After the UK Super-Deduction: Assessing Proposals for the Reform of Capital Allowances

taxfoundation.org/uk-capital-all… @CPSThinkTank @kpomerleau @danieldbunn #uk

taxfoundation.org/uk-capital-all… @CPSThinkTank @kpomerleau @danieldbunn #uk

With Liz Truss appointed Prime Minister, it’s clear that the headline rate of the corporation income tax, the most economically damaging type of tax, will remain at 19 percent.

taxfoundation.org/uk-prime-minis…

taxfoundation.org/uk-prime-minis…

However, the headline rate was only one part of the corporate tax cliff edge that the #UK faced.

The super-deduction, which has temporarily made the UK tax system much more supportive of capital investment in plant and machinery, is also set to expire.

The super-deduction, which has temporarily made the UK tax system much more supportive of capital investment in plant and machinery, is also set to expire.

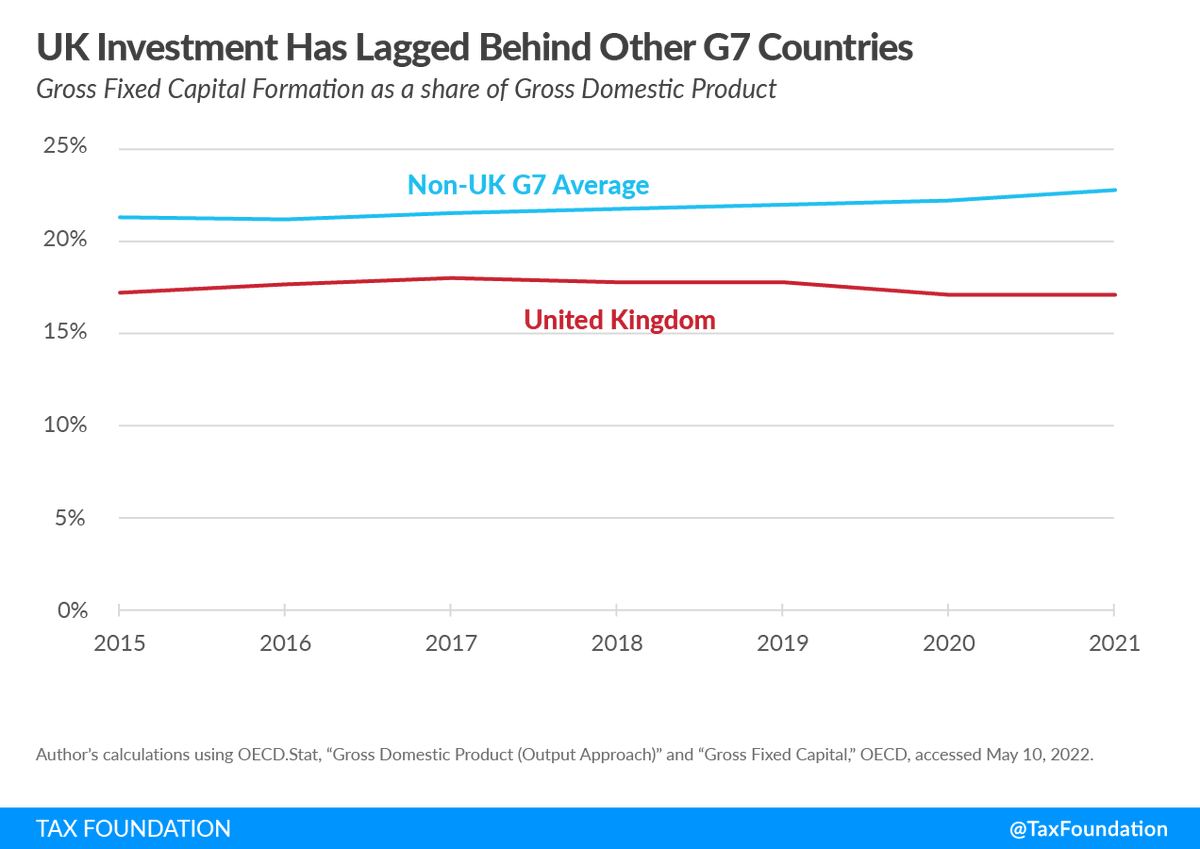

For many years, the #UK has adopted a strikingly ungenerous approach to capital cost recovery, creating a significant bias against investment.

This has coincided with consistently low levels of business investment.

This has coincided with consistently low levels of business investment.

Capital cost recovery is one of the most significant ways that the tax system weighs on economic growth.

The #UK ranked 33rd out of 37 OECD countries for ‘capital cost recovery’ on our 2021 International Tax Competitiveness Index.

taxfoundation.org/publications/i…

The #UK ranked 33rd out of 37 OECD countries for ‘capital cost recovery’ on our 2021 International Tax Competitiveness Index.

taxfoundation.org/publications/i…

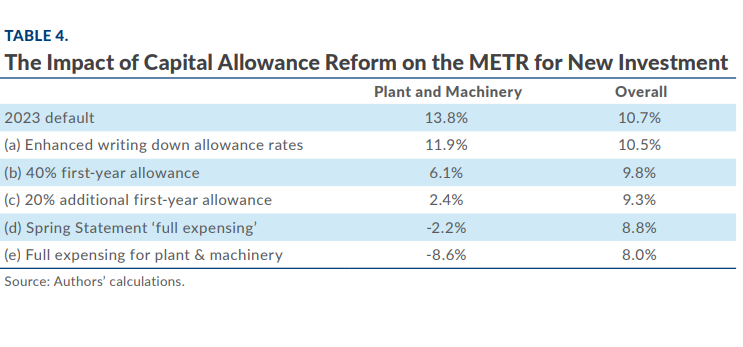

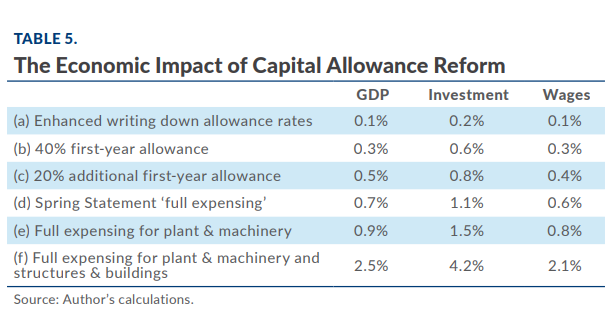

The Treasury has considered making the system of capital allowances more supportive of investment and published a number of reforms, all of which would reduce marginal effective tax rates on new investment and boost investment, wages, and growth, according to our modeling.

#UK

#UK

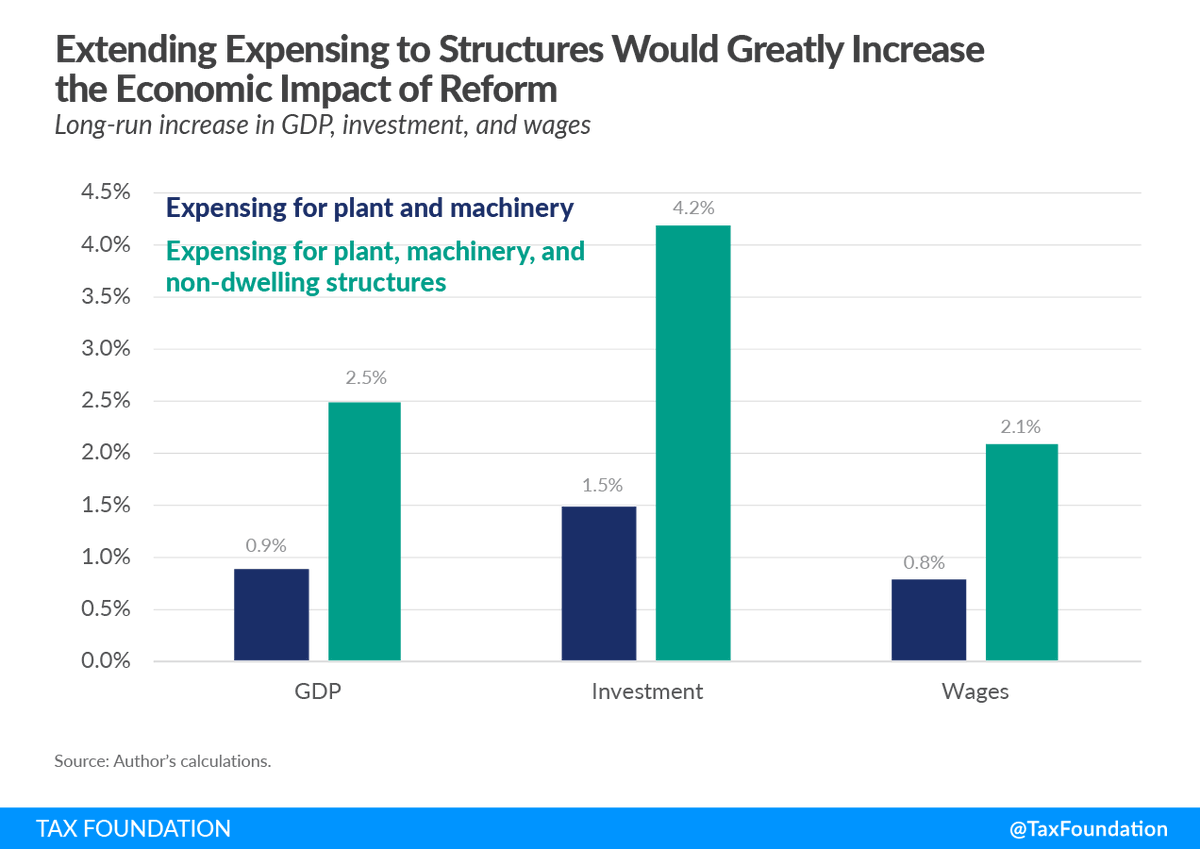

𝘎𝘰𝘪𝘯𝘨 𝘣𝘦𝘺𝘰𝘯𝘥 the Treasury’s initial suggestions by extending genuine full expensing to structures and buildings would more than triple the economic impact of capital allowance reform, boosting long-run GDP by 2.5 percent.

#UK

#UK

The #UK should be as 𝗯𝗼𝗹𝗱 as possible when it comes to 𝗽𝗲𝗿𝗺𝗮𝗻𝗲𝗻𝘁 reform of capital allowances.

High up-front revenue losses should not necessarily be prohibitive, given their transitory nature, and can be reduced using an approach known as neutral cost recovery.

High up-front revenue losses should not necessarily be prohibitive, given their transitory nature, and can be reduced using an approach known as neutral cost recovery.

• • •

Missing some Tweet in this thread? You can try to

force a refresh