*Profitable Crypto Trading Strategy #2*

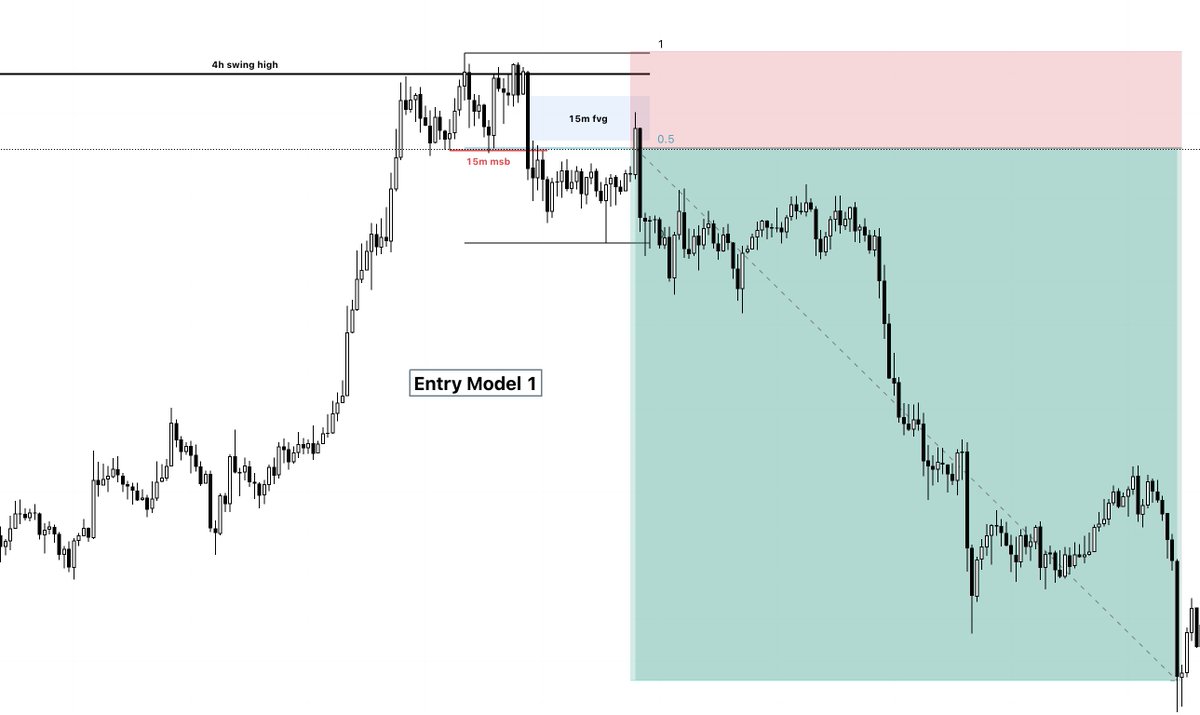

In this thread I teach this strategy step by step. It's based on ICT concepts. I've modified it for trading crypto and backtested it with years of data. If you have studied my Entry Model 1, this will be easy. Let's get into it!

In this thread I teach this strategy step by step. It's based on ICT concepts. I've modified it for trading crypto and backtested it with years of data. If you have studied my Entry Model 1, this will be easy. Let's get into it!

This example uses two timeframes: 4h/15min. It looks at a profitable long. Detailed instructions and definitions are on every diagram! Other timeframes can be used.

Step 1: A 4h fair value gap (FVG) is formed.

Step 2: Price trades into the 4h FVG.

Step 1: A 4h fair value gap (FVG) is formed.

Step 2: Price trades into the 4h FVG.

Step 3: Mark the last 15m swing high that formed before price traded into the 4h FVG.

Step 4: Price trades through the 15m swing high and a 15m candle body closes above it.

Step 4: Price trades through the 15m swing high and a 15m candle body closes above it.

Step 6: Price trades back into the 15m FVG

Step 7: Price has retraced to at least the 0.5 fib level

Step 8: Enter the trade when price is in the FVG and below the 0.5 fib

Step 7: Price has retraced to at least the 0.5 fib level

Step 8: Enter the trade when price is in the FVG and below the 0.5 fib

Step 9: Place your stop loss below the swing low in the 4h FVG (this should be done at the same time you enter the trade)

Steps 10, 11: Take profits!

Steps 10, 11: Take profits!

That's it! You can reverse the logic for entering shorts. If there's enough interest, I will release a PDF of this model. If you enjoyed this thread, please like and retweet and I will release more models!

$btc #bitcoin #trading #crypto $eth #ethereum

$btc #bitcoin #trading #crypto $eth #ethereum

• • •

Missing some Tweet in this thread? You can try to

force a refresh