🧵 on the global macros,

(1) What’s happening to Yields & Currencies globally?

(2) Why is the $ going up?

(3) Why is INR performing better than most currencies?

Do ‘re-tweet’ & help us educate more investors (1/25)

#investing #StockMarket #Markets

(1) What’s happening to Yields & Currencies globally?

(2) Why is the $ going up?

(3) Why is INR performing better than most currencies?

Do ‘re-tweet’ & help us educate more investors (1/25)

#investing #StockMarket #Markets

(Q1) Where did all of this start?

(1a) COVID put the breaks on all kind of economic activities, fear of GDP slowing down, Individuals losing jobs, Companies making losses etc. (2/25)

(1a) COVID put the breaks on all kind of economic activities, fear of GDP slowing down, Individuals losing jobs, Companies making losses etc. (2/25)

(1b) Central banks globally unleashed a liquidity package by lowering rates (so that loans become cheap & u buy more) & doing Quantitative Easing (QE)/buying back bonds (Similar to when you buy an FD from a bank, u give bank the money & increase the liquidity with the bank)(3/25)

(1c) Suddenly everyone had monies or could borrow at almost 0% & all this money started chasing stock markets & commodities (rates were zero so no one wanted to invest in fixed income then) (4/25)

(1d) Yields were going down, Stock Markets went up, commodity prices went up & hence inflation went up (You call this demand-pull inflation - An inflation that happens because there is demand) (5/25)

(1e) Along with liquidity, Russia - Ukraine war & China zero tolerance to COVID & political agendas created supply side problems thereby fuelling Inflation even further up (Ex: Supply of Gas become a problem for Europe from Russia) (6/25)

(Q2) So what’s the situation now?

(2a) You have inflation because of both, liquidity led Demand & Russia + China led Supply problems (7/25)

(2a) You have inflation because of both, liquidity led Demand & Russia + China led Supply problems (7/25)

(2b) You cant control the supply side problem as a central bank because neither Russia & nor China is in your control & hence the focus is on how to reduce liquidity so that the demand driven inflation can be controlled (8/25)

(2c) Which ever central bank infused more liquidity has more demand inflationary pressure today (US & UK)

(2d) US & UK have an inflation target of 2% but their inflation is at 9-10% vs India which infused less liquidity & hence target is 6% & inflation is at 7% (9/25)

(2d) US & UK have an inflation target of 2% but their inflation is at 9-10% vs India which infused less liquidity & hence target is 6% & inflation is at 7% (9/25)

(Q3) What are central banks doing to reduce the demand led inflation?

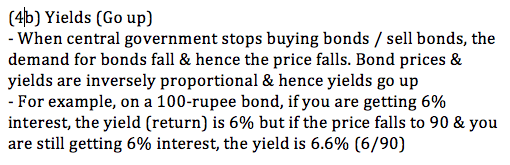

- Increasing rates & Quantitative Tightening (QT - It’s the opposite of QE/buying of bonds that we discussed above) (10/25)

- Increasing rates & Quantitative Tightening (QT - It’s the opposite of QE/buying of bonds that we discussed above) (10/25)

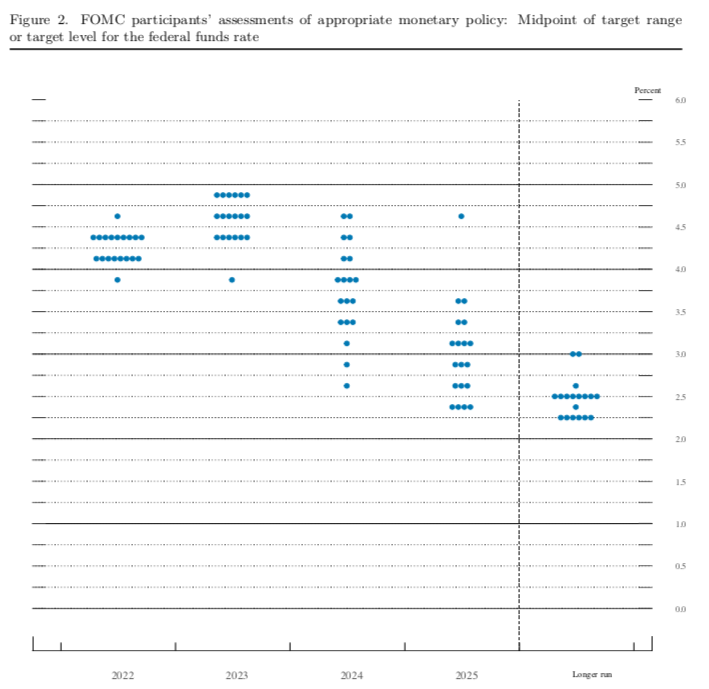

(3a) By increasing rates, central banks are trying to bring demand down (Mortgage rates in the US have gone up from 2% to 7% in 1 year)

- US has already increased rates by 3%

- UK has by 2.25%

- India has by 1.4% (11/25)

- US has already increased rates by 3%

- UK has by 2.25%

- India has by 1.4% (11/25)

(3b) Quantitative Tightening - Central banks have started selling the bonds they purchased during QE. When they sell the bonds, they receive monies from the market & thereby reducing the liquidity with the market (12/25)

(4) How did this affect the capital markets?

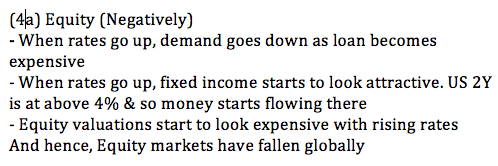

(4a) It affected Equities negatively, explained 👇 (13/25)

#investing #StockMarket #Markets

(4a) It affected Equities negatively, explained 👇 (13/25)

#investing #StockMarket #Markets

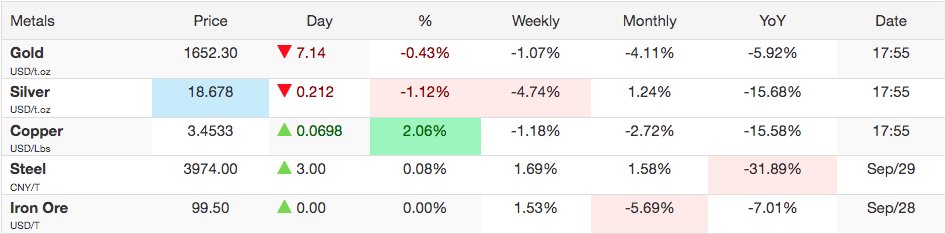

(4d) Gold went down,

- Gold is bought in $’s globally. So if the $ goes up, price of the gold goes up & hence demand falls & so the price of Gold falls (16/25)

#investing #StockMarket #Markets

- Gold is bought in $’s globally. So if the $ goes up, price of the gold goes up & hence demand falls & so the price of Gold falls (16/25)

#investing #StockMarket #Markets

(Q5) But $ was printed the most & there is inflation in the US then why is $ going up?

(5a) $ is a risk free asset, when ever there is risk off in the market, the monies flow into $ & hence it goes up (17/25)

(5a) $ is a risk free asset, when ever there is risk off in the market, the monies flow into $ & hence it goes up (17/25)

(5b) When you increase rates, it’s a signal that the economy is strong & increase in rates wont derail our growth. Strong economy deserves stronger currency. US has raised the highest rates & hence $ is up (18/25)

(5c) US does not import oil & is self dependent. Another reason why its trade deficit is better than most & hence a stronger $

(5d) Interest rate differentials vs Europe & Japan is also helping the $ (Thread explaining this concept -

(5d) Interest rate differentials vs Europe & Japan is also helping the $ (Thread explaining this concept -

https://twitter.com/KirtanShahCFP/status/1543416625151754241) (19/25)

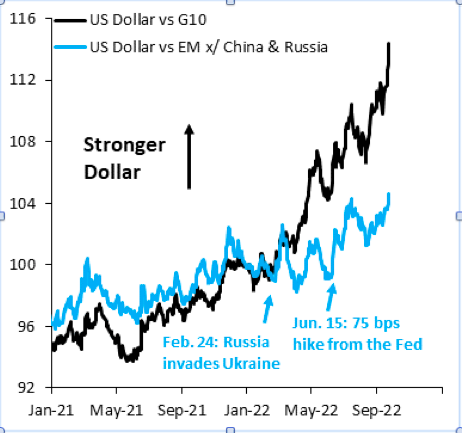

(5e) Most importantly, $ is moving higher because the other economies are weak & hence their currencies are even weaker which is benefiting the $. $ has not really moved higher vs the EM currencies. Chart Credit @RobinBrooksIIF (20/25)

(Q6) What did Japan do earlier in the month?

(6a) Japan has not been increasing rates & does not have a very aggressive policy stance & hence yields are still very low & Yen kept falling vs the $ (21/25)

(6a) Japan has not been increasing rates & does not have a very aggressive policy stance & hence yields are still very low & Yen kept falling vs the $ (21/25)

(6b) Japan intervened in the forex market & bought Yen which helped & Yen appreciated 2% vs $

(6c) This is a temporary measure in my opinion & may not make any material impact on the Yen (22/25)

(6c) This is a temporary measure in my opinion & may not make any material impact on the Yen (22/25)

(Q7) What did UK do?

UK is confused as hell. Now that you understand, you decide. UK did the below lately,

- UK cut taxes where by increased liquidity

- Did Quantitative Easing by buying bonds

What do you think should happen to GBP & Yields? You should be able to answer (23/25)

UK is confused as hell. Now that you understand, you decide. UK did the below lately,

- UK cut taxes where by increased liquidity

- Did Quantitative Easing by buying bonds

What do you think should happen to GBP & Yields? You should be able to answer (23/25)

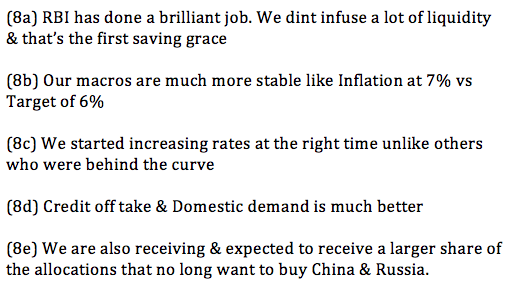

(Q8) Why is India so resilient on currency, Yields & Stocks? Explained in the attachment 👇(24/25)

- Yields & $ have to stop rising for Equity markets to stabilise

- We cant stay insulated if the world goes south, we can only outperform

#investing #StockMarket #Markets

- Yields & $ have to stop rising for Equity markets to stabilise

- We cant stay insulated if the world goes south, we can only outperform

#investing #StockMarket #Markets

This is my 58th thread, you can follow me at

@KirtanShahCFP for some interesting content around #investing

Have earlier written on,

-Various Sectors

-Macro Trends

-Debt

-Equity

-Gold

-Personal Finance etc.

You can find them all in the link below

@KirtanShahCFP for some interesting content around #investing

Have earlier written on,

-Various Sectors

-Macro Trends

-Debt

-Equity

-Gold

-Personal Finance etc.

You can find them all in the link below

https://twitter.com/KirtanShahCFP/status/1337953717274832896?s=20&t=IpXfaMap2Ssb1NTvQm9Ikw(END)

• • •

Missing some Tweet in this thread? You can try to

force a refresh