September PPI Final Demand +0.4% MoM… last month MoM revised down to -0.2% MoM.. +8.5% YoY.

Core PPI +7.2% YoY v +7.3% YoY in August.

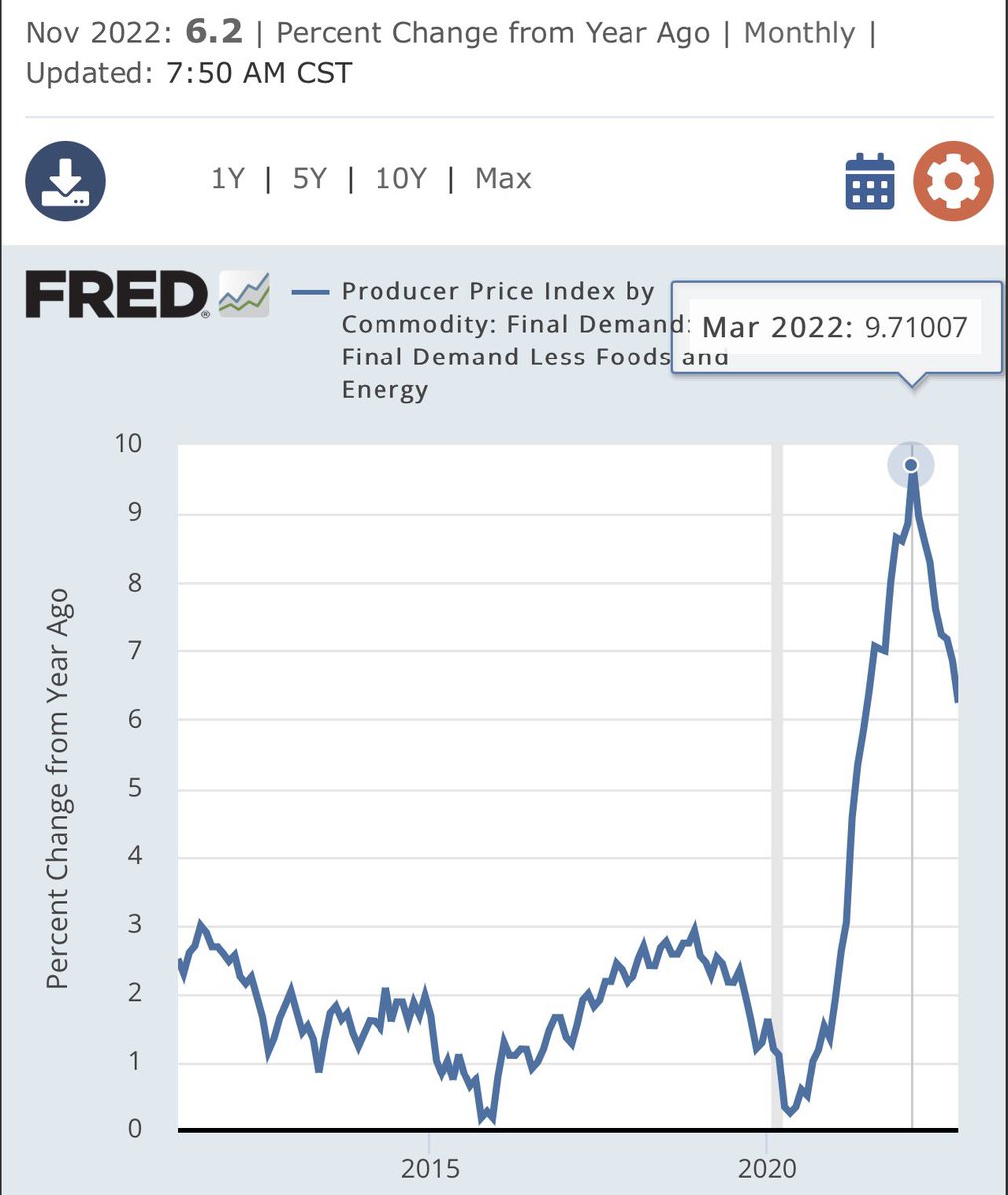

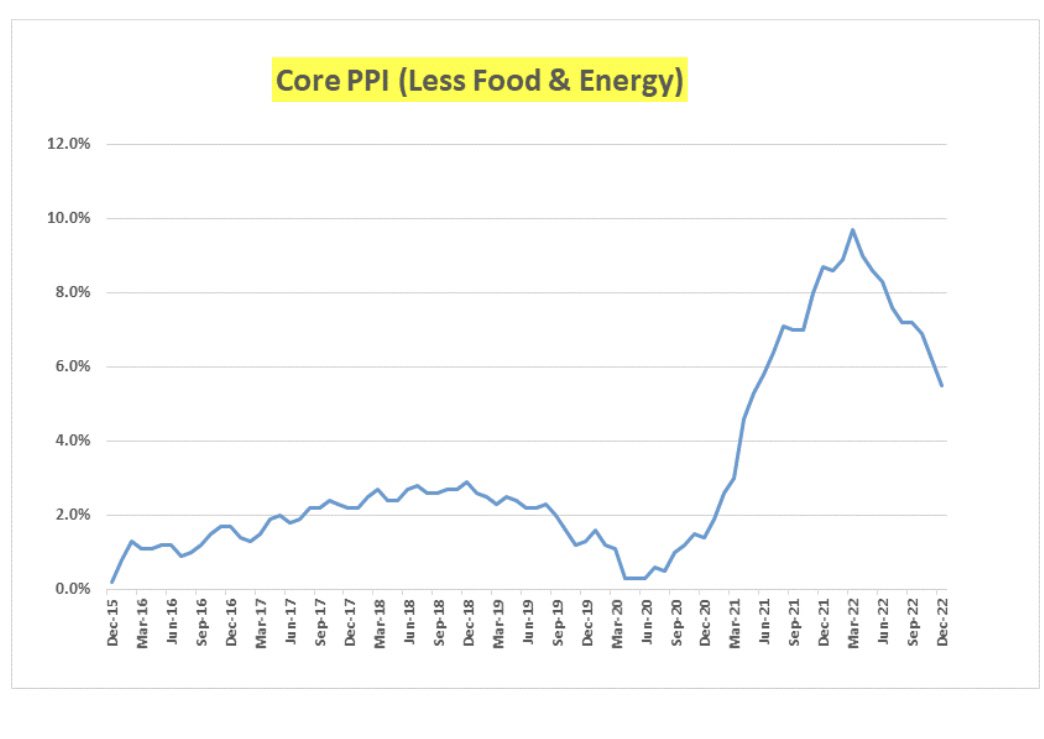

PPI Series Peaked in March 2022 at +11.7% YoY. Core CPI Series peaked in March at +9.7% YoY.

Inflation Deceleration continues..

Core PPI +7.2% YoY v +7.3% YoY in August.

PPI Series Peaked in March 2022 at +11.7% YoY. Core CPI Series peaked in March at +9.7% YoY.

Inflation Deceleration continues..

September CPI… +8.2% YoY vs a recent high of +9.1% YoY in June.

Core CPI +6.6% YoY took out +6.3% YoY high in March.. Core driven mainly by Rents… Rental Appreciation is BLS sticky… But in the Real World appreciation has been cut in 1/2 already.

Energy down big…

Core CPI +6.6% YoY took out +6.3% YoY high in March.. Core driven mainly by Rents… Rental Appreciation is BLS sticky… But in the Real World appreciation has been cut in 1/2 already.

Energy down big…

BLS OER Estimates are +6.7% YoY v +6.3% YoY in August…

OER Growth Rate is in a +2.78 Sigma Right Tail Bubble (data since 1984)…

We already know Rental Growth has been cut in 1/2 in September in the Real World.. Ask Sternlicht or Redfin.

Rental Bubble already popped..

OER Growth Rate is in a +2.78 Sigma Right Tail Bubble (data since 1984)…

We already know Rental Growth has been cut in 1/2 in September in the Real World.. Ask Sternlicht or Redfin.

Rental Bubble already popped..

October Inflation Decelerating again…

CPI +7.7% YoY v +8.2% YoY in Sep

Core CPI +6.3% YoY v +6.6% YoY in Sep

See 🧵

$XLF #Reflation

CPI +7.7% YoY v +8.2% YoY in Sep

Core CPI +6.3% YoY v +6.6% YoY in Sep

See 🧵

$XLF #Reflation

October Inflation Decelerating again…

Core PPI +6.7% YoY v +7.1% YoY in Sep

See 🧵

$XLF #Reflation

Inflation Peaked in March 2022. 👇

Core PPI +6.7% YoY v +7.1% YoY in Sep

See 🧵

$XLF #Reflation

Inflation Peaked in March 2022. 👇

Rental Inflation has Completely Rolled Over… it’s the last part of CPI to move.

Fed is True to Form… Late on the Way Up & Late on the Way Down… like Clockwork. $SPY

Chart via @calculatedrisk

Fed is True to Form… Late on the Way Up & Late on the Way Down… like Clockwork. $SPY

Chart via @calculatedrisk

November Inflation Decelerating again…that’s 8+ Months in a row.

PPI +6.2% YoY v +6.8% YoY in Oct (Revised)

See 🧵

$XLF #Reflation #RateOfChange

Inflation Peaked in March 2022. 👇

PPI +6.2% YoY v +6.8% YoY in Oct (Revised)

See 🧵

$XLF #Reflation #RateOfChange

Inflation Peaked in March 2022. 👇

More Disinflation…NY Fed Nov Consumer Inflation Expectations Plunging to 5.2%.

Peaked in June 2022 at 6.8%…1 Year BreakEvens Peaked at 6.3% in June 2022 & at 2.15% currently. 5Y5Y at 2.48% now…consistently showing no Unhinged Inflation.

newyorkfed.org/microeconomics…

$XLF $DXY 👇

Peaked in June 2022 at 6.8%…1 Year BreakEvens Peaked at 6.3% in June 2022 & at 2.15% currently. 5Y5Y at 2.48% now…consistently showing no Unhinged Inflation.

newyorkfed.org/microeconomics…

$XLF $DXY 👇

November Inflation Decelerating again…

CPI +7.1% YoY v +7.7% YoY in Oct

Core CPI +6.0% YoY v +6.3% YoY in Oct

See 🧵

$XLF #Reflation

CPI +7.1% YoY v +7.7% YoY in Oct

Core CPI +6.0% YoY v +6.3% YoY in Oct

See 🧵

$XLF #Reflation

New Cleveland Fed New Tennant Repeat Rent Index plunges to +6.0% in 3Q22 from a peak of +11.8% in 2Q22…

Just in case they didn’t believe Barry Sternlicht. $DXY

Just in case they didn’t believe Barry Sternlicht. $DXY

“While rents typically experience a seasonal decline in October, this year’s decrease was larger than average & could point to prices slowing more sharply than expected in coming months.”

- CoreLogic Economist Molly Boesel.

$DXY

- CoreLogic Economist Molly Boesel.

$DXY

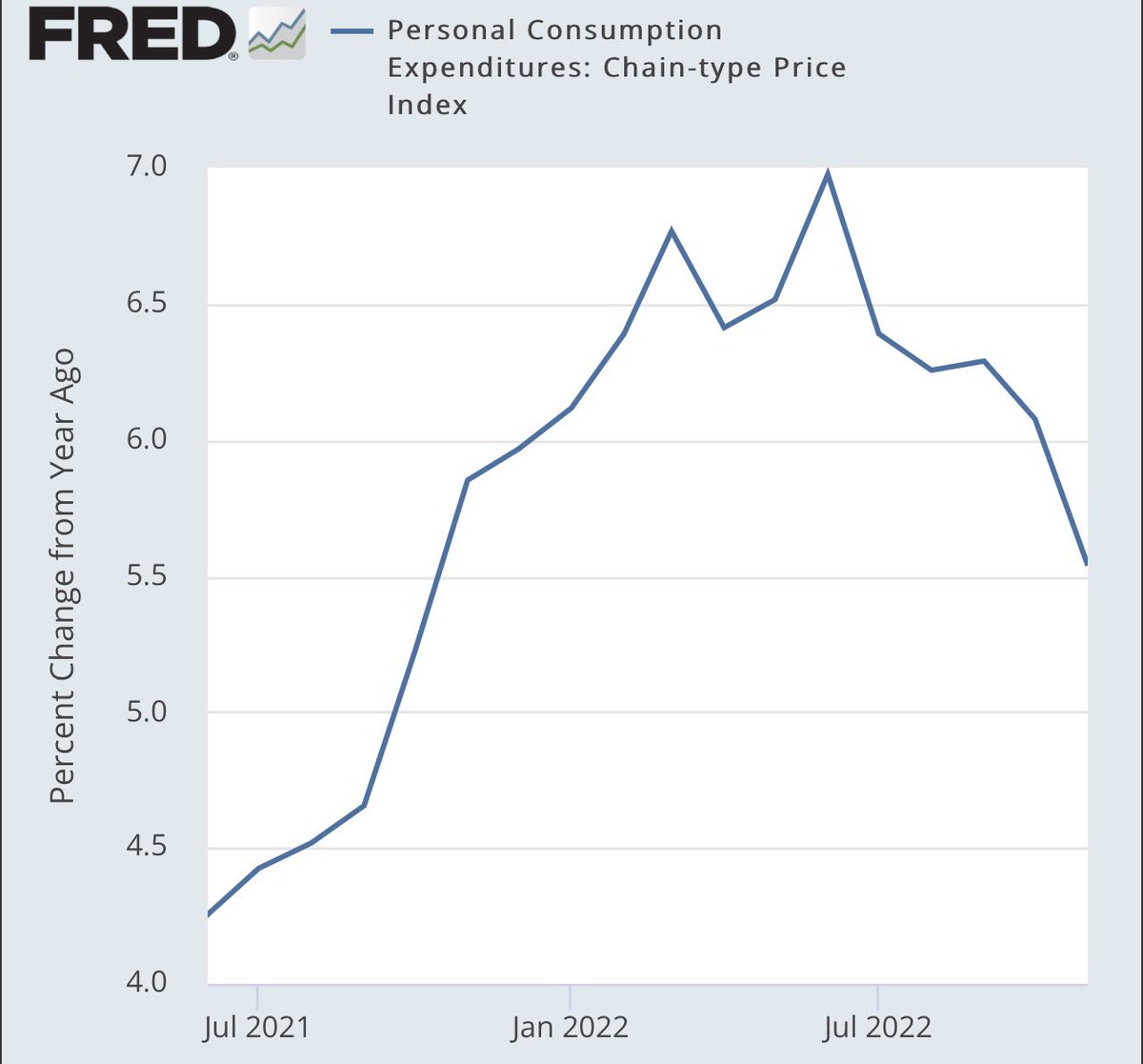

Nov 2022 PCE +5.5% YoY v +6.1% YoY

This series Peaked in June at +7.0%

Inflation is Yesterday’s News. 🧵

The trend is your friend.

$DXY

This series Peaked in June at +7.0%

Inflation is Yesterday’s News. 🧵

The trend is your friend.

$DXY

How long is the Fed & their surrogates gonna pretend this 1970s Unhinged Inflation narrative is actually thing?

$DXY #DownwardDog

$DXY #DownwardDog

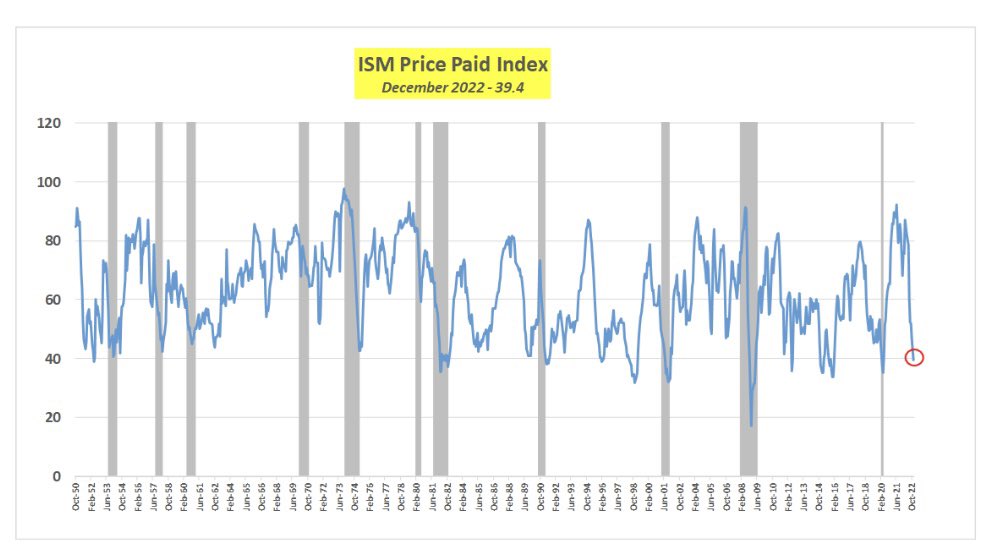

December 2022 ISM Prices Paid Plunge to 39… Where’s Waldo?

Inflation is nowhere to be seen…👇

$XLF $SPY

Inflation is nowhere to be seen…👇

$XLF $SPY

December Wage growth down sharply… to +4.6% YoY…

How obtuse can this Fed really be?

They want to see Bread Lines?

Markets aren’t paying attention to the Fed but rather the data.. 1 Year Inflation BreakEvens are at 1.83%

Inflation Peaked in March 2022.

$XLF $HYG $LQD

How obtuse can this Fed really be?

They want to see Bread Lines?

Markets aren’t paying attention to the Fed but rather the data.. 1 Year Inflation BreakEvens are at 1.83%

Inflation Peaked in March 2022.

$XLF $HYG $LQD

December Wages for the Fed defined Serfs (Production & Non Supervisory) Decelerated Sharply to +5.0%… they are ecstatic that hard working Americans are getting paid less. @JDVance1

Inflation Peaked in March. See 🧵

$XLF $HYG $LQD

Inflation Peaked in March. See 🧵

$XLF $HYG $LQD

December ISM Services New Orders in Contraction… but we are told there’s Inflation everywhere.

Stick a fork in the rate hiking cycle.

Stick a fork in the rate hiking cycle.

December Inflation -> #DownwardDog…

The Trend ain’t ur friend -> $DXY #RIP

CPI +6.5% YoY v +7.1% YoY in Nov

Core CPI +5.7% v +6.0% YoY in Nov

$XLF #Reflation 🧵

The Trend ain’t ur friend -> $DXY #RIP

CPI +6.5% YoY v +7.1% YoY in Nov

Core CPI +5.7% v +6.0% YoY in Nov

$XLF #Reflation 🧵

December Inflation Decelerating…..

Core PPI +5.5% v 6.2% in Nov

So much for the Consensus 1970s Unhinged Inflation Narrative…

$DXY

Core PPI +5.5% v 6.2% in Nov

So much for the Consensus 1970s Unhinged Inflation Narrative…

$DXY

Jan Inflation -> #DownwardDog

The Trend ain’t ur friend -> $DXY #RIP

CPI +6.4% YoY v +6.5% YoY in Dec

Core CPI +5.6% v +5.7% YoY in Dec

$XLF #Reflation 🧵

The Trend ain’t ur friend -> $DXY #RIP

CPI +6.4% YoY v +6.5% YoY in Dec

Core CPI +5.6% v +5.7% YoY in Dec

$XLF #Reflation 🧵

Jan Core PPI continues to decline to +5.4%… Peaked at +9.7% YoY in March 2022..

Memo to Fed: Stay Patient.

$DXY = Toast

Consensus Headline today: “Inflation Running Hot.” 🤦🏻♂️

Uhm…No… 👇

Memo to Fed: Stay Patient.

$DXY = Toast

Consensus Headline today: “Inflation Running Hot.” 🤦🏻♂️

Uhm…No… 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh