Read the THREAD: Inverse Biden!

💥The Red background is the reality of stock markets in 2023 - year of everything bubble blowing up!

Stocks, Bonds, Derivatives,..

Expect opposite of what he says.

#Recession #Inflation #Depression #CurrencyCrisis #BankingCrisis #housingcrash

💥The Red background is the reality of stock markets in 2023 - year of everything bubble blowing up!

Stocks, Bonds, Derivatives,..

Expect opposite of what he says.

#Recession #Inflation #Depression #CurrencyCrisis #BankingCrisis #housingcrash

19th July, 2021 Biden - There's nobody suggesting there's unchecked inflation on the way, no serious economist

13th January, 2021 My Prediction 7 days before his oath.

Inverse Biden!

13th January, 2021 My Prediction 7 days before his oath.

Inverse Biden!

March, 2022 Biden - Russia's Ruble will be reduced to rubble

June, 2022 Reality - Russia's ruble hit its strongest level in 7 years despite massive sanctions

June, 2022 Reality - Russia's ruble hit its strongest level in 7 years despite massive sanctions

10th August, 2022 Biden - The rate of inflation in July 2022 was zero percent

Reality - 8.5% in June & July on record. The change was 0 percent, if at all.

Reality - 8.5% in June & July on record. The change was 0 percent, if at all.

7th October, 2022 Biden - Don't think there will be a recession, if so it will be 'very slight'

Now you know what's coming🤣

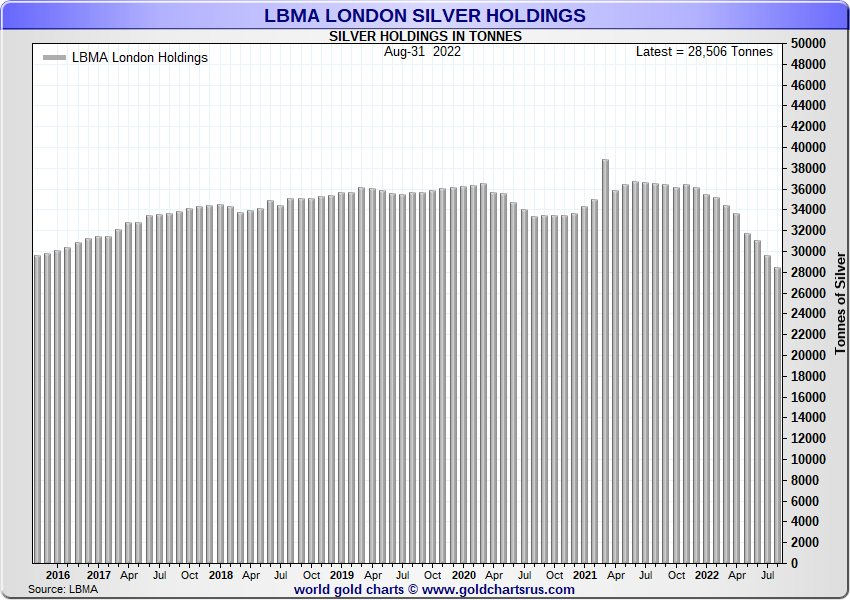

💥Westerners should convert what they have into Gold. It can be converted to Cash easily later.

Now you know what's coming🤣

💥Westerners should convert what they have into Gold. It can be converted to Cash easily later.

• • •

Missing some Tweet in this thread? You can try to

force a refresh