. Chart from: swp-berlin.org/en/publication…

6/ Because we know the unclassified spending and we know the monthly total spending (MinFin still publishes that), we can calculate classified spending. We also know the normal distribution of classified spending, so we can infer how the budget looked like until July.

7/ We just have to distribute the classified spending (3tn so far this year) to the budget lines. There are two plausible ways: Either each budget line gets the same % of classified spending as it had last year. Or each line gets the same nominal amount and defense gets the rest.

8/ I find the latter one more plausible, because the huge increase in classified spending is definitely war-related (see numbers below). The result: Defense is 2.9tn until July. If you distribute classified spending according to last year's %, the result is similar: 2.6tn.

9/ The full-year defense budget was supposed to be 3.5tn RUB in 2022, but that will probably be surpassed in August/September. For the full year, something around 5-6tn RUB is realistic. The biggest chunk always comes in December.

10/ It is possible to cross-check the 2.9tn defense spending with alternative measures: In March and April, defense spending was (officially) ~0.5tn per month. If we add 0.5tn per month to the last known April total (1.6tn), the result is 3.1tn for defense spending until July.

11/11 I expect war costs to go after July, because arms manufacturing has ramped up (there are some signs of it in production statistics - another story). As long as MinFin publishes total spending figures, it will not be hard to figure out the federal budget's war spending.

PS: It was Gurvich's "Ekonomicheskaya Ekspertnaya Gruppa" (eeg.ru) who pointed me to the fact that there is still data available, just not for all spending. They publish a monthly overview of the incomplete spending data.

• • •

Missing some Tweet in this thread? You can try to

force a refresh