This report (and this 🧵) explores dollar-pegged #stablecoins, providing a comprehensive overview of their evolution over time.

We’ll discuss the major stablecoins around today, their designs, their dynamics, and their usage.

We’ll discuss the major stablecoins around today, their designs, their dynamics, and their usage.

To start, #stablecoins are digital representations of other assets for use on #blockchains.

Although able to track the price of other underlying assets, stablecoins are most commonly linked to USD. That’s what our report focused on.

Although able to track the price of other underlying assets, stablecoins are most commonly linked to USD. That’s what our report focused on.

At a $150bn+ market cap, stablecoins have become an increasingly important part of the #crypto economy.

They combine the benefits of open crypto with the price consistency of widely accepted fiat currencies.

3/6 of the top crypto assets by market cap today are stablecoins.

They combine the benefits of open crypto with the price consistency of widely accepted fiat currencies.

3/6 of the top crypto assets by market cap today are stablecoins.

Critics often dismiss #crypto because they fail to recognize the merits of the underlying technology.

Stablecoins offer a viable use case today, functioning as a widely accepted unit of account for pricing assets and as a stable medium of exchange to facilitate payments.

Stablecoins offer a viable use case today, functioning as a widely accepted unit of account for pricing assets and as a stable medium of exchange to facilitate payments.

Like crypto, stablecoins can also support financial inclusion in a world where nearly 2B people, or ~25% of all global citizens, are unbanked.

...And many others are underbanked, as they lack access to basic financial services.

...And many others are underbanked, as they lack access to basic financial services.

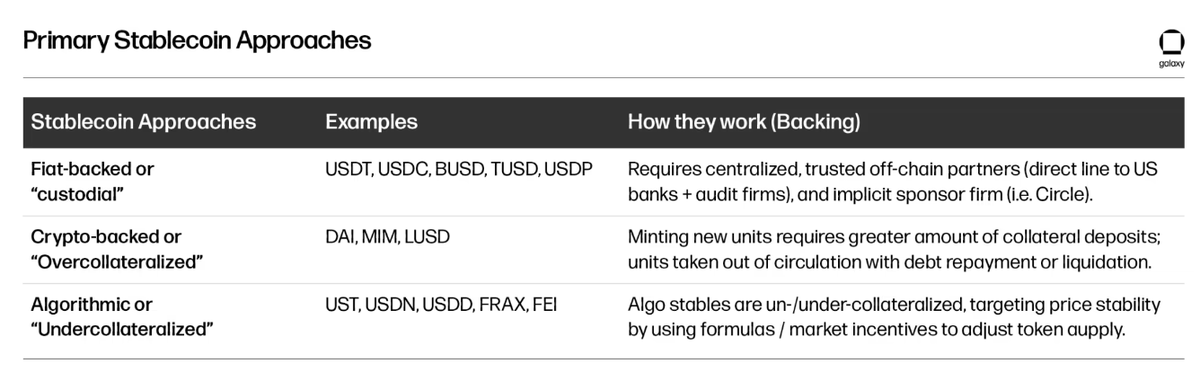

Stablecoin designs largely fall into 3 main categories:

◼️ fiat-backed

◼️ overcollateralized

◼️ algorithmic

...each comes with different advantages/shortfalls, stability mechanisms, and competitive dynamics.

◼️ fiat-backed

◼️ overcollateralized

◼️ algorithmic

...each comes with different advantages/shortfalls, stability mechanisms, and competitive dynamics.

#Tether, the long-standing leading #stablecoin by market value and volume, has endured a long history of criticisms.

Its market dominance has eroded rapidly over this past year.

Its market dominance has eroded rapidly over this past year.

It’s the world’s first stablecoin that enabled quick and easy trade settlement in dollars.

Tether also threw a lifeline to #crypto exchanges that lacked access to the traditional banking system but wanted to offer pairs based on #USD.

Tether also threw a lifeline to #crypto exchanges that lacked access to the traditional banking system but wanted to offer pairs based on #USD.

#MakerDAO’s DAI has emerged as a leader among “decentralized” stablecoins, but its current form has deviated significantly from its original vision.

Recently, it has become significantly reliant on USDC for stability.

Recently, it has become significantly reliant on USDC for stability.

The collapse of a number of other algorithmic stablecoins has led most protocols or platforms behind algorithmic stablecoins to fundamentally alter their designs to more collateralized models.

On-chain transaction data and price histories provide meaningful insights to assess the resilience and usage of each type.

New stablecoins innovations continue to emerge.

Potential users should be prepared with a risk assessment framework while conducting due diligence for each offering.

Potential users should be prepared with a risk assessment framework while conducting due diligence for each offering.

Comprehensive regulatory regimes overseeing stablecoins could soon be established across major global economies, which will have significant consequences for the issuance, redemption, usage, and adoption.

Despite recent failures and macro headwinds, the evolution of stablecoins is not slowing, and the ones that endure the toughest challenges are likely to gain share and thrive.

We dig into the biggest players across all three categories at length in the report below. And follow us here for more #crypto knowledge.

galaxy.com/research/white…

galaxy.com/research/white…

• • •

Missing some Tweet in this thread? You can try to

force a refresh